Table of Contents

- High returns compared to traditional investment options

- Benefit of compounding and rupee cost averaging

- Disciplined investment

- No need to time the market

Every parent wants to give his/her children the best of the world, and therefore works hard to keep it all on track. With the growing living cost, it may become hard to deal with the expenses that come in the way while educating them and so on. Although many people save for the same, restricting to only savings might just not be enough. Investing your savings in a mutual fund child plan is the smartest way to become worry-free about your child’s future. In this blog, you will be reading about the top SIP investment plans for your child.

Table of Content

Investment in mutual funds help one yield better returns compared to the traditional plans, and therefore is best to invest for a long-term. You may invest in them through lumpsum as well as SIP mode of investment. SIP investment provides an investor an opportunity to develop a savings’ habit through disciplined investments. It benefits the investor by its two main features which are compounding and rupee cost averaging. This type of investment is light on the pocket because the minimum installment amount is really low. Let’s read what child plans are and the top SIP plans for child in 2018.

What Is a Child Future Plan?

After the recent categorization and rationalization, SEBI introduced a new category named solution-oriented schemes which further include two types of funds, namely Retirement Funds and Children’s Funds. These children’s plans include open-ended mutual fund schemes that have a minimum lock-in period of 5 years or till the child attains the age of maturity whichever is earlier. They are also known as child future plans.

Why Should You Invest Early for Your Child’s Future?

With the hike in education expenses, it is best that the investment is started early to accumulate a huge corpus by the time your kid is ready. Moreover SIP provides the best returns when the investment is made for a long term, without disturbing your current budget. You may use the tool at MySIPonline called Child Future Calculator, to calculate the amount that you will need in future for your kid and create a plan accordingly.

Top SIP Child Future Plans to Invest in 2018

Below mentioned are the top three plans where you should invest in for your children’s future to help them fulfill their dreams and aspirations. These plans have been shortlisted by the experts after conducting intensive research. Let’s read.

ICICI Prudential Child Care Fund (G)

Formerly known as ICICI Prudential ChildCare-Gift Fund, the investment objective of this scheme is to help investors earn long-term capital appreciation by investing in the equity, equity related instruments, debt, and money market instruments.

| Parameters | ICICI Prudential Child Care Plan - Gift Plan |

|---|---|

| Category | Aggressive Hybrid |

| Benchmark | NIFTY 50 Hybrid Composite Debt 65:35 |

| Launch Date | 8/31/2001 |

| Asset Size | Rs. 627 crore (As on Aug 31, 2018) |

| Fund Managers | Mr. Ashwin Jain & Mr. Manish Banthia |

| Expense Ratio | 2.49% (As on August 31, 2018) |

| Minimum Lumpsum | Rs 5,000 |

| Minimum SIP | Rs 1000 |

| Exit Load | NIL (subject to completion of five years of lock-in period or till child attains the age of majority, whichever is earlier) |

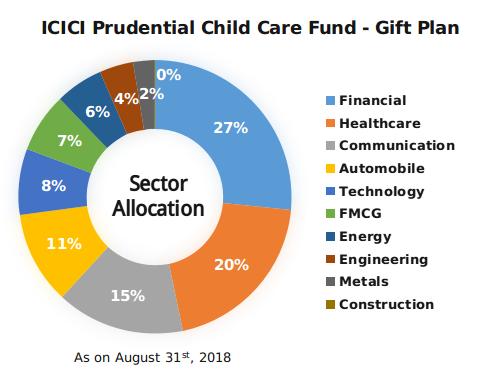

As mentioned in the above table, the assets under management is Rs. 627 crore as on August 31st, 2018. The below pie chart showcases the allocation that it has done across the different sectors. Majorly, the assets have been allocated in the financial sector followed by the healthcare and communication sectors. These sectors are likely to perform better in the coming time.

The top five companies in whose equity it has invested in the most are HDFC, HCL Technologies, State Bank of India, Vodafone Idea, and NTPC. The top five companies in whose debt the assets have been invested are HDFC 175-D 11/01/2019, Bharti Telecom 325-D 14/12/2018, 7.93% LIC Housing Fin. 2019, 7.59% Rural Electrification 2020, and IndusInd Bank 2019. All these companies have been selected after conducting thorough research on the basis of the different relevant factors.

| Return Analysis | Trailing Returns (As on September 25th, 2018) | ||

|---|---|---|---|

| Scheme Name | Since Launch | Last 5 Years | Last 3 Years |

| Category | - | 15.93% | 10.11% |

| ICICI Prudential Child Care Fund (G) | 16.51% | 19.19% | 11.20% |

This scheme has generated 16.51% average annual returns since inception. It has managed to outperform its category returns both in three and five-years time period by helping investors earn 11.20% and 19.19%, respectively.

| Scheme Name | SD | Beta | Sharpe | |||

|---|---|---|---|---|---|---|

| Category | 10.45 | 0.87 | 0.49 | |||

| ICICI Prudential Child Care Fund (G) | 11.65 | 0.85 | 0.51 | |||

| As on August 31, 2018 | ||||||

- The standard deviation of this scheme is 11.65 which is more than its category. This shows that the returns generated by this scheme is more prone to fluctuations comparatively.

- The Sharpe ratio of this scheme is 0.51 which better than its category’s ratio. This indicates that it is likely to yield better returns with the per unit risk taken.

Who Should Invest?

This scheme is for aggressive investors who are willing to earn high by taking high risk through investment made mainly in the equity instruments.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

SBI Magnum Children’s Benefit Fund (G)

Formerly known as SBI Magnum Children’s Benefit Plan, the investment objective of this scheme by SBI Mutual Fund is to generate consistent income through investment mainly in the debt and money-market instruments. The portfolio is managed actively and a portion is invested in equity as well to generate capital appreciation.

| Parameters | SBI Magnum Children's Benefit Fund |

|---|---|

| Category | Conservative Hybrid |

| Benchmark | NIFTY 50 Hybrid Composite Debt 15:85 |

| Launch Date | 1/25/2002 |

| Asset Size | Rs. 62 crore (As on Aug 31, 2018) |

| Fund Managers | Rajeev Radhakrishnan |

| Expense Ratio | 2.70%(As on August 31, 2018) |

| Minimum Lumpsum | Rs 5,000 |

| Minimum SIP | Rs 500 |

| Exit Load | 3% for redemption within 365 days 2% for redemption between 366 - 730 days 1% for redemption between 731 - 1095 days |

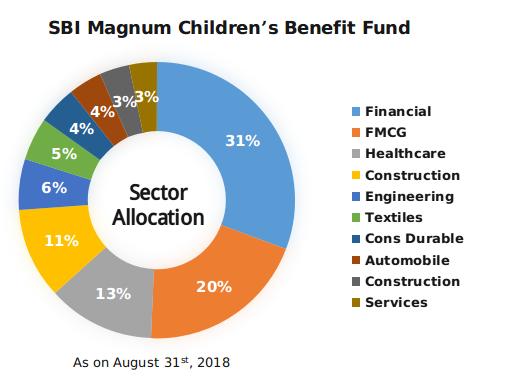

The assets under management is Rs. 62 crores as on August 31st, 2018 which have been further allocated in the following sectors. The major allocation has been done in the financial sector followed by FMCG.

The top five companies in whose equity it has invested majorly are HDFC Asset Management Company, State Bank of India, Manpasand Beverages, Narayana Hrudayalaya, and ITC. The top five companies in whose debt it has invested majorly are 7.6% Rural Electrification 2021, 9.15% ICICI Bank, 9.8773% Indostar Capital Finance 2019, Greenko Energies 2019, and Greenko Energies 2019.

| Return Analysis | Trailing Returns (As on September 25th, 2018) | ||

|---|---|---|---|

| Scheme Name | Since Launch | Last 5 Years | Last 3 Years |

| Category | - | 10.08% | 7.33% |

| SBI Magnum ChildrenÂ’s Benefit Fund (G) | - | 17.21% | 14.57% |

Talking of the three-year returns, the scheme has generated returns of 14.57% which is almost double than that yielded by the category in the form of 7.33%. In five-years time period too, this scheme has outperformed its category by giving 17.21% as the rate of return.

| Scheme Name | SD | Beta | Sharpe | |||

|---|---|---|---|---|---|---|

| Category | 4.3 | 0.81 | 0.34 | |||

| SBI Magnum ChildrenÂ’s Benefit Fund (G) | 5.51 | 0.92 | 1.49 | |||

| As on August 31, 2018 | ||||||

- The standard deviation as well as the Beta of this scheme is high which indicate that it will fluctuate more in comparison to its category.

- The Sharpe ratio of 1.49 is much more than its category’s Sharpe ratio which shows that the scheme is awesome when it comes to taking risk and generating returns.

Who Should Invest?

This scheme is for investors who are looking for an opportunity to earn consistent income by taking moderately high risk on the principal amount invested.

UTI CCF Investment Plan (G)

UTI Children’s Career Fund - Investment Plan was formerly known as UTI CCP Advantage Fund. This scheme by UTI Mutual Fund aims to provide an opportunity to investors to help them earn long-term capital appreciation through investment in equity and its related instruments across the market capitalization.

| Parameters | UTI CCF - Investment Plan |

|---|---|

| Category | Equity - Multi Cap |

| Benchmark | S&P BSE 200 TRI |

| Launch Date | 2/17/2004 |

| Asset Size | Rs. 277 crore (As on Aug 31, 2018) |

| Fund Managers | Kaushik Basu |

| Expense Ratio | 2.93% (As on August 31, 2018) |

| Minimum Lumpsum | Rs 5,000 |

| Minimum SIP | Rs 500 |

| Exit Load | 4% for redemption within 364 days 3% for redemption between 365 - 1094 days 1% for redemption between 1095 - 1824 days |

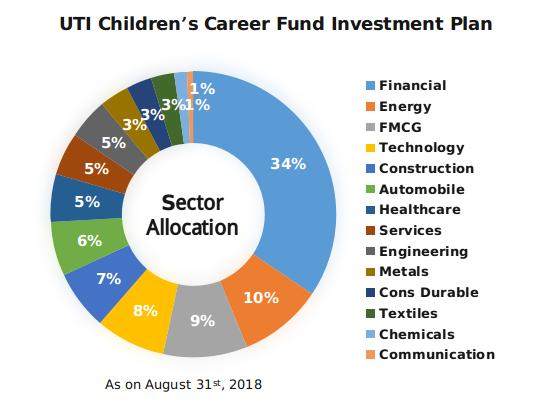

The assets under management is Rs. 277 crore which have been invested across sectors as shown in the following pie chart. This scheme has majorly invested in the financial sector followed by energy and FMCG sectors.

The top ten companies in which the assets of this scheme have been invested majorly are HDFC Bank, IndusInd Bank, Reliance Industries, Infosys, Britannia Inds., Yes Bank, ICICI Bank, L&T Finance Holdings, Avenue Supermarts, and Sheela Foam.

| Return Analysis | Trailing Returns (As on September 25th, 2018) | ||

|---|---|---|---|

| Scheme Name | Since Launch | Last 5 Years | Last 3 Years |

| Category | - | 18.94% | 11.46% |

| UTI CCF Investment Plan (G) | 9.37% | 17.09% | 12.66% |

- This scheme has generated average annual returns of 9.37% since inception.

- The scheme has although managed to surpass the three-year returns of its category, it has been unable to do the same in five-years time period.

| Scheme Name | SD | Beta | Sharpe | |||

|---|---|---|---|---|---|---|

| Category | 14.33 | 0.97 | 0.54 | |||

| UTI CCF Investment Plan (G) | 13.35 | 0.94 | 0.66 | |||

| As on August 31, 2018 | ||||||

- The standard deviation of this scheme is 13.35 which is less than its category and so is the Beta which is 0.94. This shows that in comparison to the others, it’s less prone to fluctuations.

- The Sharpe ratio of the scheme is 0.66 which is more than its category’s Sharpe ratio. This proves that it will provide better returns with the per unit risk taken.

Comparison of Top Child Plans

Returns, Expense Ratio, and AUM

| Fund | Launch | 1-Year | 3-Year | 5-Year | Expense Ratio (%) | AUM (Cr.) |

|---|---|---|---|---|---|---|

| ICICI Prudential Child Care Fund (G) | 31-Aug-01 | 9.49 | 11.20 | 19.19 | 2.49 | 627 |

| SBI Magnum ChildrenÂ’s Benefit Fund (G) | 25-Jan-02 | 6.90 | 14.57 | 17.21 | 2.70 | 62 |

| UTI CCF Investment Plan (G) | 17-Feb-04 | 5.25 | 12.66 | 17.09 | 2.93 | 277 |

| AUM & Expense Ratio (ICICI and UTI Fund): As on August 31st, 2018 | ||||||

| Expense Ratio (SBI Fund): As on July 31st, 2018 | ||||||

| Trailing Returns: As on September 25th, 2018 | ||||||

- Among these top three SIP plans, ICICI Prudential Child Care Fund - Gift Plan is the oldest and has yielded the highest one-year return as on September 25th, 2018.

- SBI Magnum Children’s Benefit Fund has topped the chart in three-year returns by generating 14.57%.

- In the five years, the child plan by ICICI Pru MF has again provided the highest rate of return to the investors.

- UTI CCF Investment Plan has the highest expense ratio among the three while ICICI Prudential Child Care Fund has the highest assets under management.

Risk

| Fund | Mean | Std. Dev. | Sharpe | Sortino | Beta | Alpha |

|---|---|---|---|---|---|---|

| ICICI Prudential Child Care Fund (G) | 12.34 | 11.65 | 0.51 | 0.76 | 0.85 | 0.01 |

| SBI Magnum ChildrenÂ’s Benefit Fund (G) | 14.62 | 5.51 | 1.49 | 2.49 | 0.92 | 5.99 |

| UTI CCF Investment Plan (G) | 15.20 | 13.35 | 0.66 | 1.04 | 0.94 | 0.01 |

| As on August 31st, 2018 | ||||||

- SBI Magnum Children’s Benefit Fund has the highest Sharpe ratio in the form of 1.49 which means it generates great returns with the risk that it takes.

- UTI CCF Investment Plan has the highest standard deviation and Beta which shows that it is likely to fluctuate more in comparison to the other two schemes.

Conclusion

You may invest in any of the mutual fund plans which is the most suitable for your portfolio. Make sure that you conduct check on the different aspects of the scheme in a detailed manner or take the help of our financial experts before finalizing the investment decision. If you have already finalized a scheme, then you may invest in the same through our platform MySIPonline.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Must Read: