Table of Contents

Motilal Oswal fund house has launched the Motilal Oswal Manufacturing Fund, which invests in companies across different manufacturing sectors. This fund aims to take advantage of India's "Make in India" initiative and the shift in global supply chains, like the China + 1 strategy.

This new NFO presents an opportunity to invest in India's booming manufacturing and infrastructure sectors. The Motilal Oswal manufacturing fund NFO is special for two key reasons.

First, it focuses on the manufacturing industry, which is expected to experience immense growth in the next 5-10 years, presenting the best opportunity for investment.

The second one is Motilal Oswal Mutual Fund has a strong track record of performance across various fund categories, and their recent NFOs have been quite successful.

The fund will be open for investment from July 19 to August 2, 2024, with a focus on growth opportunities in India's manufacturing industry. This blog will provide a detailed analysis of the dedicated manufacturing fund to assess its potential for success and wealth creation for investors.

Invest Now With SIP and Grab the Rewards of Motilal Oswal Manufacturing Fund

Why Manufacturing is Trending Sector?

First, we need to understand why the Manufacturing Sector is projected to be the fastest-growing theme in India over the next 5-10 years. This sector includes various industries and offers numerous investment opportunities.

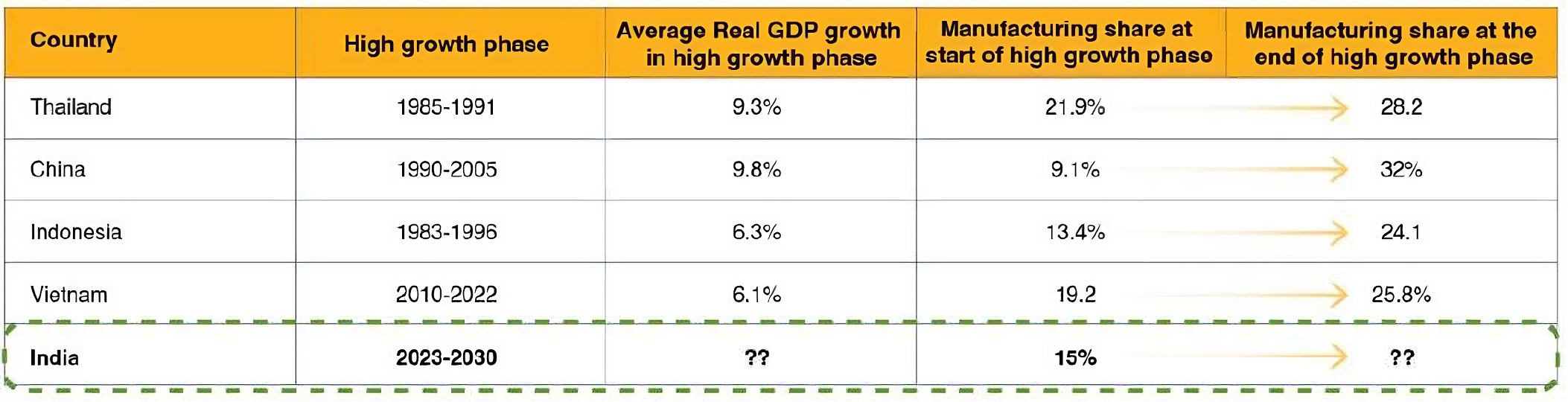

Countries with rapid economic development, particularly capitalist economies, have historically experienced significant growth in the share of manufacturing in their GDP. This trend has been observed in ASEAN countries like Vietnam, Indonesia, and China.

Notably, China's manufacturing share grew from 9.1% of GDP in 1990 to 32% in 2005, contributing to its rapid economic expansion. Several key demographic changes have been instrumental in driving manufacturing growth in countries. India has witnessed these changes over the last 5-7 years:

- Per capita income has increased, leading to a rise in domestic consumption.

- The young working population in India has grown significantly, accompanied by an increase in workforce participation.

- Logistics and supply chain infrastructure has been strengthened through reforms, including improvements in road transportation, railway logistics, and port infrastructure, thereby reducing costs and enhancing efficiency.

- Global manufacturing is seeking to diversify and reduce its dependence on China and Europe. India stands to benefit from this trend, particularly in electronics, mobile technology, batteries, semiconductor chips, and specialty chemicals.

- The government has implemented various reforms to promote manufacturing, such as the successful Production-Linked Incentive (PLI) scheme under the Make in India initiative, which provides subsidies to large corporations for increasing production.

Top Sectors in Manufacturing Theme

Now let’s understand in which sectors & industries growth & investment opportunity is available.

| Sectors | CAGR |

|---|---|

| Chemical | 19-20% |

| Pharma | 16-18% |

| Capital Goods | 18-20% |

| Electrical and Electronics | 35-40% |

| Automobile | 15-18% |

- The chemical sector is expected to see a robust 19-23% CAGR, driven by rising demand for specialty chemicals and petrochemicals, as well as the expansion of final-use industries.

- The pharmaceutical sector is another bright spot, with an anticipated CAGR of 16-18%, fuelled by growing healthcare awareness, an aging population, and advancements in drug discovery and manufacturing.

- Capital goods and industrial machinery are projected to grow at 18-20% CAGR, supported by increased investments in infrastructure, manufacturing automation, and equipment modernization.

- The electrical and electronics sector is poised for even stronger growth, with a 35-40% CAGR, attributed to the rising demand for consumer electronics, smart technologies, and renewable energy infrastructure.

- The automobile sector is expected to grow at a healthy 15-18% CAGR, driven by factors like increasing vehicle sales, the shift towards electric and hybrid vehicles, and advancements in automotive technology.

- There are promising investment opportunities in emerging sectors like semiconductors, electric vehicle batteries, solar, and wind power. Global trends toward technology-driven and sustainable production will be advantageous to these sectors.

Investing Strategy of Motilal Oswal Manufacturing Fund

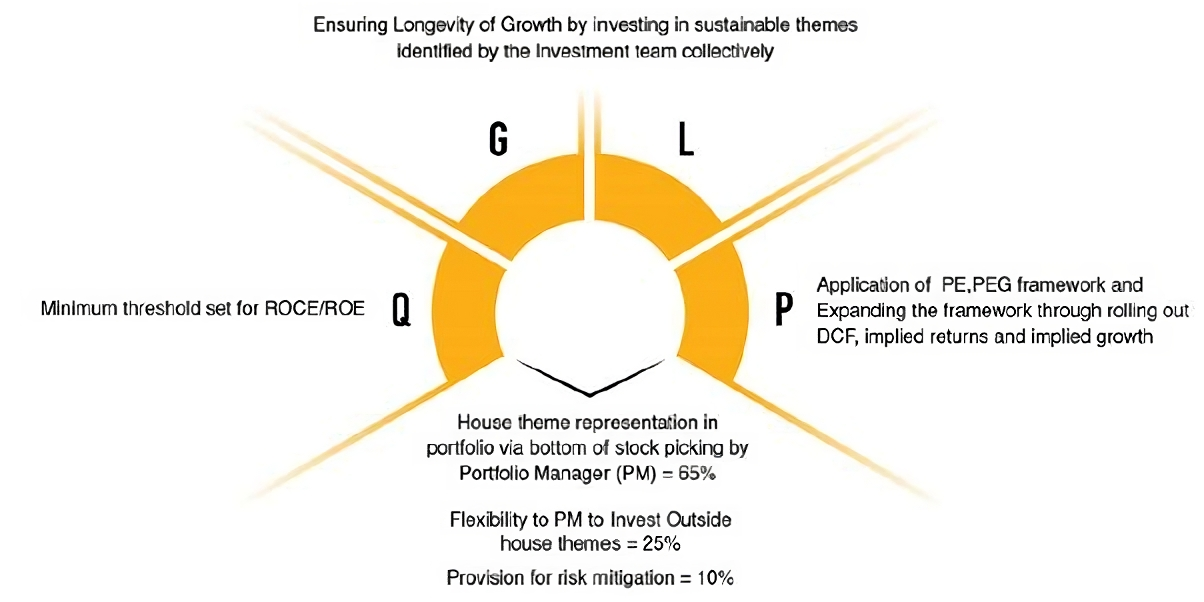

Motilal Oswal Fund’s strategy focuses on investing in various manufacturing sectors using their QGLP framework, which stands for Quality, Growth, Longevity, and Price. Here's how they plan to make money for investors:

- Quality: They will prioritize investing in high-quality companies that offer the highest returns on investment.

- Growth: They will look for companies with high growth potential that is sustainable in the long term.

- Longevity: They aim to find companies that can maintain their growth over the long term.

- Price: They will invest in companies that are available at the right price, ensuring that the investment can generate returns.

The fund will focus on the top 30-35 companies across large, mid, and small cap sectors, ensuring a concentrated portfolio. This approach aims to provide high returns in the long term. However, because they are selecting specific companies, there is also a higher risk involved, making it a high-risk, high-reward investment.

To manage this risk, they have included a profit taking and stop-loss framework. This means they will use specific triggers to exit stocks quickly if they start to fail and to book profits correctly when stocks perform well.

Overall, while they will apply their QGLP framework, they will also actively manage the funds to maximize returns.

Who Should Invest in Motilal Oswal Manufacturing Fund?

The Motilal Oswal Manufacturing Fund is designed for investors looking to strategically allocate their money in stocks, focusing on capital growth over a long period by investing in manufacturing-related companies. This fund is ideal for those comfortable with higher risks and who plan to invest for at least five years. Whether you invest a lump sum amount at once or through an SIP (Systematic Investment Plan) the fund provides flexibility to meet various investment goals and preferences. It aims to capitalize on opportunities in the manufacturing sector, making it suitable for investors seeking potential long-term gains from this specific theme.

Mostly Asked Question

1. What is the New Fund Offer (NFO) Period for the Motilal Oswal Manufacturing Fund?

Ans. The fund will open for investment on July 19, 2024, and the closing date for this fund will be August 2, 2024.

2. Can I Invest Through SIP in the Motilal Oswal Manufacturing Fund?

Ans. Yes, you can invest through SIP (Systematic Investment Plan) in the Motilal Oswal Manufacturing Fund.

3. How Much Money do I Need to Start a SIP in Motilal Oswal Manufacturing Fund?

Ans. You can start with as low as Rs. 500 to start a SIP in Motilal Oswal Manufacturing Fund.

4. What is the Risk Level of the Motilal Oswal Manufacturing Fund?

Ans. This fund may experience short-term volatility, but starting a SIP for at least 5 to 7 years can help reduce the risk.

5. What is the lock-in period for the Motilal Oswal Manufacturing Fund?

Ans. The Motilal Oswal Manufacturing Fund does not have a lock-in period.