Table of Contents

- ICICI Prudential Balanced Advantage Fund - Growth

- HDFC Balanced Advantage Fund - Growth Plan

- Motilal Oswal Large and Midcap Fund - Regular Plan Growth

- SBI Balanced Advantage Fund - Regular Plan - Growth

- Parag Parikh Conservative Hybrid Fund Regular - Growth

A Systematic Investment Plan (SIP) is a smart and easy way to invest your money in mutual funds. Instead of putting a lump sum amount all at once, you can invest a smaller fixed amount regularly like weekly, monthly, quarterly, or yearly. SIP amounts might vary based on the fund house’s regulations and the sort of mutual fund you choose to invest in. Investing through SIP can lower the average cost of each mutual fund unit, the rupee cost averaging has the potential to boost the returns on your investment. If you commit to your SIPs every month for a long time, it has the potential to compound and grow into a large corpus. This stability changes your financial health in the future. You can start investing in the Best SIP Funds for just Rs.1000 per month and earn high returns. It depends on your risk profile and investment goal.

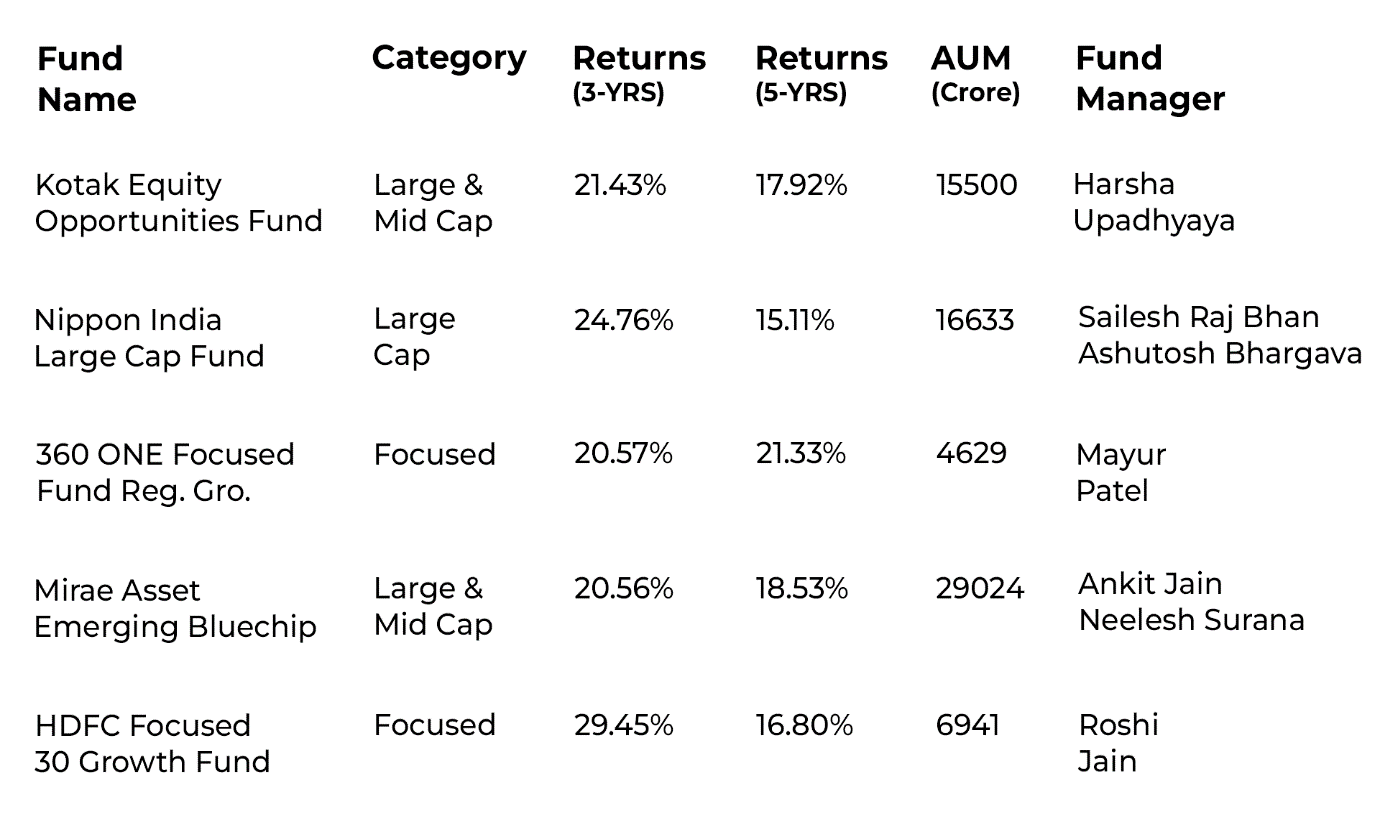

Best SIP funds for 2024

Kotak equity opportunities funds

The Kotak Equity Opportunity Fund falls under the Large & Mid-cap category. It is an old fund that was launched in 2004 with a focus on investing in established large-cap stocks and growing mid-cap stocks. This fund has shown consistently good returns with rolling returns of 14.5% and 14% for 3 and 5 years respectively, outperforming its benchmark. Mr. Harsha Upadhyaya has 23 years of proven experience in fund management and equity research and leads Kotak AMC's equity management team. He currently oversees the management of the Kotak Opportunities and Kotak Select Focus funds and has previously held positions at SG Asia Securities, Reliance Group, UTI Asset Management, and DSP BlackRock.

Launch date: 5- 09- 2004

Asset class: Equity

AUM: 15500

Expense Ratio: 1.66

Category: large and mid-cap

Fund Manager: Harsha Upadhyaya since 01-August-2012

Risk: very high

Nippon India Large Cap Fund

Nippon India's Large Cap Fund is an open-ended Equity Schemes that primarily invests in large-cap stocks. The fund was introduced to investors on August 8th, 2007. Over the last 3 and 5 years, the rolling returns of the Nippon India Large Cap Fund have been 12.86% and 13.55%, respectively, which is a good performance compared to its benchmark. Mr. Sailesh Raj Bhan, who has more than 15 years of fund management experience at Reliance Nippon Life Asset Management Limited, has over 24 years of expertise in the Indian equity markets. He has previously held positions as an equity research analyst at ICFAI-Securities Research Center, Shah & Sequeira Investment Pvt. Ltd., and Emkay Share & Stock Broker Pvt. Ltd.

Launch Date: 08-08-2007

Asset class: Equity

AUM: 16633

Expense Ratio: 1.72%

Category: Equity- large cap

Fund manager: Sailesh Raj Bhan since 12-Jun-2007

Ashutosh Bhargava since 01-Sep-2021

Risk: very high

360 ONE Focused Fund Regular Growth

The fund was launched on October 30th, 2014, and focuses on a strategy that involves investing in a small number of high-quality equities with strong conviction. This approach aims to minimize risk while maximizing returns. The Focused Fund has achieved rolling returns of 15.39% and 16.07% over 3 and 5 years respectively, outperforming its benchmark which achieved 13.7% and 12.88% over the same periods. As a result, this fund has outperformed its peer market.

Asset Class: Equity

AUM: 4629

Expense Ratio: 1.88

Category: Equity- Focused

Fund Manager: Mayur Patel since 11-Nov-2019

Launch Date: 30-10-2014

Risk: very high

Mirae Asset Emerging Bluechip

The Mirae Asset Emerging Bluechip Fund is one of the best-performing equity Mutual Funds in India. It was introduced on July 5th and has been managed by Ankit Jain since January 31st, 2019. With over seven years of experience at Mirae Asset Management Company, Ankit Jain is an accomplished fund manager. This fund has consistently delivered good returns with rolling returns of 21.95% and 18.99% for 3 and 5 years respectively, outperforming its benchmark of 16.03% and 14.73% with consistent returns.

Launch Date: 05-07-2010

Asset Class: Equity

AUM: 29024

Expense Ratio: 1.6

Category: Large and Mid-Cap

Fund Manager: Ankit Jain since 31-Jan-2019

Neelesh Surana since 24-May-2010

Risk: very high

HDFC Focused 30 Growth Fund

The HDFC Focused 30 Growth Fund was launched on 05-09-2004 and Roshi Jain has been managing it since 13-January-2022. Over a period of 3 to 5 years, the fund's rolling returns have been 11.76% and 10.76%, which is higher than its benchmark's returns of 12.86% and 12.69% over the same period.

Launch Date: 05-09-2004

Asset Class: Equity

AUM: 6,941

Expense Ratio: 1.79%

Category: Focused

Fund Manager: Roshi Jain since 13-Jan-2022

Risk: very high

Conclusion

In summary, for a monthly SIP investment of Rs.1000 in 2024, consider the best funds Kotak Equity Opportunities Fund, and Nippon India Large Cap Fund, each fund has specific objectives, primarily targeting capital appreciation through diverse portfolios. It’s important to note that all these funds come with some risk, and investors should carefully assess their risk tolerance and financial goals before making investment decisions. To streamline the investment process and benefit from compounding, investors may explore Online SIP, this allows them to automate their investments and benefit from the potential compounding effect over time.