Table of Contents

- NFO LIC Manufacturing Fund Details

- What Growth Opportunities Lies in the Manufacturing Sector?

- Investment Strategy of LIC MF Manufacturing Fund

- Where will the LIC MF Manufacturing Fund Invest?

- Is LIC MF Manufacturing Fund a Good Investment Choice?

- Fund Manager’s Expertise in LIC MF Manufacturing Fund

- Fund Facts About LIC MF Manufacturing Fund

- Conclusion

As India becomes home to over 1.4 billion people, its GDP's growth depends on sectors that have high growth potential in the long term. In fact, the manufacturing sector is the oldest with 15-16% annual revenue growth. Though this adds great value to the nation's wealth, have you considered how its performance may benefit your portfolio?

Are you ready to hop on this trend and trade your regular funds with this new NFO launched by LIC Mutual Fund?

Yes, this asset management company has opened subscriptions to its recently launched NFO, the LIC MF Manufacturing Fund an open-ended scheme broadly covering the manufacturing theme. The subscription for this NFO has started from 20th October and will close on 04th October 2024.

This post will analyse why this is the best NFO in the manufacturing sector for a smart investor like you. Let’s start with the basic information of this fund.

NFO LIC Manufacturing Fund Details

| Scheme Name | LIC MF Manufacturing Fund |

|---|---|

| Issue Open Date | 20.09.24 |

| Issue Close Date | 04.10.24 |

| Category | Thematic-equity manufacturing |

| Benchmark | Nifty India Manufacturing Index TRI |

| Minimum Application Amount | Rs.5000 |

| Fund Managers | Mr. Yogesh Patil & Mr. Mahesh Bendre |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

What Growth Opportunities Lies in the Manufacturing Sector?

Here are the three main sectors that will benefit from India's growing domestic market, increasing global demand and supportive policies making them highly scalable businesses for investment:

- Sunrise Sectors: These include defence, aerospace, power cables, electronics manufacturing services (EMS), consumer durables and data centres.

- Scalable Sectors: Automotive, industrial machinery, power equipment, pharmaceutical, chemical and textiles are covered under it.

- Evolving Sectors: Semiconductors and space satellite falls under it, which have a lot of scope and growth potential in the future.

Investment Strategy of LIC MF Manufacturing Fund

This New NFO will follow an active investment strategy to target high-growing companies in their early phase, smartly filtering companies from top to bottom and picking only those with good profit margins and high return on investment ratio (ROI).

Moreover, its expert management team, who will have full flexibility to churn meaning shifting the portfolio in favor of investors’ benefits, will actively manage the LIC MF Manufacturing fund review.

Where will the LIC MF Manufacturing Fund Invest?

The following companies would be a part of this manufacturing theme-based fund:

- Companies that are engaged in manufacturing activities.

- Companies that are well placed to carry forward India's imports by manufacturing locally.

- Companies that may benefit from the Government's Make in India initiatives and Product Linked Incentive (PLI).

- Companies that export goods manufactured in India.

- Companies that use manufacturing of new-age technology solutions in India and abroad.

Next, you will see why LIC MF Manufacturing Fund is the best manufacturing mutual fund for your portfolio.

Is LIC MF Manufacturing Fund a Good Investment Choice?

Here are five points that are responsible for growth of this manufacturing sector making this manufacturing mutual fund a profitable investment:

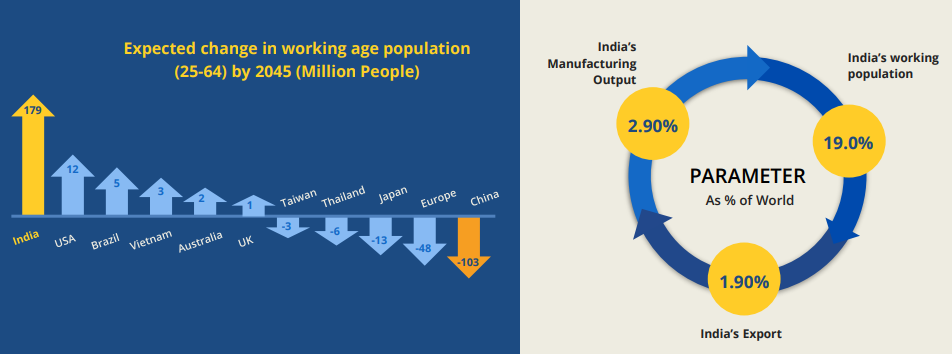

1. Sufficient and Affordable Labour: With the expected rise of the working age population of India reaching 179 million by 2045, manufacturing output and export will increase the competitive edge challenging countries like China and the USA. Look at the below picture for more clarity:

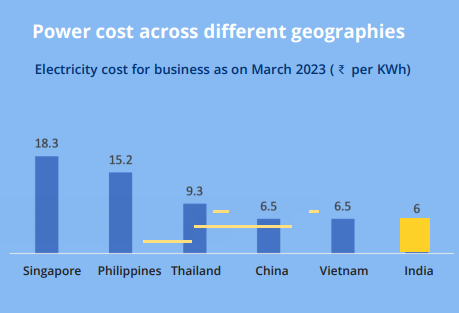

2. Low-cost Energy Access: Electricity is a key source in the manufacturing of goods. India's power supply cost is Rs.6 per KWh, which will increase manufacturing supply at a low cost and maximise profits. Here is a graph showing a comparison of electricity costs with native countries:

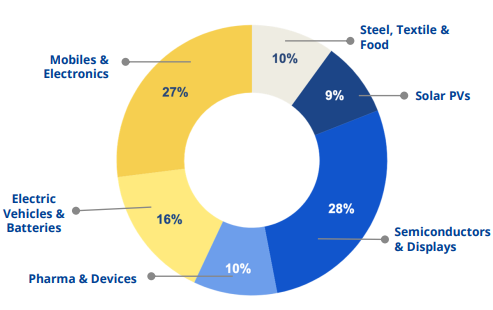

3. Supportive Government Policies: Campaigns like "Make in India" help local manufacturers and attract investment. Furthermore, initiatives like Atma Nirbhar Bharat aim for self-reliance through the economy, infrastructure, demography and demand. It will increase the value of many manufacturing industries like, mobiles & electronics, steel, textile & food, solar energy, pharma & services and many such.

Let's give you a pie chart for more clear view:

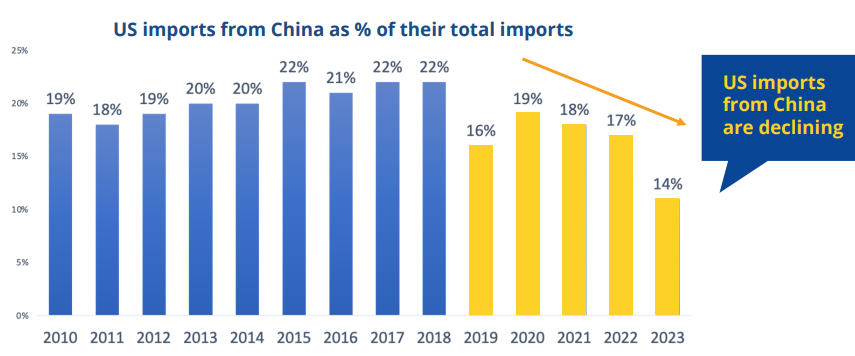

4. Shifting Supply Chains: Reducing Reliance on China: On one hand, India has seen a rise in imports and exports, while US imports from China declined by 750 bps (percentage points) since 2018. You can check the graph below for data:

5. Huge Consumer Market for Domestic Manufacturing: With continued policy support and increasing foreign direct investments (FDI), India's share of the global manufacturing market is expected to rise. You can see the below table to cross-check:

Fund Manager’s Expertise in LIC MF Manufacturing Fund

Meet Mr. Yogesh Patil and Mr. Mahesh Bendre bringing their 22 and 18+ years of experience to the table. With this duo, high return margins are expected given the flexible nature of this fund, they will shift the allocation of assets according to the market trends to take advantage of those sectors, which are in the growth phase. Moreover, Mr Patil has great knowledge and experience in managing the LIC Infrastructure Fund again a theme-based scheme.

Fund Facts About LIC MF Manufacturing Fund

Here are some Special products and facilities offered by this new fund offer:

- Systematic Investment Plan (including SIP pause, SIP Step up, Micro SIP).

- Systematic Transfer Plan (Fixed systematic transfer plan and capital appreciation STP facility).

- Systematic Withdrawal Plan (SWP)

- Facility to transfer dividend (IDCW)

- Auto Switch Facility (available only during the new fund offer period)

Conclusion

In short, investing in this new NFO will give you a great chance to make higher returns than regular equity funds. You can use the all-time best strategy by adopting a SIP route for a longer duration say 7+ years to build yourself a strong portfolio covering the top manufacturing companies of India.

Also Read : Should You Invest in NFOs?

.webp&w=3840&q=75)