Table of Contents

- New NFO Axis Momentum Fund Basic Details

- What are Momentum Funds?

- Investment Strategy by Axis Momentum Fund NFO Review

- Criteria for Stock Selection of Axis Momentum Fund NFO

- Who are the Fund Managers of Axis Momentum Fund NFO?

- Who should invest in Axis Momentum Fund NFO?

- Why you should invest in the Axis Momentum Fund NFO?

- Conclusion

Introduction Newly Launched NFO 2024

Are you a risk taker looking to maximize your investment gains? If yes, then this new NFO Axis Momentum Fund by one of the largest AMCs, the Axis Mutual Fund could be a good alternative.

Lucky for you, as you can start your early subscriptions from today onwards and it will end on 6th November 2024. Moreover, you can start by just spending Rs.100, making it quite affordable for N number of investors pan-India.

Well, this was just the tip of the iceberg, let's start this analysis to learn whether this can be the best NFO 2024 for you.

New NFO Axis Momentum Fund Basic Details

| Scheme Name | Axis Momentum Fund NFO |

|---|---|

| Issue Open Date | Nov 22, 2024 |

| Issue Close Date | Dec 06, 2024 |

| Category | Equity Thematic |

| Benchmark | NIFTY 500 TRI |

| Minimum Application Amount | Rs.100 |

| Fund Managers | Mr Karthik Kumar & Mr Mayank Hyanki |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

What are Momentum Funds?

The Momentum funds are an exciting investment choice, designed around a specific theme: momentum. But what exactly does that mean?

In the era of investing, momentum just means riding the wave. This means that these funds only focus on stocks that are performing well. These funds believe that these stocks will continue to do this in the future.

More simply, this new NFO will look for stocks that have a strong performance. The selection of these stocks is based on their recent price gain, the positive sentiment of the market and the performance of the company. They aim to find momentum stocks rather than undervalued stocks. As these stocks are in the current demand.

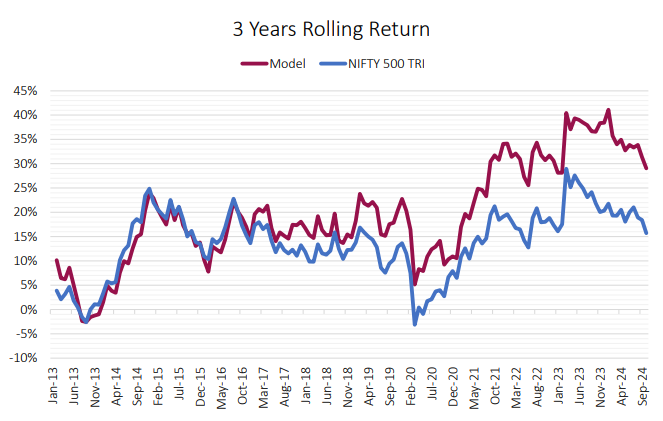

Below is the chart for better understanding:

On a 3 year rolling return, the thematic momentum fund has successfully provided 96%-time a positive return. In addition, it has also outperformed the Nifty 500 TRI with an impressive return of 76.8%.

Investment Strategy by Axis Momentum Fund NFO Review

The Axis Momentum Fund performance relies on this strategy. Let's dive deeper into the key strategies that are deployed by the fund managers:

Robust Investment Process

- This fund by Axis Mutual Fund uses well-defined models for the identification of the stock. This stock is in the momentum of uptrend.

- Decisions made will be backed by data-driven insights. This approach helps the fund’s manager in making informed decisions.

- Moreover, there is a well-defined framework that helps in ensuring consistency. Also, in minimizing the emotional biases.

Better Risk-Adjusted Performance

- Funds will be invested in a diversified portfolio. Stocks will be of various sectors that will diversify the risk.

- There are uncompromising techniques for risk management. This includes stop loss orders and sizing of positions. This helps in protecting the deployed capital.

- Fund managers also balance the portfolio continuously. This helps in maintaining the desired risk profile and strategy of investment.

Rules-Based Approach

- Stocks picked are supported by predefined rules and criteria. This eliminates subjective biases.

- Objectivity: This rules-based approach helps in ensuring the consistency and objective of the investment process.

- Efficiency: Automation and standardizing of the investment process that enhances efficiency.

Enhanced Risk Management

- Managers of funds closely monitor the market. Changes are made adhering to the market conditions.

- Risk is mitigated by stop loss orders, diversification, and position sizing.

This fund seeks to provide high, risk-adjusted returns. It will use these strategies to do so.

Now let's see how the selection of stocks is done to maximize the gains.

Criteria for Stock Selection of Axis Momentum Fund NFO

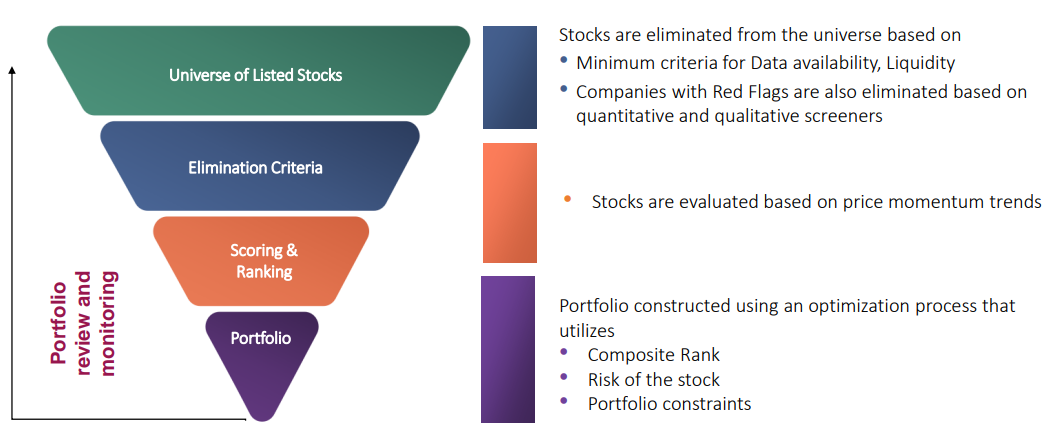

The Axis Momentum Fund returns will be based on the stocks they are invested in. This Fund deploys a well-structured process for stock selection. This helps in promising returns to investors. Below is the breakdown of the process:

Step 1: Initial Screening

- At the start, stocks are filtered by their history and trading volumes.

- At the initial stage, we exclude companies with red flags. These include poor financial performance and legal issues.

Step 2: Momentum Screening

- This fund identifies the stock that has strong upward movement. This is done by analysing the history. Stocks that have a notable price appreciation are also included.

Step 3: Portfolio Construction

- Ranks are assigned to the stocks based on the various factors. Some of the factors are valuation, momentum, and risk.

- A team of fund managers also thoroughly assesses the risk that is associated with each stock. This helps in weighing the stocks accordingly.

- Optimization techniques are used for balancing the risk and return. This has factors such as liquidity, diversification, and correlation.

By focusing on and following this approach, this fund aims to capture the market momentum. This will deliver long-term gains to the investors. This strategy states that this is one of the growth-oriented Mutual Funds.

After getting the knowledge of selection criteria. Let's enhance the reliability of this mutual fund:

Who are the fund managers of Axis Momentum Fund NFO?

- Mr Karthik Kumar is the person behind this Fund. He is highly experienced and has a thorough knowledge of the equity market. He has a perfect mix of innovation and expertise. It helps him spot emerging trends. This makes him the most valuable asset of this fund.

- A strategic approach along with disciplined investment followed him. That drives the performance of this fund and delivers returns to the investors.

Are you the right investor for this mutual fund? If you tick any of the boxes mentioned below then this fund can be the right choice for you.

Who should invest in Axis Momentum Fund NFO?

This new NFO is recommended to the following investors:

- Investors having high-risk tolerance capacity. As this new NFO with more volatile than index or large-cap funds. Investors must be comfortable enough with the conditions in the market.

- Investors aiming to outperform the benchmark index. And wants to invest in the momentum stocks.

- Momentum investing is a short-term to medium-term strategy. Investors who want to invest for a long-term period must opt out.

- Investors must know that momentum investing depends on market cycles and economic conditions. Investors must be aware of the potential risk.

Now let's see what makes this new fund offer the best NFO for 2024.

Why you should invest in the Axis Momentum Fund NFO?

This fund can come up as Best NFO 2024 for wealth creation. How? Let’s find out:

- Capitalize on Market Momentum: This fund is designed to unlock the power of market trends. By investing in stocks that have a strong upward trend. By investing in these types of stock this fund aims to generate superior returns.

- Experienced Fund Management: A highly professional and skilled team manages this fund. They excel at spotting and using momentum to boost their fund's performance.

- Diversified Portfolio: This fund has a highly diversified portfolio. This consists of stock from various sectors. This helps in reducing the dependency on the single sector. Overall, missing the risk.

- Active Management: This approach requires actively monitoring stocks. It adapts to changes in market conditions. This approach helps this fund outperform the different mutual funds.

- Potential for High Returns: Momentum investing is highly volatile. But, it comes with the chances of high returns. Funds aim to generate high returns by investing in stocks with a strong uptrend.

Conclusion

In short, if you want active management of the fund, you can invest in it. This new NFO is suitable for short-term investors. Also, for the investors with high tolerance to risk. If you want to invest in the Axis Mutual Fund, then this can be one of the best investment options. You can also start by doing an SIP in the Axis Momentum Fund that will further help you minimize the risk. This fund can be one of the Best mutual funds for momentum investing.