Introduction

The 360 ONE Focused Equity Regular Growth is an equity-focused mutual fund that was launched on October 30, 2014.

Classified under the Equity Category, this fund primarily invests in a focused portfolio of stocks. As of September 30, 2023, the total assets under management for the fund amount to Rs. 4,629 crores. The benchmark against which the fund’s performance is evaluated is the S&P BSE 500 TRI. The fund is currently managed by Mayur Patel, who has been overseeing its management responsibilities since November 11, 2019.

The fund’s investment strategy involves holding positions in 30 Equity stocks, emphasizing a concentrated approach to portfolio management. The top 10 stocks in the fund constitute 54.24% of total portfolio, reflecting a selective allocation strategy. Additionally, the fund is diversified across various sectors, with the top three sectors making up 55.26% of the portfolio. This distribution highlights the fund’s approaches to sectoral allocation to achieve a balanced and diversified investment portfolio. Overall, the 360 ONE Focused Equity Regular Growth aims to deliver returns in line with its benchmark and provide investors with a focused and well-managed investment options within the equity options within the equity market.

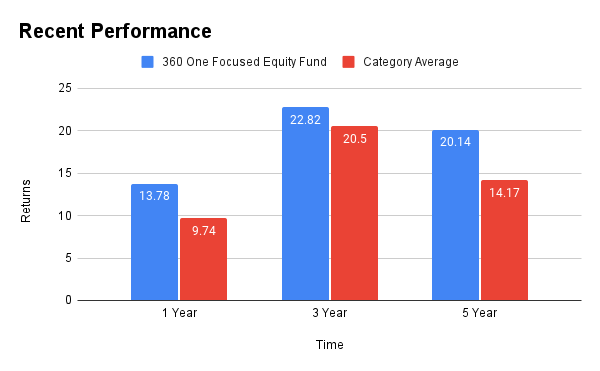

Recent Performance

The 360 ONE Focused Equity Fund has demonstrated strong performance across various timeframes when compared to both the category average and the NIFTY 50 TRI. Year-to date (YTD) return for the fund stand at an impressive 14.61%, outperforming the category average of 11.15% and the NIFTY 50 TRI at 6.42%. Over the one-year period, the fund has continued to outshine with returns of 13.78%, surpassing the category average of 9.47% and the NIFTY 50 TRI at 7.01%.

Looking at the three-year performance, the 360 One Focused Equity Fund maintains its lead with returns of 22.82%, compared to the category average 20.5% and the NIFTY 50 TRI at 19.29%. Over the more extended five-year period, the fund has consistently delivered robust returns, achieving 20.14%, again surpassing the category average at 14.17% and the NIFTY 50 TRI at 14.27%.

These performance metrics suggest that the 360 ONE Focused Equity Fund has been successful in delivering competitive returns across short-term and long-term investment horizons, positioning it favorably within its category and relative to the broader market benchmark.

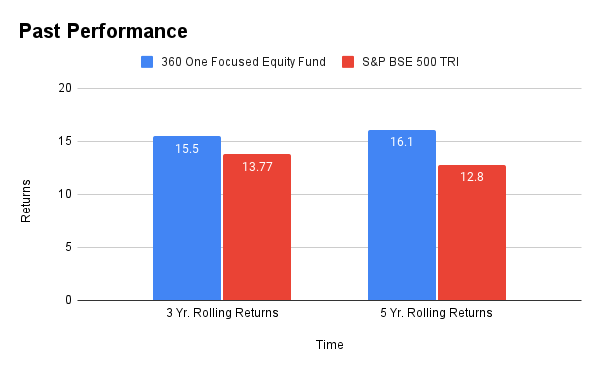

Past Performance

The 360 ONE Focused Equity Fund has excelled in performance, showing a 3-year rolling return of 15.5%, outperforming both the category average (9.89%) and S&P BSE 500 TRI (13.77%).

Over the past five years, the fund has maintained this strong performance, achieving a 5-year rolling return of 16.1%, outpacing both the category average (9.1%) and S&P BSE 500 TRI (12.8%). This sustained outperformance underscores the effectiveness of the fund’s equity investment strategy, positioning it as an appealing choice for investors in search of competitive returns.

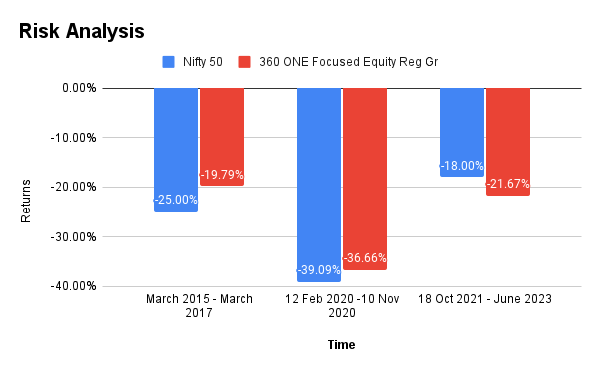

Risk Analysis

The provided data compares the performance of nifty 50 and 360 ONE Focused Equity Regular Growth across three distinct timeframes. From March 2015 to March 2017, Nifty 50 experienced a fall of 25.00%, taking 750 days to recover. In the period from February 12, 2020, to November 10, 2020, Nifty 50 faced a more substantial decline of 39.09%, with a quicker recovery period of 294 days. Moving to the latest timeframe, from October 18, 2021, to June 2023, Nifty 50 encountered a fall of 18.00%, taking 616 days for recovery. On the other hand, the 360 ONE Focused Equity Regular Growth showed comparatively milder falls of 19.79%, 36.66%, and 21.67% during the same respective periods, impressively recovering on time in each instance. These figures highlight the resilience of the 360 ONE Focused Equity Regular Growth Fund in navigating market fluctuations and promptly rebounding from downturns.

Portfolio Allocation

The portfolio allocation of the investment is strategically distribution across different market segments. A significant portion, comprising 65.99%, is allocated to large-cap companies, reflection a focus on well-established and often more stable corporations within the market.

Additionally, 28.17% of the portfolio is directed towards mid-cap companies, suggesting a balanced approach that includes firms with moderate market capitalization and growth potential.

The remaining 5.84% is allocated to small-cap companies, indicating a level of exposure to smaller, potentially more agile enterprises. In aggregate, the portfolio exhibits a comprehensive market coverage with a total allocation summing up to 100.00%, reflecting a diversified investment strategy that encompasses companies of varying sizes and market capitalizations. This diversified approach aims to manage risk and capitalize on opportunities across different segments of the market.

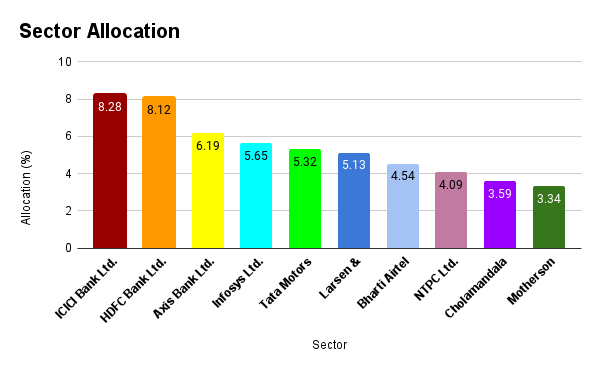

Sector Allocation

|

Sector Holdings |

|

|

Sector |

Allocation (%) |

|

ICICI Bank Ltd. |

8.28 |

|

HDFC Bank Ltd. |

8.12 |

|

Axis Bank Ltd. |

6.19 |

|

Infosys Ltd. |

5.65 |

|

Tata Motors Ltd. |

5.32 |

|

Larsen & Toubro Ltd. |

5.13 |

|

Bharti Airtel Ltd. |

4.54 |

|

NTPC Ltd. |

4.09 |

|

Cholamandalam Investment and Finance Company Ltd. |

3.59 |

|

Motherson Sumi Wiring India Ltd. |

3.34 |

|

Total |

54.25 |

AUM Growth over years

Over the past four years, the assets under management (AUM) of the investment portfolio have displayed a remarkable upward trajectory. In the year 2020, the AUM stood at Rs. 1352.72 crores, and within just one year, it experienced significant growth, reaching Rs. 2630.42 crores in 2021. This positive trend continued in the subsequent years, with the AUM further escalating to Rs. 3417.31 crores in 2022 and achieving an impressive Rs. 4629.87 crores in 2023. Calculating the compound annual growth rate (CAGR) over this period reveals a robust rate of 36.02%, indicative of the consistent and substantial expansion of the portfolio. This substantial CAGR underscores the effectiveness of the investment strategy and the growing investor confidence in the portfolio, affirming its attractiveness as a compelling investment option.

|

AUM Growth |

|

|

Years |

AUM (Cr.) |

|

2023 |

4629.87 |

|

2022 |

3417.31 |

|

2021 |

2630.42 |

|

2020 |

1352.72 |

|

CAGR |

36.02% |

Conclusion

The 360 ONE Focused Equity Regular growth fund, launched in 2014, has proven resilient and well-managed in navigating market fluctuations. Under the management of Mayur Patel, it maintains a concentrated portfolio of 30 high conviction stocks, showing superior performance during market downturns. Recent and past performance consistently outperforms category averages and benchmark indices, with a diversified portfolio covering large-cap, mid-cap, and small-cap companies. The impressive growth in assets under management (AUM) at a CAGR of 36.02% reflects increasing investor confidence. Overall, it’s a compelling choice for investors seeking competitive returns in equity market. So choose this fund for your Online SIP.

Read More - Kotak Healthcare Fund 2024