Indian equity indices traded significantly lower where Sensex ended nearly 4% down and underperformed broader market indices. Let’s find out in detail, what happened in the market last week.

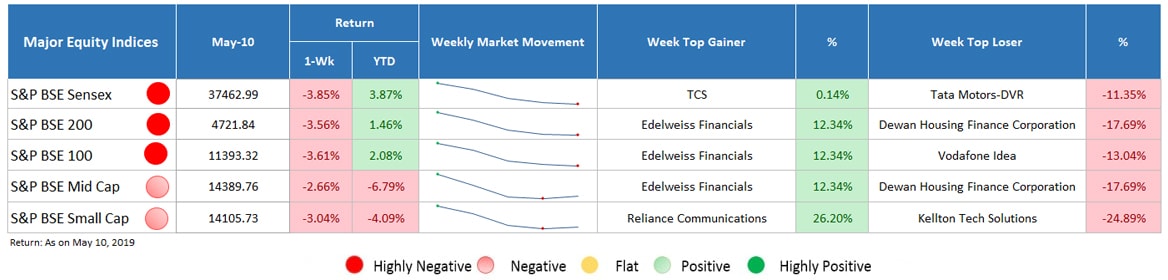

Major Equity Indices Performance

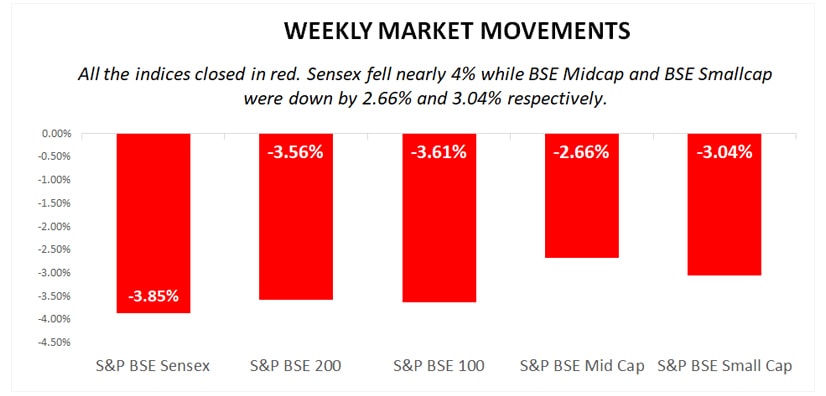

Last week, market barometer Sensex fell nearly 4% whereas broader market indices such as S&P BSE Midcap and S&P BSE Smallcap were down by 2.66% and 3.04%, respectively. Selling pressure in some heavy weighted stocks dragged Sensex lower.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

All sectors witnessed selling pressure and among these, energy, metal, power, oil & gas, and auto stocks lost the most. The key reason behind market fall is escalating US-China trade tensions where US president, Donald Trump increased tariff on Chinese imports worth $200 billion from 10% to 25% and said that further tariffs may be charged on additional Chinese imports of $325 billion. In response to it, China may also take retaliatory measure, which is giving rise to negative sentiments in the market.

On the domestic front, slow expansion in India’s private sector since last 7 months dampened sentiments. Nikkei Services Purchasing Managers Index declined from 52 to 51 and the composite PMI fell from 52.7 to 51.7, showing soften rise in business activities. Although a mark above 50 shows expansion but decline compared to the preceding month signaled slow growth.

In addition to this, renewed trade tensions between the US and China also affected institutional inflow. Evidencing it, last week, FIIs offloaded net equities worth INR 4,195.63 crore, on the contrary side, DIIs put equities worth INR 2,877.01 crore but could not compensate FIIs outflow.

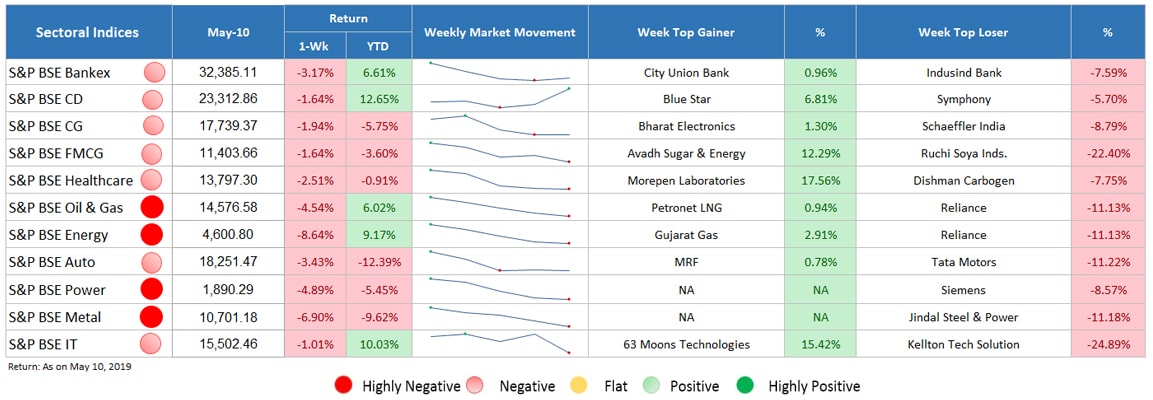

Sectoral Indices Performance

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Gaining Sectors

Last week, none of the sectors traded in green.

Losing Sectors

On BSE, all of the above mentioned sectors seen selling pressure and closed down.

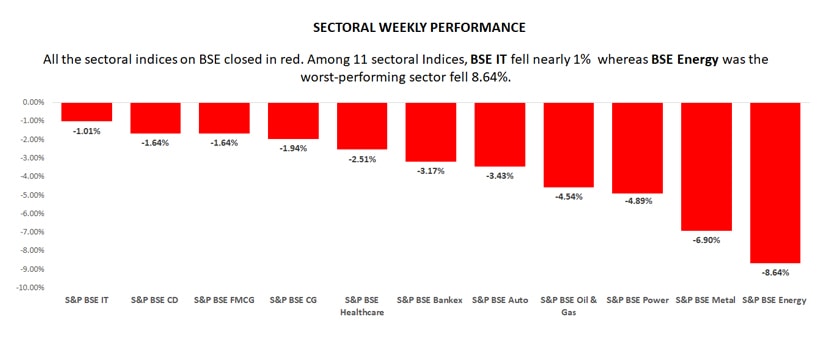

- BSE Energy was the worst-performing sector, marred 8.64% followed by BSE Metal fell nearly 7% amid worsening trade relations between the US and China.

- BSE Power, oil & gas, auto and bankex too traded in red, showing a fall in the range of 3% to 5%.

- Other sectors like healthcare, capital goods, FMCG, consumer durables and IT were marginally down by 2.51%, 1.94%, 1.64%, 1.64% and 1.01%, respectively.

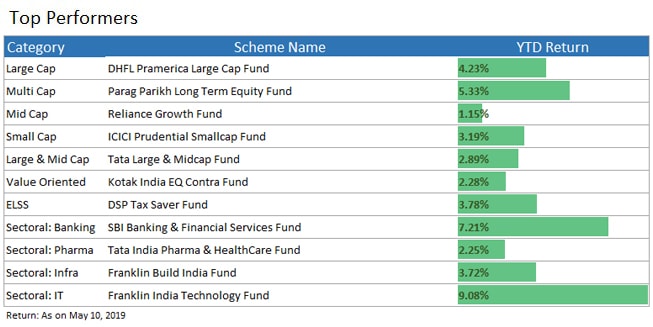

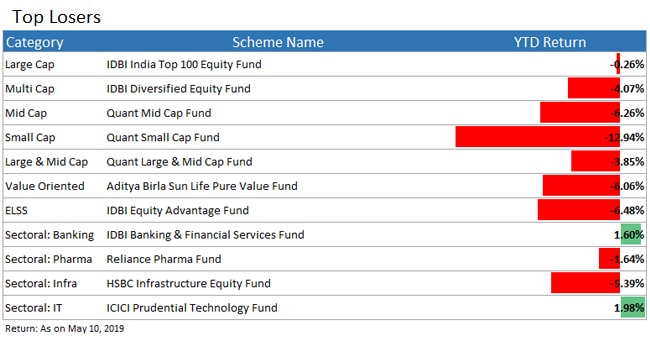

Top Performers & Losers

Conclusion

The overall scenario was quite bleak and further volatility can be expected in the market in the coming sessions as well following the US-China trade tensions and upcoming election results. Mutual Fund investors may see some ups and downs in the NAVs in coming sessions, and are suggested to not panic, as it is just a short term volatility. So, this is all in last week’s market update. To get updated with the latest trends in the market, stay tuned, and if you have any query about mutual funds, feel free to connect with the experts.

- Ask Questions

- Give Answers

- Improve Knowledge

- Invest Wisely