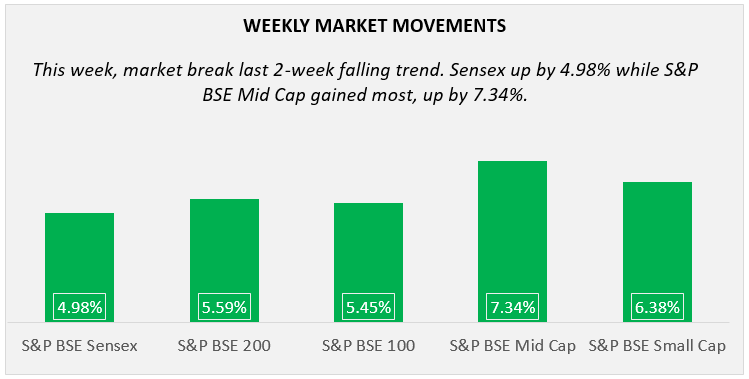

This week, the market has broken past two weeks’ continued losing streak and ended in gains. S&P BSE Midcap which was the worst hit earlier week gained the most surged by 7.34%. S&P BSE Smallcap was up by 6.38% while Sensex gained 4.98%.

Table of Content

Major Equity Indices Performance

.png)

Last week, the market traded in profits. Sensex rose by 4.98% underperformed the broader market indices; S&P BSE Midcap and S&P BSE Smallcap surged by 7.34% and 6.38%, respectively. S&P BSE 200 and S&P BSE 100 was up by 5.59% and 5.45% during the week.

On Monday, the large cap indices traded in the loss while S&P BSE mid-cap and S&P BSE small cap traded in gains throughout the week. On the domestic front, there were many reasons behind such favorable movements witnessed in the market. Manufacturing Purchasing Managers Index data release for the month of October grew at its quickest pace since last 4 month. It reflects higher production due to more order inflows. Despite this, RBI's decision to buy the government bonds worth Rs. 400 billion via open market operations supported sentiments due to ease over liquidity fears. On the contrary side, RBI and government rift deepened due to the intervention of the government over RBI’s autonomy. Furthermore, buying in banking, auto and consumer durable stocks added to the gains. On the global front, investors’ sentiments turned positive on the US-China trade deal.

Sectoral Indices Performance

_5be5139933ec1.png)

Gaining Sectors

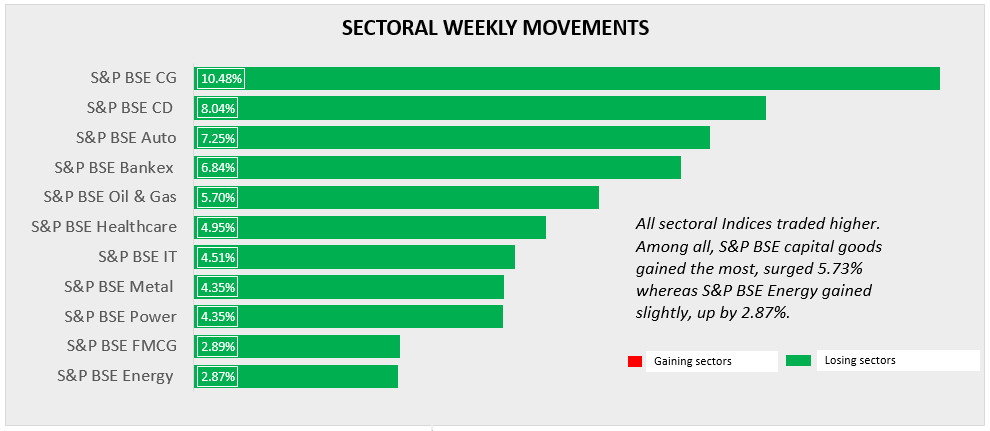

All sectoral indices traded in profits, among all S&P BSE Capital Goods was the top performer, surged by 10.48% during the week. Baring capital goods, buying pressure has been seen in consumer durables, auto, and banking stocks, their respective sectoral indices traded higher by 8.04%, 7.25%, and 6.84%, respectively. Other sectors including oil & gas, healthcare, IT, metal, power, FMCG, and Energy traded marginally higher.

Losing Sectors

None of the sectors were traded in red during the week.

Top Performers

_5be5140978b49.png)

Top Losers

_5be5143d6add7.png)

Conclusion

The week before Diwali brought in great joy for investors, leading several sectors to trade in green. Experts have even declared that it might be a signal to experience a new high in 2018 but the chances of those are still slim. Although the market is under water, it has improved a lot from the past weeks. With the blessings of Goddess Laxmi, it can be expected that you will be able to accrue great returns in the coming years. For that, we, at MySIPonline, urge all our followers to start an SIP investment now instead of buying expensive things on EMI. For the recommendation on the best funds to invest in 2018 and other mutual funds related information, connect with our experts of MySIPonline via email ( support@mysiponline.com) or phone call (+91-9660032889).

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure