Table of Contents

As India evolves as a global hub, its IT sector has been a powerhouse of growth, greatly contributing to the country's GDP. In fact, the industry has generated remarkable returns of more than 26.28% increase in one year, with the possibility for even larger gains in the future. With technology rapidly transforming the world, have you considered how its performance may benefit your investing portfolio?

Are you ready to capitalize on this thriving business and get your portion of the growth?

If Yes! Let's start!

Recognizing this trend, Invesco Mutual Fund, known for its innovative investment solutions, has established the Invesco India Technology Fund. This new NFO, open for subscription from September 3rd to September 17th, 2024, provides a unique chance to capitalize on the IT sector's promise.

This analysis explores why this may be the best IT sector NFO for forward-thinking investors.

Basic details of the fund

| Scheme Name | Invesco India Technology Fund |

|---|---|

| Issue Open Date | 03.09.24 |

| Issue Close Date | 17.09.24 |

| Category | Equity-Sectoral-Technology |

| Benchmark | Nifty IT TRI |

| Minimum Application Amount | Rs.1000 |

| Fund Managers | Mr. Aditya Khemani & Mr. Hitesh Jain |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

The Investment Strategy adopted by Invesco India Technology Fund

The Invesco India Technology Fund is a sector-specific fund that will keep its investments focused on technology-centric such as automation, AI and digitalization with companies like Wipro and Tata Consultancy Services which are at the forefront of new tech innovations.

It will balance your portfolio with a multi cap strategy giving it stability for large cap stocks with mid cap growth and small cap potential.

This IT scheme aims to target Mutual Funds investment in India's digital transformation alongside global technology leaders. It will give diversified exposure to a portfolio with efficient risk management.

Now that you know its investing style let’s learn more about the managing body that will use it.

Fund Managers of Invesco India Technology Fund

Meet the managing minds of this IT Sector Mutual Funds:

Mr Hitesh Jain: He brings a total of 15 years of experience in handling equity investments. With his previous record of working as a senior research analyst at CRISIL Limited, tracking technology and banking sectors, you can assure yourself that this stock is in good hands.

Mr Aditya Khemani: Mr Khemani has expertise in managing Equity Funds with 18+ years in the finance field. He joined the Invesco India Mutual Fund in 2023 and before that; he worked at Motilal Oswal AMC.

Well, if you are wondering, why invest in this Mutual Funds scheme? Let’s answer that.

Why Invest in Invesco India Technology Fund?

This stock gives many strong reasons to include it in your portfolio like:

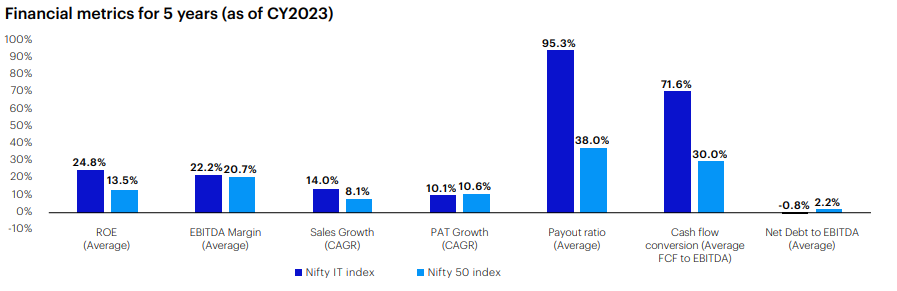

High Returns: IT industries continue to show robust financial performance delivering high ROE (return on equity investment) and healthy cash flow for their investors. You can refer to the below graph for data:

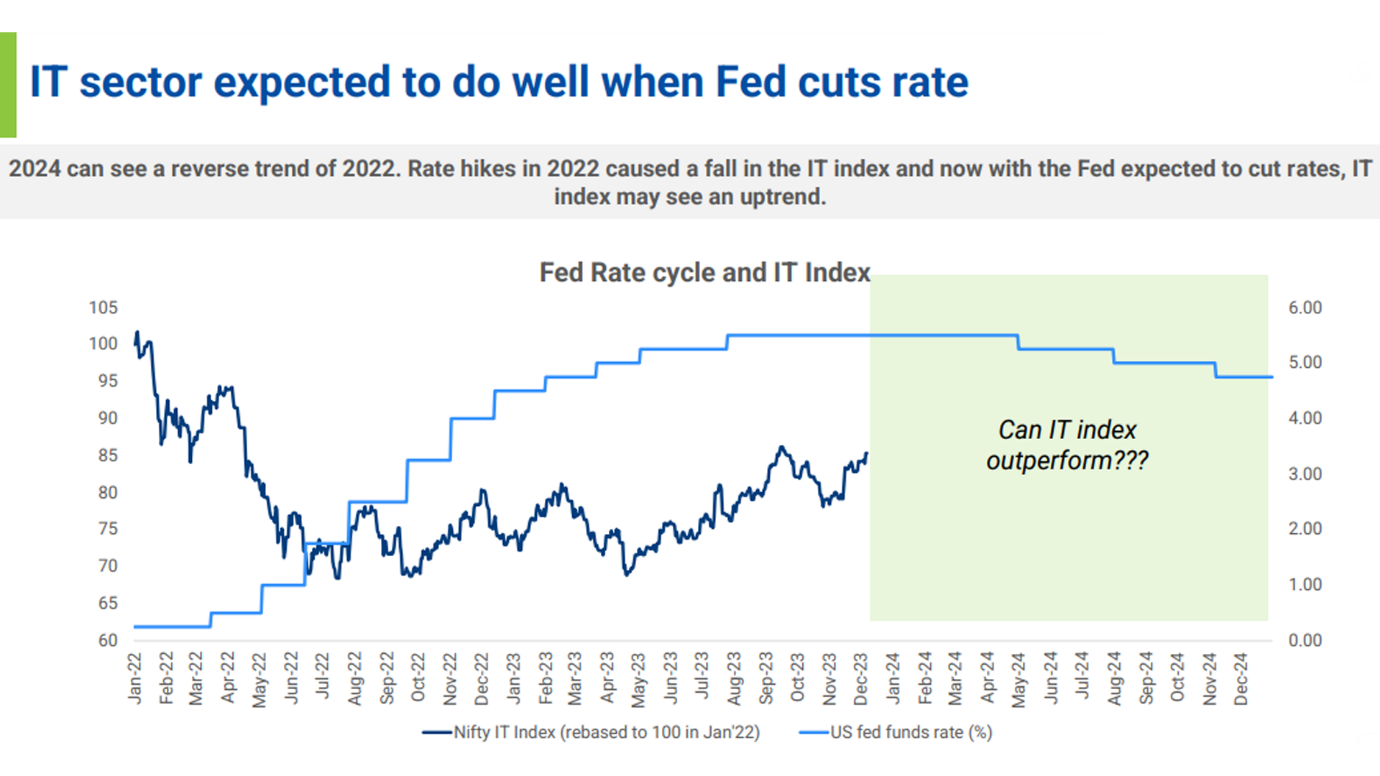

Increased Revenue Growth: It is evident, that whenever the Fed (Federal Reserve) decreases its interest rates, the growth rate of IT-related companies reaches an all-time high value. Investments in these stocks will give you a direct opportunity to make good returns in such scenarios.

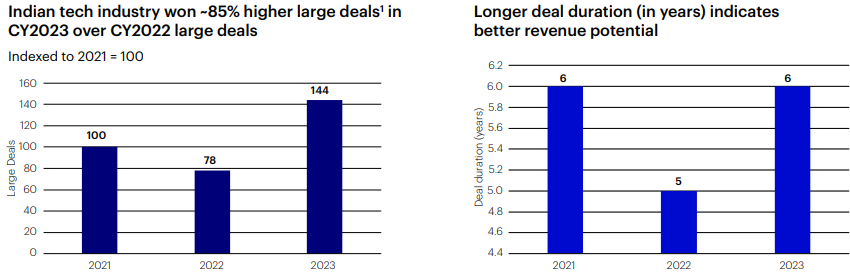

Strong Deal Momentum: With investments in these stocks, you can take advantage of the sustained business activities of India. For example, the pipeline deal made a strong revenue and still has the potential to give better margins for profits. See the below graph to track the performance:

Well, the above points gave strong reasons for investment but what about the long-term growth of this whole IT theme? Let’s study that next.

Why is IT the Next Big Theme for Investment?

The IT sector has many opportunities in the long term built on the 4 pillars for a successful investment in the IT sector which are as follows:

Industry Growth: So world IT services current market size is 1.4 trillion dollars and by 2034, it will be doubled to 2.98 trillion dollars.

India’s size is also 45 billion, which means 12-13% of the global market share. Plus, it is growing rapidly with India also experiencing a rise in its market share.

The reason is explained in the next point, which is:

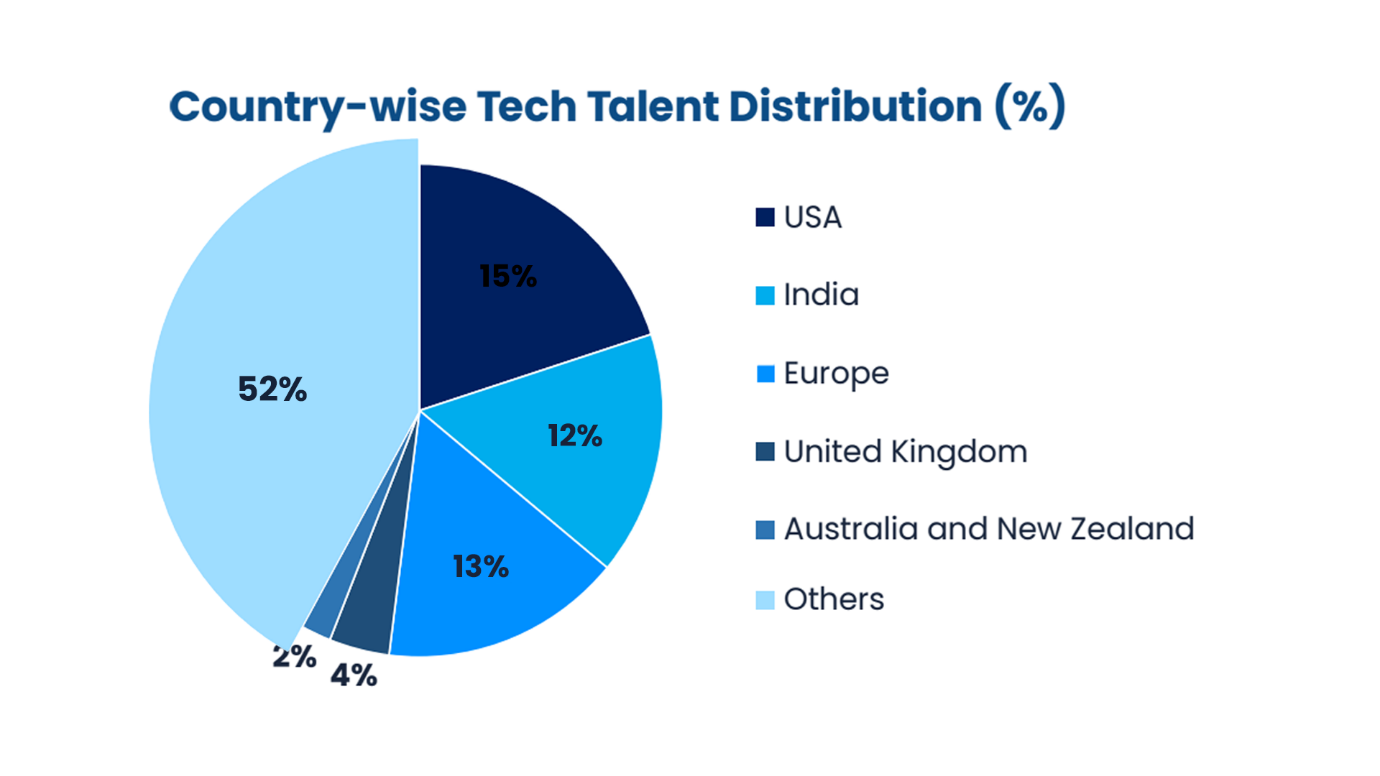

Competitive Advantage: In the IT sector the infra is fully established as compared to other sectors. So far IT infra means skilled and talented human resources with strong capacity and 2nd is capital resources.

India is filled with talented employees that’s the reason we have the largest talent pool with a 52% market share. You can see the below chart for proofs:

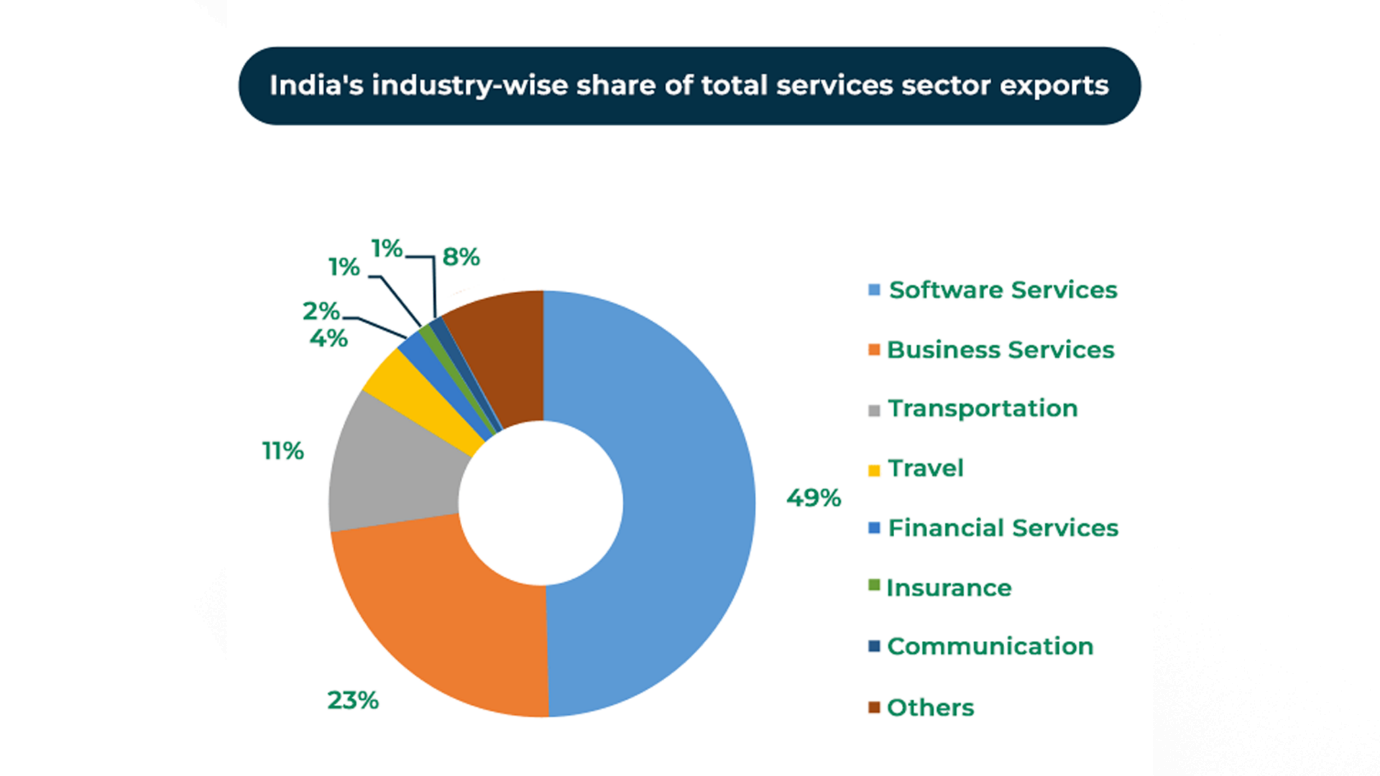

Secondly, the capital resources have been internally very strong the reason India’s industry-wise share of total services is 49%. Refer to the below chart for data:

Highly Rewarding Business Models: IT businesses have high margins as compared to other businesses that’s the reason investors make high returns on their investments. Plus the cash flow is also strong enough to expand the business where no more financial leverage is needed.

These IT companies work on asset light business model, which means they do not require big capex meaning capital expenditure.

Timing the Market Correctly: Lastly, we have to see how the timing is, for the last 2 years IT Sector was in the neglected zone because the valuations were also very high. Recently you can see positive results in this sector.

For example, Tata consultancy services results estimates show a net profit rise of 9% on-year to Rs.12,040 Crores and has declared a dividend of Rs.10. similarly, Infosys has also shown an increase in revenue as their clients are spending more money on IT services.

This leaves you with one last question, should you invest? Let’s grasp insights on that.

Final note- Who Should Invest?

The IT sector has strong growth opportunities where you can buy its stocks at low valuations and make good returns on them. If you are willing to take high risks to earn high returns then this stock is worth the investment. Make sure you keep an investment horizon for the long term at least 5-7 years and invest via SIP for stable returns during market shifts.

.webp&w=3840&q=75)