Table of Contents

- Key Highlights of Canara Robeco Balanced Advantage Fund

- How Canara Robeco Balanced Advantage Fund will Decide The Allocation?

- Key Points About Balanced Advantage Funds

- Strategy Adopted By Canara Robeco Balanced Advantage Fund

- How Equity Will be Selected in Canara Robeco Balanced Advantage Fund?

- What are the Risk and Return Expectations of Canara Robeco Balanced Advantage Fund?

- Final Note- Who Should Invest?

Canara Robeco Mutual Fund has recently launched Canara Robeco Balanced Advantage Fund on 12th July 2024. An open-ended dynamic asset allocation fund aims to grow your money and provide income. It does this by using strategies with stock-related derivatives, finding arbitrage opportunities, and investing directly in equity stocks.

Let us find out what are the other reasons to invest in this new fund offer.

Key Highlights of Canara Robeco Balanced Advantage Fund

| Scheme Name | Canara Robeco Balanced Advantage Fund |

| Issue Open Date | 12.07.24 |

| Issue Close Date | 26.07.24 |

| Category | Hybrid- Dynamic Asset Allocation |

| Benchmark | CRISIL Hybrid 50+50 Moderate Index |

| Minimum Application Amount | Rs.1000 |

| Fund Managers | Mr. Shridatta Bhandwaldar |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

How Canara Robeco Balanced Advantage Fund will Decide The Allocation?

Canara Robeco Balanced Advantage Fund belongs to a Hybrid Fund category, which means that it follows a dynamic allocation strategy. In this process, the fund manager has the flexibility to adjust the equity and debt portfolio based on market scenarios according to their opinion of the market.

This approach adds stability, diversifies your investments, and adapts to economic changes.

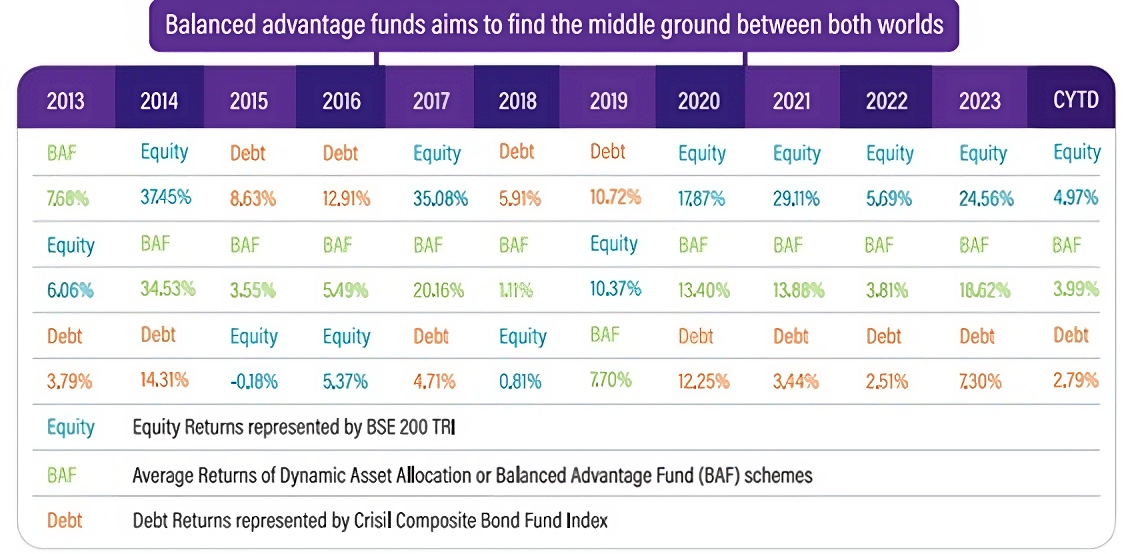

Key Points About Balanced Advantage Funds

- The fund is actively managed, focusing on equity investments.

- It continuously monitors market trends and adjusts the balance between stocks and bonds accordingly.

- It is a good choice for investors looking for equity-focused investments that consider valuations.

- It offers strong risk management.

- The fund aims to capture market trends with a balanced mix of stocks and bonds, while also providing the tax benefits associated with equity investments.

Strategy Adopted By Canara Robeco Balanced Advantage Fund

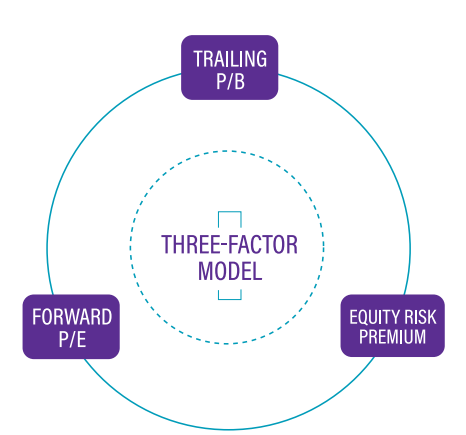

The Canara Robeco Balanced Advantage Fund uses a Three-Factor Model for its portfolio allocation. This model includes three key factors:

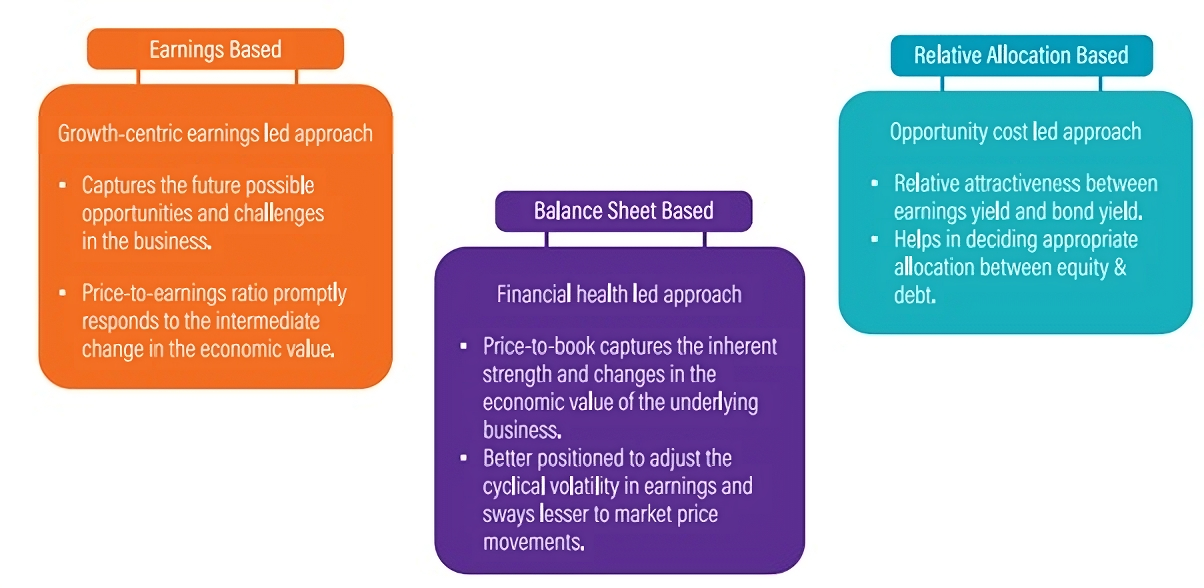

Trailing Price-to-Book (P/B) Ratio

- Evaluate the valuation of the underlying stocks.

- For Example: If the P/B ratio of a company is 0.8, it means the stock is trading at 80% of its book value, indicating it might be undervalued.

- Adjusts market exposure based on changes in the inherent economic value of businesses.

- For Example: If the fund notices that many of its holdings have P/B ratios below 1, it may increase its equity exposure, expecting these undervalued stocks to rise.

Forward Price-to-Earnings (P/E) Ratio

- Captures future opportunities and challenges in businesses.

- For Example: If it has a forward P/E ratio of 10, this indicates that investors expect the company to earn Rs.1 for every Rs.10 invested in the future, suggesting potential growth.

- Allows prompt response to intermediate changes in economic value.

- For Example: If the forward P/E ratio of companies in the tech sector increases due to positive earnings forecasts, the fund may boost its investments in tech stocks.

Equity Risk Premium

- Measures the difference between bond yield and earnings yield.

- For Example: If the yield on 10-year government bonds is 2% and the earnings yield of a stock index is 6%, the equity risk premium is 4%.

- Determines the appropriate allocation between equity and debt based on their relative attractiveness.

- For Example: With a high equity risk premium of 4%, the fund might allocate more to equities, expecting higher returns from stocks compared to bonds. Similarly, if the premium drops to 1%, the fund might shift more towards bonds for stability.

How Equity Will be Selected in Canara Robeco Balanced Advantage Fund?

- The fund uses a unique in-house model with special market valuation metrics to decide stock investments.

- This method is flexible and adapts to market changes.

- It focuses on the financial health of businesses to capture their strengths.

- The model adjusts to changes in earnings and market prices.

- This approach helps manage market volatility and optimize investment results.

What are the Risk and Return Expectations of Canara Robeco Balanced Advantage Fund?

Returns Expectations: 12-15%

The Canara Robeco Balanced Advantage Fund aims to deliver returns in the range of 12-15% annually. This target is based on the fund's investment strategy, which includes a mix of equities and debt instruments. By investing in a diversified portfolio that adapts to market conditions, the fund seeks to achieve these returns through capital appreciation and income generation.

For Example: Suppose you invest ₹1,00,000 in the fund. With an expected return of 12-15%, you could potentially earn between ₹12,000 and ₹15,000 annually. This projection reflects the fund’s approach to balancing risk and reward by adjusting its asset allocation based on market conditions.

Risk Tolerance: Low to Medium Risk

The fund is designed for investors with a low to medium risk tolerance. This means the fund aims to provide stable returns while managing the risk of significant losses. It achieves this by employing strategies such as dynamic asset allocation, which adjusts the mix of stocks and bonds based on market conditions. The goal is to reduce volatility and protect capital while still offering growth potential.

Use the SIP Calculator to Get Your Estimated Returns on Investments.

Final Note- Who Should Invest?

This fund is best for investors planning to invest via SIP for 5-8 years. Being part of Canara Robeco Mutual Fund, it has strong support and a proven track record. If the fund keeps a high allocation in stocks, it is likely to give better returns to investors in this category.