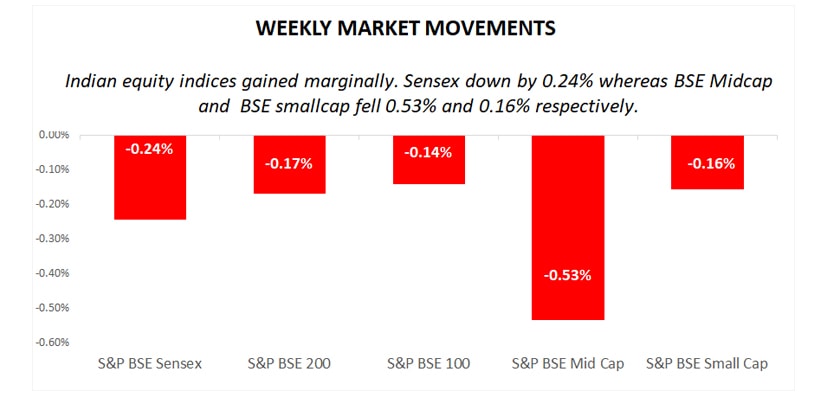

This week, all the major indices traded in red. Among the key indices, Sensex ended marginally lower and outperformed BSE Mid Cap but underperformed BSE Small Cap. Let’s find out what happened in the market last week.

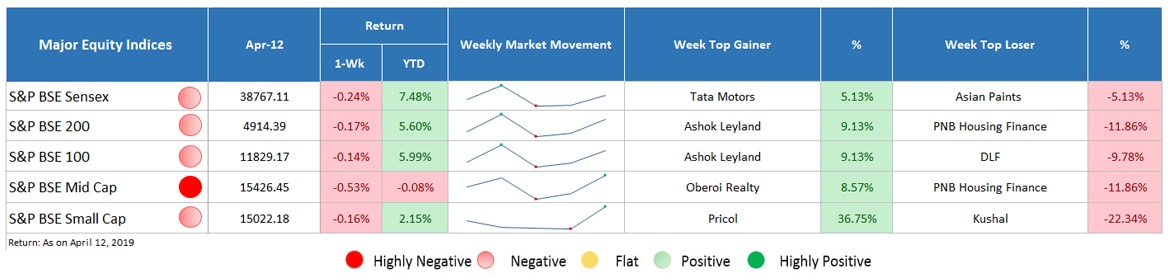

Major Equity Indices Performance

Last week, Sensex ended marginally lower by 0.24% outperformed S&P BSE Midcap fell 0.53% but underperformed S&P BSE Small Cap down by 0.16%. Other large-cap indices i.e. S&P BSE 200 and S&P BSE 100 were up equally by 0.31%.

During the week, institutional investors poured more capital into the Indian market. Foreign Institutional Investors (FIIs) remained net buyers and bought equities worth INR 4,345.83 crore whereas Domestic Institutional Investors (DIIs) offloaded their investment worth 883.74 crores in the Indian market.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Although, net inflow by institutional investors is a positive sign it could not help the market to close higher due to the impact of other factors. Evidencing it, last week, International Monetary Fund (IMF) downgraded the global economic growth outlook to 3.3% which is 0.2% lower. IMF reported that Brexit and US-China trade war are the key concerns for the global growth outlook. Despite this, on the global front, the US president’s threat to impose a tariff on European goods is a warning indicator for global growth.

Domestically, investors traded cautiously ahead of the corporate earnings season. On the other side, strength in the domestic currency managed to restrict losses.

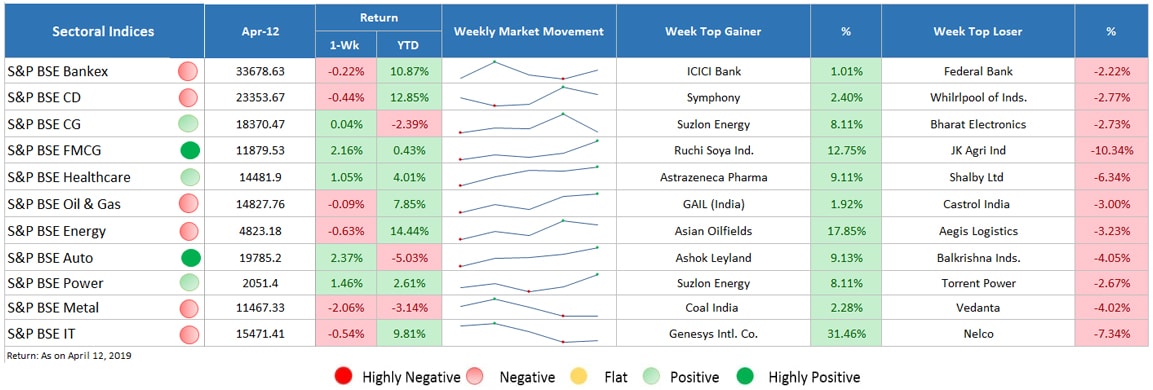

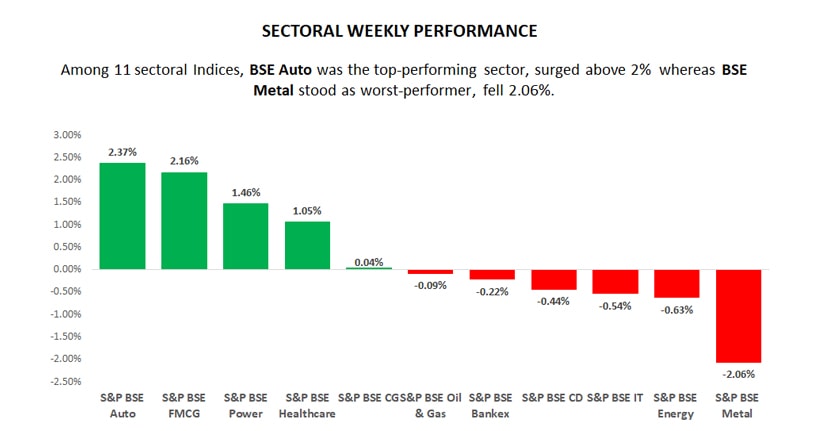

Sectoral Indices Performance

Gaining Sectors

Among 11 sectoral indices, 5 sectors traded in green.

- BSE Auto was the top-performing sector, grew 2.37% followed by BSE FMCG surged by 2.16%.

- BSE Power, Healthcare, and Capital goods ended marginally higher by 1.46%, 1.05%, and 0.04% respectively.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

Many sectoral indices traded in red, among 11 sectors, 6 sectors ended lower.

- BSE Metal which was the top performing sector last week become the top laggard, down by 2.06%.

- BSE Energy, IT, consumer durable, bankex, oil & gas were marginally lower by 0.63%, 0.54%, 0.44%, 0.22% and 0.09% respectively.

Summarising The Report

The equity market remained volatile throughout the week (8th April - 12th April) and supported few sectors to prosper while restricted others to deliver positive returns. The volatility prevailed due to multiple national and international factors although due to continuous inflow from Foreign Institutional Investors, the market remained balanced. Auto and FMCG sector impressed the most while the consistent banking and IT sector faced a slight downfall this week. The bullish trends of the last few weeks have been slowed down but are likely to continue as anticipated by the experts.