Table of Contents

- Axis ELSS Tax Saver Fund - Regular Plan - Growth

- ICICI Prudential ELSS Tax Saver Fund (Tax Saving) - Growth

- DSP ELSS Tax Saver Fund - Regular Plan - Growth

- Kotak ELSS Tax Saver Fund-Scheme-Growth

- Mirae Asset ELSS Tax Saver Fund-Regular Plan-Growth

Introduction

As the tax-saving season approaches, investors start looking for ways to reduce their tax burden. Investing is a well-thought-out move, and maintaining tax efficiency is crucial for long-term wealth. Investors can avail of tax benefits under section 80C if they invest in ELSS category funds. Long-term investors are seeking clarity regarding the validity of their investment schemes. We will assess if it's feasible to continue with their current investments and provide new recommendations to plan for 2024.

We aim to identify the best funds in the ELSS Mutual Funds in this category. We will see if they beat their benchmark and have given consistent returns in the past 3 to 5 years. In this blog post, we will discuss the latest research on the best tax-saving funds for 2024. Let’s proceed with understanding the importance of this category.

What is the Importance of ELSS Category Funds?

ELSS Mutual Funds or equity-linked saving schemes are uniquely designed to invest in various sized categories. Like large, mid and small cap-sized companies. Let us learn the importance of the ELSS category funds. It will help us identify the reasons to include this category in our portfolio. In the income tax section, to save your income there are certain provisions. It lists various investment options such as PF, LIC, and FD, which can be used to deduct the invested amount when filing your income tax return. ELSS is one of the options that fall under this category.

Let’s narrow it down with a simple example.

If you invest up to 1.5 lakh in this category, then you are eligible to deduct this amount from your income to reduce your tax liability. When it comes to investing, ELSS funds are a great option if you're looking for high returns within a short period.

In fact, on average, these funds offer an annual return of 12-15% in just 3-5 years. Moreover, the lock-in period is much lower than other funds, giving you more flexibility with your investments.

So, if you want to make the most of your money, ELSS funds are worth considering.

Identifying the 3 investing styles

Let us talk about the 3 different styles of investing in ELSS Mutual Funds:

Conservative Investing

- In this style, you invest in those funds that manage risk systematically and generate good returns.

- This investing style is seen in the Parag Parikh Tax Saver Fund. It comes under the ELSS category fund scheme offered by PPFAF MF house.

- Introduced to the market on July 18, 2019, this scheme has an Asset Under Management (AUM) of INR 2,760.76 crore as of 31.01.24.

- Over the last three years, the rolling return is 24.97%, surpassing its benchmark's return of 21.31%. The fund's recent 1-year and 3-year returns of 21.88% and 25.38%, respectively, outperformed its benchmark returns of 14.3% and 18.8% in the same periods. This fund has outperformed the market average.

Aggressive Investing

- This style includes investing in funds that understand market conditions and have a high-risk profile.

- The target is to make high returns quickly. The investing strategy and fund manager play a vital role in these funds.

- This style is seen in the performance of the Quant Tax Saver Fund under its category. This scheme holds a total AUM of 7,237.64 crores as of 31.01.24.

- The rolling return of this fund over three and five years demonstrates an exceptional performance of 24.37% and 22.39%, respectively, whereas its benchmark is 13.83% and 13.51%, demonstrating the fund's outperformance.

Quality Investing

- This style is suitable for every type of investor. These invest in quality stocks for long-term gains.

- It implements a buy-and-hold strategy to minimize risk and earn consistent returns.

- DSP ELSS Tax Saver Fund is identified as the best-performing fund with this investing style. It has an Asset Under Management (AUM) of 13,846.06 crores as of 31.01.24.

- Over the last three and five years, the fund has delivered strong rolling returns of 17.79% and 15.92%, respectively, exceeding the benchmark.

Determining the factors to filter good funds under the tax-saving category

The filtration of a good Mutual Fund is based on 2 fundamentals:

- Rolling returns

- Consistent returns

let us understand a little more about these and how the above factors help in selecting good funds.

The first step is to check the rolling return these indicate the performance of the fund at different times.

Here, returns are compared with its benchmark & if they outperform them it shows positive results. It means the fund has sustained its performance and given considerable profits.

Moving to the next step which is the consistency in returns. ELSS Mutual Funds have high levels of consistency, where returns consistently exceed a specific threshold. For example, 12% shows the fund's capacity to make profits for investors under a variety of market conditions.

A 65% consistency in returns over a specific limit shows a consistent track record of beating a given benchmark or target.

Parameters for filtering quality funds:

Consistent fund manager

A fund manager plays an important role in the performance of an ELSS category fund. These funds are managed by experts having solid track records of making informed decisions. They respond strategically during market changes. It gives guidance to the fund for its continuous development.

Investing in quality stocks

Investing in quality stocks means investing in funds having good earning margins. It encourages substantial growth of the funds in the long run. These funds invest in fundamentally strong companies as they are likely to survive the market volatility.

Low valuations

Investments in stocks having low valuations will lead to better growth opportunities. It offers a margin for safety and enhances your chances for capital appreciation as the market starts to perform better.

Active portfolio management

ELSS funds with active portfolio management confidently adapt to market changes by strategically adjusting their holdings. This enables the fund to seize emerging opportunities and mitigate potential risks, ensuring that the investments remain aligned with the fund's objectives.

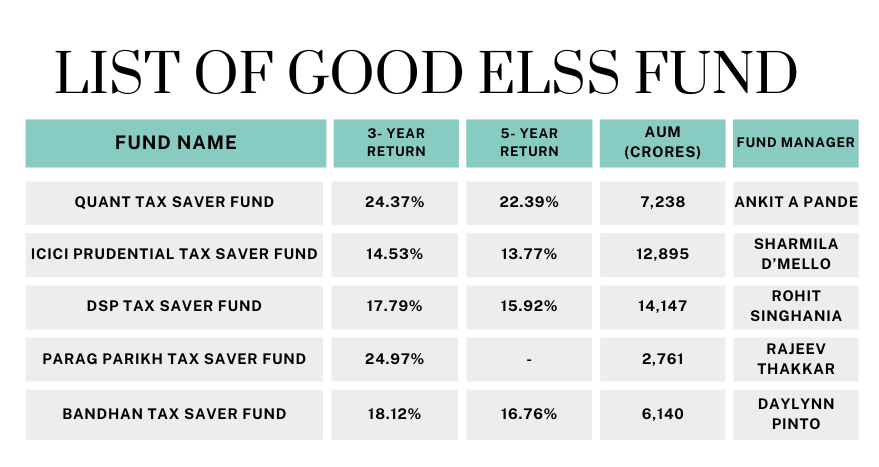

Listing some good funds to invest in

Based on the above parameters we have identified the top 5 best performing funds in the ELSS category. Check out the list given below:

In conclusion, you can use this list to determine if the funds you are invested in are suitable for you.

Conclusion

Investing in top Equity-Linked Saving Scheme (ELSS) funds can provide tax benefits for up to three years. If you are willing to take some risks, this could be an ideal option for you. It's worth noting that your money can continue to grow even after the three-year lock-in period. If you want to invest regularly and accumulate wealth over time, consider using an online Systematic Investment Plan (SIP) in mutual funds. SIPs allow you to make recurring deposits, and combining the tax benefits of ELSS with the convenience of online SIPs is an effective way to build your wealth.