Table of Contents

- What is the SIP Return Rate of Canara Robeco Consumer Trends Fund?

- Investment Strategy Adopted By Canara Robeco Consumer Trends Fund

- Who is Managing the Canara Robeco Consumer Trends Fund?

- Portfolio Allocation of Canara Robeco Consumer Trends Fund

- How is the Sector Allocation of Canara Robeco Consumer Trends Fund?

- What is the Stock Quality of Canara Robeco Consumer Trends Fund?

- Is Canara Robeco Consumer Trends Fund Suitable for Your Portfolio?

- Summary of Canara Robeco Consumer Trends Fund

Are you interested in expanding your portfolio in the consumer market segment in India? The Canara Robeco Consumer Trends Fund provides investors with a perfect opportunity to invest in this rapidly growing field of FMCG. This mutual fund has exposure in consumer durables, retail and consumer goods, which has helped it deliver a 28.25% SIP return over the last three years and beat its benchmarks.

But how would you know if it is the right choice for you? Let's delve into that.

In this blog, you will look at the performance, strategy, and portfolio to decide whether or not the consumer-oriented fund you are considering should be invested in.

Let’s start the analysis by learning the SIP returns made by this thematic consumption fund.

What is the SIP Return Rate of Canara Robeco Consumer Trends Fund?

Let’s review the year-wise SIP return consistency in the performance of this Consumption Mutual Funds:

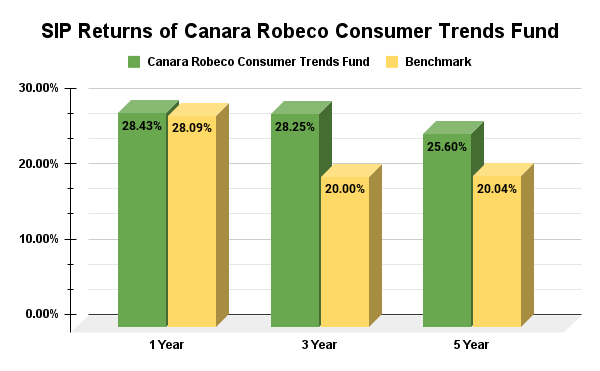

In the above graph, the green line shows the SIP returns delivered by Canara Robeco Consumer Trend MF. Likewise, yellow tells you the benchmark returns in comparison with the fund’s returns.

The difference is clearly visible in the 3rd and 5th year performance of the fund. The Canara Robeco Consumer Trends Fund impressively outperformed its benchmark, giving high returns margins.

You can see in one year, it gave only 28.43% annualised returns very close to its benchmark of 28.09%.

However, it returned 28.25% in just 3 years and 25.60% in 5 years, showing its ability to deliver consistently high returns in the long term.

Let's take the help of an example for a better understanding of how much returns you can make.

Imagine you started a SIP of Rs.3000 like a smart investor 5 years ago. Now, calculating your returns using the SIP Calculator tool, you would have invested a total figure of Rs.1,80,000 in today's date. Drawing a whopping total of Rs.3,32,699 on your SIP or systematic investment plan.

In the next step, you will understand the investment approach that helped this fund give outperforming returns.

Investment Strategy Adopted By Canara Robeco Consumer Trends Fund

The Canara Robeco Consumer Trends Fund covers a broad investment philosophy. Its main focus is to target investments in growth companies with strong management and buy them at reasonable valuations.

It uses macro research to identify themes and track business cycles that will make high returns for you.

You can simply break its investment approach into three easy steps:

- Research: It uses bottom-up analysis which means it identifies companies that have long-term potential in their early growth phase.

- Thematic Approach: It invests in high-growth consumer sectors like discretionary consumption and retail financing. It helps in targetting compounded returns for your portfolio.

- Stock Selection: It focuses on industries with changing dynamics and invests in early winners with strong execution or investment approach.

Moreover, the fund has fundamental in-house research that helps it to generate stock-specific ideas. This efficiency helps in keeping the internal risk minimal. Plus, with investments in this consumption fund, you will be able to track errors, manage beta monitoring and check regulatory limits as well.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

This brings you to the questions about the management of this consumption fund. Let’s grasp insights on that.

Who is Managing the Canara Robeco Consumer Trends Fund?

Meet Mr. Shridatta Bhandwaldar, the fund manager of Canara Robeco Trends Fund having 14+ years of working experience in the finance field. He has a unique sense of investing where he prioritizes quality stock with strong management tactics.

Furthermore, he strongly believes that it is the quality of good companies that create wealth more than stocks. It strategically plans to invest in scalable growth-oriented businesses at fair valuations to make good profit margins for your portfolio.

Let’s take a quick look at its current portfolio allocation hand to hand.

Portfolio Allocation of Canara Robeco Consumer Trends Fund

Here is how this consumption theme-based fund has distributed its portfolio:

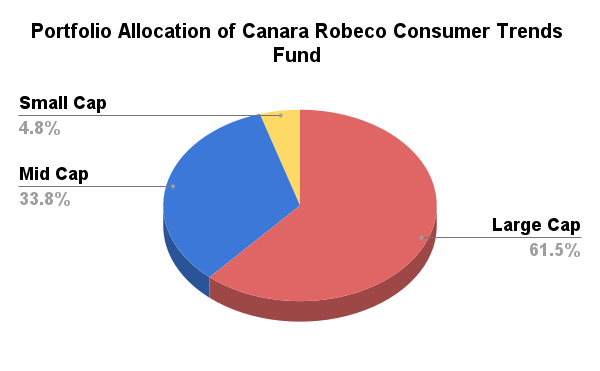

As shown in the above pie chart, the fund is majorly invested with 61.5% in large cap stocks, which gives it stability. Likewise, 33.8% is distributed in mid cap stocks whereas only 4.8% is left for small cap stocks.

It suggests that the fund's portfolio is a blend of growth and value stocks. It aims to draw high-growth return value from mid cap stocks also generating stable returns from large-cap stocks.

Let’s step further into the analysis by learning the distribution of assets among different sectors.

How is the Sector Allocation of Canara Robeco Consumer Trends Fund?

Let’s see the distribution of sectors by the Canara Robeco Consumer Trends Fund:

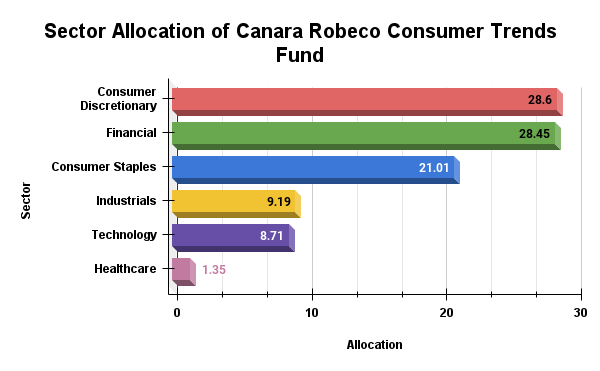

As shown in the above graph, the fund invests about 28% each in two major sectors, possibly areas like banking, technology, or consumer goods, which tend to grow quickly.

Another 21% is likely invested in industries like healthcare or industrials, which can offer both growth and stability. Around 9% is allocated to more stable sectors like telecommunications or utilities.

Finally, a very small portion of 1.35% is invested in areas like real estate or commodities, which are riskier but may have growth potential. This reliability will ensure a proper balance between the risks and rewards of your investments.

Let’s cover the stock quality in the next heading.

What is the Stock Quality of Canara Robeco Consumer Trends Fund?

The stock quality of Mutual Funds decides how much value a scheme adds to your portfolio. Let’s review this thematic consumption fund for that:

In the above data, you can see the companies in Canara Robeco Consumer Trends Fund are doing better in terms of growth compared to the overall market. They are increasing their sales by 16.77% compared to 16.01%.

Plus, it has gained profits of 23.38% and a sound cash generation of 39.64% at a faster rate. Also, the price investors are paying for these companies' earnings (measured by the PE ratio) is lower than 23.70. Look at the table given below for data:

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 16.77% |

| Earnings Growth | 23.38% |

| Cash Flow | 39.64% |

| PE- Valuations | 23.70% |

This means they are relatively cheaper compared to similar companies in the market. In simple terms, these companies are growing faster and might be a good deal, as you're paying less for that growth compared to other companies.

Lastly, you need to know if this fund is a good investment for you, let’s check the suitability for that.

Is Canara Robeco Consumer Trends Fund Suitable for Your Portfolio?

The Canara Robeco Consumer Trends Fund will suit you if you have advanced knowledge of macro trends. This means that if you are smart enough to take advantage of such rare schemes and make high returns during the ongoing market trends.

Moreover, if you are that kind of investor willing to trade your regular equity funds and take on selective bets to make higher returns for your portfolio.

Summary of Canara Robeco Consumer Trends Fund

In short, if you are convinced to move forward with this consumption mutual fund, you must plan an investment period of at least 5-7 years. Moreover, investments made into this scheme will earn you high returns from the fast-moving consumer sectors (FMCG). The only thing you need is the Best SIP Platform to start your investments today.

.webp&w=3840&q=75)