Table of Contents

One of India's most notable asset management firms, Bandhan Mutual Funds, has recently introduced a New Fund Offer (NFO), the Bandhan Business Cycle fund. The subscription for this fund will be open shortly, starting from September 10th to 24th, 2024

But what makes this fund unique? Let's get some insights on it.

This fund mainly focuses on areas that are in the way of growing and have the potential for substantial returns with less risk. Are you ready to grab this once-in-a-lifetime opportunity? If yes! let's get started.

This blog post will explain why this will be your portfolio's finest business cycle fund.

Basic details of the Mutual Fund

| Scheme Name | Bandhan Business Cycle Fund |

|---|---|

| Issue Open Date | 10.09.24 |

| Issue Close Date | 24.09.24 |

| Category | Equity-Thematic |

| Benchmark | Nifty 500 TRI |

| Minimum Application Amount | Rs.1000 |

| Fund Managers | Mr. Vishal Biraia |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

Firstly, you will see the all-rounder investment approach adopted by the Bandhan business cycle fund.

Investment Strategy by Bandhan Business Cycle Fund

This fund’s broad philosophy is making investing decisions on the business cycle. It has 4 phases, expansion, peak, contraction and decline.

It basically targets companies in their growth phase like companies generating good revenue and growing rapidly.

On the above, it uses quality research that has long-term growth cycles.

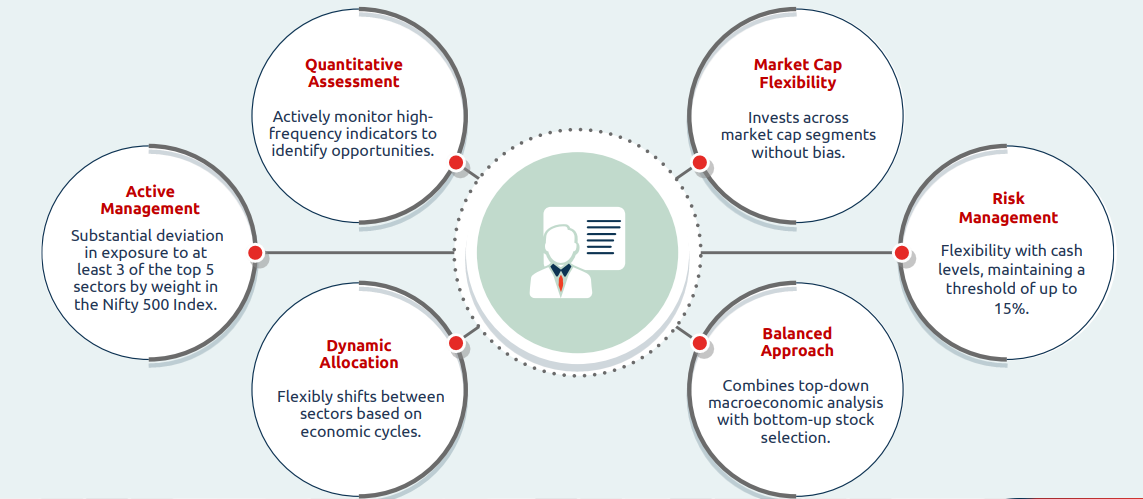

So while managing this fund actively, it changes the sectors that are outperforming and likewise, uses the flexibility of different market caps like large, mid and small while also maintaining good margins for cash flow up to 15%.

Moreover, Its flexible shifts between sectors based on economic cycles give it a double advantage with top and bottom analysis of the macroeconomic selection of the stocks.

Let’s look at the below picture for more clarity:

Next, let’s move on to the managing body of this fund. It will help you understand the execution of the above strategy.

Fund Managers of Bandhan Business Cycle Fund

Meet the mastermind of this Mutual Funds, Mr. Vishal Baraia having 20+ years of experience in the capital market he has expertise in utilities, materials, industrials and discretionary goods meaning luxury items. In short, he is perfect for managing this business-based fund and you can too make high returns under his leadership.

Lastly, let’s see if you include this fund in your portfolio what are the compelling reasons that lead you to it.

Why invest in Bandhan Business Cycle Fund?

Here are some strong reasons to take this fund under your portfolio:

- 360-Degree Investment Approach: Its investment strategy fully covers economic, market and sector cycles. This keeps your investments in high-performing sectors to make the most of their potential via SIP (systematic investment plan) during economic fall.

- Robust Stock Selection Framework: Targeting quality businesses and sectors at their growth phase builds a strong collection of stocks for your portfolio. It ensures the purity of the portfolio plus good earnings margins.

- Economic Growth Opportunities: As India is on the path to becoming the 3rd largest consumer market, economic factors like GDP, currency, and export-import contribute to its wealth. This fund allows you to make high returns with our growing economy directly.

- Quality Stocks: It invests in companies that have strong fundamentals and companies with sustainable business models. This focus will benefit you by giving quality portfolio and lower risk from underperforming stocks.