Table of Contents

- What are Multi Cap Mutual Funds?

- Investment Strategy Opted By Franklin India Multi Cap Fund

- What is the Research Process Adopted by Franklin India Multi Cap Fund?

- How does Franklin India Multi Cap Fund master the art of market cap allocation?

- Why Should You Invest in Franklin India Multi Cap Fund

- Who Should Invest in Franklin Multi Cap Fund?

In today's competitive world, the mutual fund industry is full of a number of fund companies that have been offering numerous creative programs to help investors attain their financial goals, how could Franklin Templeton have left behind?

Supporting the growth of the Indian economy, Franklin Templeton Mutual Fund has launched the Franklin India Multi Cap Fund. Yes, the NFO has opened for investment from July 8th, 2024 to July 22nd 2024.

In the coming blog, the experts are sharing with you the details about this fund along with benefits and the reasons as to why and who may invest in it.

What are Multi Cap Mutual Funds?

The Multi Cap Funds have been around for years, but their definition changed in September 2020. Initially, these funds had no restrictions on market cap allocation, often favouring large-cap stocks with some mid-cap and small-cap investments. SEBI now mandates Multi Cap Mutual Funds to invest at least 75% of their total assets in equities, with a minimum of 25% in large-cap, mid-cap, and small-cap stocks each. Large cap stocks refer to the top 100 companies by market cap in India, mid-cap stocks are ranked 101st to 250th, and small-cap stocks are those ranked 251st and beyond. This change ensures that Multi Cap Funds have a balanced mix of large, mid, and Small Cap Stocks, staying true to their label.

Investment Strategy Opted By Franklin India Multi Cap Fund

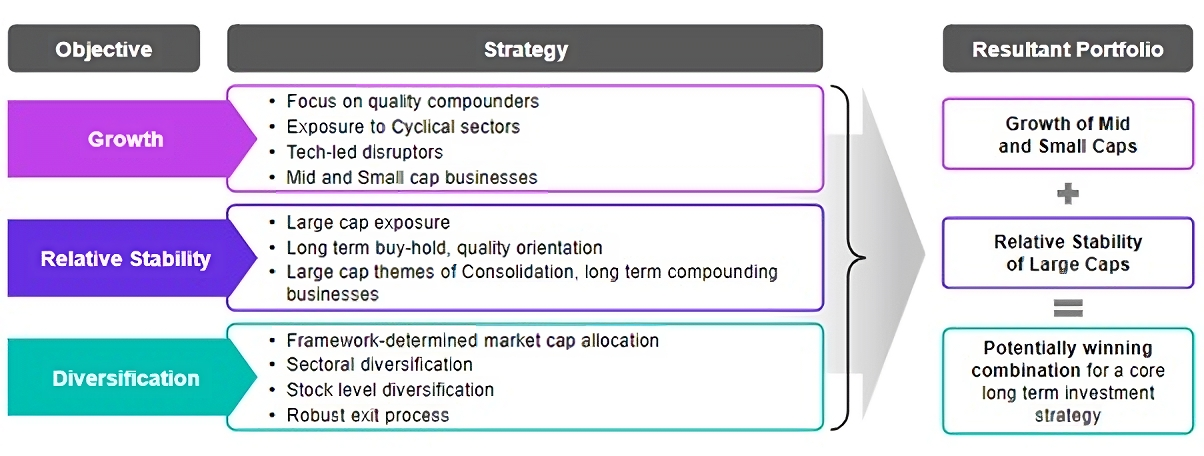

The Franklin Mutual Funds investment strategy is centred on investing in high-quality compounders, cyclical sectors, tech-led disruptors, and mid and small-cap businesses. It also has significant exposure to large-cap stocks. The fund takes a long-term buy-and-hold approach and emphasizes sectors like consolidation, which involves combining multiple smaller companies into one larger entity to improve efficiency and reduce competition. The fund also focuses on businesses that are poised for long-term compounding. Diversification across sectors and individual stocks is key, supported by a strong exit process to manage risks effectively. Look at the below picture to gain more clarity:

What is the Research Process Adopted by Franklin India Multi Cap Fund?

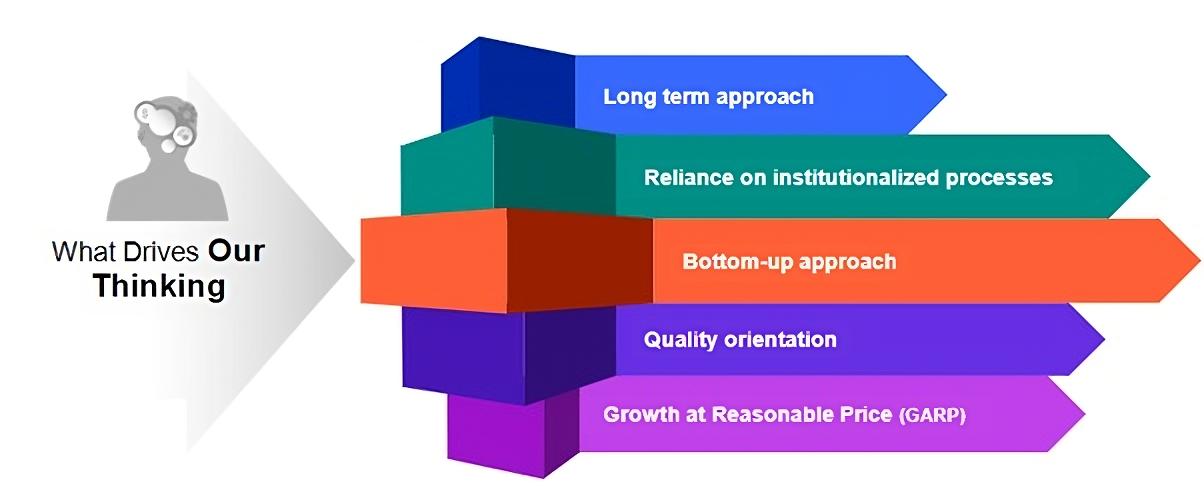

The Franklin India Multi Cap Fund uses a straightforward research process called QGSV (Quality-Growth-Sustainability-Valuation). They look at big-picture themes like urbanization, rising incomes, and economic growth to find investment opportunities. Then, they dive deep into specific Sector Diversification and stocks, making sure each investment meets their detailed criteria. They also monitor overall economic stability to make timely adjustments across different market caps, aiming to maximize returns in various market conditions. This strategy will help this fund to consistently outperform well against market volatility.

Refer to the below picture for more understanding:

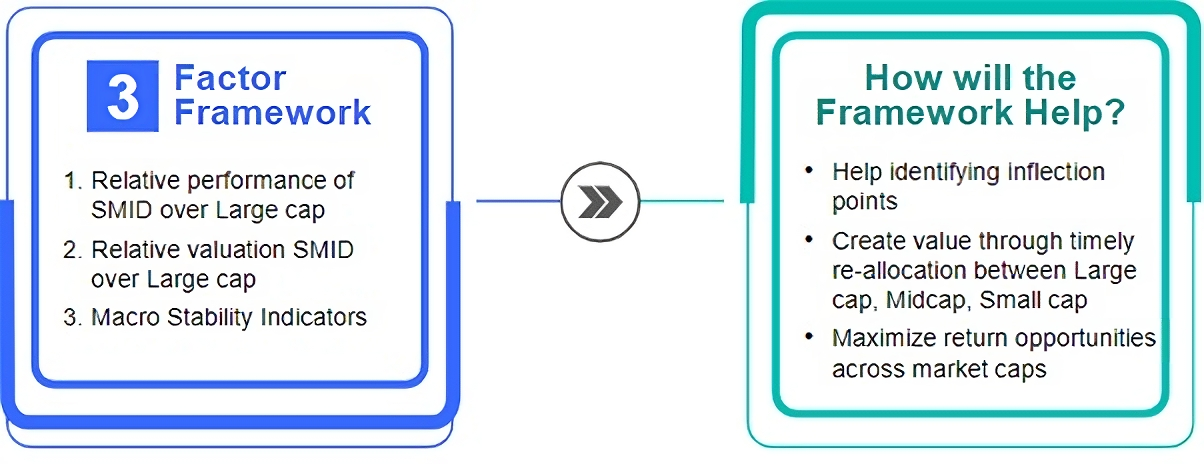

How does Franklin India Multi Cap Fund master the art of market cap allocation?

The fund's market cap allocation is adjusted based on the management team's analysis. They look at how small, Mid Cap Stocks (SMID) perform, and value compared to large-cap stocks, alongside economic stability indicators. This approach helps optimise returns by shifting investments across market caps to take advantage of growth opportunities and changes in the market.

Why Should You Invest in Franklin India Multi Cap Fund?

There are a number of reasons that can attract any investor to Franklin Templeton Investments to invest their money towards this scheme. They are as follows:

Diversified Portfolio: Multi cap funds invest in large, mid, and small cap stocks, offering a balanced mix that maximizes investor benefits.

Potential for Higher Returns: Small and mid cap funds can yield higher returns, though selecting the right ones requires a robust process.

Risk Optimization: By diversifying across different company sizes, sectors, and themes, Multi Cap Equity Funds spread and carry out strong Risk Management.

Enhanced Long-term Wealth Creation: The diversified approach of multi-cap funds enhances long-term wealth creation through higher risk-adjusted returns.

Sectoral Opportunities: These Mutual Funds provide opportunities in various sectors such as healthcare, consumer durables, and chemicals, balancing the large-cap dominance in indices like the Nifty 500.

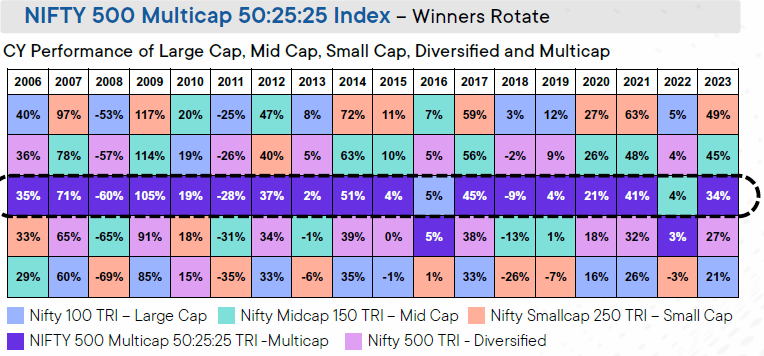

Historical Performance: Historical data shows that top-performing stocks rotate across market caps, ensuring stability and growth potential for multi-cap funds.

Suitable for Long-term Investments: Multi-cap funds are ideal for Long Term Capital Appreciation and systematic investment plans (SIPs), leveraging market volatility for potentially superior returns.

The below data validates the Fund’s Performance of the Multi Cap Category:

Who Should Invest in Franklin Multi Cap Fund?

Every new scheme is launched with specific positive pre-set notions to provide a unique opportunity for investors to earn the inflated rate of money in the future which if kept ideal would have been lost. Franklin Multi Cap Stock is a chance to invest in India's growing economy through emerging businesses and high-growth market themes. This investment opportunity is ideal for investors looking to commit for 5-8 years with an early SIP plan. With Franklin Templeton's strong backing with experienced Fund Managers and a history of successful schemes, you can trust in its management.

.webp&w=3840&q=75)