Table of Contents

- Check the investment style of the scheme

- Match the objective of fund with your own.

- Access your risk taking capacity.

- Analyze the long term performance

- Analyze the track record of fund managers.

Table Of Content

- Introduction

- Dynamic asset allocation

- How mysiponline research team select the best funds in this category

- Top 5 dynamic asset allocation funds

- HDFC Balanced Advantage Fund

- ICICI Pru Balanced Advantage Fund

- Tata Balanced Advantage Fund

- Motilal Oswal Balanced Advantage Fund

- Baroda Bnp Pribas Balance Advantage Fund

Best Dynamic Asset Allocation or Balanced Advantage Funds 2023

Introduction

Legendary investor Howard Marks believes that financial markets operate in a cycle, driven by factors like investor sentiment, the availability of money in the market, and risk tolerance.

These cycles lead to periods of rising prices (bull market) and falling prices (bear market). To succeed in such an environment, the investing strategy should be very flexible (Dynamic) and can be taking risks in the bull phase to generate good returns and switching to a conservative style of investing to manage the risk during market falls.

This is very tough for general investors to change the allocation and manage money in real time. Therefore, the mutual fund industry introduced this Dynamic Asset Allocation Fund category in the hybrid mutual fund. As it is the perfect category to deal with the market's ups and downs. It is also trending these days as the equity market currently seems overvalued.

Dynamic asset allocation

An important category of hybrid mutual fund which means it invests in equity and debt asset classes popularly known as a Balanced advantage fund. Which means fund managers use their specialized knowledge to understand market conditions and change allocation between equity and debt accordingly. As per the SEBI-managed Dynamic asset allocation funds can keep 0-100% in the equity market and 0-100% in debt instruments.

For example- when the equity market is considered undervalued, fund managers increase its equity allocation and when the market is seen as overvalued, they shift more of their investment into debt instruments as per the conviction.

How mysiponline research team select the best funds in this category

Out of the 30+ funds in the category, the MySIPonline research team found those funds that have the best track record of market timing and these funds have consistently made accurate adjustments to their asset allocation based on their understanding of market conditions.

As a result, they have a strong history of good performance in the past, and their current investment allocations are also well suited to the current market conditions.

So the top 5 best dynamic-balanced advantage funds are

Top 5 Dynamic asset allocation funds

1.HDFC Balanced Advantage Fund

This is one of the oldest funds launched in 1994 and manages the biggest investment size (AUM) of Rs 61598 Cr.

Schemes Asset Allocation Strategy-

HDFC balanced advantage fund adjusts equity and debt allocation based on corporate earning yield vs. government securities yield. High corporate yield leads to higher equity allocation; better government yield leads to increased debt allocation. Equities focus on strong revenue growth and expansion, while debt is used for risk management with occasional active calls for wealth generation.

Average Return (Rolling Return)-

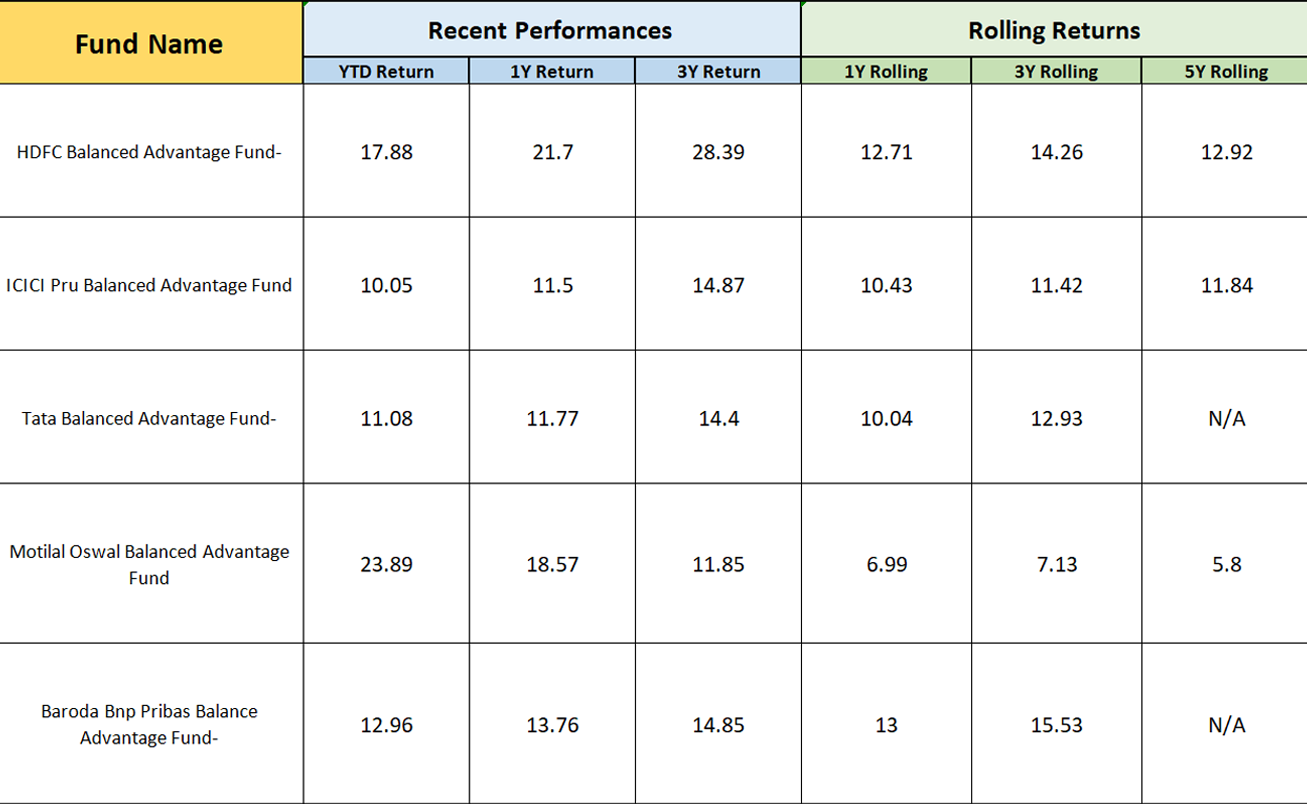

Thefund’s performance analysis over 1,3,5 years shows average returns of 12.71%, 14.26%, and 12.92%, outperforming both the category average and benchmark.

Recent performance-

The fund’s recent 1 and 3-year performance at 21.7% and 28.3% respectively surpasses the category average returns of 11.27% and 13.09%.

Current allocation

As now equity market seems overvalued they have reduced equity exposure to 58.98% and debt to 27.78 and remaining in cash 11%.

Suitability of HDFC balanced asset allocation fund-

This fund is the best fund in the category and suitable for every type of investor especially those who want less risk than equity market risk but want higher than benchmark nifty 50%

2.ICICI Prudential Balanced Advantage Fund

The ICICI Prudential Balanced Advantage Fund's major goal is to provide investors with the possibility for long-term financial appreciation while managing risk. Their asset allocation strategy simply rests on valuations. In this, they track the price-to-book value ratio of the index which increases their allocation towards debt when the price of stocks becomes higher in comparison to their book value so that the debt market can handle the risk of falling well.

Average Returns (Rolling Return):

The average annual returns of this fund since its launch till now for 3 & 5 years have been 11.42% and 11.84% which is again higher than the benchmark. Its consistency of generating returns above 10% in 3 years has been 68%.

Recent performance:

In the recent 1,3 and 5-year performance at 11.05%, 14.87%, and 11.84%. comparison to its benchmark.

Current allocation:

Now that the current equity market valuations are seen to be high, the fund has reduced the equity portion of its portfolio to 45% and has kept it the safest allocation in the category. 26% in debt and the remaining 25% in cash so that one can call as per market opportunity.

Suitability of ICICI Prudential Balanced Advantage Fund-

Suitable for conservative investors or new investors who want consistently good risk-adjusted returns.

3.Tata Balanced Advantage Fund

The key feature of Tata's balanced advantage fund is the dynamic allocation between equity and debt based on macroeconomic conditions and equity market valuations. Increase equity exposure during the bullish phase and reduce it during a bearish or uncertain market to manage risk.

Average Return (Rolling Return):

Thefund’s performance analysis over 1 and 3 years shows 10.04% and 12.93%. They are higher as compared to their benchmark, which was 36.8% and 31.91.

Recent Analysis:

Thefund’s performance analysis over 1 and 3- years shows average returns of 11.77% and 14.04%. outperforming both the category average of 11.27% and 13.09.

Current allocation-

Now the fund performs well the equity is 53.31% and the remaining debt is 21.29%, cash is 17.91%.

Suitability of Tata Balanced Advantage Fund-

The Tata Balanced Advantage Fund is ideal for investors looking for a well-balanced approach with dynamic asset allocation, skilled management, and a medium to long-term time horizon. It provides development potential with risk management.

4.Motilal Oswal Balanced Advantage Fund

The asset allocation strategy of the Motilal Oswal Balanced Advantage Fund is like other funds but in the equity segment, this fund earns high returns by targeting small & mid-cap stocks. That's why their target is to find Small companies that could become like future HDFC or Asian paints. Motilal Oswal has always been known to go for equity

Average Return (Rolling Returns):

The past performance of the fund has not been so good, the average return for 3 years is only 7.13% which is less than the benchmark.

Recent analysis:

Recently, there has been a huge improvement in their performance, hence the returns of the fund in the last year are the highest at 19%. And in 3- year 11.85%. The risk management of the fund is normal. Fall was less than the benchmark and recovery was on time.

Current allocation:

Now that the current market valuation is high the equity is 54.06%, 16.82% debt, and 26.80% cash.

Suitability Motilal Oswal Balanced Advantage Fund-

Motilal Oswal Balanced Advantage Fund is excellent for medium to long-term investors that value both growth potential and risk management. In short, it is best for those investors who want very high returns in this category

5.Baroda BNP Pribas Balanced Advantage Fund

Unique Approach of Baroda BNP Pribas Balanced Advantage Fund : This fund stands out for using both equity and debt to create wealth, not just manage risk. Its dynamic asset allocation is guided by valuation parameters and macroeconomic data, aiming for high returns.

Average Return (Rolling Return):

the average annual returns of 3 years since its launch have been 15.53% which is the highest in the industry and the consistency of giving returns of more than 10% is 100%.

Recent analysis:

The recent performance of the fund in 3- years is 14.85%. they are higher than their benchmark.

Current allocation:

Now that the current market valuations are seen to be high, the equity is 69.12%, but still high among category peers, the remaining debt is 27.00% and cash is 3.88%.

Baroda Bnp Paribas Balanced Advantage Fund

The Baroda BNP Paribas Balanced Advantage Fund is best for those investors who can tolerate little volatility but not more than the equity market. This fund aims to generate potentially higher returns over the medium to long term in its category.

The mysiponline.com research team has employed the following parameters for shortlisting best-balanced advantage funds

Selection parameter-

- Historical performance: Examine previous performance and consistency

- Risk management: Examine how the fund manages risk.

- Risk to Reward Ratio: Risk-adjusted performance should be measured.

- Fund manager Expertise: Consider the manager's background.

- Asset under management (AUM): Recognize the fund's substantial influence.

- Portfolio Quality: Examine asset types and quality.

- Fund Objectives: Ensure that your objectives are aligned.

- Expense Ratio: Consider the financial impacts.

- Liquidity: Assess ease of buying and selling.

- Tax Implication: Keep in mind the tax implications.

.webp&w=3840&q=75)