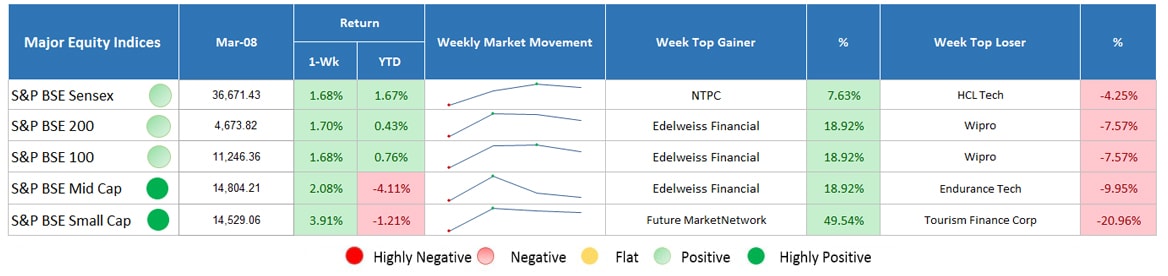

Major Equity Indices Performance

Indian Equity Market continuing with the streak showed positive growth for the third consecutive week. Sensex showed a good rise but underperformed broader market indices. Nikkei India Services Purchasing Managers Index also showed a good rise. Other factors that played a good role in the upside trend of the market are, a decline in crude oil prices and investment inflow by foreign institutional investors. On the contrary, side, lowered global growth projections somewhat restricted the gains. Read the weekly market update to know about other major happenings in the past week, which will help you in making informed decisions.

Return: As on March 08, 2019

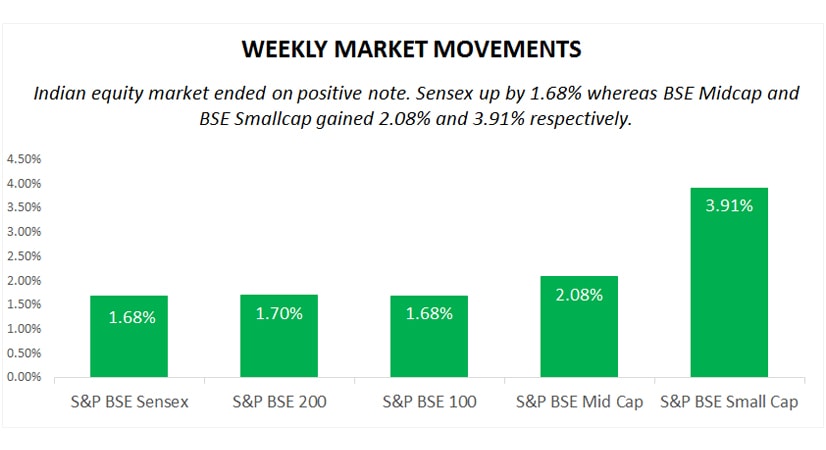

Last week, Sensex grew 1.68% underperformed broader market indices, while BSE Mid Cap and BSE Small Cap ended higher by 2.08% and 3.91%, respectively. BSE 200 and BSE 100 traded marginally higher by 1.70% and 1.68%, respectively.

In the beginning, the release of “Nikkei India Services Purchasing Managers Index” which was 52.2 in the earlier month, surged to 52.5 in February 2019, due to upbeat sentiments. The growth is mainly driven by rising output and solid job creation. Later, despite mixed global cues, the market ended higher due to optimism over US-China trade war. Metal stocks witnessed buying pressure after Chinese government’s report stated that necessary measures will be taken to foster domestic consumption in the economy. Further, crude oil prices declined following the rise in US crude inventory and bullish output projection by two US producers, Chevron Corp, and Exxon Mobile Corp. In addition to these, strengthened rupee also added gains.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Looking at institutional investors, FIIs were the net buyers during all the trading sessions whereas DIIs remained net sellers. During the week, FIIs bought equities worth INR 4,115.61 crore whereas DIIs offloaded net equities worth INR 1,693.70 crore.

However, on the other side, lowered global growth projection restricted market gains. During the week, China lowered its targeted GDP growth rate for 2019 to 6%-6.5% on the account of the slowing global economy and trade war with the US. OECD cut its global growth projections for 2019 and 2020 marred sentiments and restricted gains.

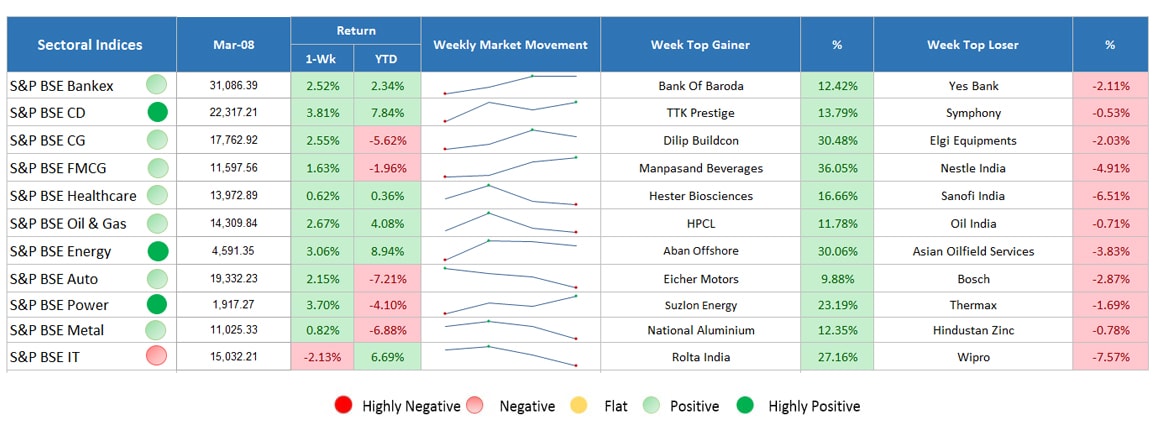

Sectoral Indices Performance

Return: As on March 08, 2019

Gaining sectors

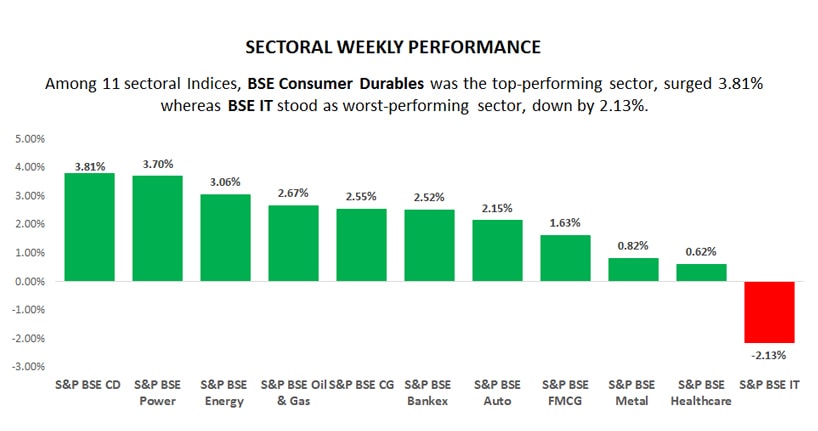

Among the 11 above listed sectors on BSE, barring IT, all the sectors traded positively.

BSE consumer durable was the top-performing sector, surged 3.81%. Buying pressure in its constituents such as Symphony, TTK Prestige, Whirlpool, Blue Star, Crompton Greaves Consumer Electrical and others added gains to the sectoral index.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

BSE power advanced by 3.70% followed by BSE energy and BSE oil & gas advanced 3.06% and 2.67%. A decline in crude oil prices after a reported rise in US crude inventory and rising output expectation by the two US producers added gains to these sectors.

Other sectors including capital goods, bankex, auto, FMCG, metal and healthcare advanced marginally by 2.55%, 2.52%, 2.15%, 1.63%, 0.82% and 0.62%, respectively.

Losing Sectors

During the week, the IT sector witnessed selling pressure, henceforth, traded in red, showing a fall of 2.13%.

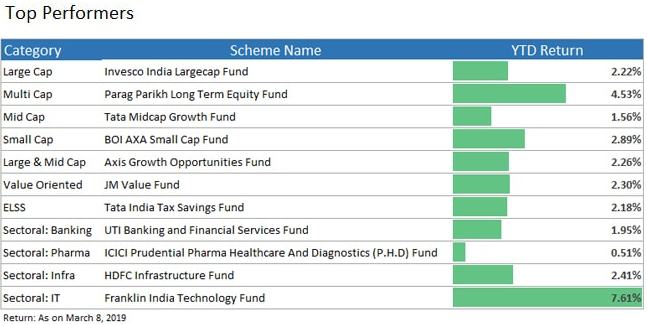

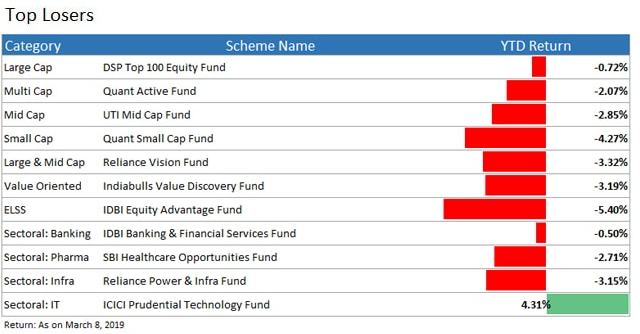

Top Performers & Losers:

Finally

Overall, the market showed a good performance and almost all the equity indices showed good growth. Looking at the current market conditions and positive sentiments in the market, the same can be expected in the coming sessions. Stay tuned for the next market update, to keep up with the market and to make informed decisions. If you have any query, feel free to connect with the experts, or you can also fill out the form provided below.