Table of Contents

- Overview of HDFC Flexi Cap Fund

- Performance Analysis of HDFC Flexi Cap Fund

- HDFC Flexi Cap Fund Investment Strategy

- Analysing the Portfolio Composition of HDFC Flexi Cap Fund

- Top 10 Holdings of HDFC Flexi Cap Fund

- Who is the Fund Manager of HDFC Flexi Cap Fund?

- HDFC Flexi Cap Fund Stock Quality Analysis

- Should You Invest in HDFC Flexi Cap Fund Through SIP in 2026?

- To Conclude HDFC Flexi Cap Fund Review

By 2026, the HDFC Flexi Cap Fund will turn 31 years old. Ever since the scheme was launched, it has been giving an average annualized return of around 18.6% to 18.8%. So, if you had started a monthly investment of Rs 3,000 in the scheme in 2016, then by now, you could have earned a huge corpus of Rs 9,74,417.

You must be regretting already, but do not worry. You can still earn such a massive amount if you start a SIP in this scheme in 2025. And this HDFC Flexi Cap Fund Review will help you assess the scheme inside out so that you can make informed investment decisions in FY26.

It examines the scheme based on some key parameters like the investment strategy, the fund manager, returns, portfolio allocation and stock quality.

So, without wasting any more of your time, let us delve into the review with the strategy of the scheme.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Overview of HDFC Flexi Cap Fund

HDFC Flexi Cap Fund is one of the open-ended Equity Mutual Funds that invest across all market capitalizations, large-cap, mid-cap and small-cap stocks to generate capital appreciation. The allocations in these market caps are adjusted dynamically by the fund manager based on the market conditions, offering flexibility.

Launched on January 1, 1995, by HDFC Mutual Fund, this fund has delivered strong long-term returns, with 17.2% CAGR since inception (Direct Plan). It is highly suitable for investors seeking a diversified equity exposure with a long-term investment vision.

Here are the basic details of the HDFC Flexi Cap Fund:

| Factors | Value of HDFC Flexi Cap Fund |

|---|---|

| Launch Date | January 1, 1995 |

| NAV | Rs 2,261 |

| AUM | Rs 94,068 Crore |

| Expense Ratio | 0.65% |

| Risk Profile | Very High |

| Benchmark | NIFTY 500 TRI |

| Exit Load | 1% if redeemed within 1 year |

| Minimum SIP | Rs 100 |

| Minimum Lump Sum | Rs 1000 |

| Fund Manager | Chirag Setalvad |

| AMC | HDFC Mutual Fund |

| Turnover | Moderate Low at ~13% |

Now, let us analyse the performance of this flexi-cap fund based on its historical returns.

Best Mutual Funds for 2026 Backed by Expert Research

Performance Analysis of HDFC Flexi Cap Fund

Here is the detailed analysis of the HDFC Flexi Cap Fund, based on its rolling returns and SIP returns:

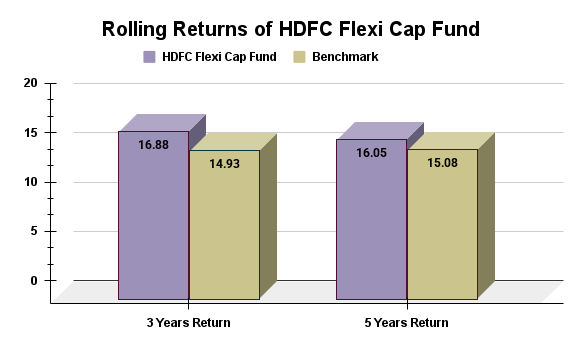

Rolling Returns

The rolling returns of the scheme are 16.09% in 3 years and 15.45% in 5 years. They are also beating the benchmark NIFTY 500 TRI. In terms of consistency, the fund still beats the benchmark of 73.02% with 77.59% over 5 years. Look at the graph below for a clear comparison:

With its impressive rolling returns, the fund has consistently outperformed its benchmark and peers.

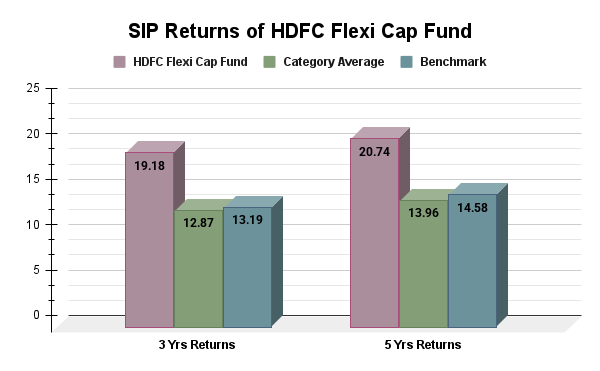

SIP Returns

The fund has given as much as 19.18% and 20.74% SIP returns in 3-year and 5-year plans, respectively. Now, take a good look at the graph below and compare these returns with the category average and the NIFTY Small Cap 250 TRI benchmark:

Did you see the towering difference between the HDFC Flexi Cap Fund Growth and others? The scheme has outperformed both of them by a margin of almost 7%.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Now, let us understand the investment strategy on which this fund works.

HDFC Flexi Cap Fund Investment Strategy

The investment strategy of the HDFC Flexi Cap Fund is a dynamic and disciplined approach. The fund carefully manages its investments. It focuses on large companies to provide stability. It uses a strategy that looks for growth at a reasonable price, combining growth and value investing based on detailed market research.

The fund house, HDFC Mutual Fund, focuses on investing in companies with strong fundamentals that have a high future growth potential, while adopting a buy-and-hold approach. The scheme aims to give you risk-adjusted returns with the help of portfolio diversification.

The fund holds 48-50 stocks to lower the risk of any single stock. The top 10 stocks make up about 50% of the total assets, which helps balance strong beliefs in certain stocks with overall diversity.

Such an impressive investment strategy has made this fund a compelling choice for investment among a large number of investors.

Must Read: 3 Best Performing Flexi Cap Mutual Funds: Expert Picks for 2026

Next, let us explore the portfolio composition of the fund.

Analysing the Portfolio Composition of HDFC Flexi Cap Fund

The market goes through many ups and downs, but what can help a mutual fund scheme navigate through these fluctuations is its portfolio. Let us now review the portfolio of the HDFC Flexi Cap Fund and see what it reveals:

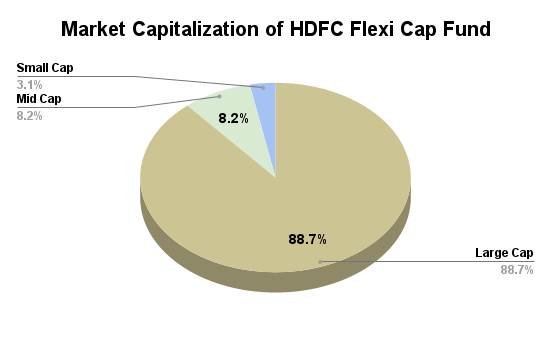

Market Cap Allocation

The scheme invests 88.71% of its assets in large-cap stocks to make sure that you get stable returns in the long term. Now take a glance at the graph below to have a clearer image of the allocation:

To achieve the objective of providing capital appreciation to you, the scheme also invests 8.23% and 3.06% of its assets in mid and small-cap stocks, respectively.

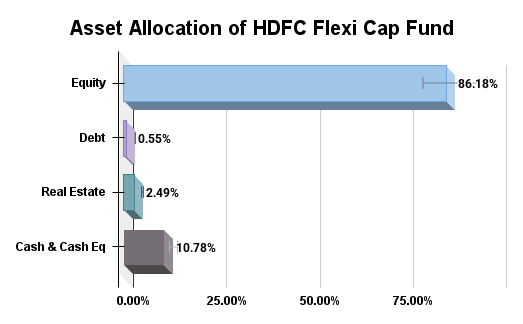

Asset Allocation

The mutual fund scheme has allocated 86.18% of its funds to equity instruments to make sure that you can earn great returns from your portfolio. The scheme has also allocated 10.78% to cash and its equivalent, 2.49% to real estate and 0.55% to debt instruments.

These assets provide the fund manager with enough liquidity and flexibility to seize potential market opportunities.

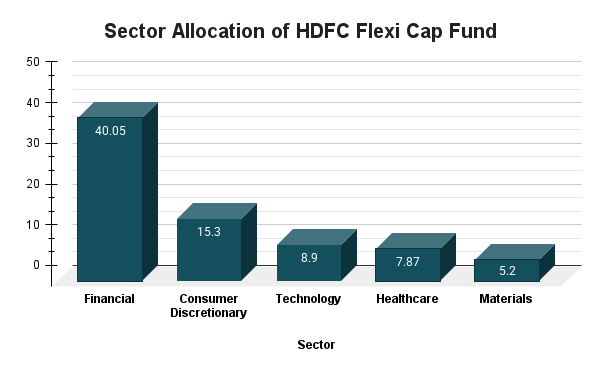

Sector Allocation

The scheme is heavily investing in financial services, 40.05%, which shows its confidence in India’s banking and financial sector. This sector is greatly benefiting from economic growth and digitalization. Other key sectors, as you can see in the above graph, are: Consumer Discretionary (14.9%), technology (8.9%), healthcare (7.87%) and materials (5.2%).

By investing relatively less in sectors like technology and materials, the HDFC Flexi Cap Fund is avoiding overexposure to these volatile sectors.

In the next heading, let us look at the top 10 holdings of the fund.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Top 10 Holdings of HDFC Flexi Cap Fund

The mutual fund holds 48-50 stocks and the top 10 make up to 50% of the total assets. Here are the top 10 holdings of the HDFC Flexi Cap Fund:

| No. | Holding Name | Holding Value |

|---|---|---|

| 1 | ICICI Bank Ltd. | 9.45% |

| 2 | HDFC Bank Ltd. | 8.78% |

| 3 | Axis Bank Ltd. | 7.35% |

| 4 | State Bank of India | 4.58% |

| 5 | SBI Life Insurance Co Ltd. | 4.18% |

| 6 | Kotak Mahindra Bank Ltd. | 4.11% |

| 7 | Cipla Ltd. | 3.42% |

| 8 | Maruti Suzuki India Ltd. | 3.38% |

| 9 | HCL Technologies Ltd. | 3.11% |

| 10 | Power Grid Corp of India Ltd. | 2.61% |

Let us know the fund manager of the HDFC Flexi Cap Fund in the next part.

Who is the Fund Manager of HDFC Flexi Cap Fund?

Ms. Roshi Jain (since July 29, 2022) is the current fund manager handling the HDFC Flexi Cap Fund Growth for you with Rakesh Vyas (since June 28, 2014). And they are doing very well so far.

Roshi has been working in equity research and audit for over 12 years now. Previously, she also had a good position in the top companies like Franklin Templeton Investments, Goldman Sachs (London and Singapore), Wipro and S.R. Batliboi. She is an expert in identifying high-quality companies focusing on long-term growth.

Her rich experience in the financial markets and Mutual Funds industry brings key insights that help her team of highly seasoned professionals identify high-quality stocks for you. Her team is highly skilled in research and portfolio management. Jain’s global experience and Vyas’s long-term association with HDFC ensures a robust investment process.

Next, let us analyse the quality of stocks of this flexi-cap fund.

HDFC Flexi Cap Fund Stock Quality Analysis

Given below is a detailed analysis of the stock quality of the fund, showing the reliability of the HDFC Flexi Cap Fund:

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 12.57% |

| Earnings Growth | 11.25% |

| Cash Flow Growth | -1.4% |

| P/E Ratio (Valuations) | 21.44 |

The data displayed above shows that the HDFC Flexi Cap Fund is more careful and selective in its investment choices compared to other flexi cap mutual funds in its category. Its P/E ratio, which is lower than its category average (26.09), shows that the fund is buying stocks at lower prices, which will be helpful in volatile markets.

Both earnings and sales growth are slightly lower than the category average (14.03% and 13.08%, respectively), which suggests that the fund prefers companies with stable growth rather than high-risk, fast-growing ones.

The one weak spot is cash flow growth. The fund shows a negative cash flow growth of -1.4%, while the category average is a positive 4.88%, hinting that some investments may face short-term challenges in turning their profits into strong cash flow.

Also Read: Parag Parikh Flexi Cap Fund vs HDFC Flexi Cap Fund: Best Pick for 2026

Now, let us know if this fund is suitable for you to invest in 2026, or not?

Should You Invest in HDFC Flexi Cap Fund Through SIP in 2026?

Investing in the HDFC Flexi Cap Fund through a SIP (Systematic Investment Plan) in 2026 is a highly suitable option for investors who are looking for a diversified equity exposure and can handle a very high risk.

According to the financial experts, investing through SIPs in funds like HDFC Flexi Cap Fund can help you invest regularly and handle market ups and downs in 2026.

SIP combines risk management with growth potential, making it an amazing investment option for a long-term investment in 2026. SIP reduces the risk of market timing by averaging the purchase price over time. This method is known as rupee cost averaging and makes SIPs a good choice in uncertain market conditions. And, this has a strong record of generating 20.74% SIP returns in 5 years when the benchmark was only at 14.58%.

This track record proves that the HDFC Flexi Cap Fund can generate massive wealth for you over time if you start SIP in the fund in 2026.

Smart Investments, Bigger Returns

To Conclude HDFC Flexi Cap Fund Review

To wrap up the review of the HDFC Flexi Cap Fund, it is clear that the fund is very suitable for investors who want diversification, flexibility, strong risk management and portfolio stability should go for a SIP in the HDFC Flexi Cap Fund in 2026.

As it offers a dynamic allocation of your assets across all market caps based on market conditions, it is highly suitable for investors with long-term goals and high risk tolerance.

Related Blogs:

- Best HDFC Mutual Funds: Strong Performers for 2026

- Top 10 Flexi Cap Mutual Funds: High-Return Picks in India 2025

FAQs

-

Is HDFC Flexi Cap Fund a good investment option for 2026?

This fund can be a suitable option in 2026 for investors with a long-term investment horizon (at least 7-10 years) and high risk tolerance.

-

Who should avoid investing in this fund?

Conservative investors who cannot tolerate sharp fluctuations or those with a time horizon below five years should avoid this fund.

-

How are returns from the HDFC Flexi Cap Fund taxed?

Short-term gains (sold within 1 year) are taxed at 20% and long-term gains (held more than 1 year) are taxed at 12.5%, if gains are more than Rs 1.25 lakh.

-

Is SIP better than a lump sum in the HDFC Flexi Cap Fund for 2026?

SIP is usually better than a lump sum in a volatile year like 2026 because it averages out the purchase cost and reduces timing risk.

-

What is an ideal SIP duration in HDFC Flexi Cap Fund?

An investment period of at least 7 to 10 years is an ideal duration for a SIP in this fund and investing for 15 to 20 years can give you more returns.

.webp&w=3840&q=75)

.webp&w=3840&q=75)