Last week, political uncertainty finally ends as the election results were out where Modi Government won a majority. Investors welcomed the NDA’s return and poured money in the Indian market, because of which major equity indices traded in the green. Let’s find out in detail, what happened to the market last week.

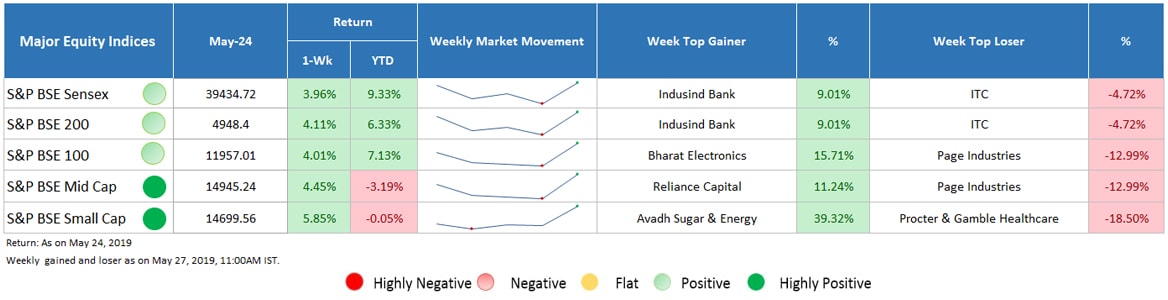

Major Equity Indices Performance

Return: As on May 24, 2019

Return: As on May 24, 2019

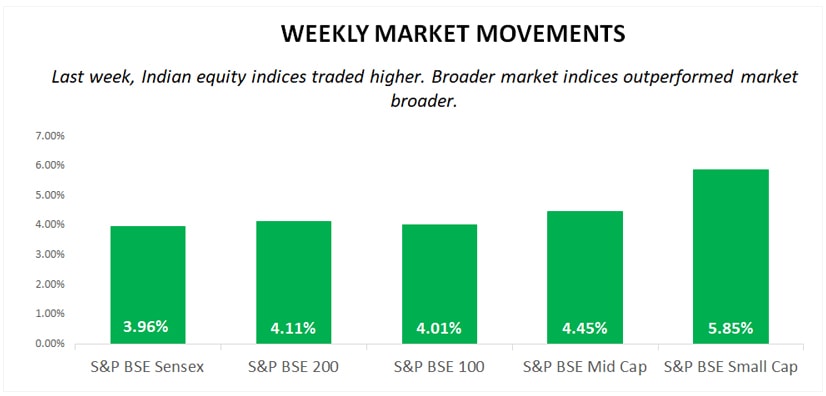

Last week, Sensex crossed 39000 mark and closed nearly 4% higher at 39,434.72. Broader equity indices BSE Midcap and BSE Smallcap rose 4.45% and 5.85%, respectively and outperformed market barometer. Other large cap indices; BSE 100 and BSE 200 also showed gains of 4% and above.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

On the domestic front, the election result was the key reason behind positive market sentiments. As results were in line with the expectations (BJP Government’s return) brought buying pressure and pushed the market higher. Positive sentiments were evident with the institutional inflows that showed reversal as FIIs became net buyers and DIIs remained net sellers. During the week, FIIs bought equities worth INR 5,333.40 crore and DIIs sold equities worth INR 2,579.67 crore. However, on the contrary side, profit booking by investors and rise in crude oil prices restricted market gains.

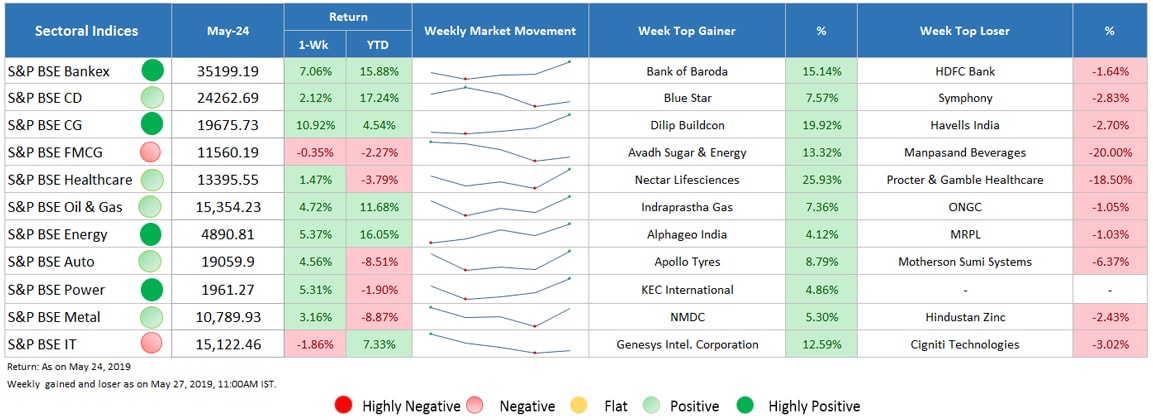

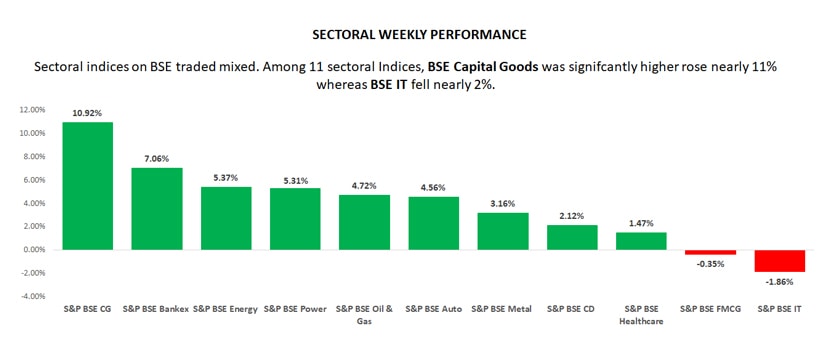

Sectoral Indices Performance

Gaining Sectors

Among 11 sectors, 9 sectors advanced.

- BSE capital goods sector lead the charts with 10.92% return. Return of Modi Government brought significant buying interest in the capital goods stock because according to the manifesto, government is planning to invest INR 100 trillion in the infrastructure in next 5 years that will benefit infrastructure, capital goods, and industrial sector.

- S&P BSE Bankex rose 7.06% on the account of expectation that economic reform policies will help banks to boost their asset quality, earnings, and loan growth.

- Other sectors including energy and power also gained above 5%. Further, oil & gas, auto, metal, consumer durable and healthcare advanced in the range of 1.47% to 4.72%.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

Among above listed 11 sectors, only 2 sectors declined.

- BSE IT sector plunged nearly 2% followed by BSE FMCG fell marginally by 0.35%.

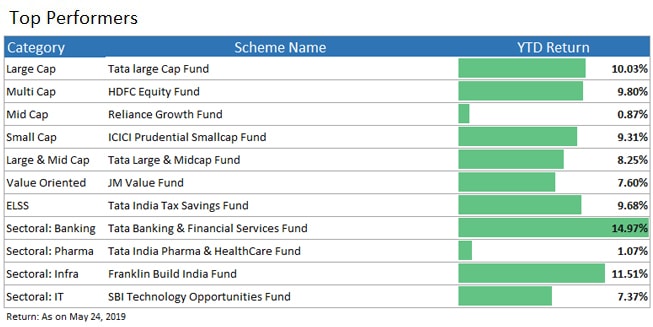

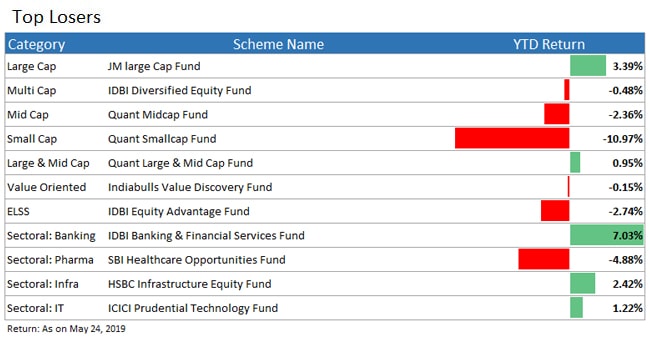

Top Performers & Losers

So, as you can see the market was quite active last week, and due to the lowering of political uncertainty positivity was observed in the market. In the coming sessions too, the market is expected to stay on the green side and good gains can be observed in your mutual funds. So, enjoy the returns and stay tuned with us for the next week's mutual funds and equity market update.

- Ask Questions

- Give Answers

- Improve Knowledge

- Invest Wisely