Table of Contents

- NFO PGIM Healthcare Fund Basic Details

- Investment Strategy Adopted by NFO PGIM Healthcare Fund

- Where will the PGIM Healthcare Fund Invest?

- Spotlight on the Sector Expertise of PGIM Healthcare Fund NFO

- Why Invest in PGIM Healthcare Fund NFO?

- Key Drivers by Sub-Segments of PGIM Healthcare Fund NFO

- Summary of Newly Launched NFO by PGIM Mutual Fund

Have you heard today's headline," Build on health, first for yourself, then in healthcare?"

According to reports, medical inflation in India has reached an alarming rate of 14%. This reliability has made the various AMCs launch new NFOs in this category. Why? Because the medical trend rates are rising faster than headline inflation. But what does it mean for your portfolio?

The latest update shows that the PGIM mutual fund has newly launched the NFO PGIM Healthcare Fund. It is open for subscription starting on 19 November 2024 and will expire on 03 December 2024.

In this analysis, you will learn whether this could be the best NFO of 2024 for your portfolio. Let's get started with the fund review.

NFO PGIM Healthcare Fund Basic Details

| Scheme Name | PGIM Healthcare Fund |

|---|---|

| Issue Open Date | 19.11.24 |

| Issue Close Date | 03.12.24 |

| Category | Equity- Sectoral- Pharma |

| Benchmark | BSE Healthcare TRI |

| Minimum Application Amount | Rs.5000 |

| Fund Managers | Mr A Anandha Padmanabhan |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

In the next heading, you will cover the investment approach used by this new NFO.

Investment Strategy Adopted by NFO PGIM Healthcare Fund

This new fund offer by PGIM Mutual Fund follows a broader investment philosophy based on a proprietary fair value framework. Now, what does that mean for you? It is a simple three-step process that involves growth, quality, and management.

The new NFO PGIM Healthcare Fund is a sectoral fund based on a structural theme: healthcare. Now, keeping healthcare as the core, it invests in diverse opportunities across various sub-segments, such as pharmaceuticals, hospitals, diagnostic services, etc.

Moreover, it uses the bottom-up stock selection approach, which will help you lower the risk from changing business cycles, which can lead to varying performance trends.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Moving on to another important question about the distribution of assets in multiple sectors.

Where will the PGIM Healthcare Fund Invest?

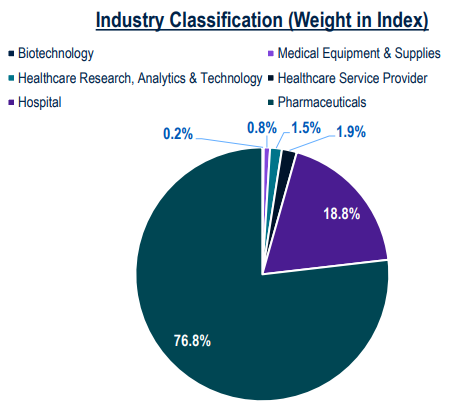

This new NFO is benchmarked against the BSE Healthcare Index, skewed towards the large cap pharma. Here, the Pharma Healthcare sector constitutes three-fourths of the BSE Healthcare TRI.

You can easily check out the distribution from the below pie chart:

It’s time to talk about the mastermind of this new NFO.

Spotlight on the Sector Expertise of PGIM Healthcare Fund NFO

This new NFO is in capable hands with Mr A. Anadha Padmanabhan, an expert in the healthcare sector.

He has 17+ years of experience tracking the healthcare sector and is currently managing various equity sectoral Mutual Funds. As India strengthens its position as a medical value tourism hub, the management of this newly launched NFO is in safer hands.

Let’s see some compelling reasons to include this new fund offer in your financial portfolio.

Why Invest in PGIM Healthcare Fund NFO?

PGIM Healthcare Fund's investment philosophy and process emphasize identifying solid opportunities within the healthcare sector. It carefully analyzes their growth and risk potential across subsegments. Their approach is systematic and comprehensive and focuses on factors like:

1. Risk/Return Potential

Examining the balance of risks vs. rewards across various healthcare themes.

2. Management Quality

Prioritizing companies with strong leadership and good corporate governance.

3. Revenue Growth and Margins

Analyzing revenue growth consistency, sustainability of operating margins, and effective cost management.

4. Regulatory Adaptability

It monitors the impact of changing regulations to ensure compliance.

5. Valuation and Growth

Selecting stocks with promising growth potential at attractive valuations.

Key Drivers by Sub-Segments of PGIM Healthcare Fund NFO

The following points give you a brief about the growth prospects amongst various sectors:

1. Domestic Pharmaceuticals

- Focus on therapy areas (e.g., chronic vs. acute conditions).

- Productivity of sales force and growth from new launches.

- Portfolio adherence to government pricing policies like NLEM (National List of Essential Medicines).

2. Hospitals

- Metrics like occupancy rates, revenue per bed, and patient case mix.

- Expansion strategies and capital allocation efficiency.

- Brand positioning in specific geographic markets.

3. Diagnostics Center

- Depth of test offerings and brand recall in core markets.

- Patient volume growth and capability to scale services to new locations.

4. US Generics

- Coping with pricing pressure and regulatory requirements.

- Strength of the product pipeline and investment in innovation.

5. CRO/CDMO (Contract Research/Manufacturing)

- Partnerships with global innovators and capabilities in drug discovery.

- Opportunities from late-stage clinical products.

6. Examples of High-Potential Companies

- Domestic Branded Pharma Companies, with scalable business models, high cash flow, and robust growth driven by field force optimization and strategic acquisitions.

- Healthcare Providers, established hospital chains with strong regional dominance, excellent clinical outcomes, and ongoing infrastructure expansion.

Summary of Newly Launched NFO by PGIM Mutual Fund

To sum up, if you are looking to expand your investment horizon, this new NFO offers the best alternative amongst its peers. Are you tired of the regular equity funds and in search of a unique category? Start your SIP in something new. You have landed yourself with the best NFO that will broaden your portfolio on a whole another level.

.webp&w=3840&q=75)