Table of Contents

- NFO Tata India Innovation Fund Basic Details

- Investment Strategy of Tata India Innovation Fund Review

- Stock Selection Criteria by Newly Launched Tata India Innovation Fund NFO

- Who Should Invest in New Tata NFO 2024?

- Why Invest in Tata India Innovation Fund NFO?

- Summary of Tata India Innovation Fund Review

Are you aware that India is carving out on its role and playing at the forefront of the intelligent age? Yes, increasing its spending to 2% of the total GDP, India has become home to nine "Unicron" start-ups.

However, how does it concern you as an investor? This is an interesting turn of events. Why? Let's find out.

Realizing this fast-growing trend in India's innovation, Tata Mutual Fund, known for its innovative investment solutions has launched the Tata India Innovation Fund. This new NFO is open for subscription from 11th November to 25th November 2024.

This analysis explores why this new Tata NFO 2024 could be the best investment opportunity in the innovation-driven world.

NFO Tata India Innovation Fund Basic Details

Here are the basic information on this new fund offer:

| Scheme Name | Tata India Innovation Fund |

|---|---|

| Issue Open Date | 11.11.24 |

| Issue Close Date | 25.11.24 |

| Category | Equity- Thematic |

| Benchmark | Nifty 500 |

| Minimum Application Amount | Rs.500 |

| Fund Managers | Ms. Meeta Shetty |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

Let’s take a quick glance at the investment philosophy adopted by this newly launched NFO.

Investment Strategy of Tata India Innovation Fund Review

In an exciting turn of events, this new NFO has adopted a unique investment approach by combining two types of innovations i.e. Breakthrough and Incremental Innovation.

Now, what will it achieve? Well, it strives to make long-term capital growth by investing up to 80% of net assets among the top technology companies in India like Tata Consultancy, Wipro, HCL Technologies etc.

This broad strategy will be a game-changer for the new technological advancements, opening new markets and revolutionary processes for you. On the contrary, incremental innovation will bring continuous improvements in products and services.

Moreover, the Tata Innovation Fund NFO will target companies with the following qualities:

- Developing new innovative products and services.

- Companies use new and updated technologies to enhance customer engagement.

- Reducing the use of traditional business models.

- Diver cutting-edge technological advancements.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Moving along, the next heading will cover the process of maintaining the stock quality of this fund.

Stock Selection Criteria by Newly Launched Tata India Innovation Fund NFO

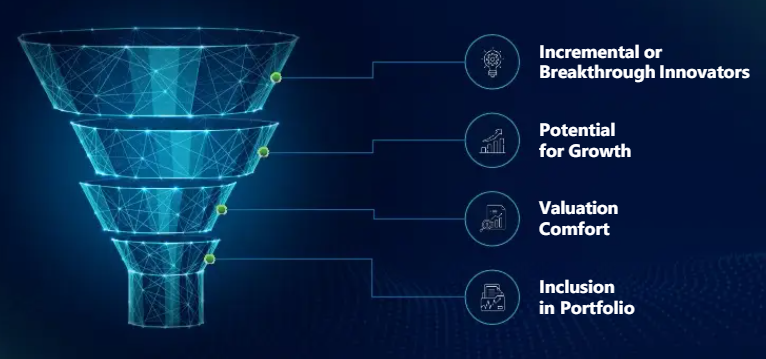

You see here, this new NFO launched by the Tata Mutual Fund is one of the largest asset management companies in India. It has chosen an active management approach with a bottom-up stock selection process to deliver consistent performance. Let's understand its analogy in 4 simple steps:

- Step 1: Focusing on Innovation

It invests in companies that are driving breakthroughs or incremental changes when it comes to innovation.

- Step 2: Investing in Potentially Growing Companies

Businesses with long-term leadership prospects are expected to deliver multi-bagger returns while having strong fundamentals.

- Step 3: Valuation Discipline

This new fund offer strives for fairly valued opportunities for maximum returns for you.

- Step 4: Diversification

It provides balanced exposure across sectors and market caps.

You can also refer to the below picture for a more clear understanding of the topic:

In these next steps, you can determine if this new fund offer will suit your long-term goals or not.

Who Should Invest in New Tata NFO 2024?

You can check the below points to know if this new Tata India Innovation NFO suits you or not:

1. High-Risk Takers

This new fund offer is best suited for investors with a medium to high-risk capacity.

2.Long-term Investors

It is an ideal choice for those looking to create strong capital gains with an investment tenure of 5-7 years.

3. Diversification Seekers

If you are one of those looking for distribution in your portfolio, this new fund offer by Tata AMC adds exposure to cutting-edge technologies like AI and biotechnology.

4. Focused on Thematic Funds

This new Tata NFO 2024 is best for investors interested in innovation-driven sectors like technology, healthcare and renewable energy.

Care to read more? Learn about the Best Mutual Funds for the Power & Renewable Energy Sector in 2024

Let’s hear some strong reasons in the next line to add this NFO by Tata Mutual Funds to your portfolio.

Why Invest in Tata India Innovation Fund NFO?

Here are some points to consider that make this new NFO worth the investment:

1. Volatility

The fund may be sensitive to market cycles, interest rate changes, and regulatory developments.

2. Sector Risk

Being a thematic fund, it is subject to higher volatility compared to diversified equity funds.

3. Global and Economic Trends

Performance can be influenced by shifts in sentiment toward growth stocks and innovation-driven sectors globally.

Summary of Tata India Innovation Fund Review

In short, the experts have said that it could be the Best NFO for 2024 under the equity thematic category. It’s time for you to make up your mind and grab this amazing opportunity to make high returns from the growing IT Sector. Don’t let the pressure of heavy investments weigh you down, join the club via Best SIP Platforms today.

Finally, you can conclude this new NFO could be the valuable addition that you are missing to make your portfolio whole. Invest now to add the potential from India's growing growth story.

.webp&w=3840&q=75)