Table of Contents

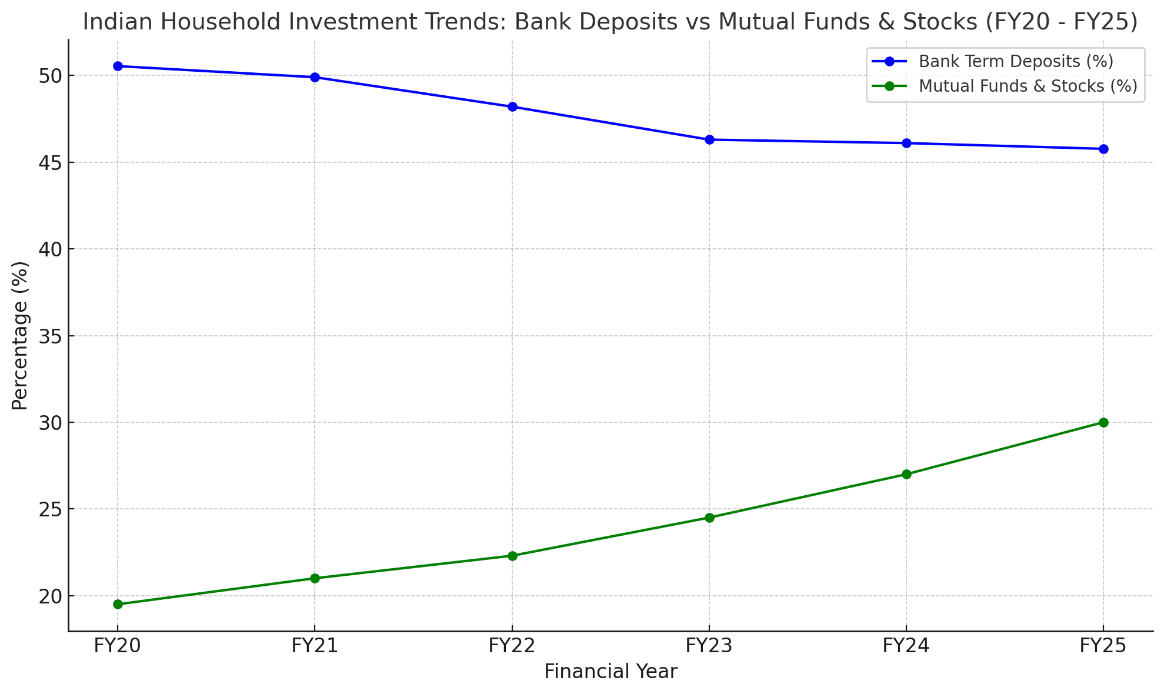

Did you know that the bank fixed deposits (FDs) have shown a decline to 45.77% by the end of FY 2025, which too down from 50.54% in 2020? Why? let’s see.

Over the last five years, more and more Indian households are moving their savings from traditional bank term deposits into investments like mutual funds and stocks, which offer higher returns but come with more risk.

This change has been influenced by the rising returns from the stock market and other investment options, especially as interest rates have changed due to the Reserve Bank of India's (RBI) policies.

According to data from the RBI, while savings deposits have remained steady, fewer people are choosing to put their money into bank term deposits. By the end of FY25, only 45.77% of households were investing in bank term deposits, down from 50.54% in FY20.

At the same time, the number of people investing in Mutual Funds and stocks has been growing steadily, reaching over 30% by FY25.

The chart below shows this shift in investment choices:

As more investors turn to the stock market, the mutual fund industry is growing rapidly, offering better returns and attracting more retail investors. However, this upward trend shows that people are looking for better ways to grow their money, even if it means taking on a little more risk.

Why Are FDs Losing Popularity?

Here are a few reasons that support the idea of why FDs (Fixed Deposits) are lagging behind in 2025:

-

Falling Interest Rates

During the COVID-19 pandemic (2020–2022), the Reserve Bank of India (RBI) reduced the repo rate by 115 basis points (1.15 percent). This caused FD interest rates to fall significantly.

-

Low Real Returns

FD returns often do not beat inflation, which means the actual value of your money does not grow much over time.

RBI has cut rates again recently (Feb: 25bps, April: 25bps, June: 50bps), making FDs less attractive.

Where Are People Investing Instead?

In such scenarios, more and more people are shifting towards investing their hard-earned money into the best mutual funds available in India:

- As of April 2025, there are 23 crore (230 million) mutual fund accounts.

- 91 percent of these belong to individual investors.

- In May 2021, the number was just over 10 crore (100 million).

Key Figures at a Glance

- Investment Type FY 2020 FY 2025.

- Share of bank FDs 50.54 percent 45.77 percent.

- Mutual Fund AUM Rs 22.26 lakh crore Rs 69.50 lakh crore.

Why Does This Matter?

This shift shows increasing financial awareness among Indians.

More people are aiming for long-term wealth creation instead of just safe savings.

Digital platforms, online education, and easier access to markets are helping investors make informed decisions.

Stay tuned for more updates on how Indian households are adjusting their investments in the coming years.