Table of Contents

- Scope of high returns

- Diversified Investment

- Balanced Risk

- No need to time the market

Mutual fund investment market is full of different investors where some remain calm, others get aggressive. Since investment in mutual funds are always subject to market risk, it becomes tricky to decide the right way to invest. A small change in market is enough to create a feeling of uncertainity among investors. Even future anticipated changes can affect the investments done today. Election 2019 is one such event that has already sowed a seed of confusion in the minds of investors.

There are multiple ways in which the election can bring about change in the investments’ performance directly or indirectly as they are interconnected being a part of a single economy. However, what you earn will solely depend on the choices that you make or the selections that you do regarding scheme from time to time. Let’s read how the coming elections can affect the performance of mutual fund investments and the ways to deal with it right away.

How Elections 2019 Can Affect Your Investment?

Elections or to be specific central elections indicate towards the selection of new government and the new ways in which the economic matters will be handled. On the basis of the results of this election, it will be decided how the coming five years will be on the economic front indicating towards the policies such as macro economics, corporate growth, and infrastructure development. This leads to volatility which further affects the investments made. It should be noted that during the election phase, you can only anticipate the functioning of the market and cannot be sure how it will actually turn out to be. At the end, it all depends on how the government finally performs and the decisions that it takes regarding various economic aspects.

Impact of Elections on the Market in the Past

If the party of your choice wins, it will surely make you happy, wouldn’t it? No matter which party wins, they are always backed by supporters who gladly take their victory as a sign of good market functioning. However, the ones against might think otherwise. This leads to a state of commotion in the overall investment market, thus leading to uncertainity.

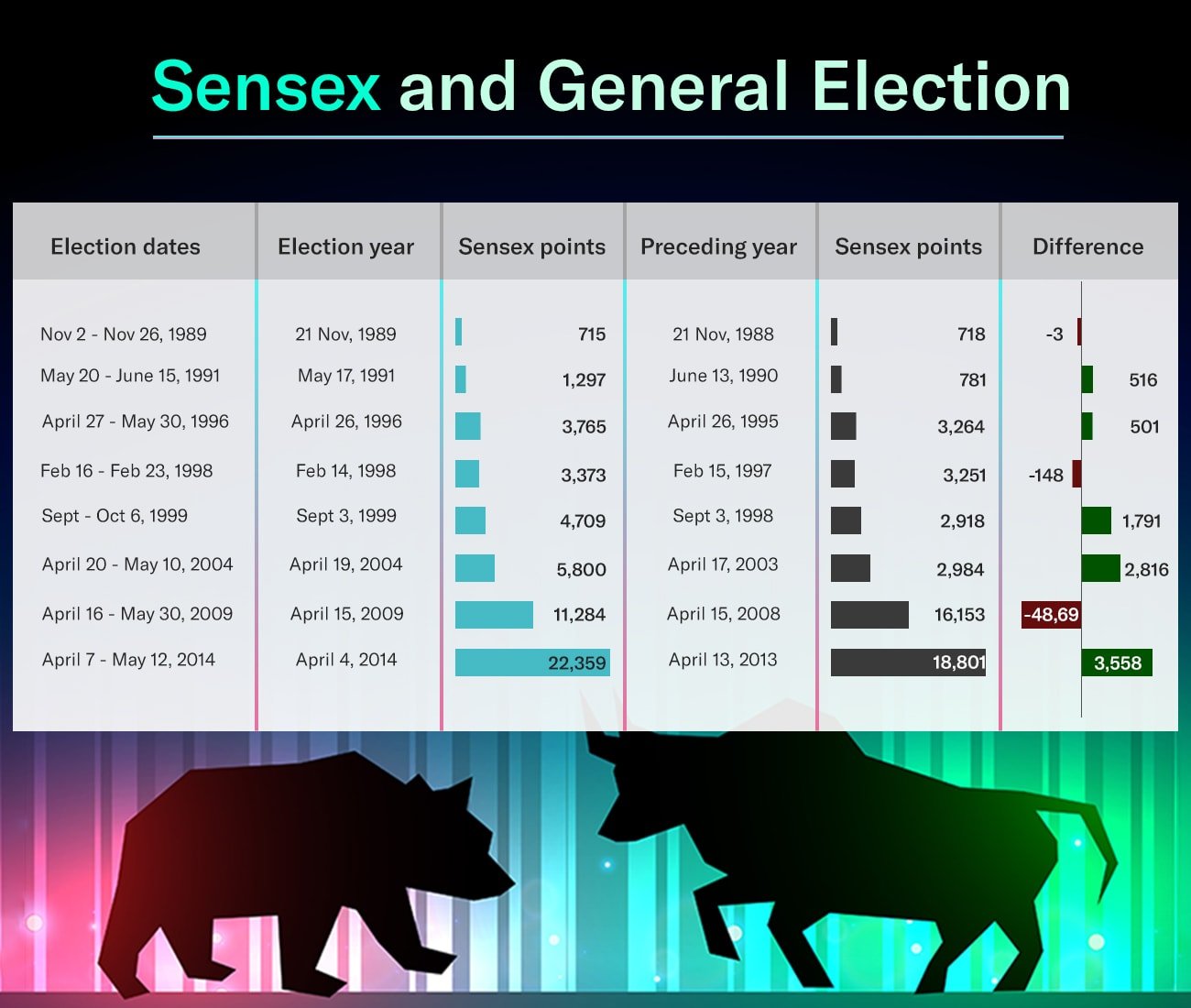

Looking at the past, it can be said that whenever the government of investors’ choice won, there was a wave of positive sentiments in the investment market which led to the rising graph of investments and further returns. In addition, the positive working of the government has only strenghtened the trust of investors.

What Should You Do to Deal with it?

Following are the points that one should keep in mind while investing in mutual funds considering the approaching elections 2019.

- Investors should focus on investing for a long-term as it will shield there investment against the short-term market volatility.

- If you are planning to invest for a short or medium term, then make sure that you remain distant from the high risk equity funds.

- You may select those schemes where the asset allocation is such that can help you pass through the volatile market. For example, a scheme investing in a good mixture of equity, debt, and money market instruments can help you manage the risk factor.

- Investment in mutual funds doesn’t generally require an investor investing for a long-term to time the market. Therefore, one may invest in it irrespective of the election period as no matter what, in the long-run, the overall returns mostly get balanced.

- You may even invest slowly, i.e., around 20% to 30% of the amount can be invested right now and the rest later. The reason being that the experts think that considering the correction phase, the market may still go lower.

- The other way in which you may invest is to opt for a liquid fund and then transfer the money slowly into the suitable scheme from it according to your portfolio’s requirement, i.e., you can select the STP mode of investment.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Expert’s Take

According to the experts at MySIPonline, it is estimated that the mutual fund investment has a bright future in the next ten years. Although the market has been favorable to investors till now, due to some overseas marcor factors, the market has faced a dip which has reduced the earning ratio of the investors. Now, the future market performance completely depends on corporate earnings, strong structure of banking and financial institution, good liquidity, and smart management of Indian macros and fiscal policies. Further in the end, it will all depend on how the selected government utilizes the power for the betterment of the economy irrespective of the fact that which party has won. Experts believe that investing in equity funds for a long-term is the right technique of parking your money in the current market situation.

You may invest in the mutual funds right now through our platform MySIPonline and in case you need any further clarification, then you can consult our financial experts. If there is any question related to regular funds that you need to be answered, you can post the same here.

Must Read: