During the week, the market traded lower ahead of the rupee fall, another round of the US tariff on Chinese import worth $200 billion and selling pressure in banking and finance sector after credit rating downgrade. Sensex fell 3.28% after sharp sell-off witnessed during the Friday’s trading session. S&P BSE Midcap and S&P BSE Small Cap Plunged 4.61% and 5.45% respectively.

Table of Content

Major Equity Indices Performance

This week, the market witnessed a sharp downfall. Sensex fell 3.28% while the broader Indices S&P BSE 200 and S&P BSE 100 were down by 3.62% and 3.38%, resp. S&P BSE Midcap and S&P BSE Small Cap heavily down by 4.61% and 5.45%, respectively.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

On Monday, Trump’s decision to levy the tariff on additional Chinese import worth $200 billion dented the investors’ sentiments. Later, the banking stocks witnessed a huge sell-off after the announcement of the proposed amalgamation of three banks; Dena Bank, Vijaya Bank, and Bank of Baroda. Besides this, the continuous fall in rupee due to rising crude oil prices dragged the market down. Although, later, the rupee recovered to some extent due to the possibility of the Government intervention to prevent currency fall.

On Friday, a sharp sell-off has been seen in the market where during the intraday trade, the Sensex plunged down by 1100 points largely driven by heavy sell-offs in the Banking and Financial sectors. It is mainly because of the credit rating downgrade of IL&FS due to possible liquidity crunch. Such a rating downgrade leads to the possibility of high borrowing cost for NBFCs to repay their financial obligations. In addition, RBI directed Yes Bank’s managing director and CEO, Rana Kapoor to step down. Yes Bank was the top loser on Sensex, traded down by 27.79%. During Friday’s trading session, Dewan Housing crashed nearly 60% on account of massive selling pressure and hit 52-week low to Rs. 246.25.

Sectoral Indices Performance

Gaining Sectors

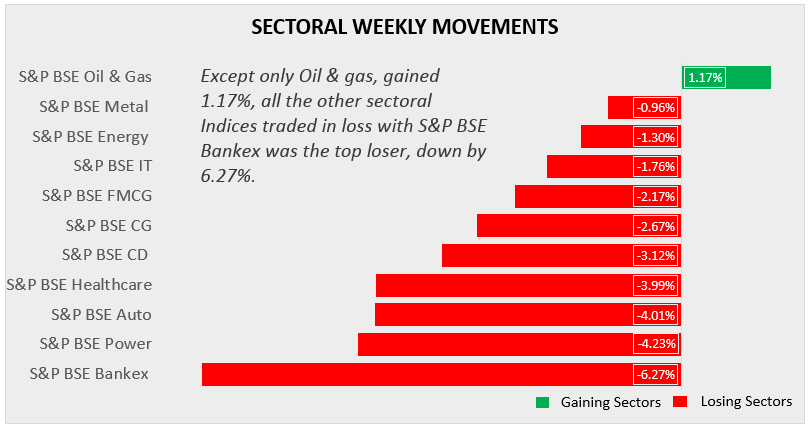

During the week, only S&P BSE Oil & Gas traded in green, up by 1.17%. BPCL was the top performer on the indices which gained 12.22%, whereas Indraprastha gas plunged 6.91%.

Losing Sectors

Barring Oil & Gas, all the other sectoral indices ended in the red. S&P BSE Bankex remains the top loser, down by 6.27% driven by heavy sell-offs. Following Bankex; Power, Auto and Healthcare traded at a weekly loss of 4.23%, 4.01% and 3.99% respectively. Sell-offs in consumer durables, capital goods, IT, FMCG, Energy and Metal brought sectoral indices down by 3.12%, 2.67%, 1.76%, 2.17%, 1.30% and 0.96% respectively.

Top Performers & Losers

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Conclusion

The turbulence seen in the past week, especially during the last day, i.e., on Friday dampened the investors’ sentiments greatly. Even though there is no major change in the macroeconomic conditions, when a sell-off occurs, it is very hard to predict the outcomes. Experts believe that such corrections can be seen in the future as well as still the market seems to be overvalued. This brings in a good opportunity for investors who are willing to invest for a long-term. To seek a recommendation from our experts on the best SIP plans to invest in now, connect with MySIPonline.