Table of Contents

How many times have you promised yourself you will start saving “next month”? If you are waiting for that one month, then you are already late in saving or rather, stepping towards your financial freedom. This may not be the best way to save money. Most people think that next month, they will be able to save some extra amount that remains after all expenses, but that extra amount never exists.

And somehow, if they manage to save some amount, they put it in their drawer, thinking that this is the best way to save money. But, these traditional methods do not work anymore, as the little money you saved is not enough to fight your emergencies, expenses or rising prices of goods and services day by day.

Saving is the essential first step but the best way to save money for future success is to put those savings in strategic investments. This blog walks you through simple, practical ways to handle your money better without stress or confusion. So, let us march towards your financial freedom now.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Get the Basics of What Saving Smart Really Means

Let us get one thing straight that the best way to save money is not just about hiding cash in your drawer and hoping for the best. Traditional savings do not work in the long run because while your money is safe but it is not generating enough power to fight against the rising prices day by day.

The real magic happens when you treat saving and investing like a tag team. When you combine the two, you take your first step towards “Smart Saving”. When you save, your savings handle the short term needs like that sudden car repair or fulfilling household needs. But your investments are heavy lifters, building your wealth in the background. Even a small portion of your income invested wisely can multiply over time. If you are thinking of the best way to save money for the future, then you have to think of both ways. This becomes more crucial if you are salaried or a professional individual.

Let us first know how you can save money in the best way.

Best Way to Save Money from Salary

If you are thinking that you will save the extra money left at the end of the month, then you might be left with nothing. Let us know step by step what the best way is to save money from salary.

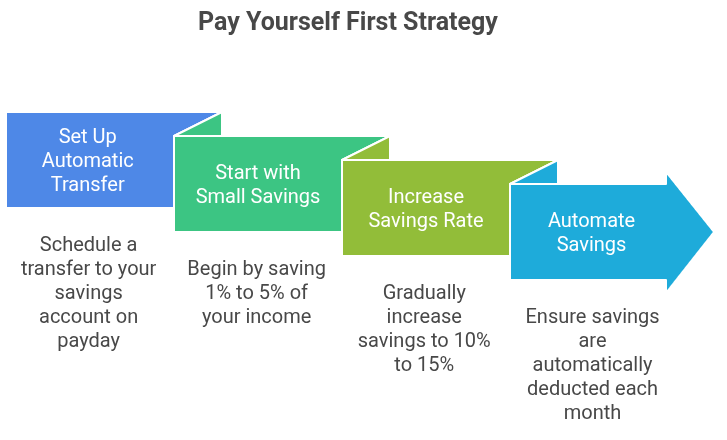

Pay Yourself First (The Non-Negotiable Rule)

Most people spend their entire salary and try to save whatever is left. This is a step towards a zero bank balance. The most successful savers turn the process upside down by saving first and spending what remains. To achieve this, you can follow the steps below:

- Set up an automatic transfer to your other savings account for the day you receive your money.

- Try to save just 1% to 5% of your income to build the habit in the beginning.

- As you adjust, then set the saving amount to the standard of 10% to 15%.

Use the 50-30-20 Rule (or Smarter Variations)

Once you have the habit of paying yourself first, you need a structure to organize the rest of your money. The 50-30-20 rule is the perfect standard for this, which suggests:

- You spend 50% of your income on daily expenses (rent, groceries and bills).

- 30% on wants (dining out, hobbies).

- 20% on savings & investments.

This provides a balanced life where you are responsible for today while preparing for tomorrow.

Best Mutual Funds for 2026 Backed by Expert Research

Separate Accounts for Spending, Saving and Investing

One of the biggest psychological traps in money management is keeping all your funds in a single checking account. It is easy to merge the savings amount into emergency funds accidentally. To prevent this, you must separate your accounts to create distance between your expenses and savings. You should operate with at least three distinct accounts.

- First is your “operational Account” that receives your paycheck and bills.

- Second, your “Short Term Savings” will be used for an emergency fund and your wants.

- Finally, your “Wealth Engine”, or say, a savings & investment account that works for long term growth.

Pro Tip: Freedom SIP helps you invest regularly and later withdraw a fixed monthly amount, turning your investment into a steady income stream.

Now you must have come to know that earning money is not sufficient, but controlling waste expenses is also important. Let us see how we can cut off this waste.

Must Read: 2026 Finance Goals: 5 Key Personal Finance Rules for Better Money Management

Cut Waste Without Sacrificing Lifestyle

Many people believe the best way to save money requires strict sacrifices, cutting enjoyment, but in reality, smartly managing your money for daily expenses can free up a surprising amount of money. Let us check below what the truth is.

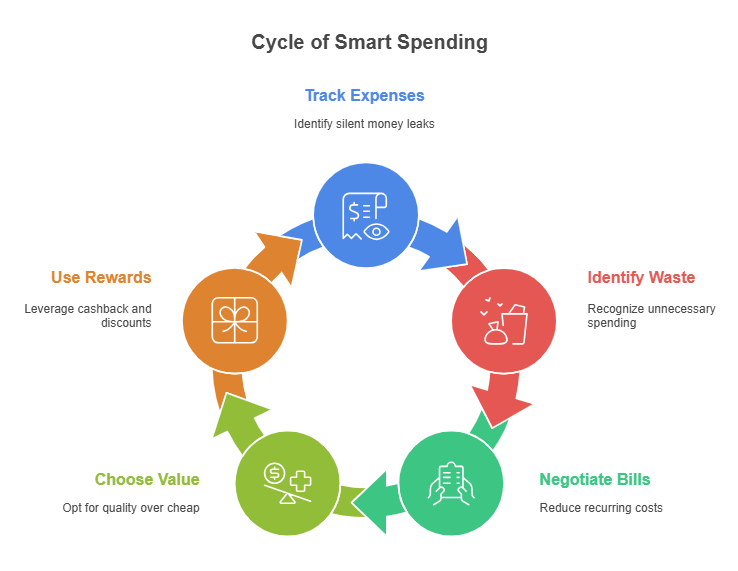

Track Expenses to Identify Silent Money Leaks

Most unnecessary spending happens silently without conscious decision making. Expenses like monthly subscriptions or gym memberships that are rarely used or paying Rs 100 in delivery fees for a Rs 150 pizza. So, now you are aware of the “silent leaks” that offer zero value or empty your pockets.

Need not worry! you can still regain control by tracking your expenses or reviewing bank statements. You can also use budgeting tools or expense tracking apps that will help you uncover these hidden patterns & make the process simple & insightful. This awareness alone is a decisive step toward adopting the best way to save money.

Smart Spending Hacks That Add Up

After identifying the waste expenses, the next step is to spend smarter, not less. Follow the steps below to save more money:

- Negotiating recurring bills such as mobile plans, internet services or credit card fees can lead to immediate savings with minimal effort.

- Choose value over cheap and low quality products that may cost more but last longer and reduce repeated spending.

- Additionally, use cashback offers, reward points and discounts wisely to save on the purchase price of any product or service.

When these practices are adopted in small steps, they lead to the best way to save money for future wealth without sacrificing lifestyle comfort. But below is a surprise on how you can turn your savings into future growth.

Pro Tip: Check in SIP Calculator how investing Rs 5000 per month for 15 years @12% can grow to around Rs 25 lakhs.

Best Way to Save Money for the Future (Long Term Strategy)

The best way to save money for the future is to build a strong financial foundation that protects as well as grows your wealth over time. For salaried individuals and professionals, combining disciplined saving with risk protection is the best way to save money from a salary. A well-planned strategy focuses first on safety and stability, then on growth.

Build an Emergency Fund First

Before you start picking stocks or buying real estate, the best strategy is to create a robust emergency fund. It acts as a financial shield during unexpected situations such as job loss, medical emergencies or urgent maintenance. Generally, your emergency fund should cover 3 to 6 months of essential expenses. This fund should be kept in liquid and safe options such as a high-interest savings account or a liquid fund, where money is easily accessible.

Protect Your Future with Insurance & Risk Planning

We discussed saving and investing, but protecting what you have built is equally critical. Isn’t it right? This protection comes from health insurance, life insurance and other critical covers that save you in case of any mishap. Even the most disciplined person applying the best way to save money from salary can have their life savings wiped out by a single uninsured medical event or a liability lawsuit.

At a minimum, every long term strategy should include:

- Comprehensive Health insurance: To cover rising medical and diagnostic costs.

- Term Life Insurance: Especially if you have dependents ensuring that they are financially safe if your income is suddenly gone.

- Income Protection (Disability Insurance): To replace a portion of your salary if you are unable to work due to illness or injury.

Also Read: How to Save Money from Salary Monthly? Best Ways in India

At first, paying premiums may feel like an expense but it is actually a vital part of your savings strategy. Let us see how you can turn your savings into a wealth generator.

How to Grow Money Faster to Turn Savings into Wealth?

Saving money is an essential first step, but building real wealth requires a shift in mindset: you must move from being a “saver” to an “investor”. To truly move on the best way to save money for the future you must understand that your extra cash needs to work as hard as you do.

Why Saving Alone Cannot Beat Inflation?

While traditional savings provide security but relying entirely on a savings account will not help your wealth grow. Simply put, the interest rate paid by the bank is not sufficient to fight against inflation or, simply, rising prices of goods and services over time. Your money is actually losing “purchasing power” over a period of time.

So, what to do? To grow wealth faster, you must buy those assets that historically outperform inflation. The best way to save money from salary is not just about putting it away, but it is about putting it where it can grow.

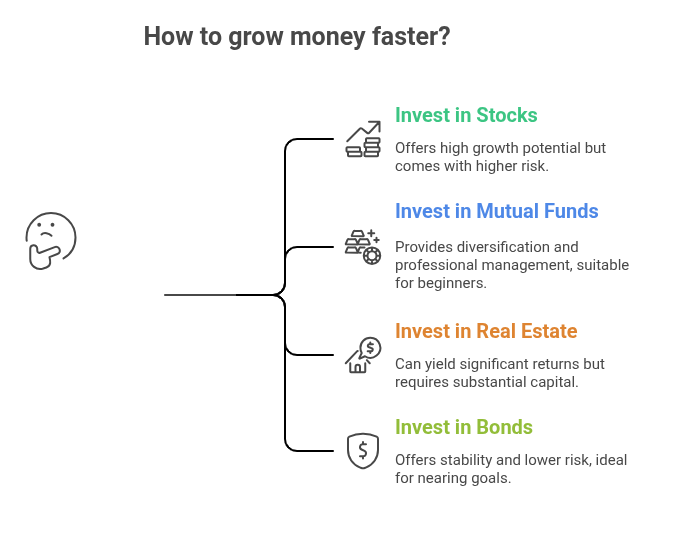

Beginner-Friendly Investment Options

Starting your investment journey does not require a finance degree. In 2026, there are various options available to invest that help them to grow their money over time.

From real estate to stocks to mutual funds, the market is open for all giving a chance to invest as per their capacity.

If you are a beginner to investing, you can start small in various stocks and mutual funds. The most effective entry point for most salaried individuals remains mutual funds, as they give a chance to earn a handsome return from stocks and securities while protecting from any overhead stress.

Balance Between Safety and Growth

The secret to a long term strategy is finding the right balance between risk and reward. Generally, the younger you are, the more growth assets like stocks you should hold.

To balance the risk and grow your money, you can opt for SIP (Systematic Investment Plan) to benefit from rupee cost averaging. This way, you invest a fixed amount of money at regular intervals instead of waiting for the right time in the market.

Gradually shift towards safety assets as you get near your set goals. Investing in bonds or government securities can help protect the wealth you have built. So, maintaining this balance helps you to lead the best way to save money for future financial security.

Pro Tip: An SWP Calculator shows how withdrawing Rs 15,000 monthly from a Rs 30 lakh fund at 7% annual returns can provide income for about 18 years.

Smart Investments, Bigger Returns

Conclusion

The best way to save money is not a single trick, shortcut or strict rule, but it is a balanced system built on the right habits and consistent actions. True financial progress happens when smart saving habits, careful spending decisions and long term investing work together.

The most important step is not perfection, but starting. You do not need to wait for a higher salary, a perfect plan, or a perfect time. Take action today by setting up automatic savings, reviewing your expenses or making your first long term investment. When you commit to this system, you will not just save money, but you will also find the best way to save money for your future goals on your own.

Related Blogs:

Frequently Asked Questions

-

What is the fastest way to start saving with zero balance?

Start by saving small amounts daily or weekly matters more than the starting amount.

-

What is the “1% Rule” for annual raises?

Every time you get a raise, increase your savings rate by at least 1% before you have a chance to spend the extra income.

-

Is gold a good way to save money for future security?

Gold acts as a hedge against inflation; experts suggest keeping it to about 5–10% of your total portfolio.

-

What is the “72-Hour Rule” for big purchases?

Wait three days before buying anything over Rs 1000; if the “need” fades, the money stays in your savings.

-

Is it okay to stop saving to build a business?

Only if you have at least 12 months of living expenses saved first, a business is a high-risk investment that needs a safety net.

-

What is a “No Spend Weekend”?

A challenge where you spend Rs 0 on non-essentials for 48 hours to reset your spending habits and find free entertainment.

.webp&w=3840&q=75)

.webp&w=3840&q=75)