Last week, the market ended in the red. The continuous increase in crude oil price to its 4-year highest coupled with rupee’s persistent fall to all-time low were the reasons. Despite this, oil & gas stocks pulled the market lower after the announcement by the finance minister to cut excise duty on fuel along with the decision to absorb Rs. 1/litre from the oil marketing companies. In addition, selling pressure in auto, energy, and healthcare were the reasons behind substantial fall.

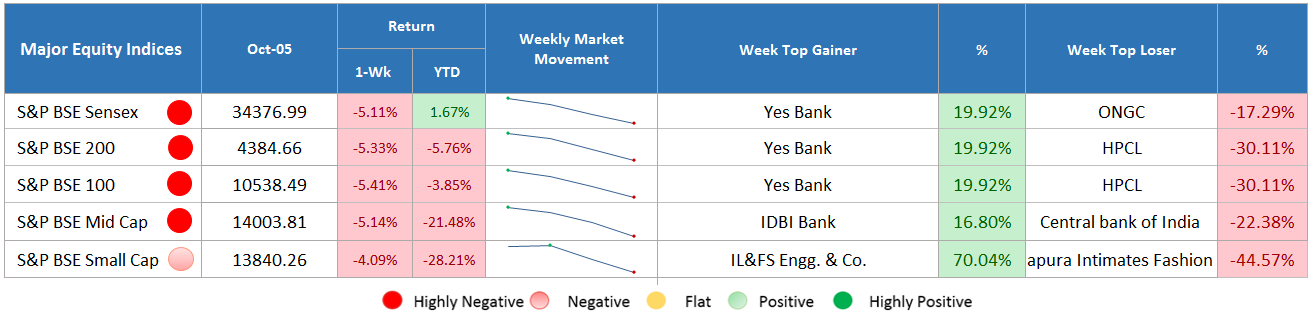

Major Equity Indices Performance

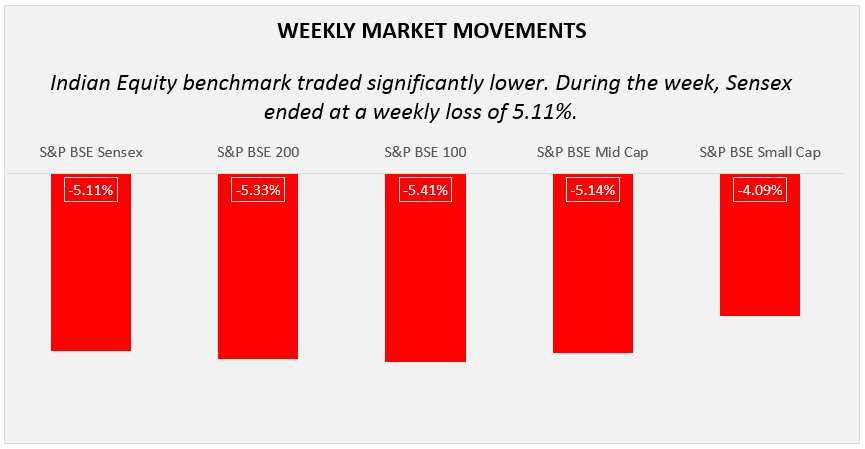

On October 05, 2018, Sensex registered a weekly loss of 5.11% by closing at 34376.99. S&P BSE 200 and S&P BSE 100 traded down by 5.33% and 5.41%. S&P BSE Midcap fell 5.14%, whereas S&P BSE Smallcap plunged down by 4.09%.

On Monday, the market traded on a positive note as investors’ sentiments were favored by RBI’s decision to ease the liquidity fears and upbeat manufacturing data as well. However, on Wednesday, rupee’s fall to its all-time low due to rising crude oil prices pulled the market lower. Despite this, investors also remained cautious ahead of fourth bi-monthly MPC’s decision.

Additionally, some auto majors posted fall in vehicle sales in the month of September, 2018. On the day, S&P BSE Auto stood as the top loser, fell 2.90%. Next day, Sensex witnessed significant fall since last 8 months by closing at 35,169.16, 806.47 points down against the previous closing. Sentiments were largely affected due to crude oil prices that reached to 4-year high at $86/barrel resultant rupee fell to its fresh low. It dampened sentiments due to the concerns over widening fiscal deficit and inflationary pressure.

Further, investors expect rate hike by the US Fed Reserve which raised concerns over foreign capital outflow. Despite this, Finance Minister, Arun Jaitley cut Rs. 1.50 excise duty on fuel while urged oil-marketing companies to absorb Rs. 1. As a result, oil & gas stocks traded in loss because of negative impact on the oil marketing companies earnings because they have to cut Rs. 1/litre which will affect their margins.

Last day, again, Sensex closed 792 points down at a closing value of 34376.99. Investors who were expecting 25 basis points hike to control inflation got surprised by the RBI’s decision to hold interest rates at the current level. Although interest rates have not been changed, RBI changed its stance from neutral to calibrated tightening in-line with the target to achieve medium-term CPI target of 4%.

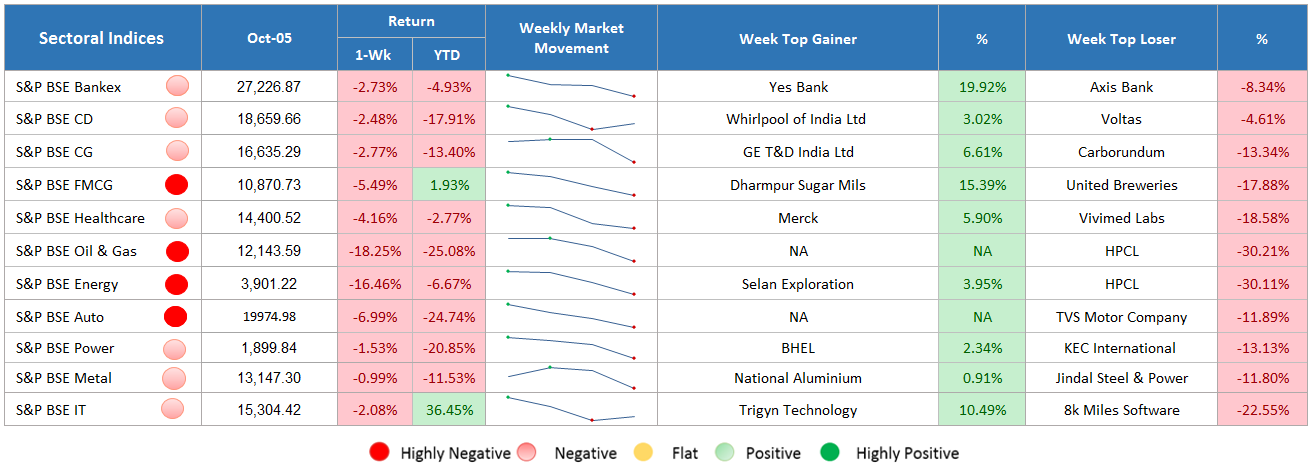

Sectoral Indices Performance

Gaining Sectors

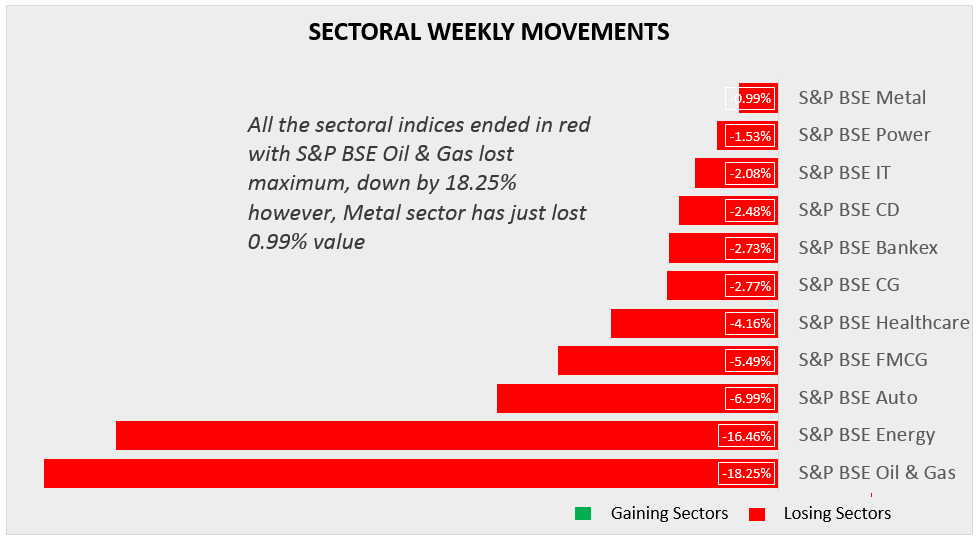

None of the sectors were traded in green in the last week.

Losing Sectors

All the sectoral indices on BSE ended in red, among all, S&P BSE Oil & Gas remains the top laggard which fell by 18.25%. It is because the finance minister cut fuel cost and announced to absorb Rs. 1 cut from the oil market companies. The energy fell 16.46%, S&P BSE Auto traded down by 6.99%, S&P BSE Healthcare lost 4.16%, and S&P BSE Capital Goods traded in loss of 2.77%. In the auto sector, the loss has been reported on account of fall in passenger car sales due to unfavorable macroeconomic conditions and erratic rainfall and floods in Kerala. Other sectors including consumer durables, IT, power, and metal traded in red at a weekly loss of 2.48%, 2.08%, 1.53%, and 0.99%, respectively.

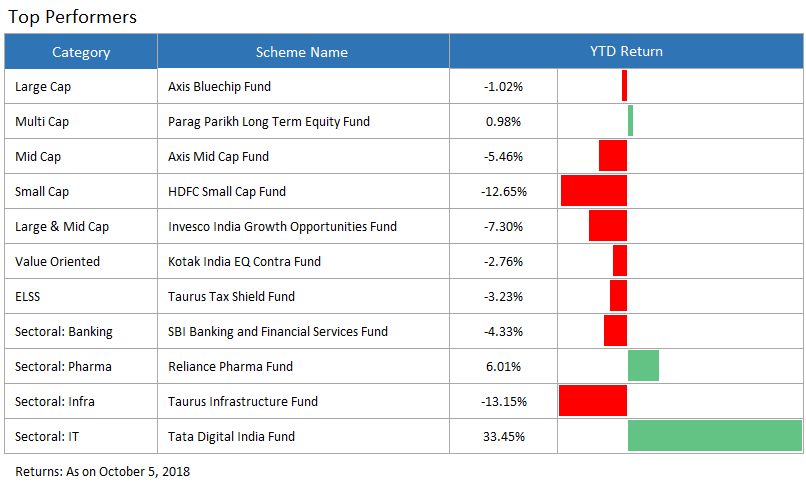

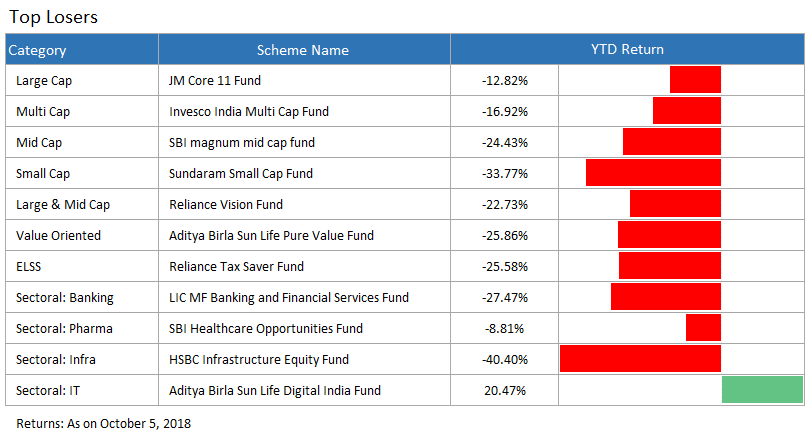

Top Performers & Losers

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

The Final Take

Seeing the bloodbath in the market, we understand if the fear of losing your money has returned in you. However, if you wish to overcome this storm of the market wisely, then staying calm is the best solution. Volatility is inherent to equities, thus predicting the market is practically an impossible task. When you invest through mutual funds, particularly SIP, you need not to time the market. All you can do is keep track of portfolio beta and adjust it to a low beta or high beta by simply shifting weights as and when the situation warrants.

To seek guidance in this context, consult the financial experts available at MySIPonline. You can simply drop your query to us by filling in the details in the form provided below.