For the last four weeks, the equity market is on a rally. The initial days of the week were remunerative but the growth slowed down as the week approached the end. The trends in the last few weeks have been gainful for the investors however, this week, trends were assorted where market barometer Sensex traded marginally higher while broader indices traded in the red. Let’s find out what happened in the market last week.

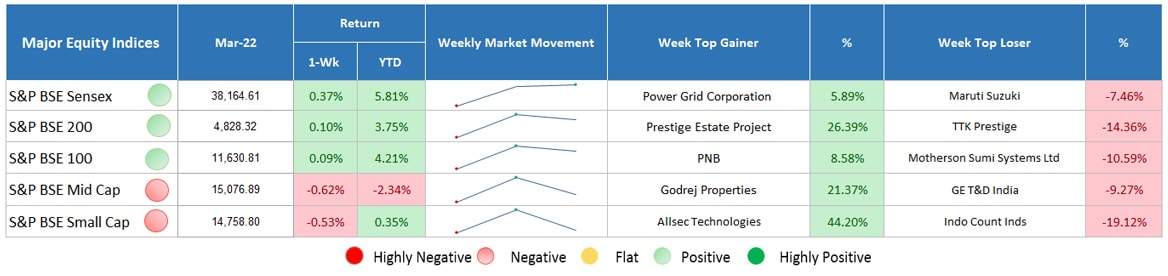

Major Equity Indices Performance

Return: As on March 22, 2019

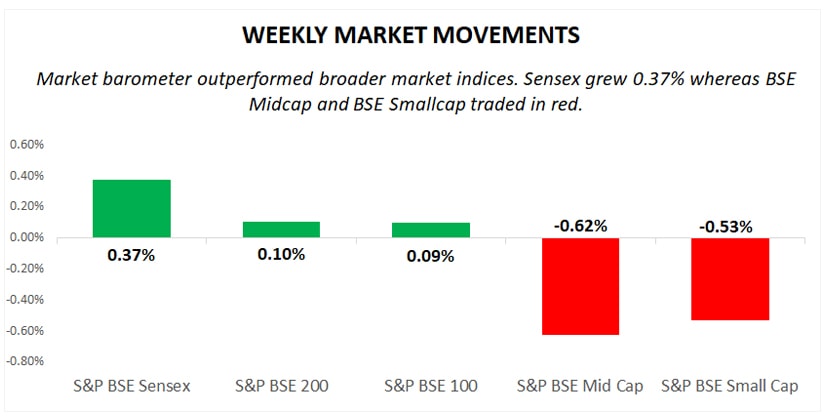

Sensex grew marginally by 0.37% and outperformed broader indices where BSE Midcap and BSE Smallcap were down by 0.62% and 0.53%, respectively. BSE 200 and BSE 100 were almost flat with a rise of 0.10% and 0.09%, respectively. During the week, the market touched six-month high on account of the expectation of stable government of the ruling party.

This week again FIIs continued to put more capital in the Indian market whereas DIIs again remained net sellers. Evidencing it, FIIs bought equities worth INR 7,101.53 crore whereas, on the contrary side, DIIs offloaded equities worth INR 4521.12 crore. Continuous buying from FIIs positively affected investors sentiments.

On the global front, US Federal meeting was the key area of investors’ focus. In the meeting, the US Federal Reserve kept the rate unchanged. Moreover, Jerome Powell (Chair of Federal Reserve) said that considering slower economic growth, Federal Reserve expects no rate hike for the rest of 2019. After Federal Reserve’s decision, investors are expecting a rate cut by RBI in the next meeting.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Besides this, Brexit has been extended by two weeks dated 12th April. During the extended period, Mrs Theresa May still has an option available to present a deal. Apart from this, initially, a global report suggesting trade talk progress between the US and China upbeat sentiments, however, in the later trading sessions gains were eroded due to re-emerged trade worries between the two countries. Sentiments also felt hurt after a major global rating agency, Fitch cuts India’s GDP growth forecast for FY 2020 to 6.8% against the previous estimate of 7%.

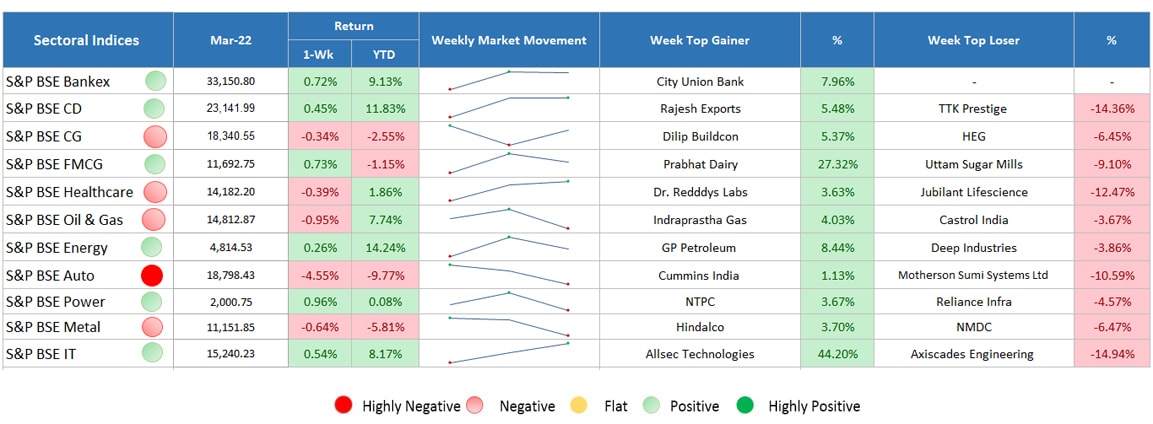

Sectoral Indices Performance

Return: As on March 22, 2019

Gaining sectors

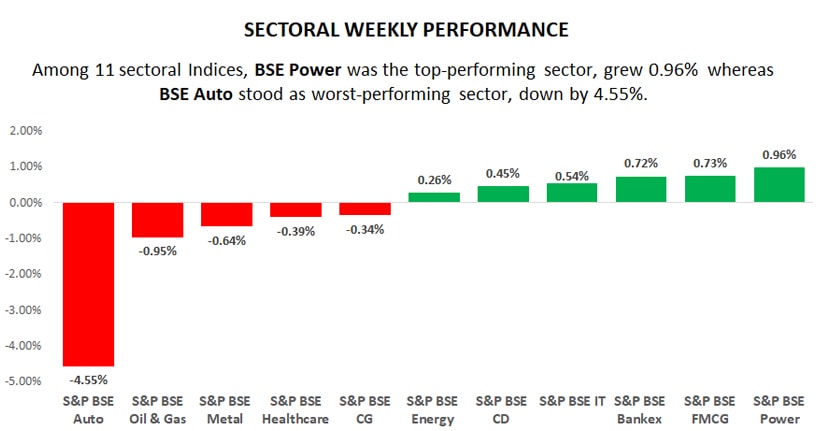

Sectoral indices traded on a mixed note where among 11 above-listed sectors on BSE, 6 advanced.

- BSE Power was the top-performing sector, grew 0.96%.

- BSE FMCG, Bankex, IT, consumer durable and energy sectors also traded marginally higher with weekly gains of 0.73%, 0.72%, 0.54%, 0.45% and 0.26% respectively.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

- BSE Auto stood as a top laggard, down by 4.55%.

- BSE Oil & Gas declined by 0.95%.

- Other sectors including BSE metal, healthcare and capital goods traded marginally lower by 0.64%, 0.39% and 0.34% respectively.

Wrap-up

The rally of the market has been slowing down in the recent trading sessions which have put resistance to constant growth in the indices for the last four weeks. Mixed results are likely to be expected in the upcoming trading sessions. The auto sector was the major shocker while IT, bank and Power stocks continued the momentum. Market barometer SENSEX remained positive for the week despite slowed down growth in the latter days. The trading sessions in the next few weeks can be surprising and investors are keeping a close eye on the market as the election approaches. To stay updated with the latest happenings of the market, stay tuned with MySIPonline.