Table of Contents

- Bandhan Small Cap Fund Review

- Investment Strategy of Bandhan Small Cap Fund

- Reviewing the Returns of Bandhan Small Cap Fund

- Analysing the Portfolio Composition of Bandhan Small Cap Fund

- Who Manages Bandhan Small Cap Fund?

- Bandhan Small Cap Fund Risk Analysis

- Stock Quality of Bandhan Small Cap Fund

- Is It Safe to Invest in Bandhan Small Cap Fund?

- Conclusion

Did you know that the Bandhan Small Cap Fund topped the list of Equity Mutual Funds for its 3-year CAGR? You heard it right. As of September 2025, this small cap fund by Bandhan Mutual Fund has delivered 29.60% returns for the past 3 years and generated AUM worth Rs 14,513 Cr, proving its worth while giving strong performance and consistently beating its category and benchmark.

But, given the high risk rating of small cap funds, "Is Bandhan Small Cap Fund Safe to Invest in 2026?" Absolutely. Although the fund carries high volatility, it is well-suited for investors with a long-term perspective and strong risk appetite. So, if the market changes do not bother you and growth is what you are chasing after, this fund stands out as a top choice for 2026.

Dive into this Bandhan Small Cap Fund Review and further explore the investment strategy, risk profile, portfolio quality and more to help you decide whether this mutual fund deserves a spot in your 2026 investments.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Bandhan Small Cap Fund Review

The Bandhan Small Cap Fund, formerly the IDFC Small Cap Fund, is a highly rated Mutual Funds known for its strong past performance, disciplined investment style and effective risk management.

Launched in 2020, it has grown its AUM to Rs 14,513 Crore by September 2025. Managed by Manish Gunwani since 2023, the fund consistently delivers impressive returns, surpassing its benchmark and peers.

The fund provides a lump sum investment at Rs 1000 (min) and SIP at Rs 100 only. Look at the other details below:

| Attribute | Value |

|---|---|

| Fund House | Bandhan Mutual Fund (acquired IDFC AMC in 2022) |

| Launch Date | February 2020 |

| AUM (as of Aug 2025) | Rs 14,562 Crores |

| Risk Level | Very High |

| Benchmark | 250 Small Cap TRI |

| Exit Load | 1% if redeemed within a year |

| NAV (as of Sep 2025) | Rs 51.64 |

Let us explore the investment style this fund uses to generate efficient returns.

Investment Strategy of Bandhan Small Cap Fund

Bandhan Small Cap Fund's investment strategy relies on the GARP approach, which stands for Growth at Reasonable Price, for stock selection. To build a well-diversified portfolio, the plan focuses on three components: growth, quality and reasonable valuation.

The fund adopts a buy-and-hold philosophy with active management to acquire long-term appreciation. These types of mutual funds commonly target small companies with higher growth potential and reasonable prices (measured using P/E, P/B, etc.). They avoid overpaying for growth.

The fund's research is based on a bottom-up approach and uses a top-down approach to align with macroeconomic trends. The fund's diversified portfolio typically holds around 210 to 215 stocks. The top holdings are kept small to manage risk, with the top 10 stocks making up less than 20% of the portfolio.

In the next part, you will explore a detailed analysis of this mutual fund's SIP and rolling returns.

Best Mutual Funds for 2026 Backed by Expert Research

Reviewing the Returns of Bandhan Small Cap Fund

The Bandhan Small Cap Fund has given a consistent & strong performance, surpassing its benchmark. Here are the best SIP and rolling returns of this fund:

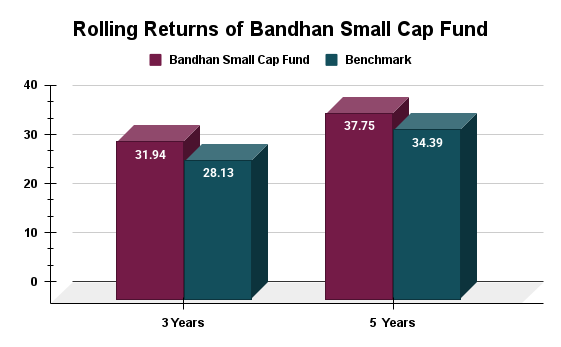

Rolling Returns

The Bandhan Small Cap Fund delivers strong returns, with around 32% over 3 years and nearly 38% over 5 years, consistently outperforming its benchmark. This consistency makes it a solid option for growth focused investors with a long-term investment perspective who are comfortable with associated risks. The graph shows the rolling returns of the fund:

The graph shows the fund outperforming its benchmark at 28.13% over 3 years and 34.39% over 5 years, giving a perfect consistency score for both periods.

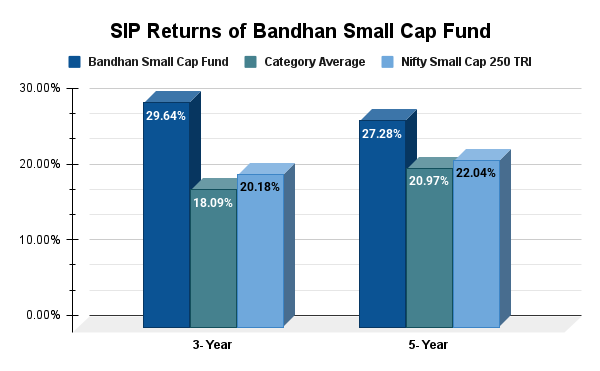

SIP Returns

The Bandhan Small Cap Fund also delivered impressive SIP returns, with returns of 29.64% and 27.28% for 3 & 5 years, respectively. These returns exceed the category average & the benchmark, making it an excellent choice for investors looking for consistent growth through regular investments. Check out the graph below:

The above graph displays the consistent performance, proving the fund’s strength in generating stable wealth over time.

Must Read: Best SIP Plan for 20 Years: With Equity, Debt & Hybrid Funds

Now, let us navigate this fund's portfolio and find out which sectors it invests in the most.

Analysing the Portfolio Composition of Bandhan Small Cap Fund

One can describe a Bandhan Small Cap Fund portfolio through three central allocations. Those are:

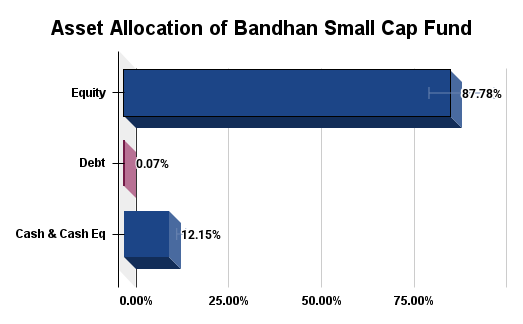

Asset Allocation

Bandhan Small Cap Fund invests 87.78% of its assets in equities for aggressive growth, 0.07% of the assets are allocated in the debt instruments to provide liquidity and maintains 12.15% cash reserves for flexible investments. Look at the graph:

This allocation suits investors who want to diversify in the small-cap category while balancing risks.

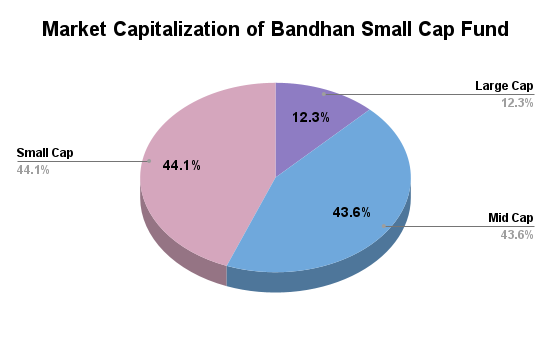

Market Cap Allocation

The Bandhan Small Cap Fund's market cap allocation primarily focuses on mid caps (43.63%) and small caps (44.11%) for higher returns, but this also comes with high risk. It has a minimal allocation in large caps (12.26%) for stability. Refer to the graph below:

The graph indicates a strategy for high growth while taking higher risks to generate strong returns in a bullish market.

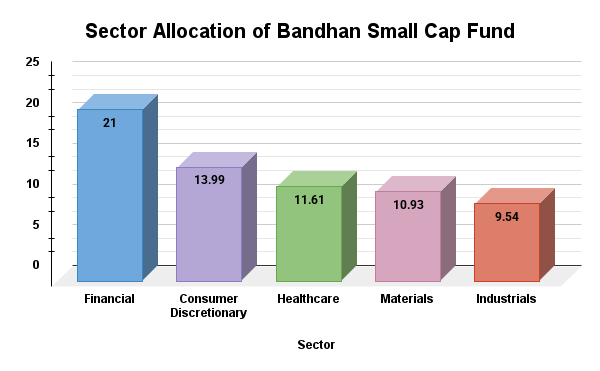

Sector Allocation

The portfolio is mainly allocated to the financials (21%) and consumer discretionary (13.99%) sectors, followed by healthcare (11.61%), materials (10.93%) and industrials (9.54%) sectors. See the graph:

The allocations represent preferring growth-driven sectors and reduced exposure to cyclical industries for a balanced approach.

Here come the masterminds. Let us review the profiles of the management team for this fund.

Smart Investments, Bigger Returns

Who Manages Bandhan Small Cap Fund?

The personalities behind Bandhan Small Cap Fund's success are Manish Gunwani (Fund Manager), Kirthi Jain (Co-Fund Manager) and their team. They have managed this mutual fund since June 2023 and increased its AUM to Rs 14,513 Crore in September 2025 from Rs 5,000 Crore in 2023.

Leading this fund since 2023, Gunwani has over 25 years of experience in Equity Mutual Funds research and fund Management. Previously, he worked with rising industries like IDFC Mutual Fund (as CIO-Equities) and Nippon India. He is a specialized mid and small-cap strategist who focuses on growth oriented opportunities.

Gunwani's strategy is to select small cap stocks using a bottom-up approach while considering market changes. His team of over 50 analysts researches thoroughly, aiming for quality investments over risky assumptions for long-term success. One Example of his expertise is the 2022-23 volatility. He managed to keep the losses below 20% when the benchmark loss was itself at 25%.

In the next heading, let us check out the risks associated with this mutual fund.

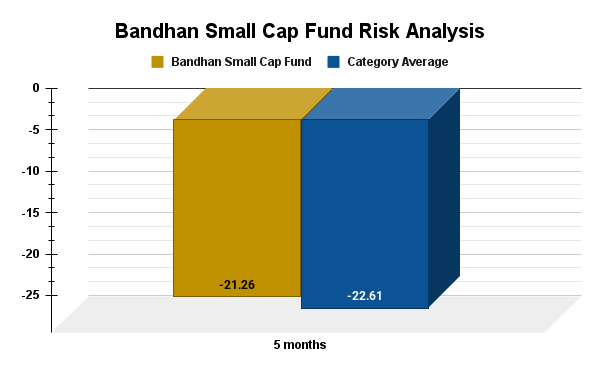

Bandhan Small Cap Fund Risk Analysis

Bandhan Small Cap Fund has a high risk level, but still shows stronger risk-adjusted returns with a higher Sharpe ratio (1.19) and alpha (7.28). Despite slightly higher volatility, it manages drawdowns better (-21.26%) and recovers faster. Check out the risk analysis of this fund below:

These ratios indicate efficient risk management and consistent performance compared to the category average.

Also Read: Best Mutual Funds to Invest in 2025: Low-Risk Options for High Return

In the next part, you will explore the quality of the stocks selected for investments from this fund.

Stock Quality of Bandhan Small Cap Fund

Bandhan Small Cap Fund has higher earnings (21.11), sales (10.7) and cash flow (6.98) growth than the category average, despite having a lower P/E ratio (15.62). This suggests the fund invests in relatively undervalued stocks with better growth potential. The following are the ratios of the stock's quality:

| Ratio | Value |

|---|---|

| Sales Growth | 10.7 |

| Earnings Growth | 21.11 |

| Cash Flow | 6.98 |

| PE- Valuations | 15.62 |

The above graph shows that the fund offers an attractive mix of value and quality for investors with long-term horizons.

Now, the main question is, “Is Bandhan Small Cap Fund Investment Safe for You in 2026?” Keep reading to know.

Is It Safe to Invest in Bandhan Small Cap Fund?

One should keenly understand financial markets to measure the fund's safety. Here is a breakdown for you to know if Bandhan Small Cap Fund is safe for you or not:

-

High Volatility

Due to the huge contribution in small cap companies (in the top 250), this fund is more volatile than mid & large cap funds.

-

Very High Risk Rating

It suits only the investors who can endure large investment fluctuations and take possible losses.

-

Strong Performance

The fund has outperformed its benchmark regularly since its launch in 2020 with its GARP investment strategy.

-

Risk Management

The fund reduces the risks through diversification & tactical allocation, showing flexibility even during market downturns.

-

Experienced Managers

Manish Gunwani and his team manage this mutual fund, which contributes to its strong track record and firm performance.

-

Liquidity

The fund effectively manages the liquidity challenges of small cap stocks, especially during sudden large redemptions in tough markets.

-

Long-Term Horizon

This fund is best for calm, long-term investors (5-7 years or more), as small cap investments require time to grow.

-

Large AUM

The fund has Rs 14,562 crore AUM and strong investor support. The challenge lies in the fund manager's ability to identify smaller chances.

Pro Tip: Use a SIP Calculator to estimate the future value of your SIP investments.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Conclusion

To conclude Bandhan Small Cap Fund Review, in 2026, this fund can be a rewarding investment for investors with a long-term investment perspective and a strong risk tolerance. Although this mutual fund has delivered remarkable rolling and SIP returns, investors must carefully consider analysing the fund's track record and performance against the benchmark before investing.

However, it is not suitable for investors who want stability, so be aware of the high risks involved in these Small Cap Mutual Funds before investing this year.

Related Blogs:

- Is SIP a Safe Investment in 2025? Truth Of Secure Investing

- Nippon India Small Cap Fund Review 2025: Complete Guide

FAQs

-

What has been the return of the Bandhan Small Cap Fund since its inception?

Bandhan Small Cap Fund has delivered a 32.06% CAGR return since its inception in February 2020.

-

Is Bandhan Small Cap Fund's fund manager good enough?

The fund managers are experienced and well-regarded for consistent performance and strong portfolio management.

-

What is the alpha ratio of Bandhan Small Cap Fund?

The alpha ratio is favorable at 8.19, showcasing good outperformance against its benchmark.

-

What is the standard deviation of Bandhan Small Cap Fund?

Fund volatility (standard deviation) is high at 17.97%, reflecting typical small cap risk levels.

-

What are the top 5 holdings of Bandhan Small Cap Fund?

The top five holdings include Sobha Ltd, The South Indian Bank, REC Ltd, LT Foods Ltd and Cholamandalam Financial.

-1.webp&w=3840&q=75)

.webp&w=3840&q=75)