Table of Contents

- Dual Benefits of Tax Saving & High Equity Returns.

- Save up to Rs 46,350* on taxes.

- Lock-in period of Just 3 years.

- Start SIP for as low as Rs 500.

According to SEBI’s circular, ELSS funds are those schemes that have a minimum investment of 80% in equity and related instruments. They are open-ended schemes with a statutory lock-in of 3 years and provide tax benefit along with high returns. ELSS funds are a new tax saving’s trend that is attracting millions of investors by providing great tax benefits and exceptional returns. Let’s see how!

Table of Content

The stress of last-minute tax planning is not new, and the low returns and high lock-in period offered by conventional tax saving options (PPF, FD, etc.,) act as a multiplier to that. Well, you don’t have to worry anymore; as with top 5 tax saver mutual funds, you can easily beat the heat.

We, at MySIPonline, find this category of mutual funds quite attractive due to the twin benefits that they offer. Thus, here we have come up with best 5 tax saving options, which include:

- Reliance Tax Saver (ELSS) Fund (G)

- Aditya Birla Sun Life Tax Relief 96 Fund (G)

- L&T Tax Advantage Fund (G)

- Axis Long Term Equity Fund (G)

- DSP BlackRock Tax Saver Fund (G)

Peer Comparison: Returns, AUM, and Allocation

| Scheme Name | AUM (in crores) | Returns (as on Aug 08, 2018) | Allocation | |||

|---|---|---|---|---|---|---|

| 3 Years | 5 Years | 10 Years | Equity | Debt & Cash | ||

| Reliance Tax Saver (ELSS) Fund (G) | Rs 10,083 Cr. | 6.10% | 23.82% | 15.67% | 98.15% | 2.21% |

| Aditya Birla Sun Life Tax Relief 96 Fund (G) | Rs 6,187 Cr. | 12.33% | 24.81% | 14.22% | 96.68% | 3.31% |

| L&T Tax Advantage Fund (G) | Rs 3,335 Cr. | 12.58% | 21.28% | 15.06% | 94.49% | 5.51% |

| Axis Long Term Equity Fund (G) | Rs 18,262 Cr. | 11.75% | 25.87% | - | 97.94% | 2.21% |

| DSP BlackRock Tax Saver Fund (G) | Rs 4,218 Cr. | 11.83% | 22.85% | 14.53% | 97.53% | 2.47% |

Top 5 Tax Saver Mutual Funds

By analyzing different parameters such as the investment strategy of the fund manager, asset allocation, risk factor, etc., the experts at MySIPonline have selected 5 best tax saving funds to invest in 2018. Let's have a look at them.

Reliance Tax Saver Fund (G)

Reliance Tax Saver Fund is an ELSS fund from one of the leading AMCs in India, i.e., Reliance Mutual Fund. Investing in it is perhaps the most efficient way to put a leash on your soaring tax liabilities and bring them within the boundaries of your spending capacity.

Reliance Tax Saver Fund (G) is an aggressive performer in the ELSS category, which has retained a three-star rating throughout his life. The fund has fared better than others in tear-away bull markets than in bearish markets. Reliance Tax Saver Fund NAV as on August 21, 2018 amounts to Rs. 58.43.

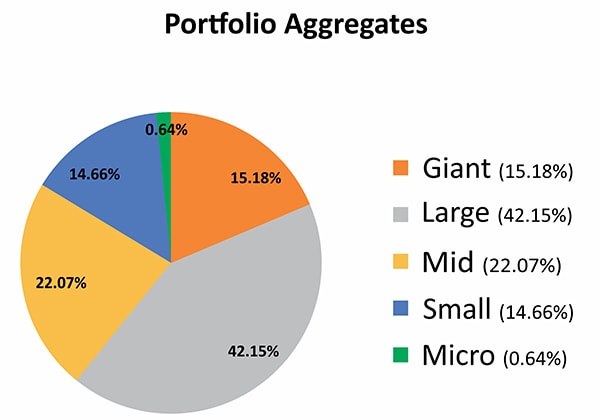

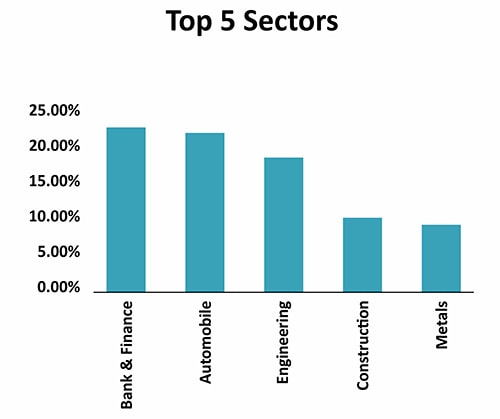

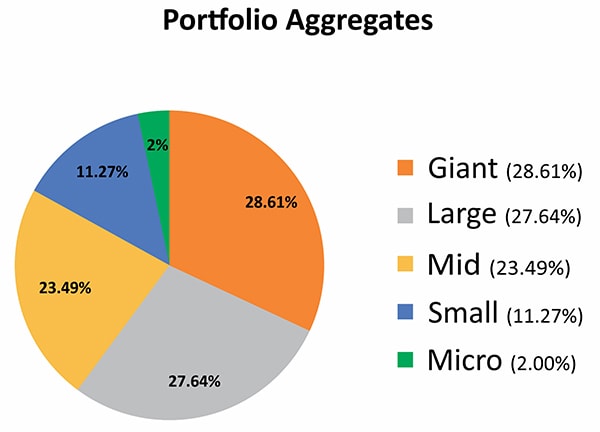

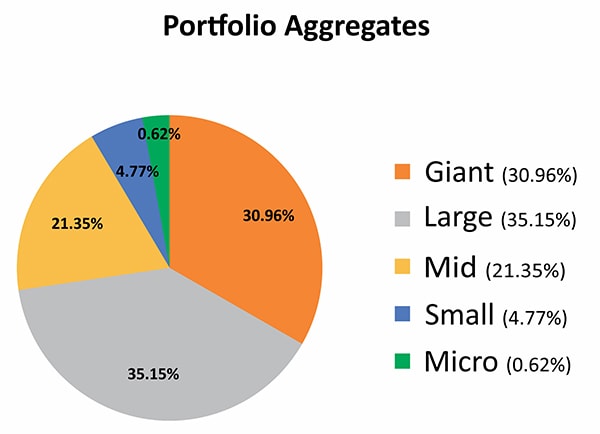

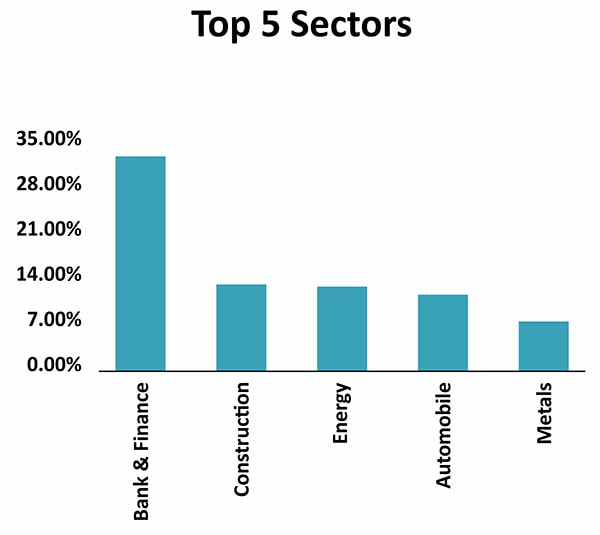

Portfolio Allocation

1.Market Capitalization

2.Sector Allocation

Aditya Birla Sun Life Tax Relief 96 Fund (G)

Aditya Birla Sun Life Tax Relief 96 Fund has depicted record-breaking performances lately by giving the highest amount of returns in the category of the best ELSS funds to invest in 2018. The average returns earned to date figure up to 25.30%, which is as good as the returns earned by a well-lit small or mid-cap fund.

Aditya Birla Sun Life Tax Relief 96 Fund NAV is Rs. 32.71 as on August 21, 2018. The fund is exposed to calculated risk and the exposure is reduced to an acceptably low level. Aditya Birla Sun Life Tax Relief 96 is managed by some of the best fund managers, which assure that a top-notch investment strategy is devised and followed to earn the best of returns.

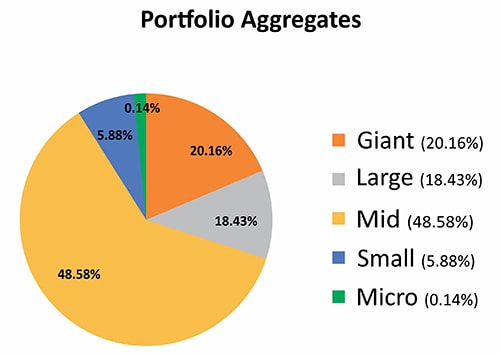

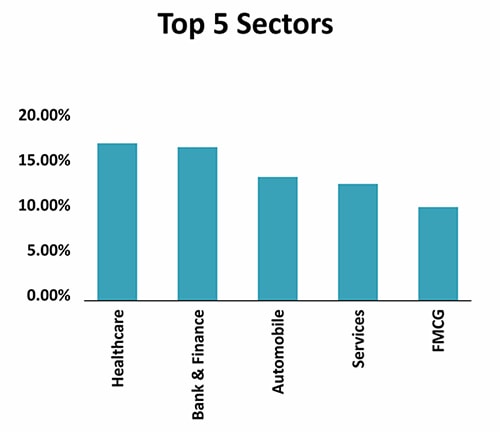

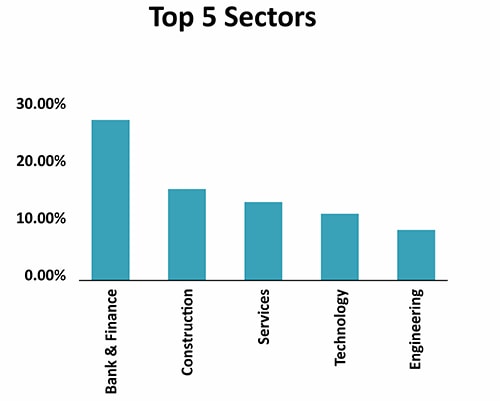

Portfolio Allocation

1. Market Capitalization

2. Sector Allocation

L&T Tax Advantage Fund (G)

L&T Tax Advantage Fund is an open-ended tax savings scheme which is more than a decade old. It has started its journey way back on February 27, 2006, and since then it has managed to provide consistent returns to its investors. The primary objective of the fund lies in generating high gains and long-term capital growth from a diversified portfolio of equities and equity-related securities.

Soumendra Nath Lahiri is managing L&T Tax Advantage Fund (G) who has over 20 years of experience in the similar field and has been managing and advising on the portfolio for more than nine years now. The scheme’s distinct style of investment makes it stand out among its peers, but that also adds an element of risk. L&T Tax Advantage Fund NAV is Rs. 57.34 as on August 21, 2018.

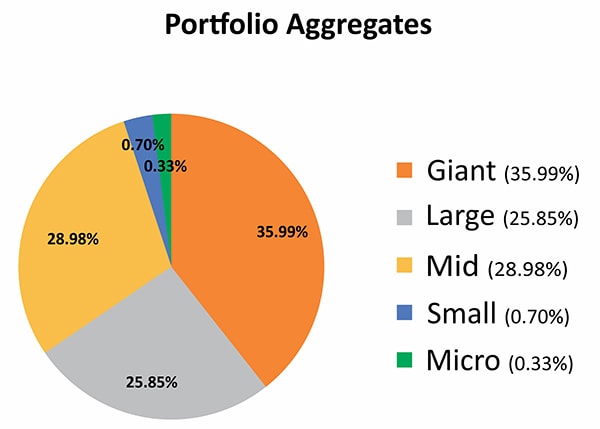

Portfolio Allocation

1.Market Capitalization

2. Sector Allocation

Axis Long Term Equity Fund (G)

Axis Long Term Equity Fund– Regular Plan (Growth) is one of the best tax saver plans to invest in India. It is highly regarded as one of the best tax savers in the market, also has the capacity to produce a good yield for the investors. Started in 2009, this fund has acquired a dominating position in the market in less than 10 years. In the market drop of 2011, it has shown its ability to contain losses.

The fund manager focuses on buying quality growth stocks of superior and scalable businesses who have the capability to offer a high return on capital and secular growth. The fund has maintained an asset size amount to Rs. 18, 262 crore as on July 31, 2018. Axis Long Term Equity Fund NAV is Rs. 45.5 as on August 21, 2018.

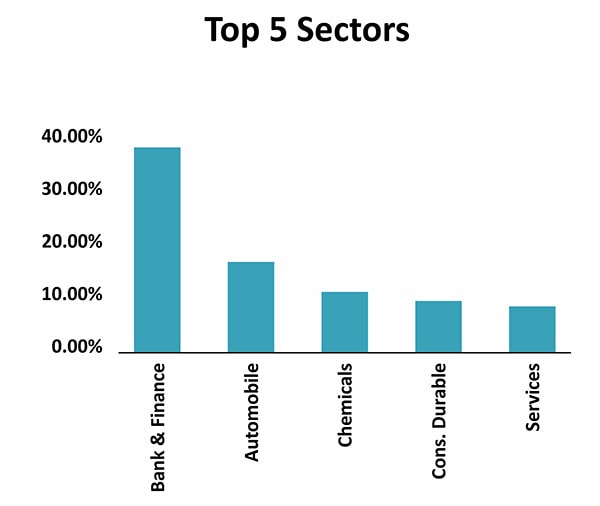

Portfolio Allocation

1. Market Capitalization

2. Sector Allocation

DSP BlackRock Tax Saver Fund (G)

DSP BlackRock Tax Saver Fund is having a tag of consistent performer that has always beaten the benchmark’s average. A large number of stocks in the portfolio depict that the scheme is focused on controlling the risk factors through high diversification which helps it to endure a conservative portfolio.

In the last 5 years, it has always tried to beat the benchmark; also, even during the hard times like 2015 and 2016, the fund outperformed the category. Currently, it is managing an asset size amounting to Rs. 4,577 crore as of July 31, 2018. And, DSP BlackRock Tax Saver Fund NAV amounts to Rs. 48.14 as on August 21, 2018.

Portfolio Allocation

1. Market Capitalization

2. Sector Allocation

Let’s find out more about this interesting mutual fund category.

What Are Tax Saving Mutual Funds?

ELSSs (Equity Linked Savings Schemes) are those mutual funds investing in which investors can enjoy the dual benefits of tax saving as well as high equity returns. This category is included U/s 80C which allows the investors to get tax benefits on investments of up to Rs 1.5 lakhs.

Who Should Invest in Tax saver funds?

Tax saving funds are best-suited to investors who have:

- A moderately-high risk appetite

- Investment horizon of 5-10 years

- The annual income of more than Rs 5 lakhs to create a good future corpus while enjoying the tax benefits.

How to Choose Top 5 Tax Saving Mutual Funds?

There are various parameters to choose a best tax saving mutual fund online. Let's have a quick look at what they are:

- Performance History- In this step, we check the past performance of an ELSS fund. This tells us about the behaviour of a scheme in various market conditions. Keep in mind that the past performance cannot be used directly to predict the future of a scheme.

- Asset Size- Look out for a scheme that has a good asset size (more than 300 crores), as it helps the respective fund managers in creating a more diversified and focused portfolio.

- Allocation: This is a two-step check in which, first you have to see what part of the total investments are in equities and how much are in debt instruments, and the second step is to see the sector allocation and then analyze it by comparing with the current equity market behavior.

- Diversification: This is a check to see in what manner the funds are distributed among different market caps. By looking at this, you can analyze the investment style of the fund manager, and can also predict what kind of returns it can give in the near future.

Benefits of Investing in Tax Saver Funds

- The first and foremost advantage of an ELSS Fund is the tax deductions that you can claim by investing in these schemes. As per Sec 80C, investment up to Rs 1.5 lakhs will be exempted from your annual taxable income. Through this, an investor can save up to Rs 46,350* in taxes.

- These tax saver schemes have a lock-in period of only 3 years, which is the lowest in comparison to other instruments (PPF, NSC, FD, etc.,) which fall U/s 80C, the lock-in of which can range from 5-15 years.

- The annualized returns of more than 12% are like a cherry on the top of a cake.

- The minimum investment amount for most of the best tax saver funds is just Rs 500, which means anybody can invest in these schemes without affecting their monthly budget.

Risk Comparison

| Particulars | Standard Deviation | Beta | Sharpe | Maximum Drawdown | Upside | Downside |

|---|---|---|---|---|---|---|

| Benchmark: S&P BSE 200 | 14.03 | 1 | 0.64 | -17.47% | 100 | 100 |

| Category | 14.72 | 0.99 | 0.53 | -17.65% | 95 | 101 |

| Reliance Tax Saver Fund | 18.38 | 1.2 | 0.24 | -21.13% | 107 | 149 |

| Aditya Birla Sun Life Tax Relief 96 Fund | 13.56 | 0.88 | 0.71 | -15.03% | 87 | 72 |

| L&T Tax advantage Fund | 14.22 | 0.97 | 0.66 | -18.85% | 97 | 92 |

| Axis Long term Equity Fund | 12.76 | 0.84 | 0.74 | -13.90% | 90 | 78 |

| DSP BlackRock Tax Saver Fund | 15.49 | 1.05 | 0.58 | -17.29% | 102 | 104 |

| As on July 31, 2018 | ||||||

You can also submit your queries by filling this form - https://goo.gl/WofRJm & our expert will get back to you as soon as possible.

Conclusion:

Considering all the above-listed points, it can be concluded that:

- Reliance Tax Saver Fund and Aditya Birla Sun Life Tax Relief 96 Fund (G) are both aggressive nature funds which attract high risk and offer high growth.

- On the other hand, DSP BlackRock Tax Saver Fund (G) is a consistent performing ELSS fund which is known for its stable returns, whereas Axis Long Term Equity Fund (G) is more of a defensive fund which is typically meant for low-risk investors.

- Lastly, the L&T Tax Advantage Fund (G) is an all-time performer which is moderately risky and offers moderately high returns.

This ends our discussion on the 5 best tax saver mutual funds to invest 2018 as recommended by the experts at MySIPonline. Investors can pick the best one for themselves considering their own risk profile, the tenure of investment, and objective. If you have a query or doubt regarding any of the above schemes, feel free to connect with our experts.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

.webp&w=3840&q=75)