Table of Contents

- What is the SIP Return of Nippon India Large Cap Fund?

- What is the Strategy of Nippon India Large Cap Fund?

- How Nippon India Large Cap Fund Portfolio Look Like?

- Is it Safe to Invest in Nippon India Large Cap Fund in India?

- Is it Good to Invest in Nippon India Large Cap Fund for Long Term?

- To Conclude Nippon India Large Cap Fund Review 2025

Introducing you to one of the top performers in Large Cap category, the Nippon India Large Cap Fund, which has been around since 2007, has remarkably achieved 21% SIP returns in the last 5 years.

However, there remains a question that circles, "Is it Safe to Invest in Nippon in India?"

Well, looking at the past returns will only take you so far, so let's get to the bottom of this Nippon India Large Cap Fund review to find out the secret of its high return delivery.

What is the SIP Return of Nippon India Large Cap Fund?

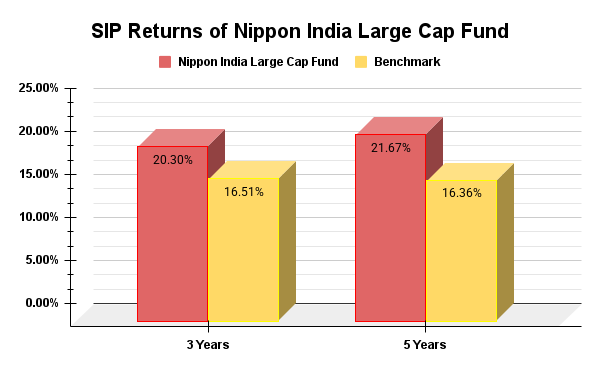

While doing a detailed Nippon India Large Cap Fund Review, the scheme outperformed both the category average and Nifty 100 TRI with 20.3% and 21.67% SIP returns in 3 and 5 years, respectively.

Let's look down at the graph of the Nippon India Large Cap Fund's performance:

In the above graph, it is visible that this large cap fund has surpassed the category average of 16.45% and 16.3%, respectively and the NIFTY 100 TRI (16.51% and 16.36%) in the last 3 and 5 years.

This strong performance shows a dedicated fund management by Mr. Shailesh Raj Bhan & Mr Bhavik Dave, along with a strong stock-picking analysis.

What is the Strategy of Nippon India Large Cap Fund?

Among the Large Cap Mutual Funds, Nippon's unique investment style involves a GARP strategy, meaning "Growth at Reasonable Strategy" targets fundamentally strong companies and buys them at low valuations.

However, the primary goal for the Nippon India Large Cap Fund remains to bring stable and sustainable business and generate high-growth revenue.

Currently, it is amongst the Top Large Cap Mutual Funds, having 72 stocks with top 10 holdings that make up 48.8% of assets to lower single stock risk.

Also Read: 3 Best Large Cap Mutual Funds for 2025: Analyst's Choice

How Nippon India Large Cap Fund Portfolio Look Like?

The asset allocation by the Nippon Mutual Fund is smartly planned, with heavy investments in equities up to 98.05% and the remaining 1.95% is reserved for cash and cash equivalents, speaking to its high-risk, high-return strategy.

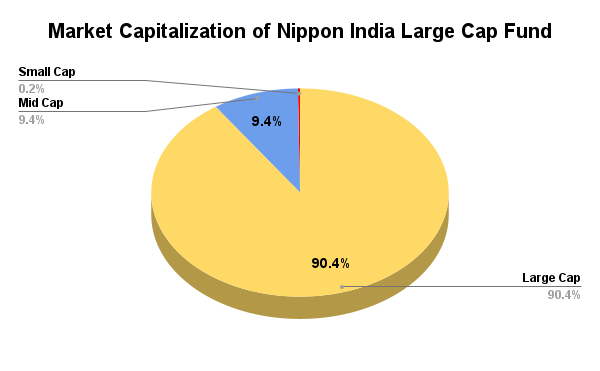

Likewise, the Nippon India Large Cap Fund is a core investor towards large and established companies, being 89.59% invested in large cap stocks and only 10.17% of money is invested in small cap stocks, leaving the next to lowest room for risk.

Let's take the help of a pie chart to study the data more clearly:

Well, this strategic allocation in this fund suggests a well-rounded approach that aims to capture stable returns for you in the long run. Moreover, this mid-cap allocation contributes to making this large cap fund a growth-oriented mutual fund.

Also Read: Why Nippon India Growth Fund is a Smart Mid-Cap Bet in 2025?

Is it Safe to Invest in Nippon India Large Cap Fund in India?

The lower standard deviation of 12.74% as compared to the category ratio of 14.09% suggests that the Nippon India Large Cap Fund is less risky or volatile in terms of returns.

Likewise, the Sharpe ratio of 1.33% which is also higher than the category, means that Nippon India Large Cap Fund is delivering higher returns for each unit of risk taken.

You can check the ratios of this Equity Fund in the table given below:

| Risk Measures | ||||

|---|---|---|---|---|

| Standard Deviation | Sharpe Ratio | Alpha | Beta | |

| Nippon India Large Cap Fund | 12.74 | 1.33 | 4.82 | 0.94 |

| Category Average | 14.09 | 0.71 | 0.08 | 0.99 |

Meanwhile, the turnover ratio is low at ~33%, reflecting a buy-and-hold approach with long-term conviction.

Apparently, the Nippon India large cap fund portfolio is actively looked after by the fund manager, where they adjust and weigh stocks regularly to be present in the market and be the “1st one to grab the opportunity when it presents itself.”

Are you aiming for wealth? If yes, Mutual Funds could be your ticket to built-in wealth.

Find, filter & invest using the Mutual Fund Screener with no fuss.

Is it Good to Invest in Nippon India Large Cap Fund for Long Term?

One key factor that makes this scheme amongst the Best Large Cap Mutual Funds for your portfolio is:

Stock Quality: It means investing in good quality companies having strong fundamentals, high growth margins, good cash flow and price-to-earnings (PE) ratios.

So, let's take a look at the large cap funds stock quality:

| Fundamental RatiosRatio | Value |

|---|---|

| Sales Growth | 14.48% |

| Earnings Growth | 18.93% |

| Cash Flow | 12.81% |

| PE- Valuations | 22.17 |

Now, coming back to the Nippon India Large Cap Fund review on a quality basis, the current valuations stand very high at 22.17% PE ratio (Price-to-earnings).

Luckily, it has a high earnings growth of 18.93%, proving that with high risk comes high rewards, too.

Smart Investments, Bigger Returns

To Conclude Nippon India Large Cap Fund Review 2025

In short, this fund checks out every point that makes it a valuable addition to your portfolio. Nonetheless, investing via the SIP route is the best strategy to cancel out any major risk that may arise. Though it's a great opportunity, it also comes rarely, which is why it is necessary to know the right time for investment.

Luckily, this is your chance to turn this into an opportunity to make multi-bagger returns with expert management every step of the way.

.webp&w=3840&q=75)