Table of Contents

- HDFC Innovation Fund NFO: Basic Details 2025

- What is the Theme of the Innovation Fund?

- HDFC Innovation Fund NFO Strategy Review

- HDFC Innovation Fund NFO Review: Asset Allocation

- Is it Good to Invest in HDFC Innovation Fund NFO?

- Risks and Mitigations of HDFC Innovation Fund NFO

- Key Takeaways on the Latest Innovation Fund NFO 2025

- To Conclude HDFC Innovation Fund NFO Review

Are you ready to ditch your traditional investment and transform it into an innovation-themed fund? If yes, this newly launched NFO might be just what you need.

The HDFC mutual fund house has recently launched an innovation-based scheme, the HDFC Innovation Fund NFO, which will give your investments a new innovative edge.

Now, this latest NFO has started its subscription on 27 June and will close on 11 July 2025.

Did you know India ranks 3rd in the number of unicorns in global innovation ranking? Yes, positioning itself on growing sectors like generative artificial intelligence (AI bridging potential and progress, and staying ahead of the market curve.

However, will this newly launched scheme become the best innovation fund NFO 2025 for you or not?

Let's find out your answer in this detailed HDFC innovation fund review 2025.

HDFC Innovation Fund NFO: Basic Details 2025

The table below covers the key information on the newly launched innovation fund NFO 2025:

| Scheme Name | HDFC Innovation Fund NFO |

|---|---|

| Issue Open Date | 27th June, 2025 |

| Issue Close Date | 11th July, 2025 |

| Category | Equity - Thematic Fund |

| Benchmark | Nifty 500 (Total Return Index) |

| Minimum Application Amount | Rs.100 |

| Fund Managers | Mr. Amit Sinha |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

| Facilities Offered | Lumpsum / SIP / SWP |

Also Read: Gold Hits New Highs: Time to Cash Out or Stay Invested

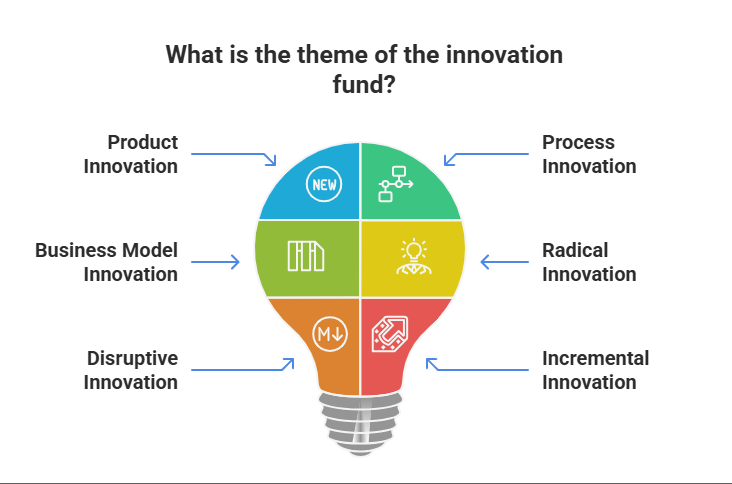

What is the Theme of the Innovation Fund?

The latest HDFC Innovation Fund NFO is based on the innovation theme, which means investing in companies that develop new ideas, services and products with the aim of creating value, solving problems and maintaining a competitive edge.

There are 3 layers covered under the innovation theme, which are:

- Product Innovation

- Process Innovation

- Business Model Innovation

HDFC Innovation Fund NFO Strategy Review

This new fund offer applies a rounded investment approach that focuses on the core nature of the portfolio, investing at least 80% of its net assets in equity and companies that are adopting innovative themes and strategies.

The HDFC Mutual Fund has carefully chosen a theme-based approach that seeks out changemakers rather than just following the trends.

For example, companies like SpaceX and Zepto, GTECH INFO INDIA PRIVATE LTD, are India's leading companies shaping the future with new innovations and digital advances.

The fund is in good hands with Mr Amit Sinha, who is leading this latest NFO with strong ethics and making it one of the best Innovation Funds for 2025.

Fund Fact: This could be the best innovation fund NFO, offering the chance to grow with tomorrow's leaders.

Start Your SIP TodayLet your money work for you with the best SIP plans.

HDFC Innovation Fund NFO Review: Asset Allocation

The asset allocation (% of Net Assets) of this newly launched HDFC Innovation Fund NFO will be as follows:

| Types of Instruments | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

|---|---|---|

| Equity and Equity related instruments following the innovation theme | 80 | 100 |

| Equity and equity related instruments of companies other than those mentioned above | 0 | 20 |

| Units of REITs and InvITs | 0 | 10 |

| Debt securities and money market instruments | 0 | 20 |

| Units of Mutual Fund | 0 | 20 |

Is it Good to Invest in HDFC Innovation Fund NFO?

The following points give you strong reasons to invest in this newly launched HDFC Innovation Fund NFO 2025:

-

Exposure to Innovative Companies

Opportunity to participate in India’s next leg of economic growth led by companies that are innovators or early adopters of new technologies/strategies.

-

Diverse Portfolio Across Sectors and Market Caps

Exposure to companies that are adopting innovative strategies through the development of new products, processes, or business models.

-

Long Term Growth Potential

Exposure to good-quality companies with medium to long-term growth drivers across multiple market caps and sectors.

-

Investment Selection with a Strong Methodology

Well-defined Methodology for selecting companies to form a part of the portfolio.

-

Managed by Experienced Professionals

25 years of track record of HDFC Mutual Fund with an experienced investment/equity research team.

Smart Investments, Bigger Returns

Risks and Mitigations of HDFC Innovation Fund NFO

The table below covers the possible risks connected with this newly launched NFO, along with the mitigates to resolve them:

| Risks | Mitigates |

|---|---|

| Slowdown in domestic economy and consumption → A large part of innovation ecosystem caters to the domestic economy, which could get impacted in the event of an economic slowdown. | Drivers of macroeconomic growth continue to be on a strong footing. |

| Slowdown in funding environment | There has been a step up in venture capital/ private equity funding, which is helping the development of the innovation ecosystem in the last few years. With healthy exit environment, this should continue. |

| Adverse government policies for the innovation ecosystem. | Government has undertaken multiple initiatives to support the innovation ecosystem. |

| Lower talent retention in the country. | A strong funding environment, India's rising global standing, and a lower salary gap (in PPP terms) should help in talent retention in the country. |

Key Takeaways on the Latest Innovation Fund NFO 2025

- Innovation is a process of introducing new ideas, services or products and improving the ones already existing.

- The three key types of innovation are product, process and business model.

- Multiple examples of innovation in the Indian context have transformed businesses in sectors like financial services, retail, auto, defence, etc.

- Innovation is important for economic prosperity and market leadership.

- Key pillars supporting the rise of innovation in India.

- There is strong potential for innovation in some of the key sectors like the Autos-EV ecosystem, electronics manufacturing, pharma and healthcare, IT and digital platforms, etc.

To Conclude HDFC Innovation Fund NFO Review

To wrap up, the HDFC innovation fund NFO review, based on an innovation theme, brings together investments in Innovation in India, bridging potential & progress, where it remains key to our nation's growth ambitions. The fund focuses on businesses driving technology and new ideas, which could lead to strong growth. Ultimately, starting with a SIP (Systematic Investment Plan) is the best all-time strategy for investing in mutual funds.

If you are interested in tapping into India's growing innovation scene, this NFO could be a good choice for your investment plan.