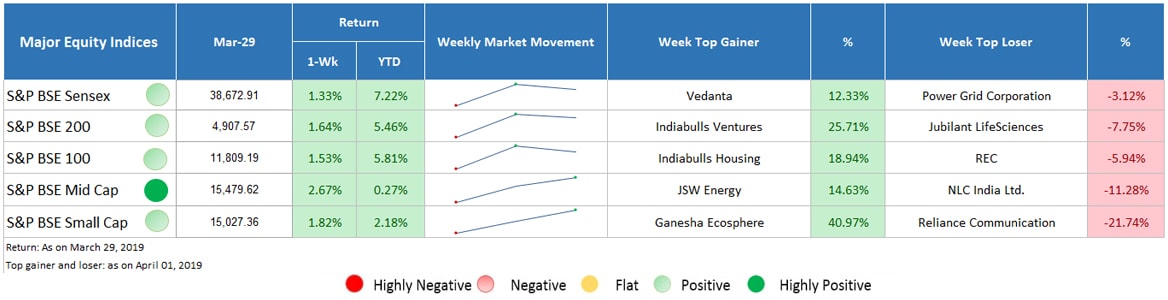

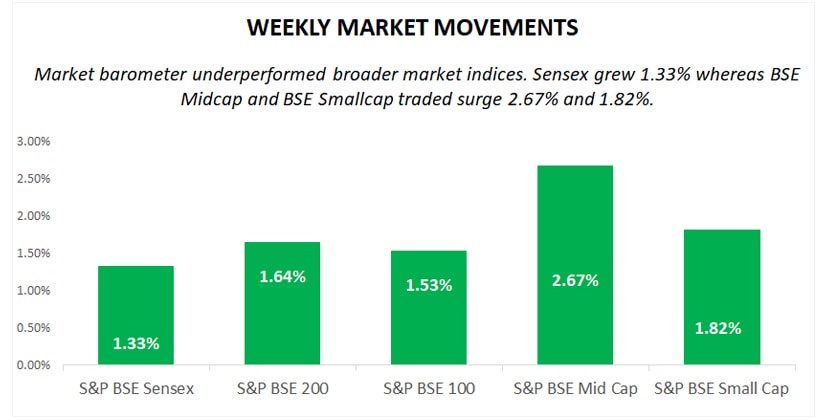

This week, all the major indices traded higher. Among key indices, BSE Midcap gained the most, surged 2.67% outperformed market barometer, Sensex gained 1.33%.

Major Equity Indices Performance

Sensex grew marginally by 1.33% underperformed broader indices where BSE Midcap and BSE Smallcap traded higher by 2.67% and 1.82%, respectively. BSE 200 and BSE 100 gained marginally, rose 1.64% and 1.53%, respectively.

This week again FIIs remain the net buyer and invested INR 6,138.83 crore worth of equities. During the month of March, the total FII investment were recorded at INR 32,371.43 crore, highest monthly inflow since last 12-years. However, on the contrary side, DIIs were the net sellers, offloaded equities worth INR 430.13 crore. Sustained FII flow on the account of hope that ruling party will come back to power affected sentiments favorably.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

On the domestic front, report suggesting that MPC may cut rates in the first bi-annually meeting of FY 2020 improved sentiments. Further, in the first round of forex swap instrument, RBI has injected liquidity of $5 billion into the banking system.

Despite this, release of Current Account Deficit (CAD) also weighed on indices. India’s CAD narrowed to 2.5% of GDP, which was 2.9% in the preceding quarter. However, on the other side, fiscal deficit widened, stood at INR 8.51 lakh crore for the period of April 2018 to February 2019, 134.2% of the estimated budget restricted gains.

On the global front, US-China resume trade talks, report suggesting that the meeting was very constructive between the two countries raised expectation of a resolution deal that will end the trade battle.

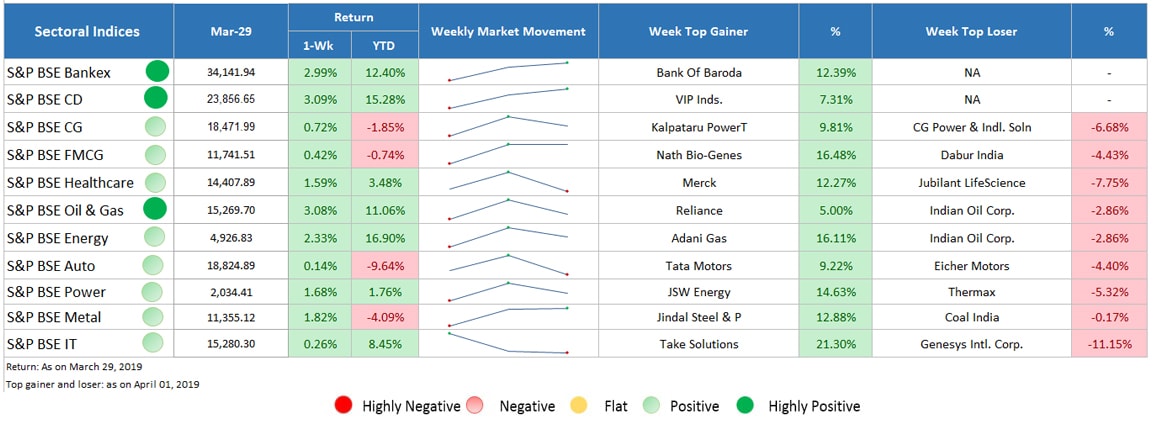

Sectoral Indices Performance

Gaining sectors

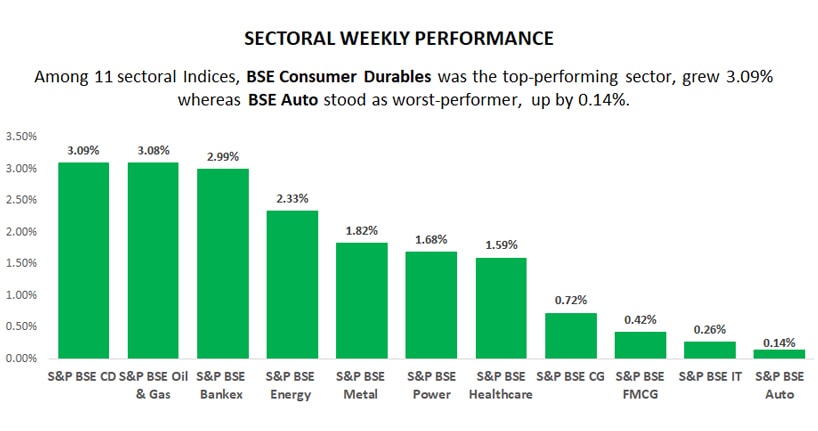

Among 11 sectoral indices, all traded higher.

- BSE Consumer Durable was the top-performing sector, grew 3.09% followed by BSE Oil & Gas, up by 3.08%. Crude oil price surged significantly in the quarter ended March 2019 on the account of OPEC’s production cut and US sanction on Iran and Venezuela.

- BSE Bankex gained 2.99% during the week. RBI has injected liquidity into the Indian banking system through Forex swap, upbeat sentiments.

- Other sectors including Energy, metal, power and healthcare traded marginally higher by 2.33%, 1.82%, 1.68%, 1.59% and 0.72% respectively.

- BSE capital goods, FMCG, IT and auto too managed to gain marginally by 0.72%, 0.42%, 0.26% and 0.14%, respectively.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

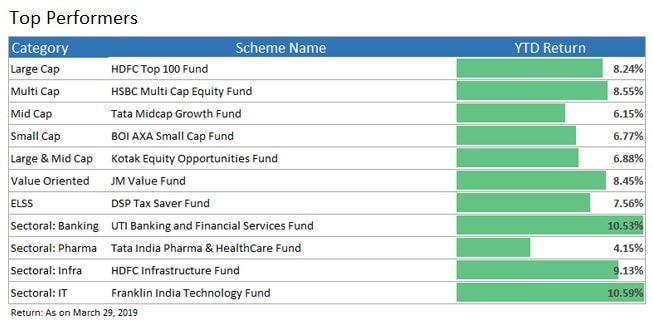

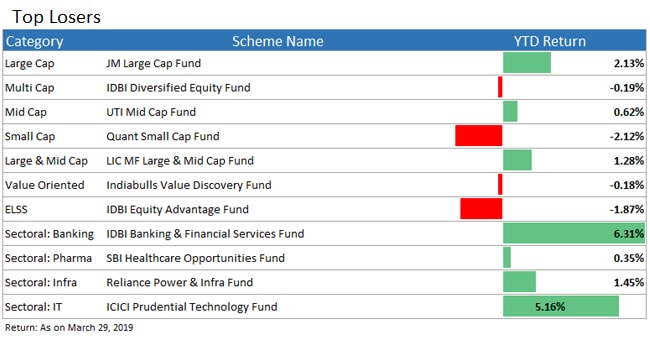

Top Performers & losers

Summing up all, the market continued to remain bullish with an uptrend graph. The equity indices showed consistent growth maintaining positive sentiments in the financial market. As per the current market trends, it is speculated that the market will remain incline towards growth in the upcoming quarter. Stay connected to know the next week market updates for investing wisely. For any further query related to the financial market, fill-in the form below so that our financial experts can assist you personally.