Table of Contents

Do you remember the good old days of Nokia 1200 phones which is simple and durable, but now technology has evolved beyond our wildest expectations. Smartphones handle everything from finance to business operations, can you imagine being able to invest in that future, that is exactly what the SBI Technology Opportunities Fund offers, it allows being part of the booming tech industries such as innovative Indian companies or global giants, this mutual fund connects you to the technology. Let's explore the SBI Technology Opportunities fund review.

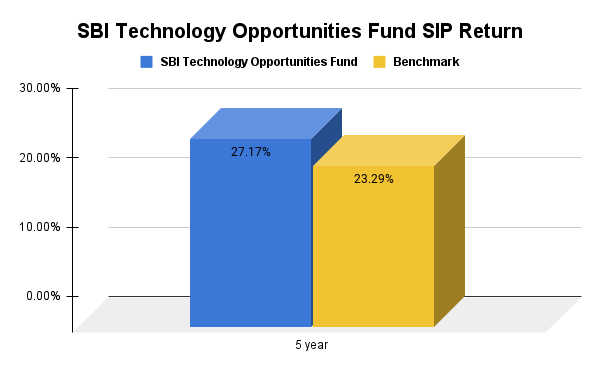

What is the SIP Return of SBI Technology Opportunities Fund in 5 Years?

The SBI Technology Opportunity Fund has severed its investors since 01-01-2013 with an amazing asset under management (AUM) of Rs. 4,390.13 crores as of 30-08-2024. Over the past five years, it has outperformed its peers with an annualised SIP return of 27.17%, compared to a benchmark index return of 23.29%.

Let’s understand this with a simple example, if your total Investment would be Rs.1,80,000, then you had invested Rs.3000 monthly for five years. You could have purchased three new smartphones with your earnings, if this had increased to Rs. 3,45,144. This IT fund has boosted the value of your investment as its outstanding growth shows.

See Your Money Multiply! Use the SIP Calculator

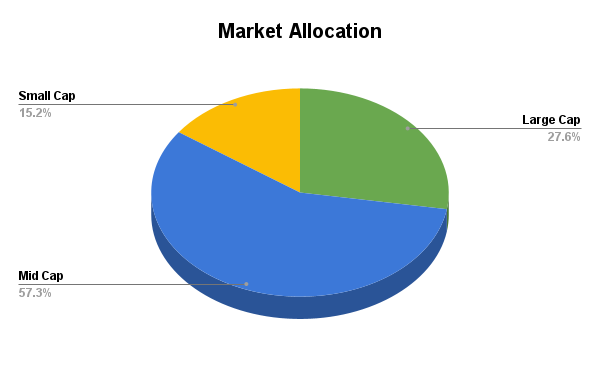

Portfolio Distribution of SBI Technology Opportunities Fund

When it comes to investing this high-return mutual fund plays smart. The Large-cap stocks are dependable and established, thus it invests 27.6% of its capital in them. To balance growth potential and risk another 57.3% is allocated to mid-cap stocks. The final percentage is 15.2%, which is allocated to small cap stocks, which may be more volatile but also have exciting growth prospects. A well-rounded option for investors, this blend looks for strong returns while also assisting in risk management.

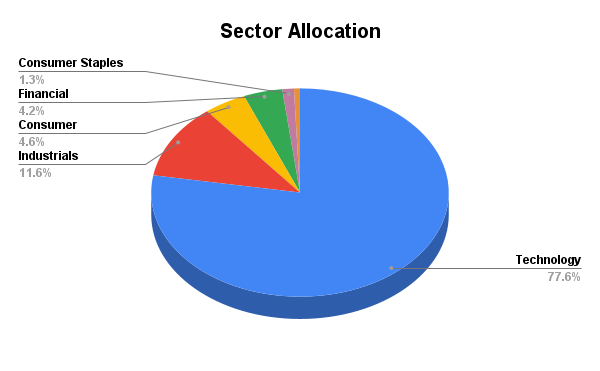

Sector Allocation

A solid industry diversification may be found in this best tech fund. The technology sector comprises a remarkable 77.6% of the fund, which includes well-known corporations like TATA Consultancy Services, Bharti Airtel, and Infosys. It also adds 11.6% to industrial firms, such as IndiaMart and First Source.

TBO Tek, PVR, and Inox are examples of consumer discretionary brands that receive 4.6% of the total. This SBI Mutual Fund scheme has 1.3%invested in consumer staples like NIIT Learning Systems and 4.2% in financials, which includes investments in businesses like PB Fintech and eMudhra. Indigene and other healthcare companies receive 0.63% of the total. Effective risk management and growth opportunity Capture are facilitated by this broad allocation for the fund.

Is it Safe to Invest in SBI Technology Opportunities Fund?

| Risk Measures | Ratio |

|---|---|

| Standard Deviations | 17.11 |

| Sharpe Ratio | 0.49 |

| Beta | 0.79 |

| Alpha | 4.12 |

Some significant performance indicators are highlighted by the SBI Technology Opportunities Fund report. The fund's volatility is shown by the standard deviation, which is 17.11%; larger values correspond to more return variations. Even though investors typically prefer a ratio above 1, the fund's Sharpe ratio of 0.49 indicates that it gives a respectable return for the amount of risk involved.

Compared to the market, this fund has a beta of 0.79, which indicates that it is less volatile than the market as a whole. Lastly, the fund has beaten its benchmark by this proportion, as indicated by the alpha of 4.12%, which is indicative of good investing strategy and management. Based on these indicators, the fund appears to be able to effectively balance risk and return.

Is SBI Technology Opportunities Fund Suit Your Investment Portfolio?

You might think about adding the SBI Technology Opportunities Fund to your collection of Mutual Funds because tech stocks are a great option for someone who is okay with market volatility, and if you believe the technology sector will increase in future years, then this investment is worth your portfolio

Younger individuals with more time to invest will benefit most from this fund as it helps them weather market swings. If you already own assets in other industries and want to get into the digital sphere, this fund allows you to invest in large tech companies in India and outside. This fund is a smart choice if you want someone to actively manage your money because it seeks to outperform others.

.webp&w=3840&q=75)