Table of Contents

- Introduction

- Why Large Cap Companies Known as Backbone of Corporate India?

- What is the Performance Track Record of Large Cap Funds?

- Drawdown Analysis of Across Market Caps

- Investment Strategy of Bajaj Finserv Large Cap Fund

- How Does Bajaj Finserv Large Cap Fund Allocate Portfolio?

- Final Note- Who Should Invest?

Introduction

The Indian equity market is diverse, with large-cap companies driving growth and increasing market cap from 84,000 crores to 19,00,000 crores.

These companies have significantly contributed to India's GDP, created millions of jobs, and taken technology to the next level. However, there is still room for substantial growth compared to international markets.

This brings us to the latest headlines running all over an opportunity presented by the Bajaj Finserv Mutual Fund announcing their latest NFO of Bajaj Finserv Large Cap Fund will help in keeping the dream alive of many Indian investors.

You can check the details of this new fund offer in the below table:

| Basic Details | |

|---|---|

| Scheme Name | Bajaj Finserv Large Cap Fund |

| Issue Open Date | 29.07.24 |

| Issue Close Date | 12.08.24 |

| Category | Equity- Large Cap |

| Benchmark | Nifty 100 |

| Minimum Application Amount | Rs.500 |

| Fund Managers | Mr. Nimesh Chandan |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

To make our argument worthy, let us understand how large cap stocks have become the market leaders.

Why Large Cap Companies Known as Backbone of Corporate India?

The following points give proof of the contribution of large cap stocks:

-

Market Leaders

Large-cap companies, the top 100 by market size, are the leaders in India's Mutual Funds industry. They are closely followed by analysts and attract major investments from both Indian and international institutions.

-

Strong Market Value

With market values ranging from ₹84,000 Crore to ₹19, 00,000 Crores, these giants play a crucial role in India's economy.

-

Contribution to Economy

They generate millions of jobs and lead in technological innovations across important industries.

Now let’s make our claim stronger by analyzing the track records of large cap stocks with other market caps.

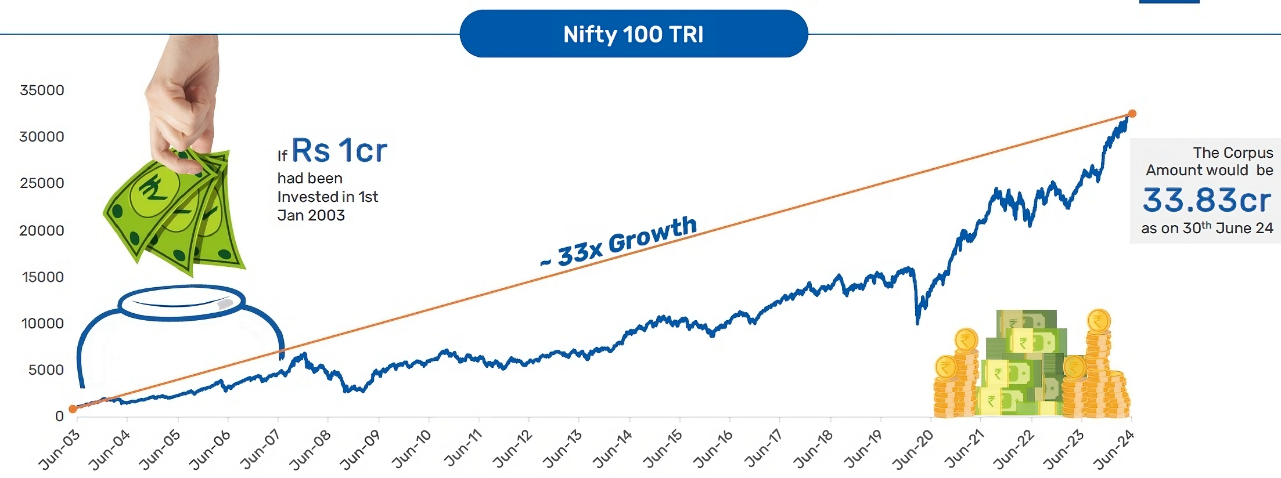

What is the Performance Track Record of Large Cap Funds?

Large Cap Funds invest in the top 100 large-cap stocks, as defined by SEBI. To understand their performance, we look at their returns over 1-year, 3-year, and 5-year periods. This helps us see how they perform in the short, medium, and long term.

The following table shows the performance of 30 large-cap funds in India, which manage a total of ₹3, 54,089 crore.

Returns for periods longer than one year are shown as Compound Annual Growth Rate (CAGR) using Direct Plans to avoid fund cost effects. The funds are ranked by their 5-year returns to give a clear view of their long-term performance.

Let’s measure the downside volatility of large cap stocks across other market caps.

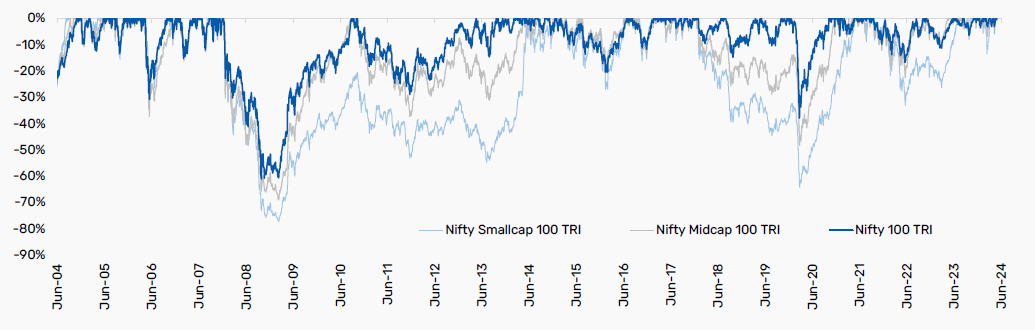

Drawdown Analysis of Across Market Caps

We have taken three Nifty indices - Nifty 100 TRI, Nifty Midcap 100 TRI, and Nifty Smallcap 100 TRI. The drawdown represents the percentage decline from the peak to the trough for each index.

Some key observations from the analysis:

- Large caps (Nifty 100 TRI) tend to have lower drawdowns compared to mid and small caps.

- This indicates that large cap stocks are relatively more stable and less volatile compared to mid and small cap stocks.

- Mid and small caps (Nifty Midcap 100 TRI and Nifty Smallcap 100 TRI) experience deeper drawdowns, indicating higher volatility in these segments of the market.

- During market downturns, mid and small caps tend to fall more compared to large caps.

The chart shows how the market goes up and down over time, with periods of growth and decline for different indexes:

Wait, aren’t you curious about how Bajaj Finserv Mutual Funds will run this large cap stock? Let’s delve into its investment approach.

Investment Strategy of Bajaj Finserv Large Cap Fund

The Bajaj Finserv Large Cap Fund takes a focused approach to building its portfolio, concentrating on investments where the fund manager has strong confidence. Here’s how the fund aims to stand out:

Investment Philosophy: The fund house uses a mix of strategies to gain an edge over the market. It is made up of three factors, information, quantity and behavior. Let us look at them one by one:

Information Edge: The fund strives to outperform by gathering and analyzing superior market information.

Quantitative Edge: By using advanced quantitative models and analytics, the fund processes information more effectively, aiming to make better investment decisions.

Behavioral Edge: The fund leverages insights into market psychology to make smart moves, taking advantage of trends and crowd behaviors.

This proactive management approach helps investors navigate the complex Indian equity market and tap into the growth potential of leading Indian companies.

With its strategic focus and innovative techniques, the Bajaj Finserv Large Cap Fund aims to deliver impressive returns and capitalize on India's corporate success stories.

Well, this begs the question; will this stock bring stability and growth to your portfolio?

Let’s check the allocation of its stocks for more clarity.

How Does Bajaj Finserv Large Cap Fund Allocate Portfolio?

The fund builds a focused portfolio of 25-30 stocks, based on careful research and a clear investment strategy. This portfolio is different from the benchmark index as it aims to achieve long-term success through the fund manager's confident choices.

Mr. Nimesh Chandan actively manages the portfolio, regularly checking and adjusting the holdings to maintain the right balance of risk and return while taking advantage of new opportunities. This ensures the fund stays responsive and well-positioned to benefit from market changes.

Final Note- Who Should Invest?

Even if you are an experienced investor or investing for the first time, Bajaj Finserv Large Cap Stock will be a great choice to invest for 3-5 years or more. The good news is you can start a SIP at just Rs.500 or you can go for lumpsum as per your financial needs.

Keep Yourself Updated with the Latest NFO in the Market.