Table of Contents

- High Returns

- Exceptional Growth

- Aggressive Investor’s Delight

- Best for Long-Term Goals

Mutual fund investments have become a talk of the town in the current time. With different funds fulfilling diverse needs of investors, they have made their way to the top, slowly and steadily. Among many different types of funds which are quenching the thirst of aggressive investors, small-cap funds have surely become their favorites. These funds are best known for the outstanding returns and exceptional growth scope that they hold. HDFC Small Cap Fund and Reliance Small Cap Fund are two such funds that have reached the list of top performing small cap funds with time. So, let’s read about these two small cap schemes by different AMCs and know which one is the best.

Table of Content

Small cap funds are the ones, the assets of which are invested mainly in the equity and equity related instruments of small-cap companies. (Small-cap companies are those which fall in the top 250 and more in terms of the full market capitalization). These funds come under the equity category of mutual fund and involve high risk. In the following blog, you will get to read about the difference between two such funds and which one is better among both for your investment.

Fund Facts : HDFC Small Cap Fund & Reliance Small Cap Fund

Basic Information

| Parameters | HDFC Small Cap Fund | Reliance Small Cap Fund |

|---|---|---|

| Category | Small Cap | Small Cap |

| Benchmark | NIFTY Smallcap 100 TRI | S&P BSE Small Cap TRI |

| Launch Date | 4/3/2008 | 9/16/2010 |

| Asset Size | Rs. 5,111 crore (As on Aug 31, 2018) | Rs. 7,618 crore (As on Aug 31, 2018) |

| Fund Managers | Chirag Setalvad & Rakesh Vyas | Dhrumil Shah & Samir Rachh |

| Expense Ratio | 2.14% (As on August 31, 2018) | 2.31% (As on August 31, 2018) |

| Minimum Lumpsum | Rs 5,000 | Rs 5,000 |

| Minimum SIP | Rs 500 | Rs 500 |

| Exit Load | 1% for redemption within 365 days | 1% for redemption within 365 days |

HDFC Small Cap Fund and Reliance Small Cap Fund as their name shows, both belong to the equity category with maximum inclination towards investment in small-cap stocks. The former one is two years older but the latter one has managed to accumulate more assets under management as on August 31st, 2018. The minimum investment amount for lumpsum investment is same for both the funds but the minimum investment amount via SIP of Reliance Small Cap Fund Growth is as low as Rs. 100 with the higher expense ratio comparatively. Any investor can invest in both the funds without incurring entry charges but will be liable to pay 1% as exit load in case of redemption made within one year of investment from the date of allotment.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

How HDFC Small Cap Differs from Reliance Small Cap?

There are a number of reasons how the two funds are different. The very first point is that both these funds are backed by two different asset management companies, namely HDFC Mutual Fund and Reliance Mutual Fund. Below are the other crucial points that the experts at MySIPonline have shortlisted for you.

Investment Strategy

HDFC Small Cap Fund (G) - The fund managers Mr. Chirag Setalvad and Mr. Rakesh Vyas focuses on creating a most rewarding portfolio. The investment strategy followed in this scheme is to invest in the stocks that are available in the market at reasonable price with high growth prospect. The companies for investment are selected after careful analysis of their business models and financial statuses.

Reliance Small Cap Fund (G) - Under this scheme by Reliance Mutual Fund, the fund managers focus on investing in the stocks of good growth businesses. The businesses selected are of reasonable size with quality management in addition to the rational valuation. Here, the risk management measures are followed such as the margin of safety along with a diversified investment across stocks and sectors.

Asset Allocation

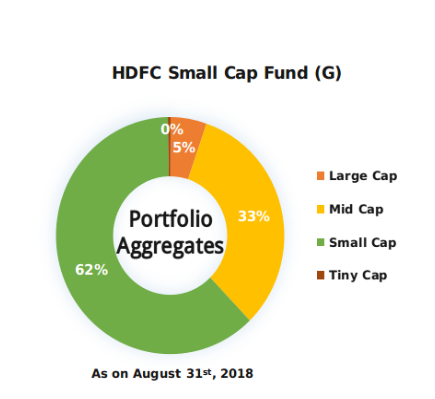

62% of the assets of this scheme have been invested in the small cap equities followed by an investment made in the midcaps with 33% of the assets. The rest of the investment in equity also includes large-cap and tiny-cap stocks.

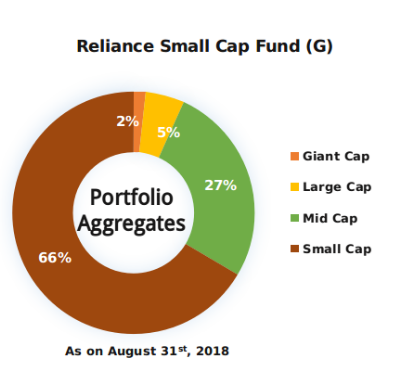

The assets under Reliance Small Cap Fund have been majorly invested in the small cap equities with 66% of the total assets. It has also invested across different caps which include giant-cap, large-cap, and mid-cap equities.

Sectors

| Sectors | HDFC Small Cap Fund (Asset Allocation %) | Reliance Small Cap Fund (Asset Allocation %) | ||||

|---|---|---|---|---|---|---|

| Cyclical | ||||||

| Basic Material (Agriculture, Chemical, Metal & Mining, Steel, Building Materials) | 22.37% | 23.35% | ||||

| Consumer Cyclical (Auto related industries, Travel & Leisure, Marketing Cos, Apparel & Furniture Mfg Cos) | 26.97% | 15.54% | ||||

| Financial Services | 8.72% | 10.92% | ||||

| Real Estate | 0.00% | 0.00% | ||||

| Sensitive | ||||||

| Communication Services | 0.00% | 0.00% | ||||

| Energy | 0.00% | 0.23% | ||||

| Industrial | 19.13% | 16.72% | ||||

| Technology | 12.62% | 16.00% | ||||

| Defensive | ||||||

| Consumer Defensive | 1.50% | 9.76% | ||||

| Healthcare | 7.69% | 6.15% | ||||

| Utilities | 1.00% | 1.33% | ||||

| As on August 31, 2018 | ||||||

- While HDFC Small Cap Fund has invested majorly in the consumer cyclical sectors with 26.97% of its assets, Reliance Small Cap Fund has invested in the basic material sector companies with 23.35% of assets. Both these investments are made in high growth scope sectors.

- HDFC Small Cap has invested around 8% less in the consumer defensive sectors compared to the other.

- Talking of the sensitive sectors, both have invested mainly in the industrial and technology sector with 0% investment in the communication services sector.

Top 10 Holdings (HDFC Small Cap Fund)

| Stock Name | Weightage (%) | Absolute Returns | Valuation | |||

|---|---|---|---|---|---|---|

| 1 Year | 5 Year | P/BV | PE | |||

| Aurobindo Pharma | 4.23 | 1.67% | 662.06% | 3.58 | 18.43 | |

| Sharda Cropchem | 4.09 | -20.65% | - | 2.54 | 16.32 | |

| NIIT Technologies | 3.6 | 128.16% | 341.20% | 4.15 | 24.35 | |

| Firstsource Solutions | 3.09 | 49.94% | 312.54% | 1.85 | 12.84 | |

| Chambal Fertilisers & Chemicals | 3.17 | 6.92% | 358.37% | 2.18 | 13.37 | |

| Vijaya Bank | 3.03 | -16.99% | 21.26% | 0.59 | 9.6 | |

| SKF India | 2.48 | 9.02% | 237.06% | 4.58 | 28.11 | |

| Sonata Software | 2.46 | 158.31% | 1304.81% | 5.67 | 19.44 | |

| TV Today | 2.36 | 20.44% | 409.69% | 3.15 | 17.29 | |

| Indian Bank | 2.08 | -0.85% | 258.13% | 0.78 | 11.48 | |

| Nilkamal | 1.99 | 11.57% | 1610.05% | 3.04 | 20.06 | |

| Atul | 1.99 | 34.69% | 871.60% | 4.08 | 29.07 | |

| As on August 31, 2018 | ||||||

In the above table, it can be seen that more than 35% of the assets have been allocated in these twelve companies which indicate towards the diversified investment. The stocks of these companies have yielded outstanding five year returns which show that investment in this fund is fruitful in the long run.

Top 10 Holdings (Reliance Small Cap Fund)

| Stock Name | Weightage (%) | Absolute Returns | Valuation | |||

|---|---|---|---|---|---|---|

| 1 Year | 5 Year | P/BV | PE | |||

| VIP Industries | 2.79 | 105.49% | 840.83% | 12.73 | 47.16 | |

| Zydus Wellness | 2.61 | 73.60% | 168.87% | 7.99 | 42.67 | |

| Orient Electric | 2.28 | - | - | 10.86 | 39.08 | |

| Deepak Nitrite | 2.13 | 58.76% | 1070.43% | 3.77 | 42.78 | |

| Navin Fluorine International | 2.06 | 10.99% | 1792.29% | 3.35 | 19.93 | |

| Vindhya Telelinks | 2.01 | 30.89% | 982.19% | 3.08 | 17.68 | |

| Cyient | 2.01 | 43.03% | 277.91% | 3.33 | 20.51 | |

| RBL Bank | 2.01 | 6.28% | - | 3.34 | 33.59 | |

| West Coast Paper Mills | 1.81 | 101.16% | 604.67% | 2.46 | 8.92 | |

| United Breweries | 1.77 | 63.47% | 58.08% | 11.96 | 76.7 | |

| Seya Industries | 1.73 | 31.49% | - | 1.78 | 20.43 | |

| Sterlite Technologies | 1.62 | 40.50% | 1605.35% | 10.05 | 32.69 | |

| As on August 31, 2018 | ||||||

Talking about the sector allocation that has taken place under Reliance Small Cap Fund, it can be said that it has invested around 28% of the assets in the top twelve companies in which it has invested majorly. This states that it has diversified its assets much more in comparison to HDFC Small Cap Fund Growth.

Past Performance

| Return Analysis | Trailing Returns (As on September 21st, 2018) | 3 - Year Rolling Returns | |||||

|---|---|---|---|---|---|---|---|

| Scheme Name | Since Launch | Last 5 Years | Last 3 Years | Dec 2013 to Dec 2016 | Dec 2014 to Dec 2017 | May 2015 to May 2018 | |

| Category | - | 26.58% | 13.18% | 25.77% | 17.87% | 13.25% | |

| HDFC Small Cap Fund | 15.08% | 23.12% | 19.73% | 19.46% | 21.61% | 21.41% | |

| Reliance Small Cap Fund | 19.63% | 36.04% | 19.48% | 34.16% | 25.25% | 21.64% | |

- While HDFC Small Cap Fund has helped investors earn 15.08% of the average annual returns since inception, Reliance Small Cap Fund has yielded 19.63%.

- In comparison to the category, both of them have yielded high returns in three-years’ period which shows that the strategies are working well towards the objective achievement. However, comparing the two schemes, it can be said that HDFC Smallcap has generated high rate of returns in the form of 19.73%.

- In five-years time, the rate of return by HDFC Small-Cap has dipped so low that it has even failed to surpass the category’s returns. Reliance Small-Cap has shone extraordinarily and generated huge returns of 36.04% beating the category’s returns.

- Talking of the rolling returns, in the period of Dec 13 to Dec 16, HDFC Smallcap scheme has again lagged behind both category and Reliance Smallcap scheme. While in other period of Dec 14 to Dec 17 and May 15 to May 18, it has been successful in surpassing the category’s returns. The latter scheme by Reliance MF has outshone in all the periods of rolling returns.

Risk Management

Risk Analysis

| Scheme Name | SD | Beta | Sharpe | Max Drawdown | Upside | Downside |

|---|---|---|---|---|---|---|

| Category | 18.53 | 0.94 | 0.73 | -18.86% | 93 | 92 |

| HDFC Small Cap Fund | 17.04 | 0.87 | 1.04 | -18.11% | 95 | 74 |

| Reliance Small Cap Fund | 19.45 | 1 | 0.95 | -21.04% | 108 | 93 |

| As on August 31, 2018 | ||||||

- The standard deviation of HDFC SmallCap is less than its category’s SD as well as that of Reliance SmallCap. Same is the case of Beta which shows that this fund is less riskier than the other two.

- The Sharpe ratio of the former scheme is 1.04 which is higher than the category’s Sharpe ratio which is 0.73. It is even higher than the ratio of other scheme which is 0.95. This shows that HDFC Small Cap Fund is likely to generate much better returns with the per unit risk taken.

- Maximum drawdown showcases that how low the return of scheme has fallen in the bad market phase. Reliance SmallCap Fund has the maximum drawdown which shows that it is likely to dip down hugely in comparison to the category and HDFC Small Cap Fund.

Consistency in Returns

HDFC Smallcap scheme

- The one-year return by this scheme is 12.58%, three-year return is 19.73% and five-year return is 23.12% as on September 21st, 2018. It can be seen that with time its performance has only increased.

- Its worst period has been from September 2008 till December 2008, in which the return rate dropped down to -39.96.

- The best period was from March 2009 till March 2010 in which the returns increased to 153.85. Considering all the points, it can be said that this fund seems to be a consistent performer due to less fluctuation in year-wise returns. The best phase of this scheme has lasted a year while the worst lasted only for four months.

Reliance Smallcap scheme

- The one-year return generated by this scheme is 5.23%, in three-year is 19.48%, and five-year is 36.04% as on September 21st, 2018. The returns have only moved upward with time that too with a great difference.

- The worst period of this scheme has been from December 2010 to January 2012 with the returns falling down to -25.07.

- The best period has been September 2013 to September 2014 in which the returns rose up to 150.05. The worst phase of this scheme has lasted for around two years while the best phase for one year.

Which Is Better? HDFC Smallcap or Reliance Smallcap

It is tough to say which is better among HDFC Small Cap Fund and Reliance Small Cap Fund.

- Although performance-wise, the latter one has outperformed the former one, in terms of risk management the former one is much better.

- Talking of the asset allocation, both focuses on investing in high growth stocks available at reasonable prices. In terms of diversification, the scheme by Reliance gets a thumbs-up.

- Consistency wise, the former one is a slow and steady performer while the other one is fast and furious. Selecting the best in this case will mainly depend on the market conditions from time to time.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Conclusion

In the current market scenario, when correction phase is going on, it is anticipated that the equity funds will be performing better will time and can help you yield great returns in the long term. HDFC Small Cap Fund and Reliance Small Cap Fund are mainly for aggressive investors who are ready to bear moderately high risk on the principal amount invested. You may invest in these funds via our platform MySIPonline and in case of any confusion, feel free to contact us anytime.

To know in detail about HDFC Small Cap Fund, you can watch the video:

Must Read

.webp&w=3840&q=75)