Table of Contents

- NFO Whiteoak Capital ESG Best in Class Strategy Fund Basic Details

- What is the ESG Fund?

- Comparing Nifty 100 ESG TRI Vs Nifty 100 TRI

- Investment Strategy of Whiteoak Capital Best in Class Strategy Fund

- Is Whiteoak Capital ESG Best in Class Strategy Fund Good?

- Mastermind’s Behind Whiteoak Capital ESG Best in Class Strategy Fund

- Why Invest in Whiteoak Capital ESG Best in Class Strategy Fund?

- Final Note- Who Should Invest?

Are you ready to support India's vision with "Sabka Saath Sabka Vikaas" to fulfil sustainable development goals? It's time to begin your financial journey towards a more sustainable future by investing in this new NFO Whiteoak Capital ESG Best in Class Strategy Fund.

Yes, the Whiteoak Capital Mutual Fund, India's leading AMC worth Rs.67 trillion has newly launched this NFO belonging to a thematic ESG category.

This new fund offer has started its subscription from 11th Oct and will close on 25th October 2024. If you plan to capitalize on steady long-term returns, then this is your chance.

This post will be your answer key to know if this could be the best NFO for your portfolio in 2024. Let’s begin with the basic details of this ESG theme-based fund.

NFO Whiteoak Capital ESG Best in Class Strategy Fund Basic Details

| Scheme Name | Whiteoak Capital ESG Best in Class Strategy Fund |

|---|---|

| Issue Open Date | 11.10.24 |

| Issue Close Date | 25.10.24 |

| Category | Equity - Thematic - ESG |

| Benchmark | Nifty 100 ESG TRI |

| Minimum Application Amount | Rs. 100 |

| Fund Managers | Mr. Ramesh Mantri |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

What is the ESG Fund?

The ESG simply stands for environmental, social and governance. It is a broader theme concept that promotes sustainable and ethical ways for you to invest your money in Mutual Funds.

In the last financial year, the SEBI (Securities and Exchange Board of India) permitted the assets management companies to launch new fund offers under the six new strategies.

These six categories are:

- Exclusion

- Integration

- Best in Class & Positive Screening

- Impact Investing

- Sustainable Objectives

- Transition or Transition-related Investments

Likewise, this new NFO Whiteoak Capital ESG Best-in-Class Strategy Fund falls under the best-in-class equity thematic category.

Now, let’s take a quick glance at the performance of this category to decide if it's even worth your time or not.

Comparing Nifty 100 ESG TRI Vs Nifty 100 TRI

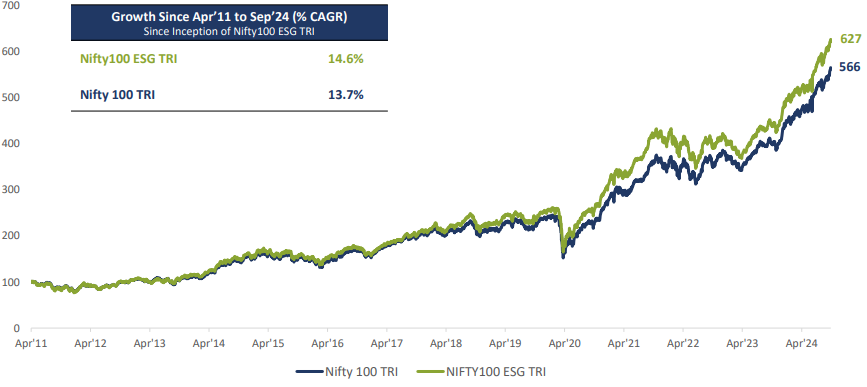

Now if you compare the benchmark Nifty 100 ESG TRI with the Nifty 100 TRI, you will see a superior performance achieved by ESG funds.

The Nifty 100 ESG TRI delivered a strong 14.6% return and in comparison, the Nifty 100 TRI only returned 13%.

You can take help from the below graph for more clarity:

Well, historically speaking, Nifty100 ESG TRI has outperformed Nifty 100 TRI in 11 out of 14 financial years. This reliability builds confidence to consider having this new NFO in the portfolio.

Next, by learning its investment style, you will see how this fund will make returns for you.

Investment Strategy of Whiteoak Capital Best in Class Strategy Fund

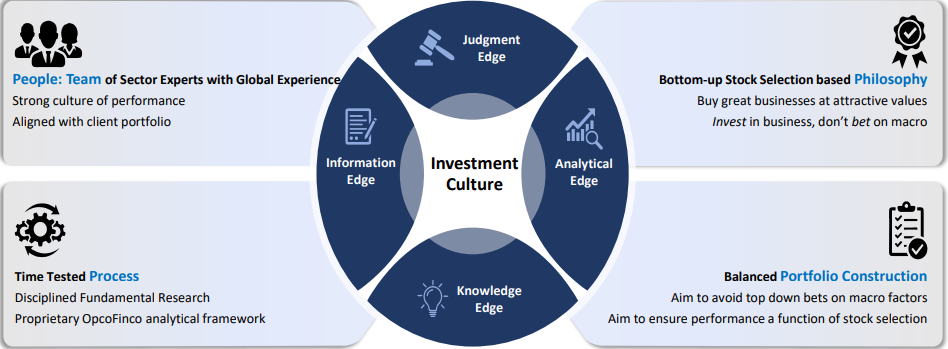

The investment philosophy adopted by Whiteoak Capital Mutual Fund focuses on how outsized returns can be earned over time by investing in great businesses at attractive valuations. How will it do that? Let's find out.

The Whiteoak Capital ESG Best-in-Class Strategy Fund has applied a broad investment strategy to give you a balanced portfolio construction. This includes a mix of styles of picking growth and value-based companies.

Now you must agree that no particular style performs consistently every year. Likewise, sector and market cap performance keep rotating year on year. That's where its balanced portfolio investment approach comes into play. This blend of cyclical and defensive sectors across large, mid and small cap stocks will give you a consistent performance.

You can check the below picture for reference:

Is Whiteoak Capital ESG Best in Class Strategy Fund Good?

Here are some good points that make this new NFO a great pick:

High Growth Opportunities: It seeks to invest in companies that have good governance standards. For example, investments made in the leading supplier of electrical equipment that specializes in power equipment like transformers, switch bars and motors. These are the key suppliers of railway holding 1 market share of approximately 38% in the LT Motors segment.

Investments in Top Mid-Sized IT Services Companies: You have a chance to invest in top-performing mid-sized IT companies covering sectors like healthcare, Hitech and financial services. This new NFO will invest in companies like Salesforce, Appian & Snowflake which have given 24% CAGR in the past four years.

High Earnings Margins: Being an ESG Scheme, consistently delivers strong cash flow, with FCF/PAT of 85-90% and a dividend payout ratio of 30-40%, while continuing to invest in companies showing growth and capabilities.

Mastermind’s Behind Whiteoak Capital ESG Best in Class Strategy Fund

Meet Mr Ramesh Mantri, who has 18+ years of experience in equity funds so you can say this new NFO Whiteoak Capital ESG Best in Class Strategy Fund is in safer and capable hands.

You can be assured as he believes that in difficult market conditions, one has to look for companies with a long track record of showcasing market leadership. One just great opportunity is this new NFO, investing in a sustainable future.

Why Invest in Whiteoak Capital ESG Best in Class Strategy Fund?

Here are some strong reasons for you to take this new fund offer into your portfolio:

A large & Experienced Analyst Team: Covering a large universe of heterogeneous businesses across different sectors and market caps.

In-house Forensic Team: In-house forensics team with prior experience in investigative journalism. They conduct extensive groundwork and framework in place to assess governance.

Market Cap Agnostic: Bottom-up approach of stock selection with no bias for market capitalization.

High Active Share: The scheme endeavours to keep a high active share, which is one of the necessary requirements for potential alpha generation.

Final Note- Who Should Invest?

In short, if you seek active management for your portfolio, this new NFO is a go-to option. It has been built on companies that have high corporate governance and offer sustainable long-term returns. Moreover, the best strategy will be to opt for the SIP route for a systematic investment journey.

.webp&w=3840&q=75)