Table of Contents

- What is Repo Rate?

- RBI Repo Rate Cut 2025: Key Changes

- Historical Overview of RBI Repo Rate

- Affect of Repo Rate Cut on Fixed Deposits

- Impact of RBI Repo Rate Cut on Bonds and Debt Mutual Funds

- Stock Market Reactions to RBI Repo Rate Cut

- How Repo Rate Cut Affects Loans and Borrowing Costs

- Factors Influencing the RBI Repo Rate Cut

- Conclusion

Did you know that on 6th June 2025 the RBI Repo Rate Cut has reduced from 6 % to 5.5% by 50 basis points after the recent Monetary Policy Committee (MPC) meeting 2025?

Along with the repo rate cut, this impacts various investments such as fixed deposits, bonds, Mutual Funds and the stock market, hold the spotlight. Well, this led to the question, "What does this repo rate change mean for investments and borrowing costs?"

Explore this analysis to know the stock market reactions and the RBI Repo Rate Cut 2025 historical overview.

What is Repo Rate?

The repo rate is the interest rate at which the Reserve Bank of India (RBI) lends money to commercial banks in India. When the repo rate is decreases, banks find it easy to borrow money.

This generally results in low interest rates on loans, deposits and other financial products for consumers. Any change in the repo rate impacts the interest rates across the economy.

Must Read: Repo Rate Vs Reverse Repo Rate 2025: Key Difference

Now, let’s explore the key changes in the repo rate cut 2025.

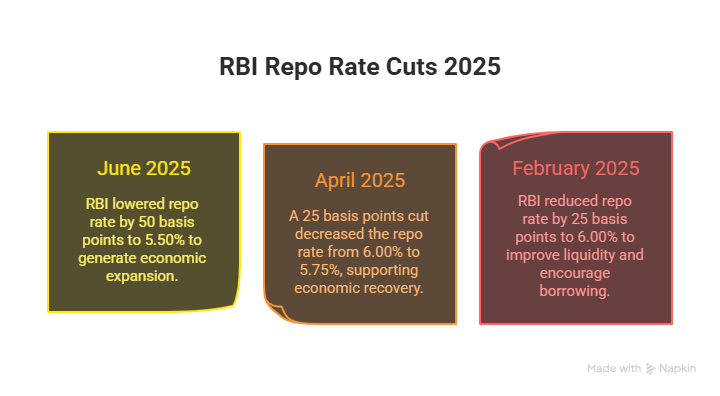

RBI Repo Rate Cut 2025: Key Changes

Here are the key changes in the RBI Repo Rate Cut 2025:

- In June 2025: the RBI lower the repo rate by 50 basis points to 50%. This decision, created by RBI Governor Sanjay Malhotra, his purpose is to generate economic expansion inflation. This rate cut impacts the banking system, affecting commercial banks such as ICICI Direct & Bajaj Finserv.

- In April 2025: A 25 basis pointscut can decrease the repo rate from 00% to 5.75%, continuing the RBI's efforts to support economic recovery during FY 2024–25.

- February 2025: The RBIreduced the repo rate by 25 basis points to 00%, which led to an initiative under Sanjay Malhotra to improve liquidity and encourage borrowing by commercial banks.

Now, moving forward to its historical overview.

Historical Overview of RBI Repo Rate

Here is the historical overview of RBI Repo Rate:

| Date | Repo Rate (%) |

|---|---|

| June 2025 | 5.50% |

| April 2025 | 5.75% |

| February 2025 | 6.00% |

| December 2024 | 6.50% |

| October 2024 | 6.50% |

| August 2024 | 6.50% |

| June 2024 | 6.50% |

| April 2024 | 6.50% |

| February 2024 | 6.50% |

Let us discuss, how the repo rate cut impacts fixed deposit returns.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Affect of Repo Rate Cut on Fixed Deposits

A repo rate cut down fixed deposit (FD) interest rates, as banks and Non-Banking Financial Companies (NBFCs) adjust their lending and deposit rates accordingly.

When the RBI reduces the repo rate, it becomes cheaper for banks to borrow money and they help by lowering the interest rates on deposits such as fixed deposits.

After the 25 basis points (bps) repo rate cut in June 2025, many banks have brought down their FD interest rates for 1-2-year term deposits:

| Bank | Previous FD Rate (1-2 years) | Current FD Rate (1-2 years) |

|---|---|---|

| SBI | 6.60% | 6.40% |

| HDFC Bank | 6.75% | 6.50% |

| ICICI Bank | 6.65% | 6.45% |

| Axis Bank | 6.85% | 6.65% |

| Bank of Baroda | 6.50% | 6.30% |

Pro Tip: Know your future returns using the SIP Calculator in 3 easy steps.

Find out how the repo rate cut influences the performance of bonds and debt mutual funds.

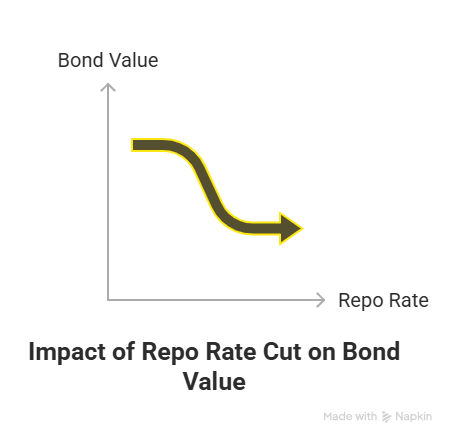

Impact of RBI Repo Rate Cut on Bonds and Debt Mutual Funds

A repo rate cut impacts the performance of bonds and debt mutual funds by low-interest-rate environment.

1. Impact on Bonds:

- When the repo rate falls, the yields on new bonds decrease, which raises the value of existing bonds. Investors holding these bonds see a rise in their bond prices.

- The repo rate cut makes government and corporate bonds more attractive to investors looking for stable returns in a low-interest-rate.

2. Impact on Debt Mutual Funds:

- In the debt mutual funds, invest in government bonds or corporate debt benefit when repo rates are cut. Their net asset value (NAV) increases as bond prices rise.

- Funds having a long tenure are sensitive to interest rate changes and will see improved growth, while funds with shorter durations have not seen benefits.

Stock Market Reactions to RBI Repo Rate Cut

A repo rate cut makes it affordable for companies to borrow money, helping them save on interest expenses and increase profits. Lower loan costs also mean people can spend more on expenses, which boost the demand for products and services, helps stock markets rise.

For example, In the revised repo rate cut 2025, this lead Sensex to rise 1.25%, closing at 63,450.28. This rise reflects strong investor confidence and the stock market reacted positively to the cut. Expect higher profits and increased economic progress.

A repo rate cut leads to growth in the stock market because businesses save on costs and consumers have more money to spend, which boosts the economy and improves the market.

How Repo Rate Cut Affects Loans and Borrowing Costs

A repo rate cut directly affects loan interest rates. RBI lower prices for commercial banks to borrow money.

This helps borrowers by reducing the interest rates on home, personal, car and business loans.

The repo rate change makes it affordable for individuals & businesses to take out loans and repay them at lower costs, reducing EMIs and financing costs.

Don't Miss: RBI Monetary Policy 2025: RBI Repo Rate Remains at 5.5%

Discover the key factors that influence the RBI's repo rate cut.

Smart Investments, Bigger Returns

Factors Influencing the RBI Repo Rate Cut

These points critical factor the repo rate change:

-

Encourage Economic Growth

The RBI cut the repo rate to encourage borrowing & investment. by decreasing the interest rates make loans low cost, which helps businesses and consumers spend and invest, increasing economic growth.

-

Control Inflation

The RBI vision to control inflation within target levels. By change the repo rate, the central bank can control the economy, manage expansion and maintain price stability.

-

Improve Liquidity

The repo rate cut increases the liquidity in the banking system, this makes more money available for lending. This helps improve businesses and consumers' access to credit.

-

Support Borrowers

With lower interest rates, the RBI aims to minimize the financial burden on borrowers, making it easier to pay off loans, mostly home loans, personal loans and business loans.

-

Global Economic Uncertainty

The RBI regularly adjusts the repo rate with global economic conditions. In times of global crisis or slowdowns, the rate cut helps support the domestic economy by making borrowing cheaper and encouraging growth.

-

Encourage Consumer Spending

Lower interest rates increase net income by lowering loan EMIs. This brings more consumer spending, which can regulate demand in many sectors of the economy.

Pro Tip: Find risk & growth of MF in seconds with the Mutual Funds Screener.

Conclusion

In conclusion, the RBI's repo rate cut in 2025 affects different aspects of the economy, from loans and borrowing costs to investments like FD, bonds and mutual funds.

Moreover, it provides immediate relief to borrowers, it also challenges investors for higher returns. These revised cut impact your financial decisions by low-interest-rate environment.

Frequently Asked Questions

-

Will loan EMIs go down after the RBI repo rate cut in 2025?

Yes, loan EMIs are going down. As banks lower their rates, home, personal, and business loans will become affordable, making it easier for borrowers to repay.

-

How does the RBI repo rate cut affect businesses and the economy?

The repo rate cut makes borrowing cheaper for businesses, encouraging investment and expansion. This helps in economic growth and supports overall financial stability.

-

How does the repo rate cut impact business loans?

A repo rate cut reduces business loan interest rates, helping businesses save on borrowing costs. It also makes it easier for companies to take out loans for different purposes or for new projects.

-

Will the RBI reduce the repo rate further in 2025?

It is unpredictable, as experts think the RBI may adjust the repo rate, depending on inflation and economic growth.

.webp&w=3840&q=75)

_(1).webp&w=3840&q=75)