Table of Contents

- NFO Motilal Oswal Digital India Fund Review

- Investment Strategy of Motilal Oswal Digital India Fund

- Where will the Motilal Oswal Digital India Fund Invest?

- Is Motilal Oswal Digital India Fund a Good Mutual Fund?

- Fund Manager's Expertise in Motilal Oswal Digital India Fund

- Fund Facts About Motilal Oswal Digital India Fund

- Final Words- Who Should Invest in Motilal Oswal Digital India Fund?

Have you heard about the New NFO launch? Yes, Motilal Oswal Mutual Fund being amongst the largest AMCs has opened subscriptions to its newly launched new fund offer, the Motilal Oswal Digital India Fund.

Now you may be wondering what sets it apart from the existing IT sector funds. Well, it is built on the motto of digital India, "Power to Empower.

Wherein you can grab your chance to invest in the top IT companies in India like Tata Consultancy Services Ltd, Infosys Ltd, Wipro, Tech Mahindra and many more.

The subscription for this new NFO has started from 11th October and will close on 25th October 2024.

This post will review why this is the best NFO in the IT Sector for a smart investor like you. Let's begin the analysis by covering the basic details of this fund.

NFO Motilal Oswal Digital India Fund Review

| Scheme Name | Motilal Oswal Digital India Fund |

|---|---|

| Issue Open Date | 11.10.24 |

| Issue Close Date | 25.10.24 |

| Category | Equity-Sectoral-Technology |

| Benchmark | BSE Teck Total Return Index |

| Minimum Application Amount | Rs.500 |

| Fund Managers | Mr. Ajay Khandelwal |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

Investment Strategy of Motilal Oswal Digital India Fund

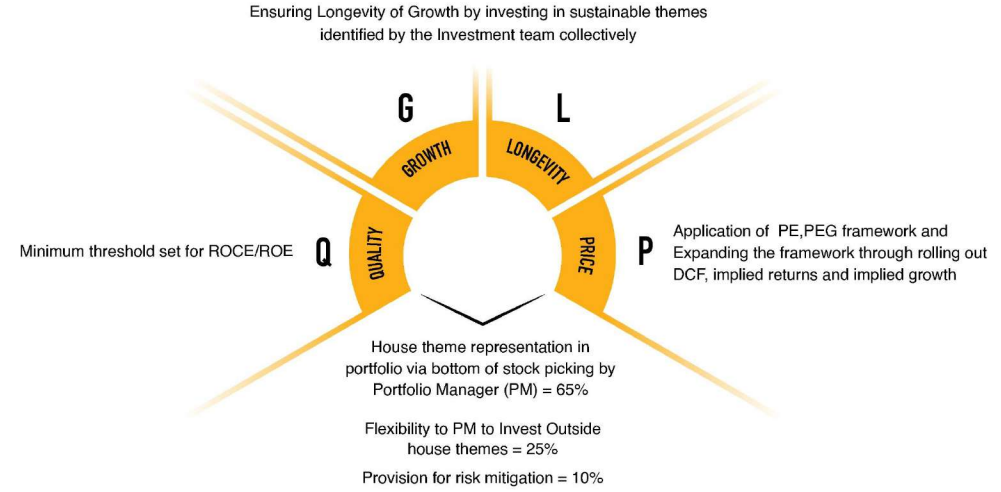

This new NFO has put a lot of focus on following a disciplined process to manage your investments. It uses a unique technique called QGLP, which stands for growth, longevity and price.

Let's see individually what each letter means:

- Quality: Investing in qualitative stocks of sound companies by setting a standard limit on the ROCE/ ROE (return on equity or earnings).

- Growth: It invests in stocks based on sustainable themes handpicked by experts.

- Longevity: Keeps a healthy investment for a long period.

- Price: It applies the PE and PEG framework and expands the framework by rolling out DCF, implied returns and growth.

You can check out the below picture for more clarity:

The NFO Motilal Oswal Mutual Funds house has distributed its portfolio in the following manner:

- house theme representation in the portfolio via the bottom of stock picking by the fund manager is 65%.

- It gives 25% flexibility to the fund manager to invest in outside house theme stocks.

- Thereby leaving only a 10% allocation to high-risk stocks.

Where will the Motilal Oswal Digital India Fund Invest?

The Motilal Oswal Digital India Fund will invest across the following sectors:

- Entertainment

- E-commerce

- Banking sector

- Healthcare

- Education

- Automobile

- Security Trading

- Payments

- Manufacturing Sector

- Communications

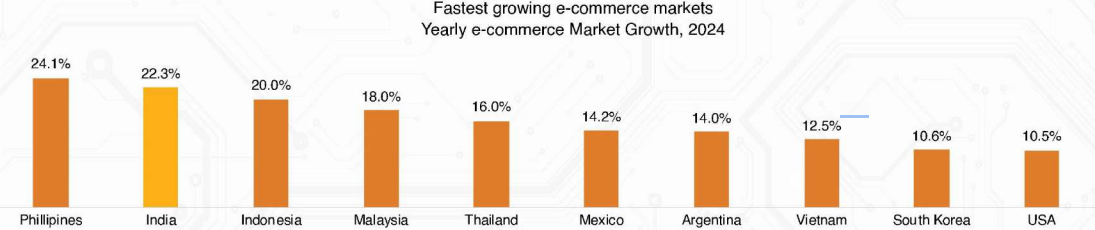

Likewise, the fund will also invest a portion in foreign digital companies for which India has the fastest-growing e-commerce market.

Let's take a quick glance at the below graph to compare the data:

Is Motilal Oswal Digital India Fund a Good Mutual Fund?

The risk management for consistency and suitability of performance makes it the best digital India fund. Let's review the new fund offer Motilal Oswal Digital India Fund on these two points:

- Stock Weightage & Stock Sizing: minimum and maximum exposure limits set.

- Sector Sizing: Limits on sector deviation mean distribution relative to benchmark.

- Diversification Strategy: Portfolio size is limited to 35 stocks only.

- Profit Taking: Propriety framework for measuring triggers.

- Stringent Liquidity Framework: Ensures efficient management to be able to take necessary actions when the time comes.

Don’t Miss to check out the SIP Calculator tool to know your return on investment.

Fund Manager's Expertise in Motilal Oswal Digital India Fund

Meet Mr. Ajay Khandelwal rich in experience with 14 years in the field of finance. He is an all-rounder in managing varied mutual funds in different categories. Moreover, backed by the support of Motilal Oswal Mutual Fund, you can expect high returns on your investments with this fund.

Fund Facts About Motilal Oswal Digital India Fund

Here are some simple facts about the Mutual Funds covered under the IT sector promoting digitalization:

- India is leading the world in terms of public digital infrastructure deployment. It is all set to cross $1 trillion in the digital economy by 2030.

- Today's digital can experience the growth of Yesterday's IT sector performance.

- The below table lists the 5 top-performing IT companies performance:

| Company Name | 20-Year Market Cap CAGR | 10-Year Market Cap CAGR |

|---|---|---|

| Tata Consultancy Services Limited | 17.90% | 12.60% |

| Infosys Limited | 14.30% | 13.60% |

| HCL Technologies Ltd | 21.20% | 15.50% |

| Mphasis Ltd | 17.90% | 21.90% |

- Over the past 25 years, IT services have become a major contributor to India's status as a strong business ecosystem.

- The ongoing digital revolution taking place in India and the support of the country's digital pillars will experience robust growth.

Final Words- Who Should Invest in Motilal Oswal Digital India Fund?

In a nutshell, for a tech-savvy investor like you, investing in the best technology fund is a must. That makes this new fund offer or NFO Motilal Oswal Digital India Fund a perfect match to get stable returns. You just need one thing, the Best SIP Platform with an investment period of at least 5-7 years.

Also Read : Should You Invest in NFOs?

.webp&w=3840&q=75)