Table of Contents

- SBI Blue Chip Fund-Regular Plan Growth

- SBI Small Cap Fund - Regular Plan - Growth

- SBI Magnum Midcap Fund - Regular Plan - Growth

- SBI Equity Hybrid Fund - Regular Plan -Growth

- SBI Large & MIDCap Fund- Regular Plan -Growth

Table Of Content

SBI Mutual Fund is one of India's leading asset management companies, and the SBI Large & Midcap Fund is one of its mutual fund offerings. This fund, previously known as the SBI Magnum Multiplier Fund, it was introduced on February 28, 1993. The primary purpose of this fund is to give investors the option to participate in a combination of large-cap and mid-cap firms, resulting in a diversified portfolio.

This blog will examine the SBI Large & Midcap Fund recent performance, investment objectives, and whether investing in this fund can help you meet your financial goals. We will break down these characteristics in simple terms to help you understand how this fund operates and whether it meets your investment needs.

What are Large and Mid Cap Funds?

Based on the total value of all of its outstanding shares, a company's market capitalization determines its classification as large-cap or mid-cap.

Large Cap

SEBI, which acts as a supervisor for the stock market, has established some guidelines for evaluating companies. Large-cap firms are those that rank in the top 100 in terms of stock market value. The funds that invest in these large corporations are known as 'large-cap funds'.

These large-cap corporations often have an excellent track record of performance. They are the market's biggest players, sometimes known as blue-chip stocks. These companies have a high market value, often about Rs. 20,000 crores or more. They are well-established and have a significant market presence.

Mid Cap

SEBI issued a guideline in 2017 that defined Mid-Cap firms as those ranked 101 to 250 by market value. These companies' market capitalizations typically range between Rs. 5000 and Rs.20000 crores. 'Mid-cap funds' refer to mutual funds that invest in these mid-sized corporations.

Mid-cap corporations have a good track record, but they are not as huge as large-cap companies. Investing in mid-cap funds carries more risk than large-cap funds. These companies may not always be included in major market indices because they are less well-known or established in the market. Next, let's explore the investment objective of this fund in simple terms.

The Investment Objective of the fund

The main goal of the SBI Large and Mid-Cap Fund is to help investors grow their money over the long term. It does this by investing in a mix of big and medium-sized companies. The fund must put at least 35% of its money into big and medium-sized companies. The rest, about 30%, can be invested in other types of stocks or safe things like bonds and money market tools.

The SBI Large and Mid-Cap Fund doesn't stick to just one way of investing. It uses both growth and value styles. This means it looks for companies that are growing quickly as well as those that might be undervalued but have potential. To pick the best stocks, the fund managers use a combination of top-down and bottom-up approaches. This means they look at the big picture of the market and also analyze individual companies in detail.

Ultimately, this fund aims to give investors growth by balancing the stability of big companies with the potential for growth in medium-sized ones. So, it tries to find a good mix of both to help investors' money grow steadily over time. Gain some knowledge about the rolling returns of this fund

Rolling return

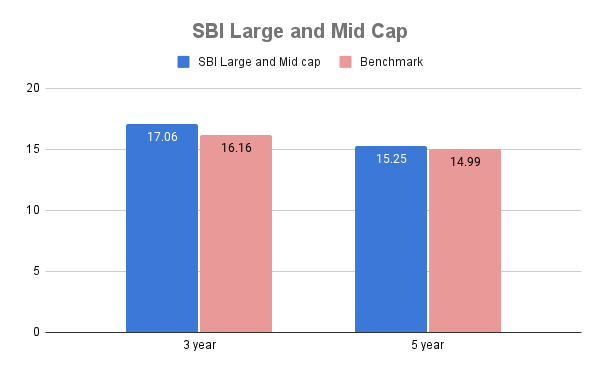

The SBI Large and Mid Cap Fund has a strong track record of performance, with its trailing returns over the past 3 years at 17.06% and over the past 5 years at 15.25%. This is compared to its benchmark returns of 16.16% and 14.99% respectively over the same periods. The fund has consistently outperformed its benchmark, demonstrating its reliability and effectiveness.

Portfolio Allocation

The SBI Large and Mid Cap Fund systematically allocates its investments among various sorts of enterprises. It invests around 20.56% in large-cap corporations, which are larger and typically more stable. Another portion, approximately 40.76%, goes to mid-cap enterprises, which are medium-sized and have moderate growth potential. Finally, around 4.85% is invested in small-cap companies, which are smaller and may expand more quickly. This blend helps to distribute risk and capitalize on opportunities throughout the market.

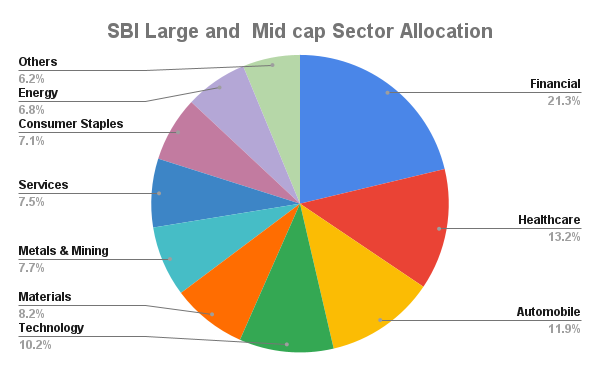

Sector Allocation

From March 2015 to March 2017, the SBI Large and Midcap Fund fell by -18.30%, while the Nifty50 index fell by 25%. However, it managed to recover on time.

Between February 12, 2020, and November 10, 2020, the fund declined by -36.47%, while the Nifty50 fell by -39.09%. However, it did recover on schedule.

The SBI Large and Midcap Fund fell -16.67% between October 2021 and June 2023, almost matching the Nifty50's slightly lesser drop of -18%. Again, it recovered on time. These comparisons emphasize the fund's performance under bear market situations, demonstrating its ability to manage risk and recover well.

Performance Analysis

Since its inception, this fund scheme has performed exceptionally well, with a recent Compound Annual Growth Rate (CAGR) of 17.87%. Let's break down what this means with an example:

If you invested Rs.1,00,000 in this Mutual Fund when it started in 2013, and it has grown at a rate of 17.87% annually, then after 10 years, your investment would have grown to Rs.4,84,807. This means your initial investment of Rs.1,00,000 would have earned a profit of Rs.3,84,807.

So, if you invested Rs.1,00,000 in this fund at the beginning and held onto it for 10 years, you would have a total value of Rs.4,84,807. This demonstrates the potential for significant growth this fund has achieved over time, with an expected return rate of 17.10% per year.

Time to Talk about Leading Fund Managers

Saurabh Pant

Saurabh joined SBI Mutual Fund in 2007 as a Research Analyst. He holds a Bachelor's degree in Commerce and a Master's degree in Business Economics from the University of Delhi. With 15 years of experience, Saurabh brings a wealth of expertise to his role.

Pant has created his distinct investment approach. He has a flexible approach to investing, which allows him to respond to changing market conditions. However, the fund is required to keep at least 35% of its assets in both large and mid-cap stocks.

Mohit Jain

Mohit Jain joined SBI Mutual Fund in 2015. before to joining SBI Mutual Fund, Mohit worked as a Senior Research Analyst at CRISIL Limited. He graduated in Engineering from Sathyabama University and has completed CFA Level III from the CFA Institute, USA.

Pradeep Kesavan

Pradeep Kesavan works at SBI Mutual Fund as an equity strategist at the moment. He is based in Mumbai, Maharashtra, India. His prior employment at Elara Capital, Accenture Strategy, Morgan Stanley, and 3i Infotech has given him invaluable knowledge. Having earned his certification at Charlottesville, Virginia, USA, Pradeep Kesavan is a charter member of the CFA Institute. His broad skill set, which includes Financial Modeling, Valuation, Strategy, Investment Banking, Equities, and other areas, makes him a valuable asset to the company.

Conclusion

In conclusion, the SBI Large & Midcap Fund offers investors a promising opportunity for long-term growth. With its focus on a mix of large-cap and mid-cap companies, the fund provides diversification and potential returns over time. Its strategic portfolio allocation and the expertise of fund managers like Saurabh Pant, Mohit Jain, and Richard D'souza enhance its performance and risk management.

Considering an online Systematic Investment Plan (SIP) in mutual funds can be a convenient way to invest regularly and benefit from rupee cost averaging. This disciplined approach can help investors achieve their financial goals with ease.

Read More - Top 10 Mutual Funds in India 2024

.webp&w=3840&q=75)