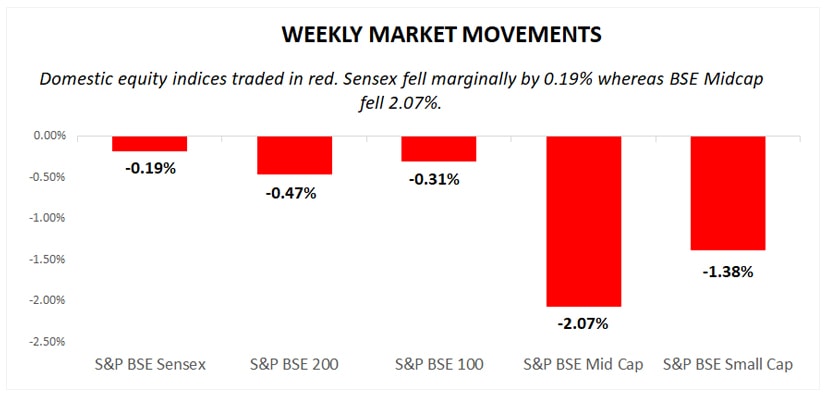

Indian equity indices traded on a negative note. Sensex ended marginally lower whereas broader equity indices were down by 2.07% and 1.38%.

Let’s find out in detail, what’s happened in the market last week.

Major Equity Indices Performance

Last week, Sensex traded marginally lower by 0.19%, however, broader indices BSE Midcap and BSE Smallcap were down by 2.07% and 1.38%, respectively. Other large cap indices i.e. S&P BSE 200 and S&P BSE 100 fell 0.47% and 0.31%.

During the week, mixed trends were witnessed in the institutional flow where Foreign Institutional Investors (FIIs) bought equities worth INR 4,525.49 crore, on the contrary side, Domestic Institutional Investors (DIIs) offloaded equities worth INR 3,675.97 crore.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Major contributing sector in Sensex such as banking and auto sector witnessed selling pressure whereas buying interest was seen in IT and energy sector that helps to restrict market losses. On the domestic front, investors were concerned over rising crude oil prices that rose up after the news that the US could further tighten sanctions against Iran. Apart from this, elections kept the market under pressure. Market loss remains restricted after the report from the International Energy Agency stating adequate oil supply in the market.

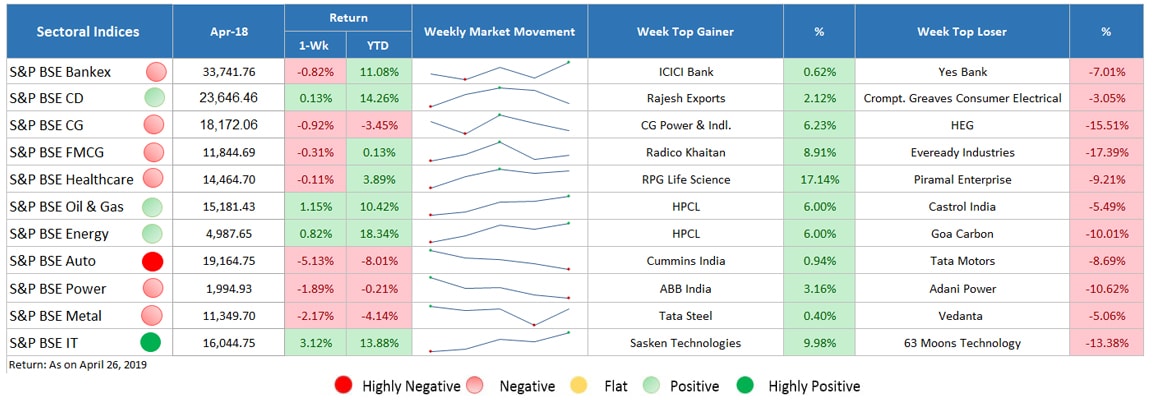

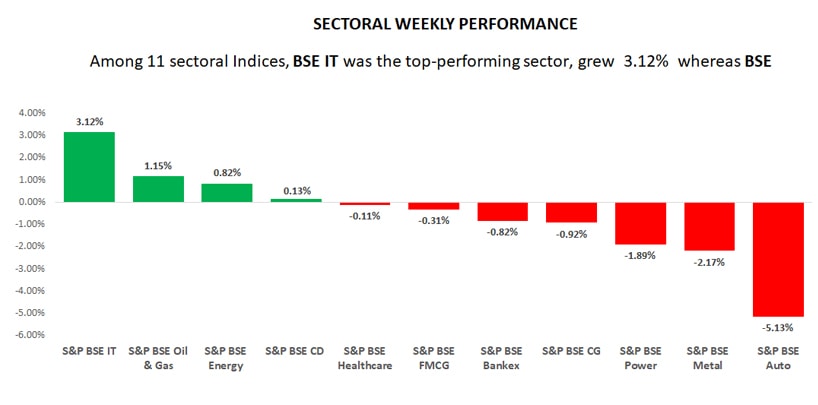

Sectoral Indices Performance

Gaining Sectors

Among 11 sectoral indices, 4 sectors advanced.

- BSE IT was the top-performing sector which grew 3.12% during the week. Strong quarterly results by IT giants i.e. TCS, Infosys and Wipro beating market expectations brought buying interest in the sector.

- BSE oil & gas and BSE energy gained marginally, rose by 1.15% and 0.82% respectively.

- BSE consumer durable sector traded almost flat, grew 0.13%.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

Among 11 sectoral indices, 7 sectors declined.

- BSE Auto was the worst performing sector, fell 5.13%. On the index, all the stocks except only Cummins India witnessed selling pressure. During the week, one of the auto stock, Hero Motor Corporation released its 4th quarter results and as per the reports, revenue fell 7.92% against the same quarter of last year. Profit fell 24.51% on YoY basis and operating margins stood at 13.6% against 16% in the same quarter of last year.

- BSE metal and BSE power sector traded marginally lower by 2.17% and 1.89% respectively.

- BSE capital goods, bankex, FMCG and healthcare sector faced slight downfall of 0.92%, 0.82%, 0.31% and 0.11% respectively.

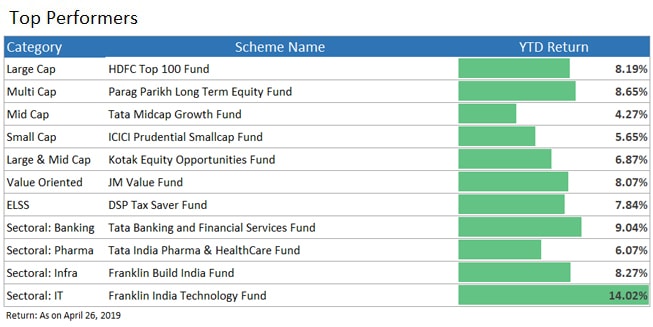

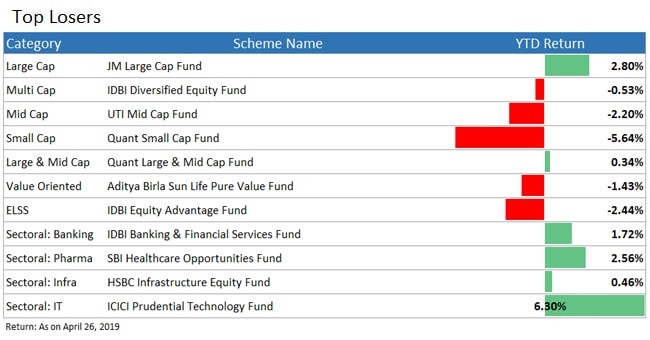

Top Performers & Losers

Summing-Up

The market showed volatile trends throughout the week where mid and small cap stocks faced major downsides. IT sector once again showed opposite trends and moved upwards along with oil & gas and energy sector. Other sectors including finance, metal, power, etc., faced negative trends while the automobile sector was the worst performer among all. The fluctuations in the market are expected to continue for a few more weeks before the results of the election while the international market can also increase the volatility in the Indian market in the coming weeks. To clear any query regarding market conditions and mutual funds, connect with our experts @ 9660032889.

- Ask Questions

- Give Answers

- Improve Knowledge

- Invest Wisely