Table of Contents

- What kind of Investing Strategy Does Quant Small Cap Follows?

- Now It’s Time to Know About the Fund Managers

- Did You Know the Rolling Returns of Quant Small Cap Funds?

- What Does the Quant Small Cap Recent Performance Look Like?

- Quant Small Cap Fund Risk Analysis: Balancing Risk with Reward

- Portfolio Allocation

- Finally Quant Small Cap Suitability

The Quant Small Cap Fund, introduced in 2018, has emerged as a hidden gem in the Small Cap Mutual Funds category, well Known for its aggressive investing style, this fund came into the limelight from 2020 to 2024. While it has higher volatility compared to similar funds, it has consistently delivered strong returns, outperforming many well-known competitors. As of April 30, 2024, it boasts an impressive Asset Under Management of Rs. 20,164.09 Crore. This fund has consistently delivered strong returns, but have you ever conducted a detailed analysis of a quant small cap fund? Here is where you should start.

What kind of Investing Strategy Does Quant Small Cap Follows?

They follow the perfect investment strategy funnel to actively manage their funds, by buying stocks at the right time and selling based on their risk tolerance level to generate high returns.

To do this, they use Quant data to conduct predictive analysis to identify inflation points in sectors or stocks. When sectors and stocks shift from a negative zone to an admirable zone, that is the time when they buy. This strategy is the key to their high returns. They also have a strong track record of consistently managing their funds.

The VLRT Frame Work

(Valuations, Liquidity, Risk, and Timing)

- Valuation Analytics: Understanding the gap between how much something costs and how much it's actually worth.

- Liquidity Analytics: Grasping how money moves between different types of investments.

- Risk Appetite Analytics: Recognizing why people in the market choose to buy or sell certain things.

- Time: Knowing the patterns that control how all these aspects work together over time.

Now It’s Time to Know About the Fund Managers

Ankit Pande - Quant Specialist

Mr. Ankit is a fund manager at Quant Mutual Fund, which is India's best-performing and fastest-growing mutual fund. With over 15 years of experience, he has worked with India's leading technology service firm, specializing in core banking products. He has also been honored with a lifetime membership award from the Beta Gamma Sigma international honor society and has received an equity analyst award from Thomson Reuters in India. Additionally, Ankit Pande has won multiple awards in the mutual fund industry, more expertise who’s hand in this fund Vasav Sahgal and Sanjeev Sharma.

Attention: You can also discover Expert Selected Best Small Cap Funds Now!

Did You Know the Rolling Returns of Quant Small Cap Funds?

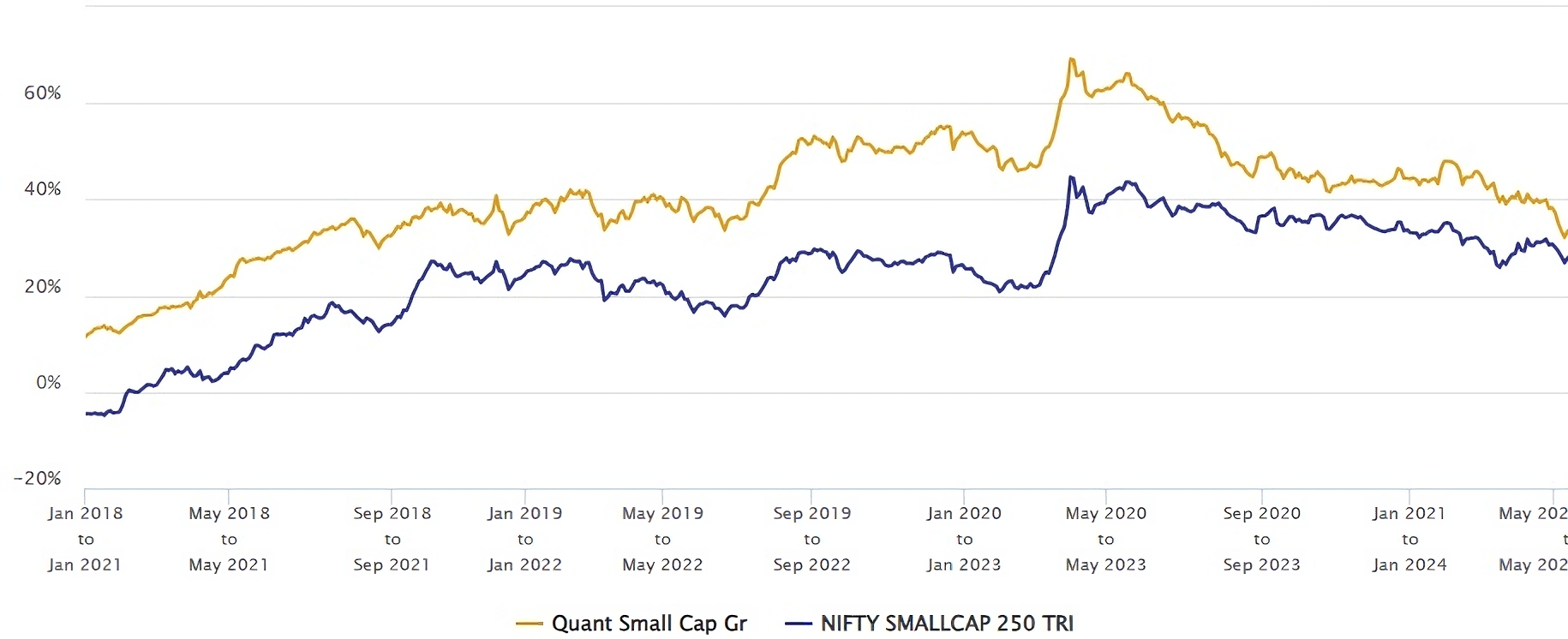

Since 2018, if you had invested your money for a period of 3 years at any point, you would have received an average annual return of almost 44.00%. In terms of consistency, 100% of the time it has delivered returns of more than 15%. We compared the same investment with its benchmark, the NIFTY Small Cap 250 TRI, to evaluate the fund's performance. The index has provided only a 24.84% return with a 97% probability of consistency. This is why this fund is considered an alpha generator.

Furthermore, the fund's 5-year rolling return is 29.05%, outperforming its benchmark of 15.26%. This demonstrates the consistent outperformance of the Quant Small Cap Fund compared to its benchmarks.

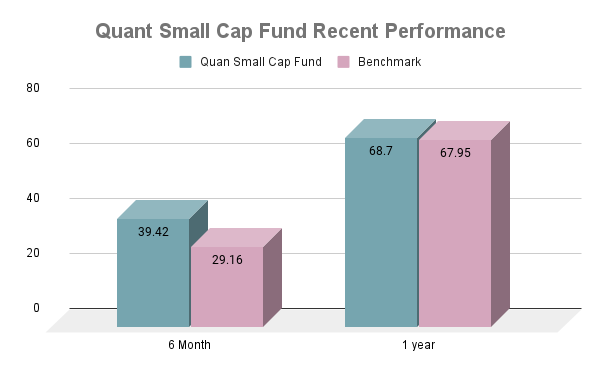

What Does the Quant Small Cap Recent Performance Look Like?

The recent performance data for the Quant Small Cap fund shows impressive results under the leadership of Mr. Sandeep Tandon and the Quant team, who have been managing this fund for a long time. Over the past 6 months, the fund delivered a remarkable return of 39.42%, significantly outperforming its benchmark, which returned 29.16%. When analyzing the 1-year returns, the Quant Small Cap fund had a return of 68.70%, which was very close to the 67.95% return of its benchmark over the same time period.

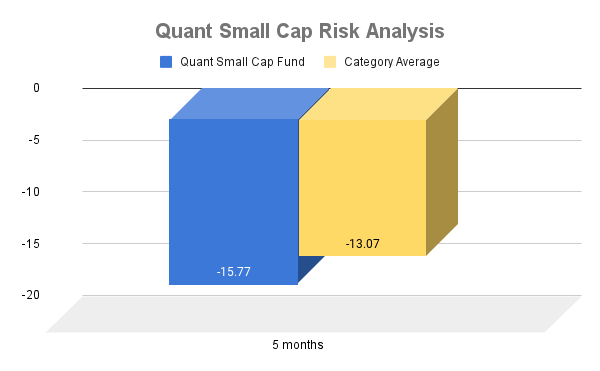

Quant Small Cap Fund Risk Analysis: Balancing Risk with Reward

The Quant Small Cap Fund experienced a decline of 15.77% over a period of 5 months, while the average decline for similar funds in the same category was 13.07%. This means that the Quant Small Cap Fund fell more than the average small-cap fund during this period. However, the fund recovered quickly. This shows that although the fund may be more volatile and riskier than the average, it also has the potential to bounce back rapidly after declines.

The Quant Small Cap Fund's risk analysis shows a standard deviation of 19.2, indicating high volatility. Its Sharpe Ratio is 1.53, meaning it offers good returns for the risk taken. The fund's upside capture ratio is 105, outperforming its benchmark in rising markets, while the downside capture ratio is 75, showing it loses less than the benchmark in falling markets. Overall, the fund is volatile but provides strong risk-adjusted returns.

Did you know investing with the SIP in a small cap fund will help to reduce risk? Start Your SIP Now!

Portfolio Allocation

The Quant Small Cap Mutual Funds has a well-diversified market cap exposure, with its largest portion 40.39% allocated to small-cap stocks The fund also has a high allocation to large-cap stocks 30.21% and mid-cap stocks 29.41%. This balanced strategy combines the stability of large-cap assets with the potential for growth from mid-cap and small-cap investments.

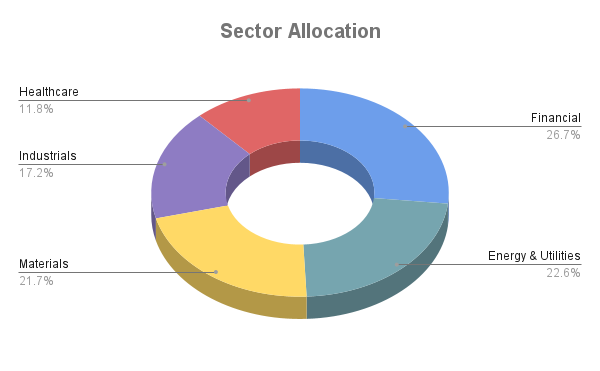

The Quant Small Cap fund has its largest exposure in the Financial sector, which makes up 19.37% of the portfolio. This is followed by the Energy & Utilities sector at 16.39% and the Materials sector at 15.75%.

The fund also has notable allocations to the industrial sector (12.48%) and the Healthcare sector 8.56%.

|

Market Cap Allocation |

|

|

Large |

30.21% |

|

Mid |

29.41% |

|

Small |

40.39% |

The Stock Selection and Quality

Quant Small Cap Fund usually holds a well-diversified portfolio of 80-90 stocks at any point in time. As of April 31, 2024, the fund held 92 stocks in its portfolio, with the top 10 stock holdings accounting for around 38.96% of its assets

The top 5 stock holdings of the fund include:

Reliance Industries Ltd. - 9.64

JIO Financial Services Ltd. - 6.81

IRB Infrastructure Developers Ltd. - 3.42

Hindustan Copper Ltd. - 3.39

RBL Bank Ltd. - 3.13

|

Fundamental Ratios |

|

|

Price/Earnings |

20.03 |

|

Profit Growth% |

20 |

|

Sales Growth% |

8.86 |

|

Cash-Flow Growth% |

34.20 |

While analyzing stock selections of the fund, we look at four important things to make sure they're good quality: how fast their sales are growing, how much profit they make, how much cash they have coming in, and how their price compares to their earnings (that's the PE ratio). This fund is filled with companies that are growing fast. On average, their sales are going up by 9%, they're making a 20% profit on what they sell, their cash flow is increasing by 34%, and they have a low PE ratio of 20, which means we're getting them at a good price.

These factors suggest that the fund is filled with companies that are growing rapidly and are of high quality. This makes the Quant Small Cap Fund one of the best choices for investors, as it provides exposure to a portfolio of top-notch companies.

Finally Quant Small Cap Suitability

The Quant Small Cap Fund is best suited for investors who are comfortable with taking on higher levels of risk in pursuit of potentially higher returns. This fund is ideal for aggressive investors who are seeking to diversify their portfolio with small-cap stocks through SIP that have strong growth potential. Small-cap stocks can offer significant growth opportunities, but they also come with higher levels of risk due to their volatility and smaller size compared to larger companies. The Quant Small Cap scheme is known for its flexible management style, using numbers and data to make investment decisions. It's a great choice for investors who can handle high risk and are looking for high returns on their money.

Will You hear the Market Game Changer: Nippon India Small Cap Fund... Stay tuned for our upcoming blog!

.webp&w=3840&q=75)