Introduction

In the world of finance, certain names stand out as pillar of stability and growth. HDFC bank is undoubtedly one of them. The bank recently unveiled its financial report for the second quarter of 2023, and the numbers have sent ripples through the financial sector.

In this blog, we’ll dissect the key highlights from the report and understand why HDFC bank continues to be a force to be reckoned with the Indian banking industry.

Let’s have a look at some of the key highlights

An Incredible Jump in Profits

In the second quarter of 2023, HDFC bank’s earning took a remarkable leap. Their net profit, which is the money they make after covering all expenses, surged by a whopping 51% compared to the same time last year, reaching a staggering RS 15,976 crore.

What’s even more impressive is that this number was even higher than what the financial experts expected.

This shows that HDFC bank is in excellent financial shape and is dedicated to providing good returns to its shareholders.

Notable growth in total income

In the latest quarter, HDFC bank’s total income experienced a remarkable year-on-year expansion of 70%, reaching an impressive figure of RS. 78,406 crores.

This substantial increase in the total income underlines HDFC bank’s remarkable capacity to generate substantial revenue, a crucial sign of its financial robustness and continuous expansion.

It demonstrates that the bank is thriving in its ability to not only manage finances but also contribute significantly to its financial strength and growth.

Strong Interest Earnings

HDFC bank’s net interest income, the money earned from interest on loans after deducting interest expenses on deposits, grew by over 30% to reach RS. 27,385 crores.

While this number was slightly below market expectations, it still reflects a substantial gain and underscores the bank’s robust lending portfolio.

Effective Management of provisions

Provisions, the funds set aside for potential losses or bad loans, declined to RS. 2904 crore from RS. 3,240 crores a year ago.

This demonstrate HDFC bank’s effective risk management practices, a crucial aspect of any successful financial institution.

Asset Quality Remains stable

HDFC bank’s asset quality remained stable, with a slight increase in the percentage of non-performing loans compared to the previous year.

Importantly, this increase is well within manageable levels, indicating the bank’s commitment to maintaining a healthy loan bank.

Deposits and Loan Portfolio Expansion

The bank experienced a substantial 30% increasein total deposits, reaching an impressive RS. 21.73 lakh crore.

This deposit growth reflects the unwavering trust that customers place in HDFC bank’s stability and reliability. Furthermore, HDFC bank’s loan portfolio witnessed significant expansion, a testament to its role in driving economic development through lending.

Strong Liquidity Position

HDFC bank’s capital adequacy ratio, a measure of its capital against regulatory requirements, stood at a robust 19.5%, significantly exceeding the regulatory requirement of 11.7%

This underscores the bank’s financial resilience and its ability to absorb potential shocks, ensuring continued stability.

Market Resilience

Despite a minor dip in stock prices leading up to the earnings report, HDFC bank continues to be a formidable presence in the Indian financial market, with a strong reputation and widespread trust.

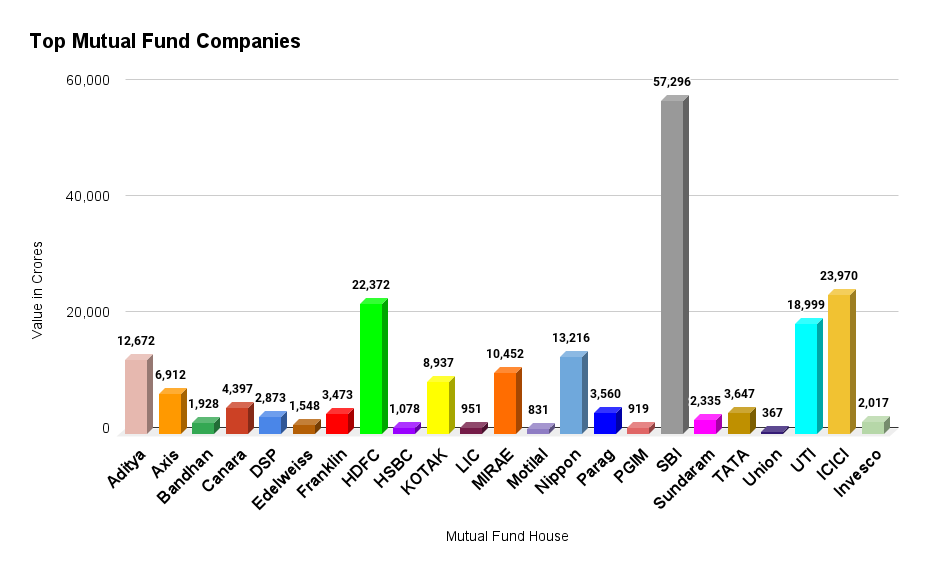

Let’s see the list of Top Mutual Fund companies holding highest value in HDFC stock:

The graph shows the Top Mutual Fund Companies holding highest value in HDFC stock.

|

Mutual Fund House |

Value in crores |

|

Aditya |

12,672 |

|

Axis |

6,912 |

|

Bandhan |

1,928 |

|

Canara |

4,397 |

|

DSP |

2,873 |

|

Edelweiss |

1,548 |

|

Franklin |

3,473 |

|

HDFC |

22,372 |

|

HSBC |

1,078 |

|

KOTAK |

8,937 |

|

LIC |

951 |

|

MIRAE |

10,452 |

|

Motilal |

831 |

|

Nippon |

13,216 |

|

Parag |

3,560 |

|

PGIM |

919 |

|

SBI |

57,296 |

|

Sundaram |

2,335 |

|

TATA |

3,647 |

|

Union |

367 |

|

UTI |

18,999 |

|

ICICI |

23,970 |

|

Invesco |

2,017 |

Based on the information provided regarding the list of mutual funds houses, we can identify which mutual funds are most likely to thrive in light of these positive results

Investors looking to capitalize on these positive results should consider investing in mutual fund companies with strong cash positions.

Among these, SBI stands out with the highest cash shares of 57,296 crores, followed ICICI at 22,372 crores, UTI at 18,999 crores, and Nippon at 13,216 crores. These companies are well-positioned to potentially benefit from their financial stability and liquidity. Utilizing a systematic investment plan in these funds can potentially yield higher returns and substantial financial growth for investors.

Conclusion

In summary, HDFC bank’s Q2 2023: 51% profit surge, strong financials. 70% YOY income growth to RS. 78,406 crores highlights HDFC bank’s financial strength and growth. Its strong performance is evident with a healthy net interest income and a 30% deposit increase to RS. 21.73 lakh crore. Moreover, bank’s growing loan portfolio fosters economic development. A 19.5% capital adequacy ratio exceeds regulations, ensuring stability.

In mutual fund realm, investors looking to leverage these positive results should consider fund companies with a strong cash positions, such as SBI, ICICI, UTI, and Nippon, which are poised to benefit from HDFC bank’s financial strength and liquidity.

Recognizing the synergy between robust banks like HDFC and mutual funds can lead to prudent investors choices.

As HDFC Bank flourishes, investors participating in Mutual Fund Online SIP with significant holdings can ride the wave of its success, potentially gaining lucrative growth opportunities.

Read More : Is It Good to Invest in TATA Balanced Advantage Fund: Reviews 2023?