Table of Contents

- What are Consumption Mutual Funds?

- What is Driving the Consumption Funds?

- Why Invest in Consumption Mutual Funds?

- Consumption Theme Vs Benchmark

- What are the Risks and Rewards of Investing in Consumption Funds?

- Is Consumption Mutual Fund Suitable for You?

- 5 Best Consumption Funds for SIP in 2024

- Endnote

In the ever-evolving landscape of the Indian economy, the FMCG sector stands as a strong foundation for consistent growth, reflecting consumer demand that rarely fades. This reliability has made Consumption Mutual Funds a go-to option for investors aiming for steady returns. But with a market flooded with options, how do you pick the winners?

In this blog, you will find a spotlight on the top consumption schemes in India that have consistently delivered strong performance, helping investors secure their financial future.

Let's start by answering the basic question that will define this category for you.

What are Consumption Mutual Funds?

As the name suggests, Consumption Mutual funds are part of a thematic category that focuses on industries that manufacture, distribute, and sell consumer goods and services.

Though any sector can be classified as a consumption sector since, at the end of the day, each product or a consumer, in some sectors, consumes services given customers do not buy directly from the firms but rather consume them indirectly.

For example, Metals have corporations that produce aluminium, steel, zinc, and so on, but customers do not buy these products directly from these companies. As a result, metals do not qualify as a consumer-oriented sector.

Some consumption-oriented firms listed on the stock exchange include Hindustan Unilever, ITC, Nestle, Maruti Suzuki, Tata Motors, Bharti Airtel, SBI, HDFC Bank, and Whirlpool. All these firms provide products or services that millions of people purchase. Mutual funds with a consumption theme invest in such firms.

Let's hear what the experts have predicted about this trending consumption theme.

What is Driving the Consumption Funds?

The following factors contribute to making the consumption theme the talk of the town:

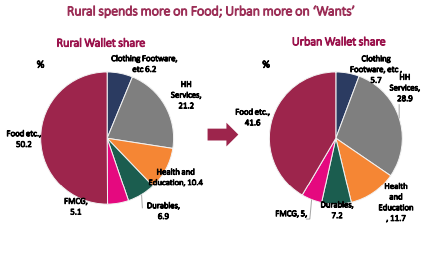

Changing Lifestyles of Consumers: People are moving beyond their basic needs, from clothes to food and transportation. It has led to various opportunities for businesses in different sectors.

Seeking Quality Experience: It is not only about consuming products but the quality of experience is also important. For example, personalized content on Netflix shows you exactly what you want to see.

Emergence of New Categories: New products in various categories are introduced at a much faster pace such as the evolution of watches to smart watches to fitness bands today.

Advancement in Consumer Preference: The traditional business models are challenged on different fronts. For example, big stores like Reliance and D-mart have beaten the general stores in your neighbourhood. Consumers prefer going to such supermarkets as they offer the same goods at discounted prices.

However, what are the advantages of investing in such a fund? Let us try to grasp that.

Why Invest in Consumption Mutual Funds?

These consumption stocks give strong reason to include them in your portfolio such as:

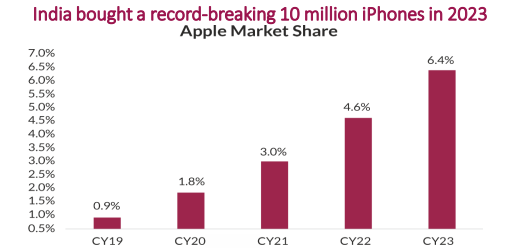

1. High Growth in Consumer-Related Companies: It is a broader theme with over 8 sectors and 70 basic industries. For example, smart inverter AC sales increased to 77% in 2023 from 27% in 2017. Similarly, iPhone sales in India experienced an all-time high in purchases, you can see the below graph for data:

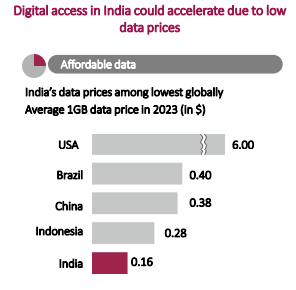

2. High-Margin Businesses: The difference between the cost and selling price of a product decides its profitability. The premiumization of consumer goods and shifting trends towards luxury items have resulted in high margins and increased profitability for businesses. Digital access in India has given large opportunities, especially in small towns. The below graph shows the strength of digitalization:

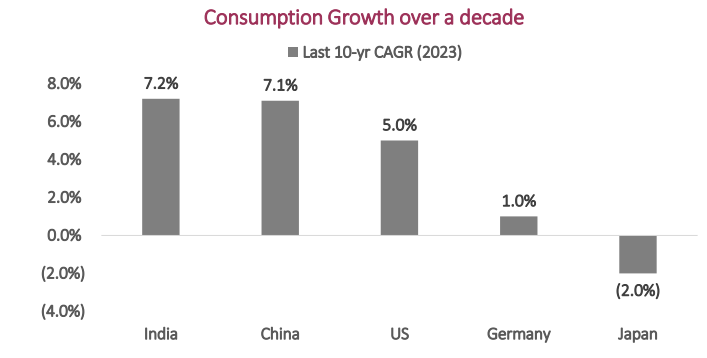

3. Long-Term Secular Growth: India is among the largest and fastest-growing consumer markets with nearly doubled household consumption in the past decade at a CAGR of 7.2%, higher than China, the US and Germany. See the below graph for more clarity:

4. High Return Expectation: India has crossed its inflection point, which means that the economic growth of the country is increasing. In such a scenario, the development of such companies will lead to you making good profits with investments in these stocks.

5. Lower Risk: Even though these stocks are sector-specific, they are defensive in nature meaning they invest in stable companies and maintain steady revenue during market downturns. This nature helps beat volatility and results in minimizing risk.

Consumption Theme Vs Benchmark

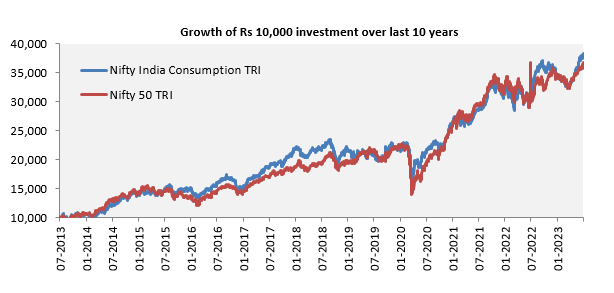

The stocks have outperformed the benchmark, Nifty India Consumption TRI delivering a 14.3% strong annual return in the last 10 years.

Let’s look at the below graph for more clarity:

According to Experts, India is on its way to becoming the third-largest consumer market by 2030. This steady growth offers a numerous opportunities for its investors. This growth is evidenced by the increasing demand and supply in various industries, as more and more Indians are choosing to spend on goods and services.

Now, regarding the growing trend for consumption funds, it would be unfair to see it as a short-term buzz as they are a much larger part of the economy and contribute to its long-term improvement.

What are the Risks and Rewards of Investing in Consumption Funds?

Let us understand the risks and rewards of investing in consumption theme funds:

| Index | Standard Deviation 1 Year | Standard Deviation 5 Year | Beta- 1 Year | Beta- 5 Year |

|---|---|---|---|---|

| Nifty India Consumption TRI | 11.20% | 17.03% | 0.69 | 0.76 |

| Nifty 500 TRI | 13.70% | 18.67% | 1.03 | 0.96 |

- The above table shows, that Nifty India's Consumption TRI valuations are lower when compared with the Nifty 500 TRI with strong 21% earnings growth and 19% ROE (returns on investment).

- Over one year, its standard deviation is 11.2% reflecting that the risk of these stocks is relatively low the Nifty 500 stands at 13.7%.

- Moreover, its beta values are below low, which again suggests that the consumption sector is less sensitive to market shifts.

- Thereby, these stocks will give you more stability for your portfolio with minimum risk.

Now, let's check whether this thematic category suits your portfolio or not.

Is Consumption Mutual Fund Suitable for You?

These funds are suited for the following investors:

Long-term Investors: If you are planning to invest for 5-7 years, then these stocks have good potential to make high returns in future. This strategy gives the necessary time to the funds to ride out the market shifts.

Looking to Diversify: These stocks invest in consumer goods, which have N number of categories and investment opportunities within the sector. If you seek to make good returns from the growing economy of India, then it is the best option for you.

Aggressive Investors: Such investors who are quick to catch onto the trending scheme in the vast mutual fund market will find these stocks attractive. Investors ready to take high risk for high returns can include these consumption schemes in their portfolios.

Now let’s see the top-performing scheme of thematic consumption mutual funds:

5 Best Consumption Funds for SIP in 2024

Here is a list of 5 Best Consumption Funds to start your SIP with:

| Scheme Name | AUM (Crore) | 3 Months Returns (%) | 6 Months Returns (%) | 1 Yr Returns (%) | 3 Yrs Returns (%) | 5 Yrs Returns (%) |

|---|---|---|---|---|---|---|

| Nippon India Consumption Fund | 2345 | 12.97 | 23.88 | 42.64 | 25.78 | 27.93 |

| SBI Consumption Opportunities Fund | 2679 | 17.55 | 24.09 | 41.41 | 29.51 | 26.56 |

| Mirae Asset Great Consumer Fund | 4050 | 15.68 | 25.04 | 42.37 | 24.29 | 25.12 |

| Canara Robeco Consumer Trends Fund | 1694 | 12.58 | 21.9 | 41.01 | 21.97 | 24.96 |

| ICICI Prudential Bharat Consumption Fund | 2613 | 11.45 | 17.96 | 40.67 | 26.02 | 22.88 |

| Category Average | 41.99 | 23.28 | 23.78 | |||

| NIFTY 500 TRI | 45.85 | 23 | 22.62 |

Check your returns by using the simple SIP Calculator tool.

Endnote

To sum up, you are likely to find N number of categories to invest your hard-earned money. However, you are always attracted to the things you relate to most. Such a connection is seen with the Consumption Funds, which has made a 16% CAGR in its category. Moreover, starting an early SIP and keeping an investment time of 5-7 years will be the best strategy to plan your future.