Last week, Sensex showed a rise of nearly 1% whereas broader market indices traded in the red. Let’s find out what happened in the market last week.

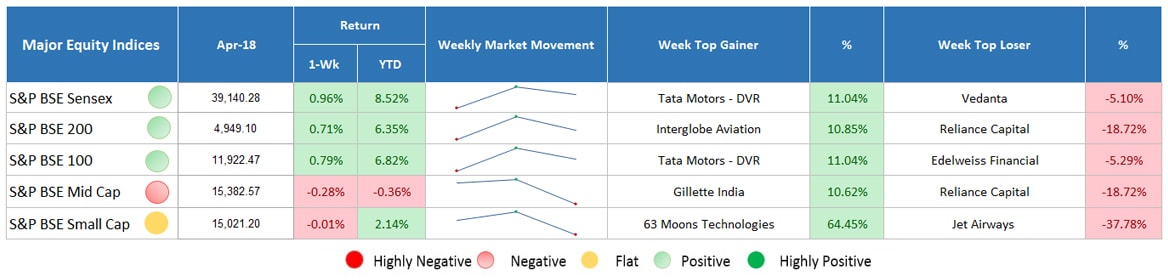

Major Equity Indices Performance

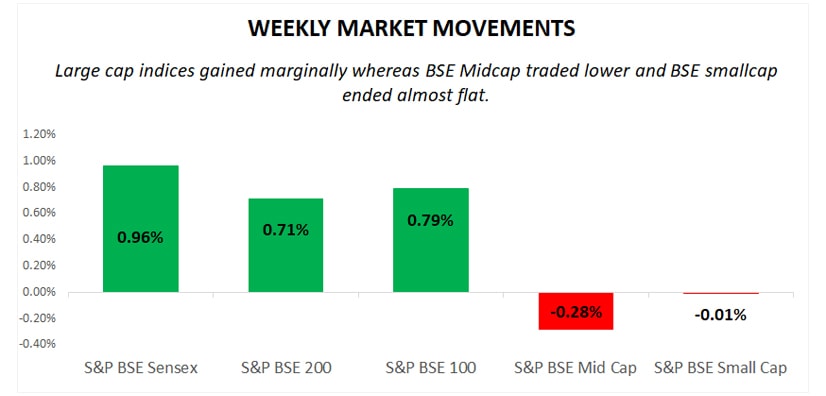

Last week, Sensex ended marginally higher by 0.96%, however, on the other side, broader indices traded in the red. S&P BSE Midcap fell marginally by 0.28% whereas S&P BSE small cap ended almost flat, down by 0.01%. Other large cap indices i.e. S&P BSE 200 and S&P BSE 100 traded slightly higher by 0.71% and 0.79%, respectively.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Initially, the Indian Meteorological Department’s projection of near normal monsoon in 2019 provided a sigh of relief to investors and a further rate cut by RBI over near normal monsoon forecast is expected. Moreover, strong buying by institutional investors also added to the gains. During the week, institutional investors poured more capital into the Indian market where Foreign Institutional Investors (FIIs) remained net buyers and bought equities worth INR 2,790.26 crore and Domestic Institutional Investors (DIIs) invested capital worth 280.99 crores.

In addition to these, buying interest in auto, energy, oil & gas and metal counters contributed to the market gains. This week, trade deficit data were released and as per the reports, although trade deficit narrows in the month of March from USD 13.51 billion to USD 10.89 billion on the account of higher exports but trade deficit for the whole year of 2018-19 widened to USD 176.4 billion as against USD 162 billion in preceding year restricted gains.

On the global front, positive cues on the hope of progress in US-China trade talks boosted sentiments. However, gains remain restricted as investors traded cautiously amid corporate earnings season.

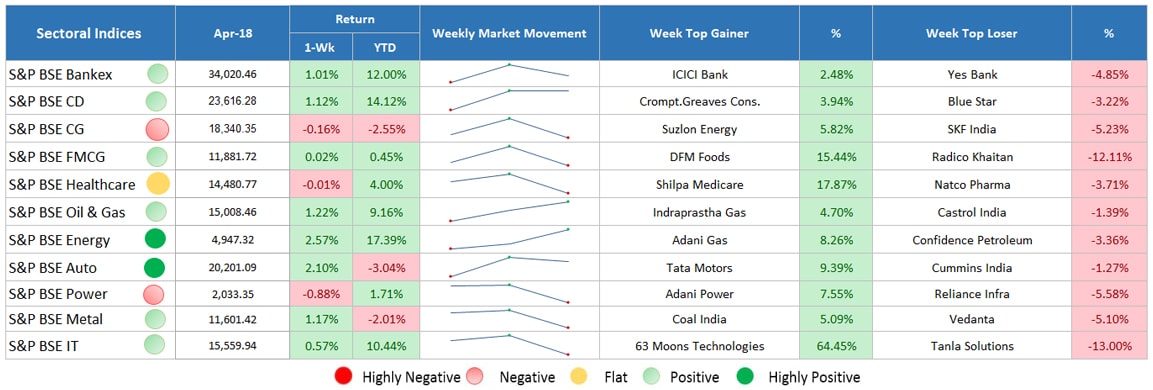

Sectoral Indices Performance

Return: As on April 18, 2019

Return: As on April 18, 2019

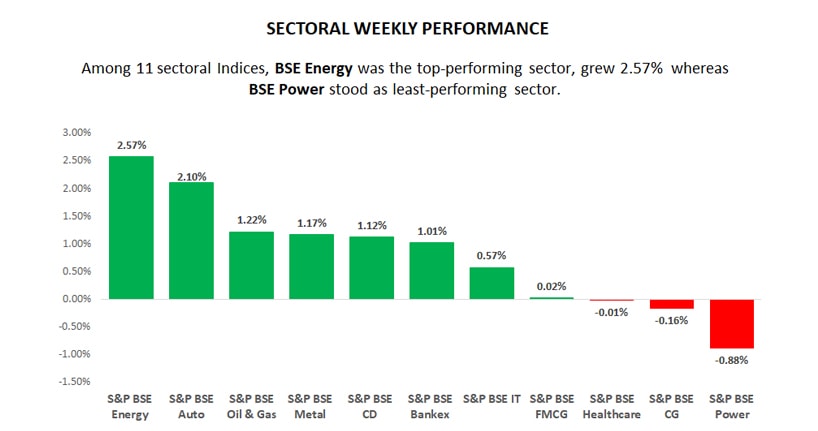

Gaining sectors

Among 11 sectoral indices, 8 sectors traded in green.

- BSE Energy was the top-performing sector on both the weekly basis and year to date basis with the gains of 2.57% and 17.39%, respectively.

- S&P BSE Auto surged by 2.10% while on a YTD basis, it is the worst performing sector, down by 3.04%.

- BSE oil & gas, metal, consumer durable, bankex and information technology sectors ended marginally higher by 1.22%, 1.17%, 1.12%, 1.01% and 0.57%, respectively.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing sectors

Among 11 sectoral indices, 3 sectors traded in the red.

- BSE Power remains the top laggard, down by 0.88%.

- BSE healthcare sector ended almost flat, down by 0.01% while the BSE capital goods sector was down by 0.16%.

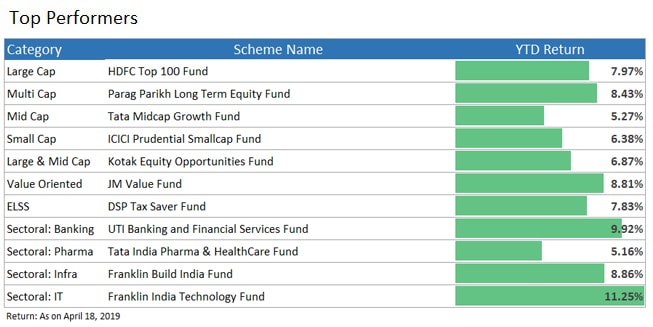

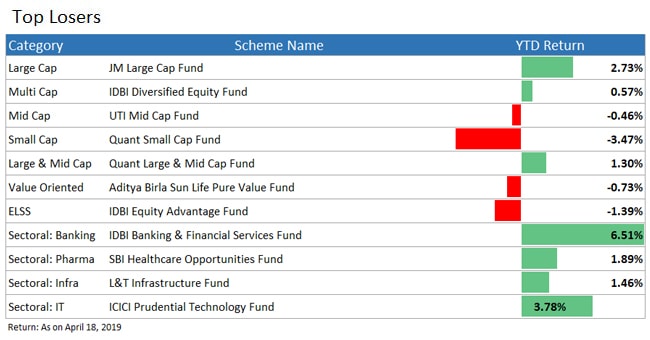

Top Performers & losers

At Last

Last week a mixed performance was seen among the equity market indices. Just like the previous weeks, FIIs remained net buyers. Now, in this week too a mixed performance can be expected due to the rising oil prices. Stay tuned for the next weekly market update.