Table of Contents

- SBI Long Term Equity Fund - Regular Plan- Growth

- Mirae Asset ELSS Tax Saver Fund-Regular Plan-Growth

- Bandhan ELSS Tax saver Fund - Regular Plan - Growth

- Quant ELSS Tax Saver Fund Regular Plan-Growth

- Parag Parikh Tax Saver Fund Regular - Growth

Introduction

You may find yourself asking, what can I do to save taxes? It is a commonly asked question among many Indians. People look for different investment solutions that allow them to save money in the shortest time possible. If you are one of them, you have come to the right spot. As the taxpayers are trying to complete their tax prep for the fiscal year ending March 31, 2024, we've made an effort to make things easier for you by providing information on the greatest tax savings options.

Among the varied categories of diversified mutual funds, an ELSS Mutual Fund (Equity Linked Savings Scheme) is a type of mutual fund in which you can invest to save taxes.

It invests mainly in stocks (equity) and comes with a lock-in period, usually three years.

By investing in ELSS, you can get tax benefits under Section 80C of the Income Tax Act. ELSS is an Equity Mutual Fund that helps save taxes and has a three-year lock-in period. How does it help us to generate returns for wealth creation?

The answer is simple you can create wealth by taking advantage of the compounding 13-15% annualized returns.

Let's understand this with a real-life example. Suppose you started a systematic investment plan (SIP) of Rs.1000 for 10 years with a rate of return of 15%. At the end of the investment period, you would gain a total annualized return of Rs.1,39,972.63 and your total investment amount would be Rs.2,59,972.63. This power of compounding helps you to take advantage of the cumulative returns.

In this post, we will delve into a deep analysis of the Best ELSS Funds. The way it works, pros & cons determining if it is worth your money. At last list the best funds for you to begin your investment journey.

How does ELSS Mutual Fund work?

After gaining an understanding of this category, let us learn about how it works. The following are some key aspects that will give you an idea about its working theory:

- Equity Linked Savings Schemes (ELSS) are special investment funds that mainly invest in equities of different companies.

- These companies are listed on the stock market.

- ELSS funds invest in equities from large, mid-sized, and small businesses in various industries.

- The primary goal of ELSS is to encourage the long-term growth of the invested capital.

- The main objective is to maximize profits while minimizing risks in investing.

- The fund manager overseeing the fund carefully selects equities after performing in-depth market research.

Pros & Cons of Investing in the ELSS Scheme

Everything has its own merits and demerits which makes it important to understand both aspects before investing.

Let’s understand the pros & cons of investing in these schemes separately. Beginning with the advantages, here is a simple breakdown for you:

Tax Benefits

ELSS funds provide tax deductions of up to Rs.1.5 lakhs under Section 80C. To know better, imagine your annual salary is 5,00,000. Now, with this income, the tax will be calculated at a rate of 20%; but, if you invest Rs.1.5 lakh, the tax responsibility will be calculated on an amount of Rs.3.5 lakhs at a rate of 5%, and your tax liability would be greatly reduced.

Wealth Creation

Equity-Linked Saving Scheme (ELSS) funds are a type of Mutual Fund that invests mainly in stocks of companies across various sectors and market capitalizations. These stocks have the potential to generate higher returns in the long run. ELSS funds are known for their tax-saving benefits as well as the potential for wealth creation through equity investments.

Professional Management

ELSS funds are managed by skilled fund managers who strive to optimize profits for investors. As you are aware of the 3-year lock-in time, it gives time to the manager to help the fund reach its full potential.

Now that we know the pros of investing in this scheme let’s discuss the cons as well.

3-year lock-in

ELSS funds have a three-year lock-in period, which means you can't withdraw your money before then. This encourages long-term investing, but it also means that you cannot access your cash in an emergency. It is a trade-off between tax advantages and future wealth development. Before investing in ELSS funds, make sure you're okay with locking up your money for that time.

Market Risk

ELSS funds invest in stocks, which can rise or fall. This indicates that your investment has the potential to increase as well as decrease. It is determined by the performance of the fund's firms and the current state of the globe. So, while ELSS funds might increase your money over time, they can also lose value in the near term.

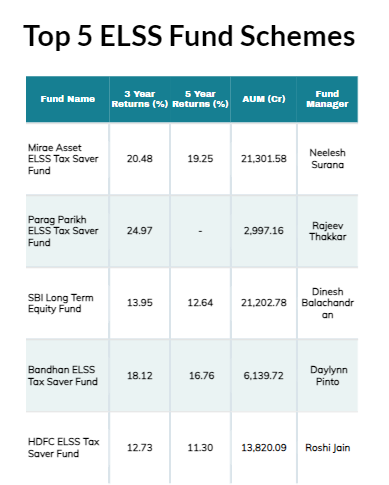

Top 5 ELSS Fund Schemes to Invest in 2024

The best way to determine the right fit for you is to identify your goals and assess your risk tolerance. To guide you further here are the top 5 best ELSS Funds to invest in 2024:

Funds Table

ELSS Tax Saver Funds

| Fund Name |

|---|

| Mirae Asset ELSS Tax Saver Fund |

| Parag Parikh ELSS Tax Saver Fund |

| SBI Long-Term Equity Fund |

| Bandhan ELSS Tax Saver Fund |

| HDFC ELSS Tax Saver Fund |

Now that you have the list with you, take a look at some necessary information given below in the table.

Conclusion

Steal the best fund that will help you grow money in the long run. When it comes to tax-saving solutions, ELSS provides a dual advantage, The ELSS category is primarily intended to reduce your tax burden. As demonstrated in this blog article, it provides investors with multiple reasons to say yes to this fund.

You can also do an Online SIP to include this fund in your portfolio. This method of investing is a wonderful approach to plan your investments and achieve significant long-term gains.

Read More - Top 5 Tips for Tax Planning in India 2024