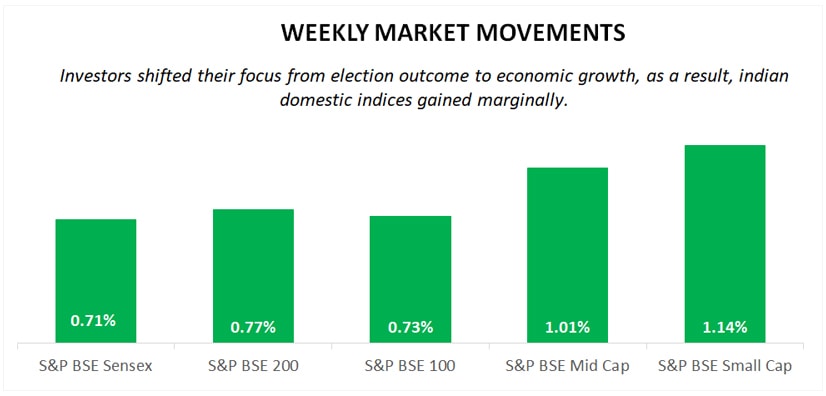

Last week, investors shifted their focus from the election result to economic growth numbers and as a result, domestic equity indices closed marginally higher. Let’s find out in detail, what happened in the market last week.

Major Equity Indices Performance

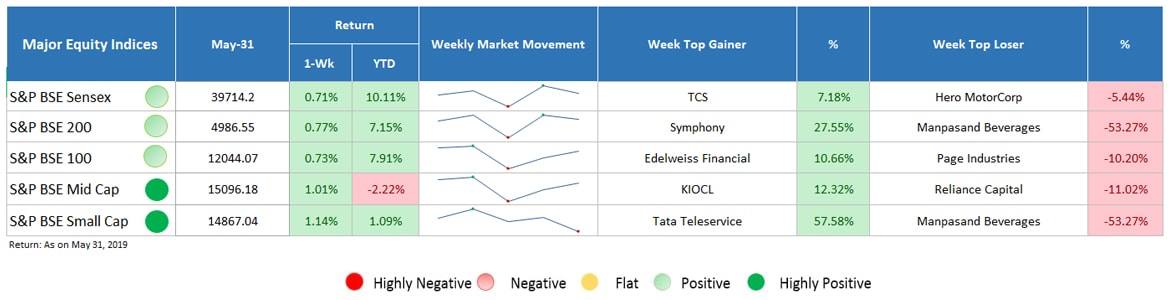

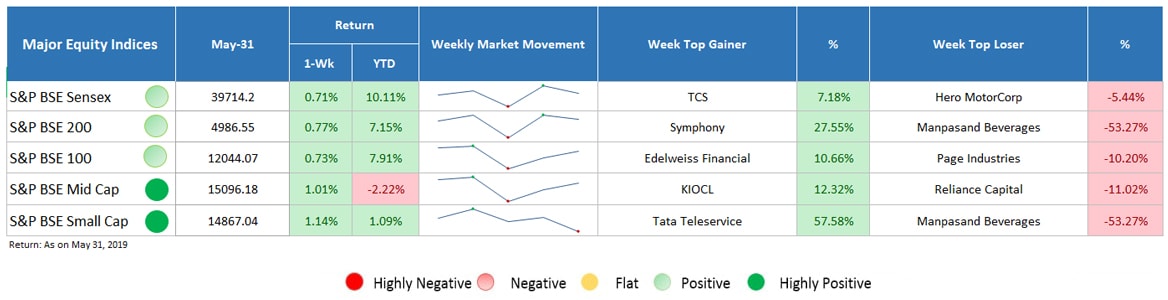

Bellwether index, Sensex rose 0.71%, but underperformed broader market indices where BSE Midcap and BSE Smallcap were up above 1%. Other large cap indices; BSE 100 and BSE 200 were up by 0.77% and 0.73%, respectively.

On the domestic front, institutional activities played a major role in affecting investor sentiments. During the week, FIIs poured equities worth INR 2,750.87 crore, significantly lower than earlier week’s inflow of INR 5,333.40 crore. On the other side, outflow by Domestic Institutional Investors (DIIs) fell from INR 2,579.67 crore to INR 976.73 crore.

Despite this, investors shifted their focus from the election outcome towards GDP growth numbers and expectation of lower than estimated GDP growth restricted market gains. As per the released GDP data, weakening consumption, escalating trade war and global growth concerns pulled India’s March quarter GDP growth to 5.8%, lowest since last 20 quarters. Moreover, 2019’s GDP is recorded at 6.8% that is lowest since last 5-years.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

In addition to this, core sector industrial growth also dropped to 2.6% in April as against 4.9% growth in preceding month. Contraction in output of natural gas, fertilizers, and crude oil dragged industrial growth lower.

However, on the global front, US-China trade war and US President, Donald Trump’s decision to impose tariff on Mexican import affected sentiments adversely.

Now, after the GDP numbers are out, investors are waiting for the monetary policy committee’s decision and expecting further rate cut by RBI in the upcoming meeting next week.

Sectoral Indices Performance

Gaining Sectors

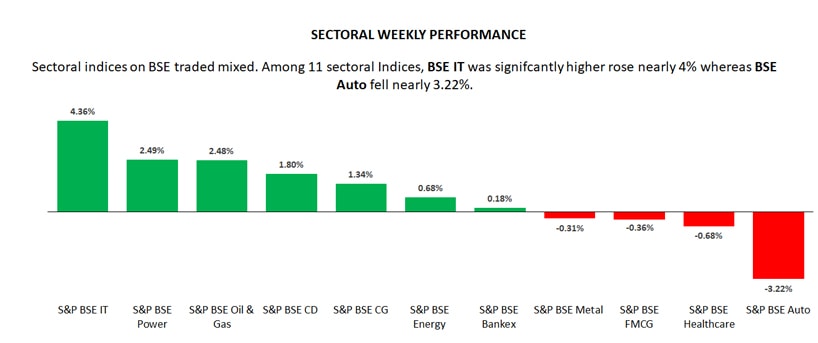

Sectoral indices ended on a mixed note, among 11 sectors, 7 sectors advanced.

- BSE IT sector which was the worst performing sector the week before headed the list of top performer, with a rise of more than 4%.

- BSE power and BSE oil & gas were up nearly 2.5%. A significant fall in oil prices that came to 3-month’s low brought buying pressure in the sector.

- BSE consumer durable, capital goods, energy and bankex sector were marginally higher, up by 1.80%, 1.34%, 0.68% and 0.18%, respectively.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing sectors

Among above listed 11 sectors, only 4 sectors traded lower.

- BSE Auto headed the list of top loser, plunged above 3%.

- Other sectors including BSE healthcare, FMCG and metal also traded in red, down below 1%.

So, as you can see that the past one week was a mix of negative and positive sentiments, leading the equity market on a bumpy ride. The slowing economic growth can affect the market this week as well, so some volatility can be seen. Be ready for the week and stay tuned for the next weekly update.

- Ask Questions

- Give Answers

- Improve Knowledge

- Invest Wisely