Table of Contents

- Buy more units at low cost.

- For better capital appreciation in the future.

- Get the benefit of rupee-cost averaging.

- Can start with small investments.

With the high volatility in the market, mutual funds’ biggest sale of the year is on. As the Sensex is going down each day, more than 70% of the equity funds have already dropped their NAVs. Such blips are always good news for smart investors who believe in purchasing more number of mutual fund units and maximizing their returns in the long run.

Keeping all this in mind, we are disclosing once-in-a-lifetime opportunity for all the investors reading this blog! Well, here’s the mutual funds’ big billion season sale!

You all must be on a shopping spree seeing the big discounts and savings in the popular brands this festive season on almost all of the e-commerce sites. But have you wondered, are you shopping right? Do you really need the products you are going to purchase in the sale? We apologize to start the moral science lecture again, however, it’s time you must understand the true difference between savings and investments.

“A few bucks on the product you hardly need isn’t saving, making the most of the market downfall and investing the amount in a mutual fund is.”

The motive is not to refrain oneself from getting new clothes, accessories, etc., but to save a small amount and invest it in mutual funds to seek benefit from the market dip.

Big Sale, Big Offers: The Best Mutual Fund Deals

The market is volatile, and it’s expected to stay the same due to too many uncertainties hovering in the horizon, increasing oil prices, turmoil in the banking and financial sector, upcoming elections, to name a few. It has tanked by around 4500 points, and this has certainly hurt the investors’ sentiments. However, you don’t have to worry much because if you’ve chosen your mutual fund schemes based on your investment goal, risk appetite, and horizon, then you can continue your investment to accrue long-term benefits. Further, it’s the time to purchase more and seek the maximum profit from mutual fund sale.

What’s the Big Sale?

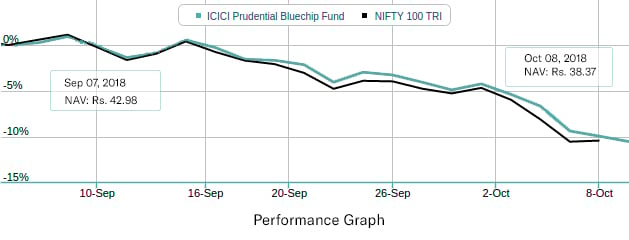

Remember, this market downfall is your chance to buy stocks cheap. Let’s understand this with the help of the performance graph of a popular equity mutual fund scheme, i.e., ICICI Prudential Bluechip Fund.

The NAV of ICICI Prudential Bluechip Fund was Rs. 42.98 as on September 07, 2018, and the value has dropped to Rs. 38.37 as on Oct 08, 2018. This has shown a dip of around 10.7%. This is just one case. The point of quoting it is that if you invest in the dip now, you will be buying units at 10.7% times lower than what you would’ve purchased in the previous month. As the equity market has the tendency to change cycles, you will be making more profits as the NAV goes up.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Expert’s Take

Start a SIP and invest regularly irrespective of the market conditions. Going with the view of experts, when it comes to investing, one can never tell which is the best investment plan for a specific time. The best way to do it is pick a scheme that is diversified, available at low cost, and has a good track record. The current time is where all the three conditions are met. So, it’s a big sale going on. When are you making your purchase?

Here’s What You Should Do

The dip in the market is a golden time for all investors, only if you know where to invest. But let’s first discuss what all should you do.

- Never stop any of your investments out of panic, instead buy more mutual fund units and maximise returns over a long period.

- If you are investing regularly via SIP, consult an expert and increase your SIP investment to buy more units when the market is down, and this way you multiply your growth for the period when the market will rise again.

- For all new investors, it’s time to treat your portfolio cautiously and make any new investment in the guidance of an expert. Besides, avoid making hasty decisions or investments in quick money-making schemes.

- If you are sitting on idle cash that you don’t need for the next five to seven years, invest it in an equity scheme that matches your risk profile.

- Avoid value hunting if you’re not wise enough to do that. You can take help of an expert if you truly want to make a value investment.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Products That You Must Buy Now

| Scheme Name | Category | AUM (As on Aug 31, 2018) | Returns (As on 05 Oct, 2018) | ||

|---|---|---|---|---|---|

| 1 Year | 3 Years | 5 Years | |||

| ICICI Prudential Bluechip Fund | Large Cap | Rs. 19,836 crore | 2.63% | 10.33% | 15.43% |

| Kotak Emerging Equity Scheme | Mid Cap | Rs. 3,453 crore | -8.87% | 8.71% | 25.40% |

| Mirae Asset India Equity Fund | Multi Cap | Rs. 9,049 crore | 0.82% | 11.33% | 19.87% |

| Mirae Asset Emerging Bluechip Fund | Large & Midcap | Rs. 6,120 crore | -4.91% | 13.74% | 28.95% |

| HDFC Small Cap Fund | Small Cap | Rs. 5,111 crore | 4.19% | 15.76% | 21.33% |

To know more about these schemes, connect with our experts now and they will help you pick the best product according to your needs and investment goal. You can even mention your query from right here by filling in the form mentioned below.

Must Read: