Table of Contents

Did you know to seize the growth opportunity in India, Asset Management Companies (AMCs) have launched business cycle funds. The New Fund Offer for Motilal Oswal Business Cycle Fund will be open from 07-August-2024 to 21-August-2024. The fund aims to boost returns by choosing stocks that fit current market trends and economic conditions while managing risk.

I know what you are looking for: the straightforward answer of the benefits you will get with this new NFO mutual fund. Let’s delve into it!

How do Business Cycles and Rotation Work?

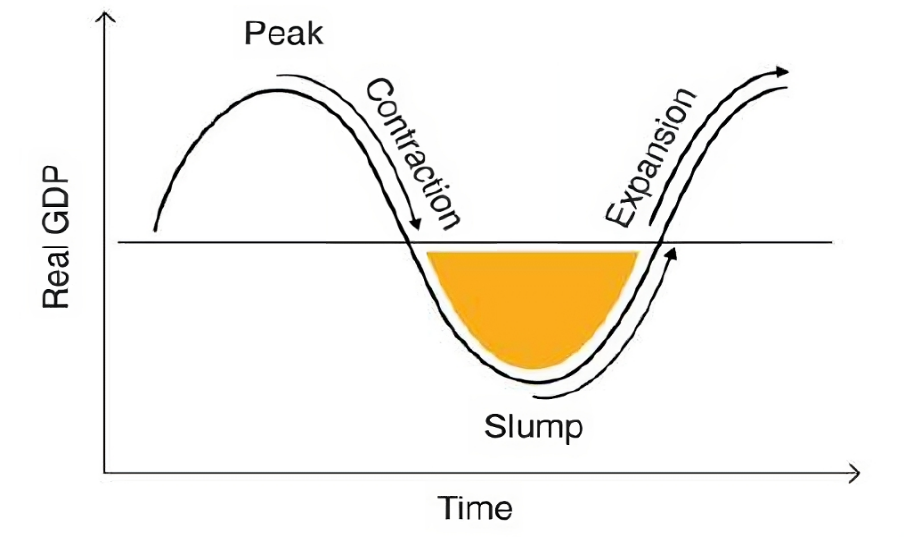

Companies go through phases of expansion, development, and decline. Investors need a flexible approach to maximise the highs and minimise the lows in order to take full advantage of these cycles. Let's examine both conventional and contemporary approaches to identifying and capitalizing on these economic cycles.

_66b1fde8bf687.png)

Why Focuses on Business Cycle Based Investing?

Understanding of different phases of business cycle:

- Expansion Phase: In the Expansion Phase, the economy grows, interest rates are low, unemployment drops, and inflation rises. Businesses invest more, ROCE improves, and sentiment is positive.

- Peak Phase: In the Peak Phase, the economy is at its best, with stable growth and low unemployment. Interest rates rise to control high inflation. Businesses invest heavily, showing strong profitability and optimism.

- Contraction Phase: In the Contraction Phase, the economy slows, interest rates rise, and unemployment increases. Inflation drops as demand weakens. Companies cut back on investments, and business sentiment turns negative.

- Slump Phase: In the slump phase, the economy struggles with weak growth, high unemployment, and low inflation. Interest rates drop to encourage recovery. Companies adjust their investment plans, and business sentiment is very low.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Investing strategy of Motilal Oswal Business Cycle Fund?

Let’s see, how the Motilal Oswal Business Cycle Fund selects stocks for its portfolio:

The Motilal Oswal Business Cycle Fund focuses on investing in top quality companies with solid business structures and experienced leadership. It targets sectors with high growth potential, benefits from India's economic growth, and selects stocks that offer good value. The Motilal Oswal Mutual funds prioritizes early investments in emerging themes and adjusts its portfolio to take advantage of India's capital expenditure trends.

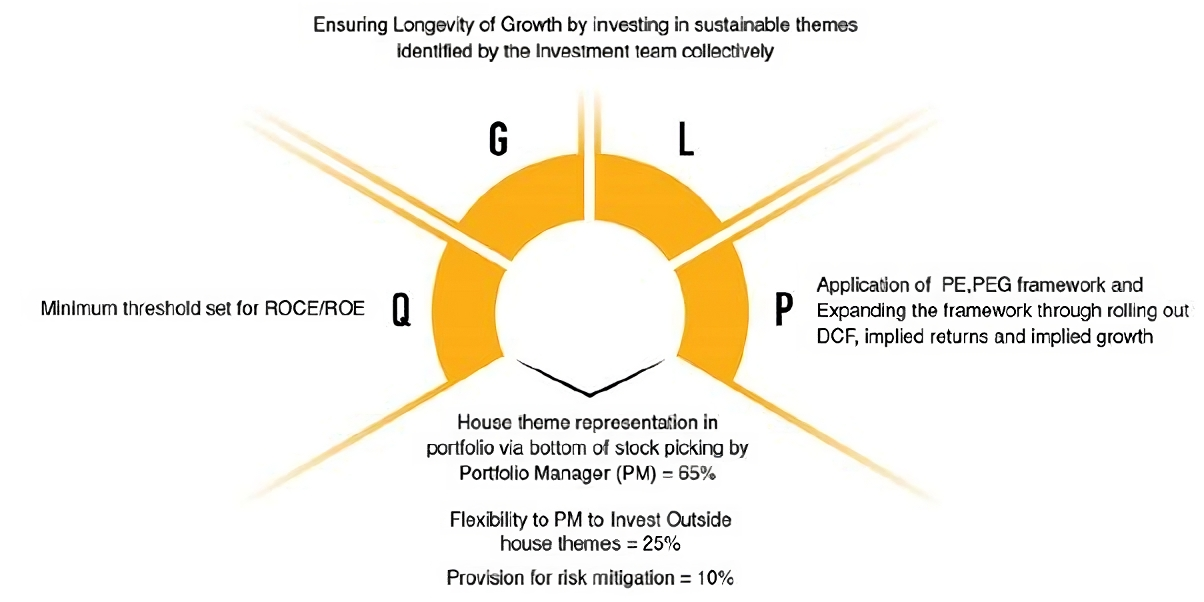

The Research Process based on the QGLP Framework:

The Motilal Oswal investment strategy is based on the QGLP (Quality, Growth, Longevity, and Price) framework. This approach involves identifying companies with robust business models, strong growth potential, and skilled management. The fund's experienced team uses their expertise to spot emerging trends and future wealth creators, ensuring that their investment choices align with the goal of delivering long-term success for investors through thoughtful and strategic decision

Is the Motilal Oswal Business Cycle Fund Ideal for Your Portfolio? See If It’s a Match!

This business cycle investment approach is ideal for investors who want to invest in high quality companies in rapidly growing sectors, especially during India's economic growth. It's perfect for those who seek to benefit from early investments in promising opportunities and prefer a disciplined, value based approach. The fund uses the QGLP framework to select stocks and focuses on long-term growth potential by investing in a concentrated portfolio of about 30-35 stocks. It's suitable for investors who are comfortable with some risk and are looking for long-term gains. It is also works well with SIP (Systematic Investment Plan) which lets investors take advantage of rupee cost averaging by making frequent investments.