2018 was not a good year for the equity mutual funds, and the two categories that suffered the most during this time frame are mid caps and small caps. In this time frame, even the top schemes from these two categories lost the ground, showing a steep fall in returns. One such scheme that faced a huge impact from this volatility is Reliance Small Cap Fund.

This small cap scheme was the most popular scheme of the small cap category and was providing an awesome growth to investors. But, after a sudden fall, investors started redeeming the investments in panic, and a lot were in the confusion that what will be the appropriate decision. So today, through a quick analysis of the scheme and the market sentiments, we will see if you should carry out the investments or redeem them.

2019: A Good Year for Small & Mid Caps

The year 2018 was full of volatility for the small and mid caps if the last two months are not taken into count, where a small recovery was seen in the market. The major reasons for this were rising crude oil prices, unfavorable rupee-dollar valuations, and an increase in the interest rates. Now, in the past 1-2 months, the crude oil has shown a huge drop in prices, the INR to USD valuations have improved and the bond yields have also fallen, indicating towards a reversal in conditions. Many experts are considering that this reversal will also mean improvement in conditions of small caps and mid caps. Volatility can be seen in the first half due to general elections, but good growth is expected in the second half.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

How Has Reliance Small Cap Performed in the Past?

| Description | Returns (As on Jan 04, 2018) | |||

|---|---|---|---|---|

| 1 Year | 3 Years | 5 Years | 7 Years | |

| Reliance Small Cap Fund (G) | -18.36% | 12.59% | 26.20% | 25.94% |

| Benchmark | -28.06% | 5.72% | 17.59% | 16.31% |

| Category | -20.35% | 9.16% | 21.31% | 20.18% |

Reliance Small Cap Fund was launched on Sep 16, 2010, and for the starting few years, it showed a flat performance. But, after Nov 2013, it started showing great growth and provided a superb performance even when the small cap index was not performing well. From the above table, you can see that not only the fund has managed to perform spectacularly in the long term, but it has also managed to cap the losses exceptionally better than the benchmark as well as the category in the last 1 year too. This shows that the management is really good and the strategies are working in favor of the scheme.

The Current Asset Allocation

One of the best ways to predict the future of a scheme is through its asset allocation style. Reliance Small Cap Fund is an equity category scheme, but recently it has increased its investment in debt (6.88%) and cash instruments (3.74%) to deal with the volatility. Now, let’s move to the portfolio allocation of the scheme.

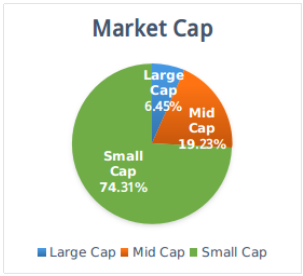

As can be seen from the above pie charts, the small cap scheme has the highest allocation in the small cap space, but a considerable allocation is also in the mid caps and large caps. This is yet another step taken to provide stability and a much better growth in the coming years. In addition to this Reliance Small Cap is also following a diversified style of stock picking and as of now has an investment in 110 stocks. This diversification has helped the fund in capping the losses in the past and are expected to provide a similar aid in the future too.

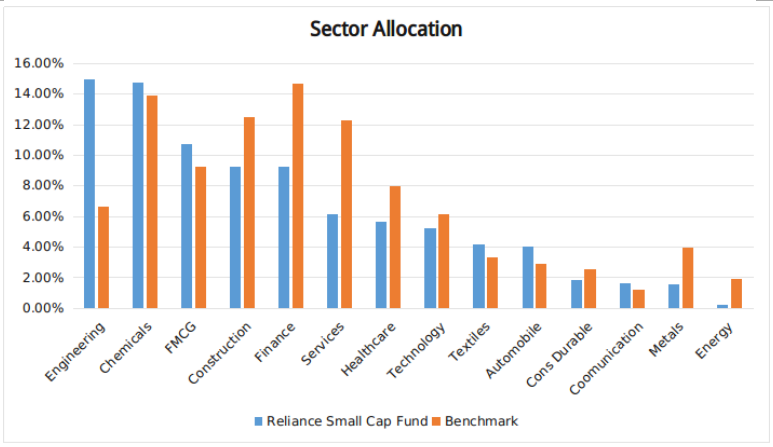

The sector allocation of Reliance Small Cap is completely favoring the 2019 market conditions. The 5 sectors that hold the major investment are engineering, chemicals, FMCG, construction, and finance. All these are showing great growth possibilities in 2019, and are a great choice for long-term growth as well. The 3 sectors that will play a major role in the growth of this small cap are chemicals, FMCG, and construction, as a lot of experts are holding great convictions for them in this year. And, it is also following a frequent stock selling and buying style which will also play a major role in short term as well as long term growth.

Risk Parameters

| Risk Measures (%) | SD | Beta | Sharpe | Alpha |

|---|---|---|---|---|

| Reliance Small Cap Fund | 20.93 | 0.89 | 0.38 | 6.09 |

| Benchmark | 22.99 | 1 | 0.09 | - |

| Category | 18.26 | 0.76 | 0.21 | 2.54 |

What to Do with Investments in Reliance Small Cap Fund?

Risk parameters of Reliance Small Cap Fund will further help in relieving you from panic. With the help of the above table, you can see that the SD and Beta of the scheme are lower than the benchmark and more than the category’s average. This shows that the fluctuations it shows in returns are lower than the former and higher than the latter. But, the most important measure to see here is the Sharpe of the scheme, which is exceptionally higher than the benchmark and category and shows that the rewards you get for taking the risk with your investments are really great.

What to Do?

Looking at the above information, it can be clearly seen that Reliance Small Cap Fund is a really great scheme and has never failed the trust of investors. Over the years it has shown a spectacular performance and looking at the current investment & asset allocation style a similar growth can be expected in the future too. So, it is suggested you continue your investments and keep gathering the units at lower NAV. Also, remember that this small cap fund follows the objective of long-term capital growth and has a high risk associated with it. So, don’t make your decisions based on short term volatility, and carry out your investments to achieve your financial goal in the set time.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

In case you have any query, you can submit it in the form provided below to get a quick resolution from the experts.

Must Read:

Top Mutual Funds to Invest in January 2019

After a Bumpy Ride in 2018, What 2019 Holds for MF Industry?