With the increased awareness and active participation in the investment world, investors are getting plenty of choices matching their requirements. Among the many options, large-cap funds have always served as the most preferred choice of all.

What does the Large-cap fund depicts?

The large-cap fund, as the name suggests, invests in the large and giant companies which have massive capitalisation ranging from Rs. 25,000 to Rs. 50,000 crores and over Rs. 50,000 crores respectively. As the large businesses are older players in their respective industries, they ensure trustworthiness and give the investor a sense of security. With the strong corporate governance, it becomes the most reliable and strong fund for the investors.

Is it the least risky fund?

The outstanding shares of the large companies have gradually gained a stability in their NAV. As the number of shares is more, the risk spread across all of them making it less risky. The capital of the investors tends to be in secure hands as these giant companies enjoy fidelity. The fear of default nullifies as these companies are well-established in the industry and has strong presence widely.

How Rewarding is the Large-cap funds?

Risk becomes reward when the intensity decreases. The large-cap funds, annul the risk making it a more stable fund regarding rewards. However, these funds do not promise skyrocketing growth but provides assurance of consistent returns. Investors, who do not want to expose in a high risk profile and looking for stability in returns should invest in the large-cap funds.

Suits well for?

Large-cap funds are most suitable for the investors who are new to the investment world and looking forward to debut in equities. Investors looking for stable returns should opt for the large-cap fund.

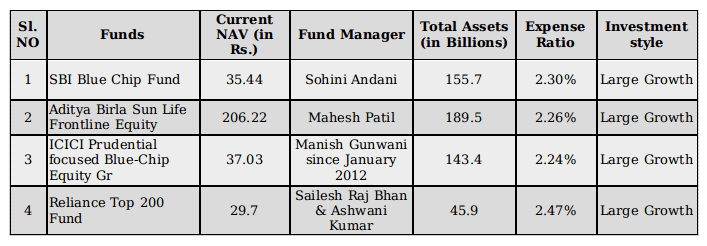

In the end, if you are a type of the equity investor, looking for long-term financial goals and are ready to lock in your money for a minimum time horizon of five years, a Large cap is the type of fund for you. Let’s take a glance of the performances of the top four large cap mutual funds which are provided in the below tables:

Portfolio Management of the Top Four Large-Cap Funds

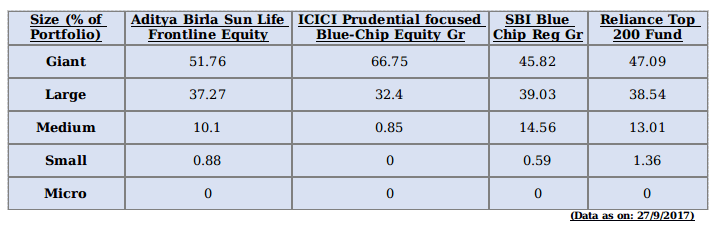

The table below defines the size of the large-cap funds regarding the Portfolio percentage of their Market Capitalization:

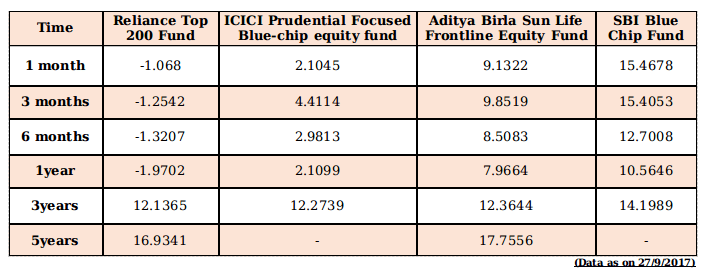

The table below gives a brief analysis of the returns anticipated for different schemes for five years:

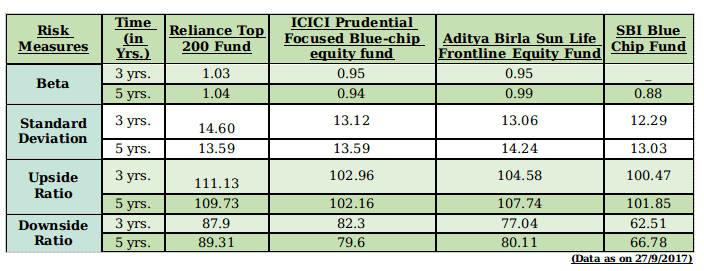

The table below analyses the risk with different statistical measures in the span of three and five years:

Beta is a measure which depicts the risk intensity of the fund in comparison with the market risk. If the beta is 1.2, it means the scheme may fluctuate up to 20% higher than the market volatility.

Standard Deviation is a measure of the dispersion of a set of data from its mean. It shows that how much the actual returns are deviating from the expected returns based on the past performances.

The ratio calculated by taking the fund's monthly returns during months when the benchmark had a positive return and dividing it by the benchmark return during that same month are called Upside Ratios. Ratios calculated by taking the fund's monthly return during the periods of negative benchmark performance and dividing it by the benchmark return are Downside Ratio.

Stay tuned to our “Investment Tips” page for more information on categories of Mutual Funds. To get more benefits of mutual fund investments, sign up today at MySIPonline.

.webp&w=3840&q=75)